Nestled in the southwest corner of Washington, home to coho salmon and the occasional spotted owl, the Winston Creek carbon project is extending rotations on 10,000 acres of forest. By delaying harvest from 40 years to 60 years and letting these trees continue to grow during their carbon sequestration prime, Port Blakely, the forest owner, hopes to double the biomass of its forest.

According to American Carbon Registry (ACR) documents, this extension will sequester about 850,000 metric tons of carbon dioxide equivalent (CO2e) above and beyond what a 40-year rotation would sequester. One ton of CO2 is about what a gas-powered car emits on a trip from Klamath Falls, Oregon, to Anchorage, Alaska (about 2,500 miles); therefore, this forest carbon project offsets the emissions from about 850,000 road trips to see moose and hear glaciers crack and rumble.

As part of its Carbon Balance program, Puget Sound Energy (PSE) purchased many of these credits on the “voluntary” carbon market. REI, Avocado Mattress, Boeing, Direct Wines, and the City of Eugene are only a few of the other groups to have bought Winston Creek carbon offset credits. The voluntary market includes all transactions outside of the dozen or so global “compliance” markets that result from mandatory government regulations to reduce greenhouse gas emissions, such as California’s cap-and-trade program.

An Xcel Energy coal-fired power plant. Source: Tony Webster

Globally, the entire voluntary carbon market is projected to grow from about $320 million in 2019 to between $5 billion and $30 billion by 2030. Even though only a tiny fraction of carbon market dollars will go to forest projects in the Pacific Northwest,1 excitement is brewing among conservationists and savvy wood products companies alike.

Tom Tuchmann, who’s worked in forest conservation for 30 years and is now president of US Forest Capital, is excited about carbon market growth. “It’s the first time that a true market price has been created to incentivize private landowners to invest in conservation at scale,” he said. “Hundreds of millions of dollars are being raised and spent on carbon credit.”

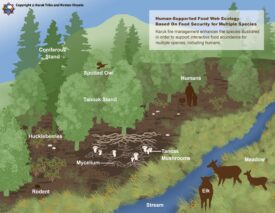

On the ground in Oregon and Washington, carbon offsets have financed innovative forest conservation that protects clean drinking water and salmon habitat as well as jobs for loggers, mills, and mountain bike guides. Native American tribes that have logged less aggressively have sold offset credits from their carbon-rich forests and used the income to reacquire ancestral territory. But how much of forests’ “natural climate solution” potential can the carbon market actually fund?

This article is part of a series investigating the potential of long rotations to increase carbon storage and improve forest health in the “wet” forests of western Oregon and Washington. The first article in the series explained why long rotations store more carbon. The second article outlined the four main hurdles landowners face in extending rotations. This article and the next several ones explore how to overcome these hurdles, starting with market mechanisms to compensate landowners. The goal is a landscape-level shift to long rotations on private timberlands.

By themselves, carbon markets cannot solve our climate problem, and they pose some environmental justice dilemmas. Even New Zealand’s full-enrollment Emissions Trading Scheme has shown little progress in decarbonizing that country’s economy. But it has been effective at reforestation, extending rotations, and preventing deforestation (if not without some hiccups that I will discuss below).

Could carbon markets help incentivize long-rotation forestry in western Oregon and Washington?

Forest carbon markets show promise. But they have severe limits: insufficient market demand and price, impermanence, and ghost credits (offset credits for carbon that would have been stored in forests even without any carbon market payment). To confront these limits, forest carbon markets need more rigorous standards and oversight. But the best solution to remove these limits may be to include all forests in a mandatory nationwide cap-and-trade program.

The climate potential of forests

To keep warming under 1.5 degrees Celsius, we need net-zero global emissions by 2050. For Oregon and Washington together, net-zero emissions means a reduction of 170 million metric tons of CO2e in annual emissions. It’s hard to imagine reaching this goal without boosting forest carbon storage. Scientists have pointed to extending forest harvest rotations (long rotations) on private land as the most effective (and cost-effective) land-based carbon sequestration strategy in Oregon and Washington.

Different kinds of carbon projects have different comparative advantages. Long rotations can store a lot of carbon while also producing a lot of timber. A steady supply of timber supports local economies—not only forest jobs but also those of restaurant owners and teachers, and revenue for county services. Plus, the question of leakage (any increase in logging elsewhere associated with a carbon project’s supply reduction) becomes moot because long rotations can beat short rotations on timber volume.

Western Oregon and Washington have more than 12 million acres of privately owned forestland, of which around 8 million acres are owned by large commercial timber companies and likely harvested on short rotations* . For the productive Douglas-fir forests west of the Cascades, extending rotations from 40 years to 80 years can store roughly an additional 110 metric tons of CO2 per acre in an average year (including the carbon in long-lived wood products).

By extending rotations on these 8 million acres, forests could sequester and store about 880 million additional metric tons of CO2. That is more than five years’ worth of Washington and Oregon’s current combined emissions from all sources.

Growing out all the trees at once is not a realistic option. But even a gradual transition would impact the finances of forest landowners. In a previous article, I explained why landowners make more money logging on short financial rotations. Long rotations yield more timber and more value, but delaying harvest means forgoing lucrative investment opportunities in the short term.

A hard look at the numbers: Carbon finance fizzles at scale

How much of landowners’ costs could forest carbon markets pay for?

Forest carbon markets suffer from a scale problem. The price of carbon and the intensity of market demand both fall far short of what’s needed. The median break-even price of carbon to finance extending rotations by 20 years (including paying the project development costs) is around about $58 per ton of CO2e.2 To finance a full 40-year extension, from 40 to 80 years, would cost more than double this price (more than $120 per ton).

What is today’s market price for carbon? Recently it has hovered around $7.47 per ton in the voluntary market ($9.79 for direct sales), which is not nearly enough to compensate Port Blakely’s 20-year rotation extension. The compliance market, which is typically higher, was around $18 in 2021 and recently jumped to about $30. To spark real action on long rotations, the voluntary market price needs to grow about twelvefold.

In terms of demand, all up-and-running forest carbon projects in Oregon and Washington currently store around one million tons of CO2e per year* , and buyers seem to be snapping up these credits, which is not surprising at today’s bargain prices. Many of these carbon project acres are east of the Cascades.

To reach western Oregon and Washington’s carbon potential of 880 million tons from long rotations, the current market would need to grow somewhere in the ballpark of 880 times its current size, and a greater share of investment would need to go to long-rotation carbon projects.

Is this growth in price and market demand inconceivable? Not necessarily. Just this past April, Regen Network Development paid between $34 and $45 per metric ton (among the highest prices ever paid for forest carbon credits) for 31,000 tons of CO2e on the voluntary market. A small share of this carbon is being stored in forests around Issaquah, Washington, as part of a grassroots effort to save a beloved forest from development. While this unusually high purchase price may partly reflect the buyer’s desire for positive brand recognition to boost its blockchain venture, the purchase may be a harbinger of market momentum to come.

If the market price could increase twelvefold to around $120 per ton, if the market demand increased 100 times to around 100 million tons of CO2e stored per year, and if more of the investment went to long rotations on commercial timberlands), then the carbon market could finance somewhere in the ballpark of 12 percent of western Oregon and Washington’s carbon potential from long rotations.

Roosevelt Elk. Source: Linda Tanner

That’s a lot of ifs to get to 12 percent, but it’s possible. Financing 12 percent means extending rotations on roughly 960,000 acres—a considerable area of cooler streams and better habitat for Roosevelt elk, black bears, and Northern spotted owls.

Unfortunately, new rules in California mean that future growth will depend on the voluntary market. In the past, California’s compliance market purchased the majority of the credits from Oregon and Washington’s forest carbon projects. As of 2021, California requires that at least one-half of offset credits be sourced from projects that provide direct environmental benefits in California. Plus, regulated entities can now only offset 4 percent of their emissions (down from 8 percent).

Impermanence

When United Airlines, Amazon, or Puget Sound Energy (PSE) burns fossil fuels, the carbon emitted stays in the atmosphere and harms the climate for centuries to millennia. If these companies buy forest carbon credits to offset these emissions, that carbon may only get stored in trees for 40 years before it is re-released into the atmosphere. The Winston Creek long rotations carbon project is one example of the emissions–offset time mismatch. After the one-time 20-year rotation extension, nothing prevents Port Blakely from logging the property on short 40-year rotations. Projects like this are essentially renting out carbon storage to emitters. It would be different if the project included a conservation easement guaranteeing long rotations in perpetuity.

In light of this impermanence, for some PSE customers, even today’s low carbon offset price seems wasteful. One customer wrote, “I fail to see how much good this will do, if you’re only just delaying harvesting the trees by 20 years.”

Carbon market proponents believe these customers are missing the point. The income stream from selling carbon can continually incentivize landowners to delay harvest. On the other hand, these PSE customers are pointing out a real problem. To truly “offset” their emissions, PSE would need to continually finance Port Blakely’s long rotations for one thousand years.

Other credits come from projects that will likely store the carbon permanently. For example, when an Issaquah–King County coalition purchased 15 acres of old forest in western Washington in order to block a planned development that would have logged most of those trees, the carbon became permanently protected, subject only to natural disturbance.

Carbon market standards could be amended to require permanent storage. For example, when the van Eck Trust donated a working forest conservation easement to the Pacific Forest Trust, it guaranteed increased carbon storage on 9,400 acres of forest in Oregon and California in perpetuity. The van Eck carbon project, covering 2,200 acres of these forests, has sold more than $2 million in carbon credits in its first reporting period alone.

A working forest conservation easement protects against the deforestation that accompanies development while allowing continued timber production. Some easements further require particular forestry practices, such as maintaining wide riparian buffers, multi-storied stands, and a minimum amount of older trees (e.g., greater than 30 inches in diameter), or long rotations. By guaranteeing older trees, the stock of carbon stored in the forest gets a permanent boost.

Given the immediacy of the climate crisis, there is a strategic tension between attracting the most participation now and securing the most cost-effective and long-term public benefit. The permanence of conservation easements is more expensive up front but more cost-effective in the long run.

“Ghost credits” haunt our climate’s future

What if the scarce carbon dollars aren’t even buying real carbon sequestration? The forest carbon market has come under intense criticism for essentially selling “ghost” credits that fail the “additionality” test. Greenhouse gas reductions are only additional if they would not have happened without the prospect of carbon market payment. For example, Laurie Goodrich, director of conservation science at Hawk Mountain Sanctuary, said that even without the carbon payments, “we’d still be managing the land the same way.” Some projects have even sold offsets for forests that were already legally protected or, worse, credits for planting trees that were already growing.

Hawk Mountain Sanctuary, Pennsylvania. Source: Wikimedia

The compliance market is typically stricter than the voluntary market, but even with California’s gold-standard oversight, researchers found that nearly one in three credits (about 8.5 million cars’ worth of emissions) have zero effect on actual forest carbon stores (which the California Air Resources Board refutes).

If forest carbon projects are to remain competitive against a growing market in technologies that remove and permanently store carbon, such as direct-air carbon capture, forest carbon markets need more rigorous standards and oversight. Already some offset buyers are having second thoughts about forest carbon.

Numerous proposals for tighter standards and more oversight of the voluntary carbon market are being debated. California nearly passed two voluntary market reform bills that together would have mandated uniform standards and “truth in advertising,” and Pacific Forest Trust is collaborating with several US senators on a bill that would create a federal rating system for voluntary carbon offsets. “Just like you have ENERGY STAR when you buy a refrigerator, or a standard EPA mileage rating for a car,” explained Laurie Wayburn, co-founder and president of Pacific Forest Trust.

Measuring diameter at breast height (DBH). Source: Project Learning Tree

How effective this new oversight might be is an open question. It’s expensive to verify the carbon condition of a forest and whether this carbon is at risk. In a competitive market, developers, who take a 20–40 percent cut of the offset sale, would still be tempted to cherry-pick projects and measurements to inflate carbon gains, as would landowners. Registries and third-party verifiers would still be tempted to cut corners to reduce their oversight and verification costs. Those companies who buy offsets simply to greenwash their brand could still purchase cheaper offsets that don’t carry the contemplated “CARBON STAR” label.

In time, these shortcomings may prove to be no more than bumps along the carbon market’s road to fulfilling its potential. For example, new technology that uses remote sensing data to measure forest carbon is being developed. This could potentially reduce the burden of oversight by automating verification and monitoring, and it might help small forest owners participate in the market.

Bettina von Hagen, co-founder of EFM, a forest investment company that manages its land according to the “5Rs™ of climate-smart forestry,” attests to recent improvements in the forest carbon market. “In the last two years, there’s just been a huge evolution in the quality of standards, pricing, increased rigor,” she said. “I just think it’s a whole new ballgame.”

If you took Econ 101, you might remember that prices go up when supply goes down, as long as demand stays the same. Thus, weeding out ghost credits from the carbon offset supply could potentially raise the market price of carbon high enough to attract meaningful management changes on commercial timberlands. For example, at the right price, Weyerhaeuser might be convinced to grow its trees to 80 years old in a forest it truly had planned to log at 40.

But that’s the forest carbon catch-22. Supporters of forest offsets say that focusing solely on the carbon math overlooks the incentives offsets create for protecting forests.

Carbon does not guarantee habitat, water, or biodiversity

The fear is that the carbon market will actually do exactly what it is intended to do—but nothing more. In New Zealand, high carbon prices have led to dense plantations of exotic, short-lived tree species (such as radiata pine) that offer poor habitat and that can displace slow-growing native forests.

Restored forests and long rotations that are managed for habitat provide a whole suite of ecosystem services. But the only ones that have a market are carbon and timber, so conservationists have relied on the carbon market to pay for other forest values.

Hikers in the Issaquah Alps. Source: Peter Stevens

For example, when Save Cougar Mountain, the Issaquah Alps Trails Club, and community members fought to prevent conversion of their beloved forest near Issaquah, Washington, they did it to prevent habitat fragmentation and to protect the ecological integrity of the forest, streams, and wetlands. The resulting land purchase will also result in substantial carbon storage, and the extra funding from selling carbon credits will help pay back the loan and could help fund future land acquisitions. But carbon was not the coalition’s main concern. Because the project would have proceeded with or without the carbon offset dollars, the carbon credits Regen Network Development purchased technically correspond with zero additional carbon storage. If market standards are tightened to avoid non-additionality, worthy projects like this one would become ineligible.

In fact, a majority of forest offset credits sold in the California compliance market have come from “conservation” forests and not from “timber” forests. While any conservation forest not legally protected (for example, by a conservation easement) could theoretically be logged at any time, and sometimes they are logged, these forests are not meant for harvest and therefore offer limited “additionality.”

Clearly, projects that are essentially fraudulent should be weeded out, but many so-called ghost credits are funding real conservation efforts, such as King County’s Land Conservation Initiative. How can the voluntary carbon market be fixed without stranding important conservation efforts?

And is it wrong to pay carbon stewards for doing something the rest of us benefit from, even if they would have done it anyway? As Peter Hayes of Hyla Woods put it, “Do you reward the people who were already doing the good thing? Or do you save your offset dollars to get a ‘bad actor’ to change their ways? There’s a genuine dilemma between the ethical and the strategic.”3

A coho salmon swims upstream to spawn. Source: Wikimedia

Since a disproportionate number of “good actors” are small forest owners, limiting the forest carbon market to landowners who clear-cut on short rotations would exclude many of them. Small forest owners already struggle to access the carbon market because project development costs can quickly outweigh carbon revenues on their small acreage. One proposal to reform the voluntary market would explicitly exclude small projects.

If the price of carbon climbed high enough to attract commercial timberlands, the tie between carbon and other forest ecosystem benefits could be severed. For example, instead of growing a portion of its forests to 80 years old, which improves habitat and protects stream flows, Weyerhaeuser could generate the same carbon credits for less cost by extending its rotations by just one year over a larger acreage, which would yield almost no ecological co-benefits.

But is that a bad thing? The residents of planet Earth are relying on the carbon market for one very important purpose: to reduce the concentration of greenhouse gas in the atmosphere. You don’t need to be a carbon essentialist to ask whether the carbon market shouldn’t focus solely on carbon math while other tools protect forest ecosystems.

Learning from New Zealand

Across the Pacific Ocean, a thriving forest carbon market may offer some lessons for the United States.4 Since 2008, New Zealand has had the world’s only national cap-and-trade program that mandates the participation of forest owners.

The program is complicated, but the basic gist is that forest owners who increase their carbon get paid and those who decrease their carbon have to pay. As long as its carbon price is high enough, the program effectively deters forest conversion, stimulates reforestation, and indirectly incentivizes long rotations. New Zealand’s price for a metric ton of carbon has risen steadily since 2013, hitting US$16.50 in 2021 and more than US$52.65 in February 2022.

Radiata pine, a popular tree for carbon storage in New Zealand. Source: North Sullivan Photography

According to Phil Taylor, who manages Washington-based Port Blakely’s New Zealand forests, “the higher the price of carbon, the greater the incentive to plant new forests and extend rotations.” For example, Port Blakely has made more than $100 million by extending its rotations in New Zealand, for example from 45 years to 70 years in its Douglas-fir forests.

Port Blakely’s Mike Warjone supports a New Zealand–style policy in the United States because he has seen it work. “We make more money selling carbon than trees from New Zealand in some years,” he said. Warjone notes the New Zealand program works because everyone has to be in it. Mandatory forest enrollment could help even the playing field for the Pacific Northwest timber industry, which has been losing market share to the US Southeast, in some part due to looser environmental regulations.5 Warjone emphasizes that “whatever we do here should take account of the yellow pine plantations in the Southeast.”

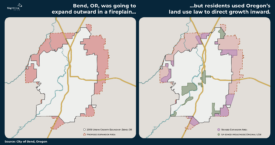

If the United States enacted a national cap-and-trade program with mandatory forest enrollment, it could altogether avoid many shortcomings of the current project-based crediting system: scale, impermanence, ghost credits, and the moral hazards of excluding small forest owners and “good actors.” Plus, nearly all the money that currently goes to carbon project developers, third-party verifiers, and registries (often more than 50 percent of offset revenues) would go directly to forest owners.

There are more advantages: The automatic inclusion of small-scale forest owners could dampen the systematic transfer of forestlands from family forests to Timber Investment Management Organizations (TIMOs) and Real Estate Investment Trusts (REITs). And making forest owners pay to deforest would likely reduce the profitability of development, calming land speculation and land prices and reining in sprawl.

Unfortunately, New Zealand’s national program has not avoided the forest carbon market’s catch-22: the potential decoupling of carbon storage from a holistic suite of forest benefits. In fact, high carbon prices have incentivized planting exotic species such as radiata pine, whose superpower is vacuuming carbon two to three times faster than indigenous forests. These species come with ecological problems: fire risk, disease, and inferior habitat. They also sacrifice higher long-term carbon storage for short-term carbon gains.

Improving on New Zealand’s model

New Zealand’s native kauri trees are slow-growing behemoths. Source: Wikimedia

The world owes many thanks to New Zealanders for 14 years of experimentation and reform. At least four phases of program-wide review have each provided extensive data and analysis and precipitated substantial changes to their system.

Still, there is room for improvement. A national cap-and-trade system that covers Cascadia could preferentially target land based on its carbon potential. To help secure forest carbon against increasing disturbance as the climate changes, land at lower risk of fires, disease, and drought could receive higher payments. The same goes for forests identified as especially promising for natural carbon solutions. This includes the staggering carbon reserves in old growth and other high-carbon forest ecosystems, which New Zealand is struggling to protect.

At the same time, forests that sequester carbon more slowly but offer important co-benefits would need protection. This includes slower growing native species and forests with diverse tree species, multilayered canopies, open flight corridors, and wide stream buffers. When long rotations are narrowly managed for financial returns from timber and carbon, they are planted in dense plantations that largely negate their potential as habitat.

Ultimately, the success of a cap-and-trade system is measured by its progress toward net-zero emissions. Outside of the forestry sector, New Zealand has not made substantial progress toward decarbonization. In its defense, net emissions did not increase as New Zealand’s population increased by 18 percent and its GDP increased by 77 percent from 2008 to 2019.

In Cascadia we can learn from New Zealand’s diagnosis of this failure and require low and declining emissions caps, policy certainty, sustained high carbon prices, and a closed system that only transacts credits from other entities regulated within the same system.

Now for the main act

“So, will carbon credits single-handedly take down climate change? Not exactly.” So concedes Evergreen Carbon, an offset portfolio management company brokering credits from more than 800 carbon projects worldwide.

But can carbon markets (voluntary and compliance) play a valuable role as one of many tools to help societies decarbonize? Quite possibly.

Extending forest harvest rotations on private lands in western Oregon and Washington offers the chance to sequester an additional 880 million tons of CO2e (more than five years’ worth of the two states’ emissions from all sources). On their current trajectory, carbon markets can finance only a fraction of this potential.

The first generations of carbon markets have been helpful as warm-ups for the main act. They face some big challenges, though: scale, impermanence, ghost credits, and the potential de-coupling of carbon storage from overall forest health. For the forests of the Pacific Northwest, the best solution to those problems is to replace voluntary project-based carbon crediting with a nationwide cap-and-trade program that enrolls all forests. In the United States, this might sound like a pipe dream, but developing a plan now prepares for the day when rising costs from heat waves, hurricanes, and drought push Congress (and the Supreme Court) to act.

At the same time, it’s vital to start looking for other ways to incentivize long rotations and other forest carbon solutions through a combination of market transparency, public financing, and carbon protection policies. In future articles, I will explore these promising synergistic strategies.

Methods

Acres harvested on short rotations in western Oregon and Washington: 8 million

To estimate the acreage under short rotations, I subtracted out all small forestland ownerships (fewer than 5,000 acres). Although there are exceptions, large commercial businesses tend to harvest on short rotations while small ownerships are more heterogenous. Western Washington has about 5.5 million private forestland acres, 3.7 million of which are owned by large commercial businesses. Western Oregon has about 7.3 million acres of private forestlands, 4.4 million of which are owned by large commercial companies. The total for both states is 12.7 million acres of private forestlands west of the Cascades, 8.1 million of which are owned by large commercial businesses and thus likely to be harvested on short rotations.

Currently active forest offset credits from Washington and Oregon: 1 million per year

There are currently 20 carbon projects in Oregon and Washington that are registered with the American Carbon Registry, Carbon Action Reserve, Verra Verified Carbon Standard, or City Forest Credits registries, and that have been issued at least some credits. There are additional projects in the pipeline, and there may be some whose application has recently been completed/accepted but are not yet registered and have not been issued credits. While the market experts I checked with believe that these potentially uncounted projects are unlikely to add substantially to the total, to be conservative I adjusted the total for this possibility.

Some of these projects will likely continue “in perpetuity” (for example those covered by a conservation easement), while others may or may not last past the minimum required project length. American Carbon Registry requires carbon sequestration and/or storage for at least 40 years, whereas 100 years is the minimum for California Air Resources Board (CARB)-eligible projects.

To convert different types of projects into comparable units, regardless of their ultimate length, I calculated the amount of carbon each project stores in an average year. For example, the Colville Confederation of Tribes was issued 12,336,210 credits for the first 25-year project period, or 493,448 credits per year. This annual credit value reflects the total amount of CO2e stored in a given year due to carbon projects.

Adding up the annual carbon credited from forest offset projects returned a value of 861,000 tons of carbon stored each year in Oregon and Washington. To account for soon-to-be-credited and potentially uncounted projects, I rounded up this annual credit total to 1 million per year.

Because all compliance projects forfeit a proportion of their credits to a buffer pool in case of natural disturbance or intentional reversal by the landowner, I did not subtract out any canceled credits. (Of the Oregon and Washington forest projects registered in the American Carbon Registry, 538,847 credits have been canceled.)

MICHAEL LAURIE

Thank you for that excellent article. My wife and I recently purchased 19 acres of forested land adjacent to our original property. Within a year of purchase we had put it in King County’s Open Space program and received approval for a Forest Plan. Prior to creating that plan I read a number of books on forestry topics. And in the 1970s and 1980s I worked for 12 seasons in the forests of the West doing a wide range of work. And I have been following the forestry carbon credits subject for a number of years.

Here is my question. Why not allow some level of carbon credits for projects that were going to be protected to some degree. At the risk of sounding self-serving, in our case we absolutely plan to preserve the 19 acres. But we are both busy working full time and our original 3.5 acres keeps us more busy. But if we could receive some amount of carbon credit funding then we could use that money to be rewarded for spending some of our time increasing the carbon sequestering potential of the 19 acres beyond what it would be by just leaving it alone or doing the limited work in our Forest Plan.

We could use that carbon credit money to increase the amount of tree planting we carry out and efforts to improve the habitat.

Like many things, I don’t think we should see this forestry carbon credit subject as an all or nothing thing. There are many levels in between and if carbon credit funding can motivate an owner to carry it to a level or two beyond what they had in mind, isn’t that an improvement that we want to see?

Kate Anderson

Michael, you hit the nail on the head. In a world where money for important conservation is scarce, the carbon market does fund valuable efforts with real forest health impacts and some real carbon impacts. I would love for the market to pay your family for improving the carbon and ecological value of the land.

And yes!, we should not see the forest carbon market as all or nothing. Thank you for saying that.

Unfortunately, that is how many do see the carbon market. The market may diffuse political energy from policy changes that could actually address the true scale of the greenhouse gas problem. That is the real problem with the market, in my opinion.

There is a dragon at the castle gate, and we are bartering over who will build the fire used to fight it. Fires do many things, but they don’t slay dragons (or so I’m told).

As Jonathan Clemens points out, below: We need to reign in the emitters. As taught in college environmental economics classes, the carbon market is premised on mandatory, not voluntary, participation. Without being required to buy carbon offset credits, most companies and individuals won’t. It’s the classic “free rider problem” that causes so many environmental market failures.

In addition to allowing unlimited growth in emissions, a voluntary market also means the price of carbon will remain too low to pay for meaningful changes, such as long rotations maintained into the foreseeable future.

To your specific case:

My mother also owns 19 or 20 acres of forest. She does not plan to log, but she also does not plan to improve the carbon storage. If she fraudulently submitted a carbon claim for improved forest management, but did nothing, it would be hard for market managers to distinguish between your valid claim and her fraudulent claim. (The non-additionality problem.) It’s possible they would choose her project over yours.

In another scenario, if my mother did honestly manage for carbon, and received payment for it, but she eventually sold the land to a developer, who turned the property into a subdivision of houses, asphalt, and grass, then the scarce dollars used to pay her would have been largely wasted. (The impermanence problem.)

Jonathan Clemens

With the latest US Supreme Court decision against the EPA’s regulation of carbon dioxide emissions, we lost an important factor in meeting the carbon reduction goals of the Paris Agreement, which worked to constrain emitters. Unregulated carbon emitters are orders of magnitude larger than our current fledgling carbon credit system, negatively offsetting so much of the progress of carbon forest sequestration or potentially carbon capture. We need to reign in the emitters along with investing in or before spending too much on offsets and mitigation.

Kate Anderson

Well said.