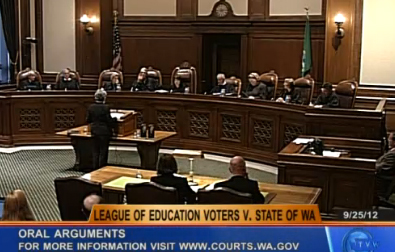

The Washington Supreme Court has thrown out as unconstitutional the viciously antidemocratic, reflexively right-wing, school-and-public-services-impoverishing supermajority voting requirement that has tied Washington representatives’ hands, on and off, for the last two decades. This win is so important that northwesterners, even those in neighboring jurisdictions, should be dancing in the streets.

The ruling changes the long-term outlook for everything: state budgets, tax reform, climate policy, tax loopholes for fossil fuel companies, and more. Though politics may temper the ruling’s impacts in the short run, the long view looks newly bright. This is a turning point.

As Goldy reminds us at the Stranger, while the state supreme court “invalidated Washington’s two-thirds supermajority requirement by only a 6-3 margin, it is important to note that there was only one justice who dissented on the merits of the underlying issue.”

Tim Eyman’s undemocratic, unconstitutional, unfair, oil-industry Trojan Horse supermajority rule imposed government by minority faction on the state legislature for closing tax loopholes and raising new revenue. It was the single biggest legal barrier to progress in Washington on issues ranging from climate to education.