There’s been so much news on the coal export front of late—the massive scope of the proposed Gateway-Pacific terminal’s Environmental Impact Statement; the Lummi Nation’s unequivocal opposition to a coal terminal at Cherry Point; and recent revelations about the ongoing financial woes of coal terminal developer Ambre Energy—that it’s hard not to sense that Northwest coal export projects are on the ropes.

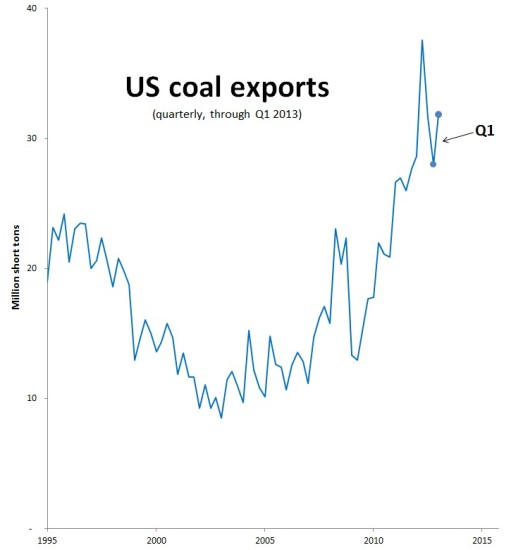

But perhaps the most important coal export story has gotten surprisingly little attention—the collapse of Pacific Rim coal prices. With the latest price decline, I think we can definitively call the hype over Northwest coal export projects for what it always was: a bubble.

But to see why the inflated hopes for Northwest coal exports were the product of a bubble mentality, you have to look at the long-term price trends.