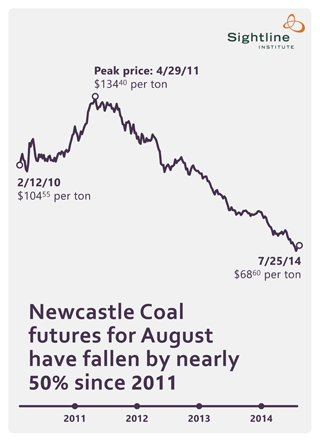

In case you don’t check the coal futures markets every day, you may have missed the news that international coal prices recently reached a multi-year low. To understand just how dramatic the decline has been, all you need to do is look at the chart of futures prices for coal at Newcastle, Australia, one of the key pricing points for Pacific Rim coal markets.

If you’re a coal buyer in Korea or Japan you’re probably applauding the ongoing price collapse, because it means that you can buy a ton of coal for a lot less than you used to. But if you’re in the business of selling coal on the seaborne coal markets, the trends have been nothing short of a financial catastrophe.

When Pacific Rim coal prices shot up in 2009 through 2011, mining firms throughout the Pacific Rim invested tens of billions of dollars in new mines and export facilities, expecting a sure payoff. China’s demand looked like it was skyrocketing, and many market observers were convinced that prices would stay high indefinitely—leading many coal companies to lock themselves into long-term contracts with rail and port companies that required them to export coal, or else pay a stiff penalty.

Those long-term coal contracts turned out to be the financial equivalent of a poison pill. The flood of new coal throughout the Pacific Rim sent prices tumbling, even as China started to tap the brakes on its coal consumption, driven by high prices, a cooling economy, and terrible urban air quality.

Yet even though Pacific coal prices have fallen through the floor, those long term export contracts force many coal companies to keep selling coal at a loss. Sure, they’re losing money shipping coal overseas, but if they stopped exporting, they’d lose even more money from the contractual penalties with port and rail operators. This dynamic helps keep the coal flowing, driving prices lower and lower.

If you’re wondering whether these trends spell bad news for coal exports from the Pacific Northwest, the answer is simple: YES.

As I’ve said before, Cloud Peak Energy is in a better position than any other Powder River Basin coal miner to take advantage of the export markets, due to the high calorie content of its Spring Creek coal and the shorter rail trip to west coast export terminals. But at today’s prices, Cloud Peak is almost certainly losing money hand over fist. As the company’s CEO said in an investor conference call in April, transcribed by Seeking Alpha, Cloud Peak needs to see the Newcastle benchmark at about $85 or thereabouts to make money selling coal overseas.

Neil Mehta – Goldman Sachs

And just on PRB netbacks, what Newcastle price do you need to make [Powder River Basin] coal in the money?

Colin Marshall – President & CEO

[I]t’s between $80 and $90 I think and maybe $85 is a good a number as any.

Remember, August futures prices for Newcastle coal are now at $68.40 per ton—roughly $16/ton below where Cloud Peak needs them to be to make money exporting coal. The only saving grace for the company is that its sales are partially hedged, meaning that Cloud Peak will make at least a bit of money from their bets that coal prices would fall, even if they lose money selling coal to Asia, as they have for the last several quarters.

Oh, and in case you were wondering, Cloud Peak executives have told investors that they signed the same sort of long-term “take or pay” contracts that have become such albatrosses around the necks of Australian coal companies. So even if coal prices stay low for the foreseeable future, Cloud Peak will probably keep on exporting—losing money selling coal, just to avoid even steeper losses on their contractual penalties to rail companies and the ports.

Nobody knows how long coal prices will stay so low. But what’s perfectly clear is this: at the moment, the US coal industry’s export ambitions are causing far more harm than good to coal company’s bottom lines. I expect we’ll see more evidence of this as companies like Cloud Peak and Arch Coal announce their second quarter results next week.

Steve Erickson

Isn’t this how capitalism is supposed to work. You want to make money, so bet that you’ll lose money and that way you win if you lose. Or is it that you lose if you win? Anyway, whether its win-lose or lose-win, its a loss and that’s a win. Yippee!

Michael Riordan

The Newcastle price for thermal coal is getting close to its 5-year low of about $61 per metric ton, last reached in 2009. This benchmark price has been very spiky over the last seven years, going as low as $56 and as high as $190, but it looks to me that these take-or-pay contracts are now going to keep the price low for a long time.