What if we could click our ruby slippers and transport ourselves to a magical place where polluters pay and we all get checks in the mail? The Oregon legislature is considering two bills that would take us there.

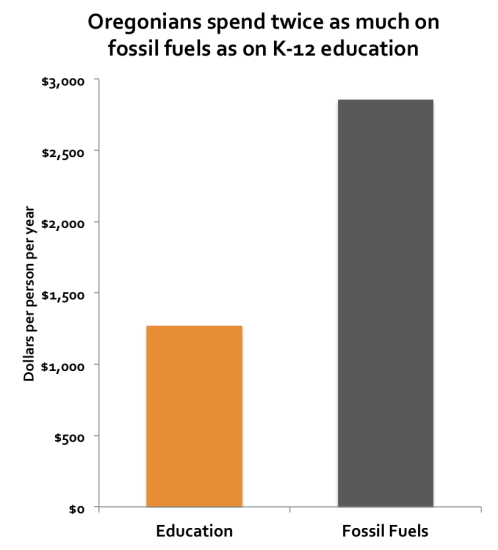

When designing a program to make climate polluters pay, one of the most important decisions is what to do with the money. Northeast states and California invest in energy efficiency and transportation. British Columbia gives tax cuts to people and businesses. Two Oregon bills contemplate mailing out dividend checks. If Oregon passed a polluters-pay-plus-dividend bill, the air would no longer be a free dumping ground for pollution, clean energy would be on an even playing field with fossil fuels, and each Oregonian would get a check for $500-$1,500 every year. Sound too good to be true? It’s not. Here are the details, Q & A style.

1. What are these Oregon dividend bills and what do they do?

HB 3176 would charge fossil fuel sellers a fee for each ton of pollution, starting at $30 per ton and increasing by inflation plus $10 per ton every year. All the money would go into a Trust Fund. Each September, the Department of Revenue would mail every Oregon taxpayer and taxpayer dependent a check for an equal share of the money.

HB 3250 would do roughly the same thing, but instead of creating a set fee schedule it would create a set number of pollution permits that fossil fuel sellers could buy in an auction. Each year, less pollution would be allowed and fewer permits would be available. By 2050, Oregon’s climate pollution would be 85 percent below 1990 levels. As permits become scarce, the price would go up.

2. Why are there two bills? Is one better than the other?

Both bills lead to the Emerald City, but they encounter different lions, tigers, and bears along the way.

Read more