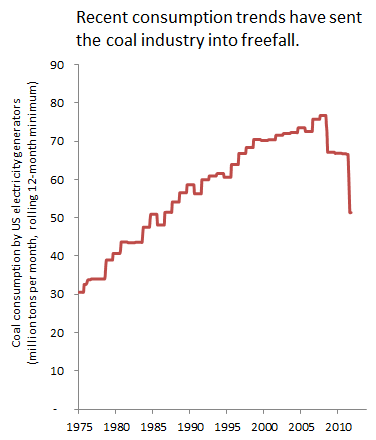

A few weeks ago I wrote about the astonishing and unprecedented nosedive in domestic demand for coal. That collapse has been good news for the climate and human health. But it’s been terrible, horrible, no good, very bad news for Big Coal.

Just how terrible?

Simply put, the coal industry is in freefall. Mining companies are shuttering operations left and right. A quick Google scan turns up recent coal mine closures in Indiana, Virginia, West Virginia and Pennsylvania, and reports of layoffs and mine closures throughout Appalachia. At the same time, power companies are shuttering a raft of coal-fired power plants, including facilities in South Carolina, West Virginia, Wyoming, Virginia, Texas, Ohio, Pennsylvania, and Maryland, as well 10 aging plants in the Midwest and East. I’m sure that a few more minutes on Google would turn up examples that I missed.

And the financial markets are certainly noticing the same trends we are. Stock prices for major domestic coal companies went into a nose dive just over a year ago, and have dipped even lower this year. See, for example, this chart from Yahoo Finance: