President Obama and leaders at all levels of government have been vocal about the role energy efficiencies can play in economic recovery, creating green jobs and reducing climate-changing emissions. But encouragement from the top to develop innovative financing for energy efficiency is running smack into constitutional reality in Washington, where state constitutional limits might hinder innovative financing. The state’s constitution (written in the century before last, 120 years ago) needs to be amended to make creative financing for energy efficiencies easier.

President Obama and leaders at all levels of government have been vocal about the role energy efficiencies can play in economic recovery, creating green jobs and reducing climate-changing emissions. But encouragement from the top to develop innovative financing for energy efficiency is running smack into constitutional reality in Washington, where state constitutional limits might hinder innovative financing. The state’s constitution (written in the century before last, 120 years ago) needs to be amended to make creative financing for energy efficiencies easier.

And a recent Gallup poll confirms that Americans are most concerned about money when they consider retrofitting their homes to make them more energy efficient by doing things like adding insulation, replacing water heaters and installing fixtures that use less energy. More and more people are beginning to consider these kinds of retrofits just as important as new countertops when they make home improvements. Making it simple and cheap to finance these improvements—and the jobs that go with them—should be an easy sell.

I covered one idea from Oregon, Property Assessed Clean Energy financing (PACE), as an example of what the President and others are talking about. PACE uses government financing to help homeowners pay for retrofits; the loan is paid back with an incremental increase that appears on the property’s regular tax bill. Oregon passed this financing tool this year, and it’s a good example of innovative financing, using government-backed financing for energy retrofits for homeowners and small businesses. Easy access to money and an easy way to pay it back will result in reduced energy costs for homeowners, green jobs in the energy efficiency sector, and a reduction of climate emissions.

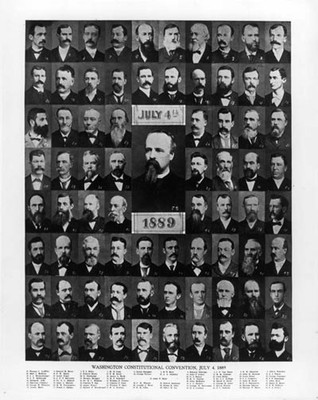

But, in Washington, there may be a catch. In the 19th century, when the state’s constitutional convention was drawing up its founding document, the drafters included some provisions that at the time made sense. Article 8 of the state’s constitution prohibits the loaning of credit, by the state or local government to any private entity. The worry in those days was about railroad barons who, in other states, made lots of money using public credit to build railroad projects that ultimately failed. Those projects left taxpayers with a broken railroad and a big debt to pay back.

The language from article 8 states clearly, in section 5, that “the credit of the state shall not, in any manner be given or loaned to, or in aid of, any individual, association, company or corporation” and further, in section 7 that “no county, city, town or other municipal corporation shall hereafter give any money, or property, or loan its money, or credit to or in aid of any individual, association, company or corporation.”

According to some energy efficiency advocates, section 5 of article 8 means that state and local governments can’t borrow money on behalf of a business, non-profit or a homeowner to complete energy saving retrofits—even if the money is paid back with interest. In Washington, an innovative program like PACE might run afoul of the constitution because it uses money borrowed by the state or local government to cover costs of retrofits which homeowners pay back, over time, on their tax bill. (PACE programs typically sell bonds to create the cash stream for the loans.) Using state or local debt capacity like this would be a loan of the state’s credit, a big no, no.

There are two possible solutions to the constitutional problem. First, the legislature should pass carefully crafted PACE legislation anyway, and then settle the constitutional question in court. The state could make the argument that programs that use state credit for energy efficiency in the household sector have the public as their ultimate beneficiary, reducing emissions and creating jobs, among other benefits.

But the best solution would be to amend Washington’s constitution in 2010 to allow for state credit to be used expressly for financing renewable energy and energy efficiency, especially for programs that make it easy for homeowners to borrow money and easy for them to pay it back. Washington State voters amend their constitution at the ballot box frequently, 102 times since the document was ratified. As I have written often, analyses of the economic impacts of a PACE-like programs consistently show huge economic potential. Voters might see the advantages to using the state’s ability to issue bonds to achieve significant energy savings, reduce climate changing emissions, and create jobs.

That’s what Oregon did in 1980. The Oregon constitution—written with similar language to Washington’s as a reaction to the railroad barons—Article 11 section 7, prohibits “lend[ing] the credit of the state nor in any manner create any debt or liabilities which shall singly or in the aggregate with previous debts or liabilities exceed the sum of fifty thousand dollars.” But there is an exception in Article 11-J:

Notwithstanding the limits contained in sections 7 and 8, Article XI of this Constitution, the credit of the State of Oregon may be loaned and indebtedness incurred . . . for the purpose of creating a fund to be known as the Small Scale Local Energy Project Loan Fund. The fund shall be used to provide financing for the development of small scale local energy projects.

The exception makes room for the state’s credit to be used for local energy projects. No wonder then that Oregon has a reputation as a leader in innovative energy policy. It’s time for Washington State to catch up with Oregon, either by exploring the legal limits of using state credit for energy or by giving the people an opportunity to amend their antique constitution to make possible real energy innovation—and the money and jobs that go with it.

Note on sources on constitutional history: There are two essential, and frankly fun, reads for anyone interested in the history of Washington’s founding document. First is “The Washington state constitution : a reference guide” by Robert F. Utter and Hugh D. Spitzer. Utter and Spitzer’s book provides rich legal and historical background for every section of the constitution. Second, is the actual record of debates and amendments, successful and unsuccessful, contained in “The journal of the Washington State Constitutional Convention, 1889.“

Amy

With the promise of energy efficiency to deliver both economic and environmental benefits and given the critical role of state and local governments in designing incentives to spur action it’s interesting to note potential legal roadblocks. I’m wondering now if this will arise in more states as new programs gain momentum? If an amendment to the state constitution does come to a vote in Washington this year, at least energy efficiency is an issue that’s clearly in the self-interest of voters.

Melissa

Washington does have more than one variation on TIF such as “local revitalization financing” for public improvements that will result in economic growth and development. Each has been used in several instances, most recently with 2009 legislation.