As we’ve discussed before, land-value taxation is a smart tool for revitalizing cities. By raising the cost of land speculation, a land-value tax (LVT) would create clear financial incentives to develop underutilized properties near the urban core—helping to create new homes and businesses in the very places where demand is greatest.

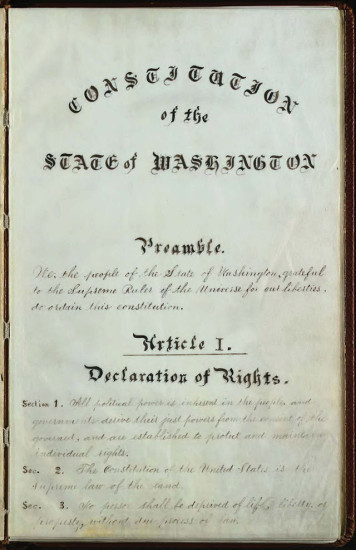

The basic idea of LVT is to tax land at a higher rate than buildings. But there’s a significant obstacle to implementing LVT in Washington. Article VII of the Washington State constitution, which covers revenue and taxation, states:

The power of taxation shall never be suspended, surrendered or contracted away. All taxes shall be uniform upon the same class of property…

Would this requirement for “uniform” taxation make a split-rate LVT, in which land and improvements are taxed at different rates, unconstitutional?

Maybe. But I’m convinced that a glimmer of hope exists for proponents of LVT, which includes both old fans of 19th century political economist Henry George and converts from this new Sightline series.

Before analyzing the possible reasons why an LVT might in fact be possible in Washington, let’s take a closer look at Article VII of the state constitution.

1889

This was a pivotal time for Washington. On June 6th, 1889, a small gasoline and glue fire at a cabinet-making shop quickly became a raging inferno, and practically all of Seattle burned to the ground. Today’s Seattle was hastily rebuilt on top of the charred remains. Just over 5 months later, with its constitution agreed, Washington was admitted as the 42nd state. Article VII of the constitution passed with little debate, and its language was a combination of original text mixed with phrases borrowed from contemporary state constitutions, including, Texas, California, Oregon, and Kansas. The original wording read:

All property in the state, not exempt under the laws of the United States, or under this Constitution, shall be taxed in proportion to its value.

No uniformity clause. No talk of separate classes of taxation.

As it happened, the later tax rebellion that transformed the constitution was spearheaded by a dedicated cohort of angry farmers, who although lacking pitchforks in their hands, sustained a 22-year campaign to change the prevailing state law.

The Grange: A Farmer’s Revolt

Political historians dubbed the period between 1867 and 1896 the Farmers’ movement, which was a time when many farmers campaigned for radical social and economic changes, including the abolition of national banks, free coinage of silver, a sufficient issue of government paper money, tariff revision, and a secret ballot. The Grange (the name of the local chapter) was a part of the Order of the Patrons of Husbandry, the national leader of the larger political movement.

Grangers, Farmers’ Movement by Strobridge & Co. Lith.

As 1900 approached, the many offshoots of the movement had been rolled into the Democratic Party, but the Washington State Grange worked independently with a powerful local backing.

In 1908 Washington Grange members staged their first attempt to alter Article VII. The ballot measure to amend the constitution was soundly defeated, 60,244 (68%) to 28,371 (32%). The farmers did not give up, and 20 years later the measure was again on the ballot. Pictured below are the 1928 campaign statements for both supporters and opponents.

Pamphlet (1928) by State of Washington (Public domain)

The Grange rhetoric of 1928 will sound quite familiar to a modern audience, as it called for a progressive tax structure that would set down heavier taxes on the rich and lighter taxes on everyone else. Moreover, Grange members vigorously argued that Washington State tax law was both antiquated and ill-designed, permitting a favorable operating environment for “special interests and tax dodgers.”

This clamorous group of advocates rallied around two central points: 1) Preventing rampant tax evasion on stocks and bonds; 2) Ending excessive taxation on property and confiscation as a result of nonpayment. Their prescribed remedy? Creating classes of taxation. The proponents for the ballot measure optimistically predicted that under their proposed constitutional amendment:

The cost of government will be shared by all members of society, and more revenue raised with less cause for complaint, and the taxes of the homeowner, the farm owner, and the landowner, under the new system will be materially reduced.

Much like in 1908, the November 1928 ballot measure was defeated, but by a closer margin, 140,887 (52%) to 131,126 (48%). But, as too often happens, other historical forces reared their heads to considerably alter the public mood on matters of public revenue. Wall Street crashed on Black Tuesday, October 29th, 1929, initiating the 11-year Great Depression, and a new critical mass of support grew around lowering taxation in Washington. In November 1930, the ballot measure amending state tax law passed with overwhelming support, 138,231 (61%) to 88,784 (39%). In the most resounding fashion, the electorate implemented the uniformity clause and taxation classes still seen today.

The Present Day

Following their hard-fought victory, the farmers gradually were replaced by an equally persistent phalanx of lawyers. According to The Washington State Constitution: A Reference Guide, “Virtually every substantive word in Section I has been litigated.” The crucial matter is whether something is a property tax or not, because only a property tax is subject to the constitutional uniformity requirement.

I pose a rather different question: when is a tax not really a tax at all? Three key examples spring to mind. First, there are “special local assessments,” which are charges for improvements that increase property values (e.g. fixing street pavement, maintaining green spaces, extra security for businesses). State courts have labelled these charges placed on businesses not as taxes, and thus not subject to the uniformity clause. (See, Seattle v Rogers Clothing, 1990).

Secondly, a gross receipts tax, like Seattle’s “business and occupation tax,” has been defined by our courts as an excise, rather than an unconstitutional nonuniform property tax. (See, State ex. rel. Stiner v Yelle, 1993).

Lastly, and most importantly, a quasi-land-value tax already exists in Seattle: the Multifamily Property Tax Exemption (MFTE) Program, a city-approved, state-sanctioned measure created in 1998 to stimulate the development of new housing units. The MFTE exempts the residential portion of multifamily projects from city and county property taxes, provided that developers set aside 20% of the units for moderate-wage workers. The tax exemption applies to residential improvements only; commercial portions of the property are still taxed at normal rates. Additionally, the exemption remains in effect for 12 years and is transferable from one property owner to another.

Pictured are the Joule Apartments, a mixed-use development located in Seattle’s trendy Capitol Hill neighborhood. Marketed as the “premier Seattle apartment development,” it is a beneficiary of the MFTE. The 2013-14 total taxable value for the building’s commercial property is $16,350,400. Conversely, the exempt total for its residential property is $59,321,600. Obviously, it is no small sum being exempted.

The MFTE is perfectly legal, even though it taxes commercial and residential portions of a single property at different rates. And this raises an enticing possibility: with careful legal wordsmithing and thoughtful construction, perhaps an LVT that taxes land and buildings at different rates might also pass constitutional muster.

Despite its many benefits, the MFTE has a major flaw: its byzantine application and review process subtly impede the development of housing stock.

To be eligible for the MFTE, for example, the city requires that:

- The development site must be located within the boundaries of one of 39 target areas.

- The development must be a residential or mixed-use project with a minimum of 50% of the gross floor area for permanent residential use.

- New construction projects must have a minimum of four housing units.

- Rehabilitation or conversion projects must include the addition of at least four new housing units.

- For vacant buildings, the residential portion shall have been vacant for at least 12 months prior to application.

In contrast, a well-designed split-rate LVT would create incentives for new development minus the byzantine process. And if teamed with other smart growth measures—like the removal of building height and parking requirements—the development spurred by LVT could simultaneously increase the city’s tax base and reduce rents.

So now to travel back to the question of the constitutionality of the land-value tax: Would state courts define this sort of split-rate tax as a permissible excise tax or special assessment? Or would they declare it unconstitutional? Nobody can know for sure. The ultimate answer may lie with the skill of lawyers drafting such a tax, and with the temperament of the judges considering a challenge. But I’m optimistic, and if the legal and political forces align, the LVT—in my view, the most equitable tax of them all—could one day be a reality in the Evergreen State.

thomas cappiello

I am against any kind of property tax whatsoever. Essentially, such a tax prohibits individual freedom to exist, and inhibits many uses that are beneficial to society, primarily the use of land as open space, farming, and other aesthetic purposes.

Michael

My understanding is that taxable value of property classes may be exempted by simple legislative bills. Thus the senior exemption, designated forest exemption, etc.

Michael

RCW 84.36.005

“Property subject to taxation.”

All property now existing, or that is hereafter created or brought into this state, shall be subject to assessment and taxation for state, county, and other taxing district purposes, upon equalized valuations thereof, fixed with reference thereto on the first day of January at twelve o’clock meridian in each year, **excepting such as is exempted from taxation by law.**

What would stop King Co. from exempting improvements from taxation and adjusting the mill rate to the land-only value?

Nate

Brilliant

Jeff Smith

States have other charges that evade their constitutions, such as quid pro quo fees (as for parking). The deed fee can be raised and made annual or monthly. A periodic Displacement Fee could be created, charging owners for displacing everyone else and every other usage but their own.

Even better, the captured land rents could be kept out of the general fund and not be made available to politicians but instead enter a trust fund and be used only for disbursing to citizens. That’d make the charge a non-tax. The payment could be a straight dividend that the recipient could spend it anyway they like a la Alaska’s oil share or Singapore’s land dividend, or it could be a housing voucher good for renting, leasing, buying outright, mortgages, a la Aspen CO’s housing assistance, or making improvements.

Whatever form the fee, it must first be passed into law, which naturally requires political support. Support for asking landowners to hand over all their “housing equity” — actually, potential land rents — to politicians has not been fanatically forthcoming (quite the opposite). A better strategy than trying to pass an unpopular tax is to pass a popular dividend that happens to need a fee to fund it.

Mark

In theory, the LVT sounds like a good prod for development. Since it is not smart to prod development everywhere, significant land areas would need to have reductions in their rates, as we have now for certain agricultural, forest, and open space lands.

Along with that problem is the problem that, especially in urban areas, very little undeveloped land changes hands, so an assessor would have to figure out the land value from the total sales price. Discerning how much of a sale price is attributable to the improvements (considering its size, condition, rent, lease status, etc.) versus the land value, is more art than science. Take Northgate Mall, for example. But for the buildings and tenants, what would you have? a great location next to the freeway, yes, but the presence of the anchor tenants on that property make it and even the properties around it more valuable, because rents are higher the closer you are to those anchor tenants that generate the foot traffic needed to support smaller businesses nearby. Should the taxable land value of Northgate Mall take this into account? If so, would that not be taxing the owners of the mall for the improvements on their property?

Although breaking out land from improvement value is ostensibly done now on each tax assessment, the distinction is unimportant because they are added back together to get the total taxable value. Algorithms based on real sales data are used to adjust total taxable value, then the split is made using a secondary method, simply to comply with state law that such a distinction be made. I once came across a property in Seattle containing over two hundred fully rented apartments in a complex with open space and a swimming pool (in good condition!) that has an improvement value assessment of $1000 while the land is valued at $15M. The total was probably about right, but the split was an expedient fiction.

Rick Rybeck

“All taxes shall be uniform upon the same class of property…”

The state legislature merely needs to enact a law stating that “land” and “improvements to land” are separate classes of property and that taxing jurisdictions shall have the option to tax improvements at lower rates. Land and improvements are different classes of property because the value of improvements is privately created where as land values are created by the community.

As for those who are concerned about the preservation of farms, it is important to remember that the tax is upon “value” and not upon “acreage.” Additionally, rates in rural areas could be lower than in urban areas. Zoning and other development regulations can help ensure that rural land values remain appropriate for agricultural activities.

Within an urban context, zoning and historic preservation laws can help direct development activities to areas where such activity is appropriate.

As for assessments, many major cities use computer-assisted mass appraisal (CAMA) systems. These systems include a multiple regression module that can allocate total value among its component parts. Properly applied, it can provide a reasonable estimate of the allocation of value between land and improvements.

For more info, see “Funding Infrastructure To Rebuild Equitable Green Prosperity” at http://revitalizationnews.com/article/funding-infrastructure-for-sustainable-equitable-revitalization/

Martin L. Bring

We might also promote LVT as a tax on unearned income as opposed to earned income; a method of possibly reducing, negating, or forestalling a State income tax. Seattle’s wealthy might cotton to that idea.