With the sharp rise in Seattle real estate values over the last several years, you might assume that landowners have been champing at the bit to redevelop some of the low-value, dilapidated properties that they own in and around downtown.

Yet in many cases you’d be wrong. As it turns out, holding onto a crumbling building, and even letting it slowly deteriorate, can be a terrific business proposition. As the surrounding neighborhood develops, growing in value by attracting new residents and businesses, a rundown piece of property can skyrocket in price. Landowners themselves have done nothing to boost the value of the neighborhood; they’re just taking a free ride on the coattails of their neighbors.

The King County Department of Assessments appraises property with the express intent of reflecting property at its “highest and best use,” defined by the Assessment office as:

If improved: Based on neighborhood trends, both demographic and current development patterns, the existing buildings represent the highest and best use of most sites.

We find that the current improvements do add value to the property, in most cases, and are therefore the highest and best use of the property as improved. In those properties where the property is not at its highest and best use, a nominal value of $1,000 is assigned to the improvements.

So based on appraisal data, most assessors seem to assume that downtown properties are put to their “best” use. Yet you can find quite a few properties assigned the default value—a measly $1,000—indicating that the “improvements” on the property are virtually worthless, and would be better replaced with, well, practically anything else. At times, assessors even assign buildings a value of $0, certainly the strongest possible statement that the property is not being put to good economic use.

What does a Seattle property with improvements assessed at $1,000 look like? What about one assessed at $0? Walking through Seattle’s Central Business District, six specific sites stuck out to my eye.

1. United Parking Garage, 701 4th AVE; Lot area, 14,280 sq. ft.; Built in 1964

Taxable Improvement Value, 1999-2015, $1,000

Taxable Land Value, $1,785,000 (1999); $10,710,000 (2015)

2. Fourth and Columbia Valet, 719 4th Ave; Lot area, 14,280 sq. ft.; Built in 1919

Taxable Improvement Value, 1999-2015, $1,000

Taxable Land Value, $1,785,000 (1999); $10,710,000 (2015)

3. Budget Parking Garage, 807 4th Ave; Lot area, 13,320 sq. ft.; Built in 1923

Taxable Improvement Value, 1999-2015, $1,000

Taxable Land Value, $1,998,000 (1999); $9,990,000 (2015)

A charitable architectural critic might politely call these parking garages aging novelties. Someone far more blunt would call them eyesores. But what they lack in aesthetic value they make up for in location, location, location, as both City Hall and the Columbia Center, the second tallest building on the West Coast, are just seconds away. So even as the property owners have allowed these buildings to languish, with assessments showing that the structures are nearly worthless, the land values have soared, principally because of investments by neighbors and taxpayers to create a more vibrant downtown.

Holding these downtown properties off the market—rather than turning them into more valuable homes, offices, or stores—has fed sprawl, since it has forced developers to turn their gaze outward to find developable land. Together these three adjacent lots make up 41,880 square feet, with a total taxable value (land plus improvements) of $31,413,000. In comparison, the Columbia Center, sits on a lot sized at 59,266 square feet, only moderately larger than the three aforementioned lots. Total taxable value? An eye-catching $310,396,000. This is not to say that a junior-sized Columbia Center could be erected at these three lots, but it does suggest a considerable opportunity cost of having deteriorating parking structures in the heart of downtown Seattle.

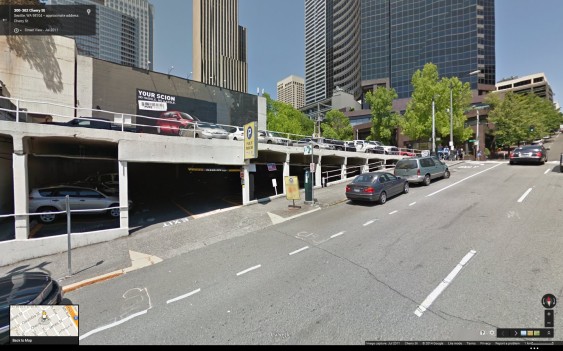

4. Cherry Street Parking Garage, 213 Cherry Street; Lot area, 9,160 sq. ft.; Built in 1900

Taxable Improvement Value, $355,000 (1999); $1,228,400 (2004); $1,000 (2008-15)

Taxable Land Value, $1,145,000 (1999); $5,496,000 (2015)

Unlike the other examples listed, this aging parking structure has fluctuated in value over the years. From 1999 to 2004, the assessed value of the structure increased; potentially a sign that the owner had made some improvements on the property. But this figure proceeded to plummet, and has been stuck at $1,000 since 2008. Its Cherry Street location is a prime spot, sitting between the historic Pioneer Square and City Hall. In the future, the land value will only increase, as it is located next to the Civic Square development site, what should be the next towering addition to Seattle’s skyline. That is, of course, if construction ever gets a much-needed jump-start.

5. Surface Parking Lot, 1516 1st A; Lot area, 13,320 sq. ft.

Taxable Improvement Value, $1,000 (1999); $0 (2000-15)

Taxable Land Value, $1,332,000 (1999); $3,330,000 (2015)

This 13,320 square foot parking lot is owned by the Samis Foundation, the charitable body of the late Sam Israel, a former Seattle property tycoon best known for snapping up choice lots and allowing them to sit idle as they slowly fell into neglect and ruin. Directly across from Pike Place Market, Seattle’s top tourist attraction, and right next to Fifteen Twenty-One Second Avenue, one of the glitziest condo towers west of the Mississippi River, this surface parking lot could be one of the best addresses in the entire city. But in an unpleasant juxtaposition that’s all too common in the city, it’s just a patch of empty concrete bordered by a low-rise strip club.

6. Surface Parking Lot, 1101 Western Ave; Lot area, 35,233 sq. ft.

Taxable Improvement Value, $1,000 (1999); $0 (2000-15)

Taxable Land Value, $2,818,640 (1999); $9,689,000 (2015)

This Western Ave space is quite possibly the most infamous surface parking lot in Seattle, the subject of a 2013 showdown between the lot’s 103 year-old owner, Myrtle Woldson, and the Seattle City Council. The city, you see, hoped to use its powers of eminent domain to seize the property for the purpose of turning Woldson’s parking lot…into a parking lot. Located near Seattle’s soon-to-be renovated waterfront, the value of this land is set to rise even faster than it already has over the past 16 years, which may help explain why the city wanted the property in the first place. In the end, despite a Council vote granting a mandate for the acquisition of the parking lot, it remained with Woldson, who died recently at the age of 104.

Obviously, there’s no sight of illegal activity in any of these examples. Landowners are perfectly within their rights to hold on to crumbling parking garages and surface lots, profiteering from rising property values in a revitalized city. The problem is that our property tax system actually rewards this behavior. Leaving a valuable property underdeveloped is an effective method of keeping your tax bills low. At the same time, holding a lot of properties off the market is a great way to make land scarce, which also puts upward pressure on land prices. The tax system, as it’s designed, gives clear incentives for property owners to sit tight as city property values rise.

As mentioned in previous articles, one solution is simply to tax land speculation, by shifting the tax burden away from buildings and onto land. Land-Value Taxation, as it’s called, isn’t an all-or-nothing proposition. In theory, it’s easy enough to tax buildings and land at different rates (often called “split-rate” taxation), a system used in a few other places in the US. Boosting the tax on land would simultaneously cut into land speculators’ profits, while making it more expensive to hold valuable but underutilized properties off the market. Those sorts of incentives could help spur infill development—a vitally important step towards boosting housing supply, decreasing the need for car ownership, and building a cleaner, more livable urban landscape.

Ann

The value of the structures on the “developed” sites seems to be off. While the structures are marginal, they are obviously used to produce income greater than would be possible with a vacant piece of land. While not the point of your article, I question the basis for the assessment. Maybe logic has nothing to do with it, but still…

Jerrell Whitehead

Hello Ann,

Thank you for your response!

All of the supplied data in this post can be found at:

http://gismaps.kingcounty.gov/parcelviewer2/

Ben Schonberger (@SchonbergerBen)

I agree with Ann that this needs more explanation. How can a functional, usable building that generates significant income be valued at only $1,000? Perhaps there is a definition issue, or a tax waiver, or something about the building that makes it so worthless? A comparable parking garage in downtown Portland (similar age and size) as your 4th and Columbia example in Seattle is valued at $2.6M for the building and $4.1M for the land.

Ben Schonberger (@SchonbergerBen)

Sorry, here’s the link:

http://www.portlandmaps.com/detail.cfm?action=Assessor&&propertyid=R246153&state_id=1N1E34CC%20%20200&address_id=374450&intersection_id=&dynamic_point=0&place=201%20SW%206TH%20AVE&city=PORTLAND&neighborhood=PORTLAND%20DOWNTOWN&seg_id=114480&x=7644095.484&y=684049.82

http://awesomescreenshot.com/0ed370797d

Michael Andersen, BikePortland

Hear hear. I’d love to duplicate this work for Portland but I don’t understand the $1,000 valuation thing. Just a quirk of King County assessment practice? As Ben’s figures show, if there’s a tax subsidy at work here, ignoring the value of improvements to the land seems like it’s a big part of the problem.

Curious

How would could we go about incrementally adopting (and trying out) land-value taxation or something close to it, in a large metropolitan area? And if you could randomly select an area and set it up to have such taxation, can we make any evidence-based prediction of how its average (median) property owner would be faring 5 or 10 years from now, compared to under the current tax system?

Alan Durning

I do not understand how the property tax appraisals are done or why a parking garage that generates more revenue than would a surface lot is valued at $1,000.

But I can imagine.

Consider the cost of demolition. If I were a developer of a prime site, I’d much prefer a truly bare lot over one with a marginal building. Before I could start building something, I’d have to first spend tens of thousands of dollars on demolition and site clearing. From that perspective the value of the building is actually negative. That is, the site would be worth more money without the building.

That could even be true if the building is generating some income, though obviously the net-present value of the likely income stream ought to be reflected in the appraised value of the building.

One thing I’ve long wondered is why tear-downs are not appraised as negative values by tax appraisers. Failing to do so actually means that the appraisers have to REDUCE the stated value of the land, distorting the data.

jerome parker

Henry George had it right over 100 years ago. Pennsylvania has allowed land value taxation. I believe it will require action by the Legislature to make it legal in WA. Any coaliton to capture these society generated windfalls for the public?