Author’s note June 2022: As American families buckle under high gas prices and the Biden administration considers a gas tax holiday that would almost entirely benefit Big Oil corporations, it’s worth recalling the points made below: 1) gas taxes are largely invisible to consumers, and 2) if governments really wanted to help people needing to move around their cities and towns, they’d invest generously in reducing reliance on gasoline.

A recent surge in gas prices has prompted state and federal legislators in the United States to propose suspending the gas tax. But if consumers didn’t hear about it on the news, would they even notice?

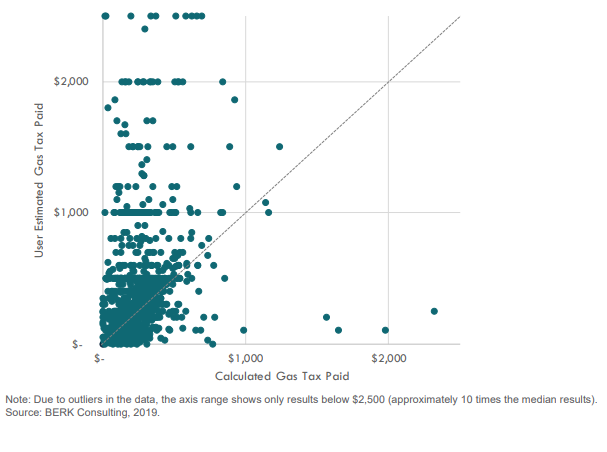

Governments collect gas taxes from a small number of fuel distributors, not directly from drivers. That means consumers often have no idea how much they’re paying back into the transportation system when they fuel up. In that void of information, imagination abounds, as illustrated by a 2019 survey of participants in a Washington State pilot project for a gas tax alternative. When asked to estimate their annual state gas tax expenditure, only one in five participants came within 10 percent of the calculated cost. 55 percent of respondents underestimated their gas taxes by more than 10 percent. The other 24 percent overestimated, sometimes by huge margins:

Another 2017 survey asking Washington’s registered voters about transportation funding found similar results. People often couldn’t guess how much they paid in state gas taxes, but 52 percent of respondents still thought it was too high. DHM Research, which conducted the survey, wrote, “Awareness that there is a gas tax and a tendency to default to the idea that it is too much (whatever it is) may reflect media attention on this issue following implementation of gas tax increases over the past two years.”

When record gas prices make headlines in a competitive election year, it can lead politicians to further subsidize driving.

When record gas prices make headlines in a competitive election year, it can lead politicians to further subsidize driving. For example, the Move Ahead Washington transportation package paid for highway expansions without an increase to the state gas tax (which is unprecedented in its own right). Instead, legislators filled the gap with billions from the state’s General Fund and Public Works Trust Fund. In other words, the state burdened everyone, whether they drive or not, with the cost.

Proponents of suspending the gas tax make quick calculations about how much a family might save. Washington Senator Sefzik, who proposed suspending the state gas tax, claimed it would give an estimated $1 billion of financial relief to families. But as any economist can tell you, the effect of taxes on prices isn’t that simple. And there is scant evidence that all those savings for oil companies would transfer directly to consumers. For instance, according to AAA, on Wednesday March 16th the average cost of gasoline was just a penny cheaper in Oregon than Washington, despite state gas taxes being 11 cents lower in Oregon.

There are more direct ways to lower transportation costs

The long-term solution to shield the transportation system from global spikes in fuel prices is, of course, to reduce demand for fossil fuels. And in fact, that is already happening… slowly. Average fuel efficiency of new vehicles is up 20 percent since the last time gas prices spiked in 2008.

In the short term, there are many ways governments could help people drive less and save them money at the same time. At $4 per gallon, which has already arrived in Cascadia, 59 percent of Americans would make changes to their driving habits or lifestyle to offset the costs, according to a recent survey by AAA.

One proposal from the Climate and Community Project was a Clean Mobility for Clunkers program, which would let people trade in gas-powered vehicles to get electric cars, e-bikes, mobility passes for shared bike or scooter systems, or transit passes. BikePortland.org advocated for making bikeshare temporarily free, similar to promotions in the past that boosted ridership.

Cutting public transit fares is also a popular idea. New Zealand just reduced fares by half for a three-month trial period. Boston declared three bus lines completely free for two years beginning this month. The program, which started with bus routes whose ridership primarily comprises low-income people of color, is expected to make the buses more reliable. One bus line has already reported a 20 percent reduction in boarding times.

Another option would be to use the same money to add or preserve transit frequency, which could make driving less necessary. Some rider surveys show that low-income riders value frequency and reliability even more than lower fares.

Any of these proposals would both reduce demand for fossil fuels and lower people’s transportation costs. And unlike the murky benefits purported by boosters of a gas tax holiday, these benefits would be crystal clear.