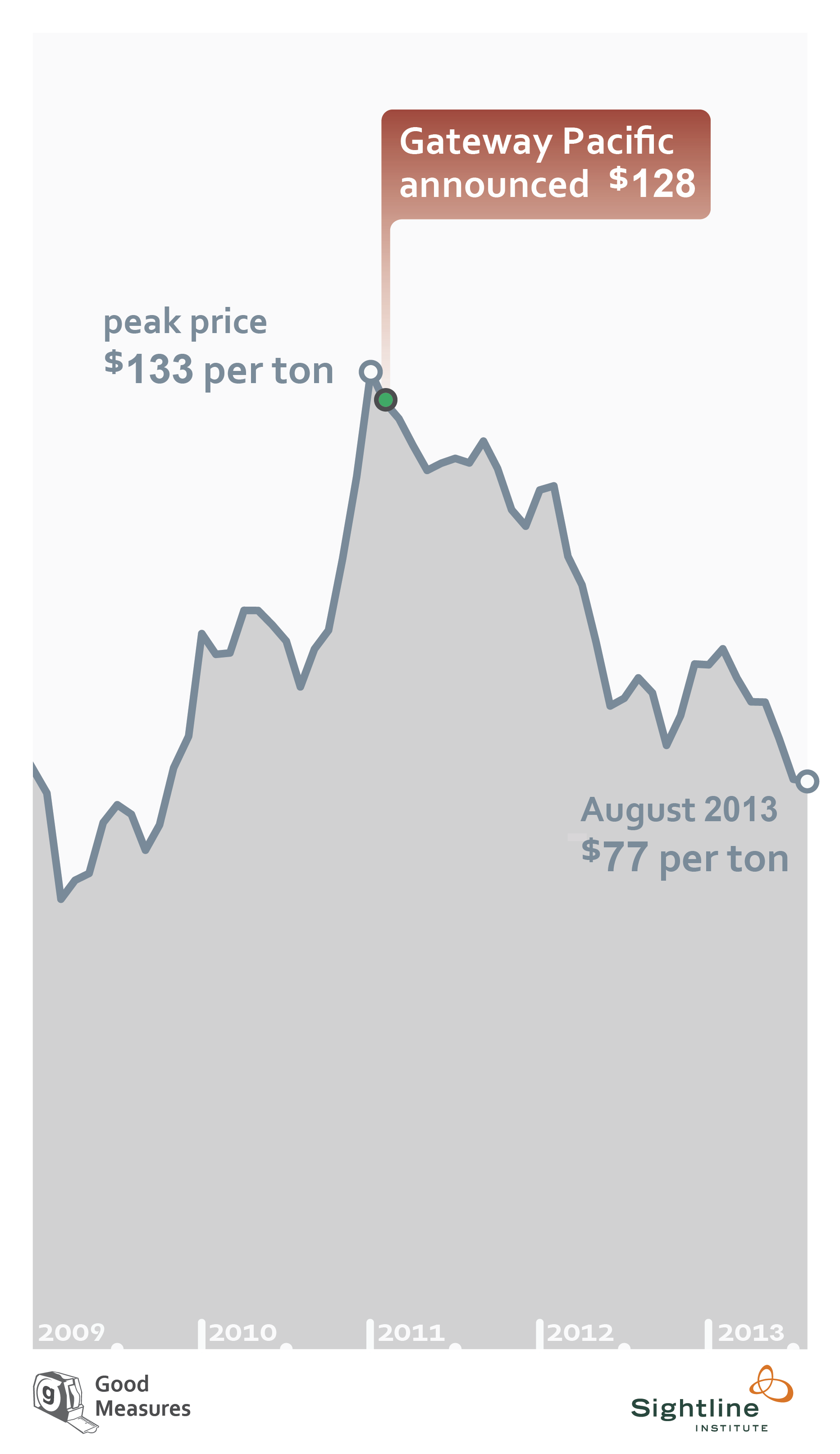

As Eric mentions below, Goldman Sachs just sold its interest in the Gateway Pacific coal export project to a Mexican billionaire. It’s far too soon to say what this development will mean for Gateway’s prospects. But when coupled with Ambre’s difficulties finding new financing, Goldman’s move underscores an important new reality: Wall Street now views Northwest coal exports as too risky to touch.

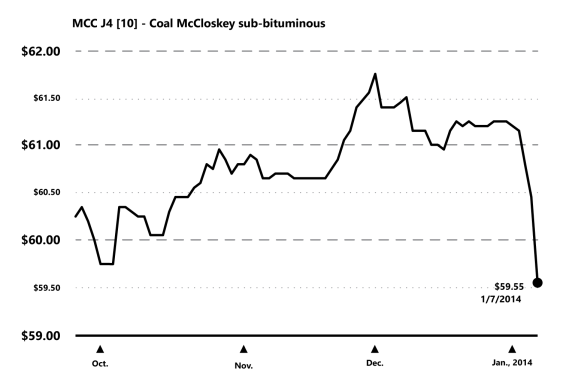

And for good reason. Pacific Rim coal prices have taken a severe beating over the past few years, with prices for benchmark Australian coal falling from more than $132/ton in early 2011 to less than $78/ton in September 2013. And after clawing back a few dollars late last fall, Pacific Rim coal has been caught in yet another sell-off over the past week, as shown in this chart of Indonesian sub-bituminous coal futures…

So it could be that Goldman got out of the coal export business just in time. Of course, they had plenty of warning: Wall Street analysts have been issuing increasingly dire assessments of coal export prospects for more than a year. Take a look: