If you still need to meet Reggie, you can get introduced in Part 1.

(1) Yes, you can lower emissions without harming the economy.

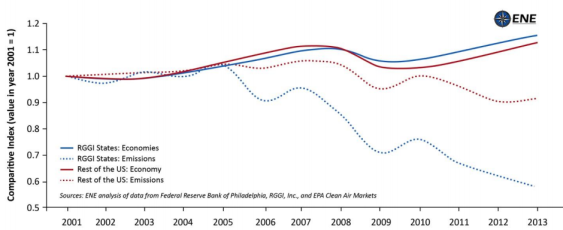

RGGI’s CO2 emissions from electricity dropped by more than 40 percent between 2005 and 2012 while the region’s economy improved. The entire US economy has been slowly backing away from its unhealthy, codependent relationship with energy use, but RGGI’s economy has really broken it off. Below, RGGI CO2 emissions (blue dotted line) steeply declined from 2005 to the present, while RGGI state economies (blue solid line) improved. The US’s failure to cut emissions (dotted red) as fast as RGGI hasn’t helped the economy (solid red).

RGGI Performance To-Date and the Path Ahead, May 2014 by ENE (Used with permission.)

The big secrets to scaling down emissions while maintaining a healthy economy are: 1) increase energy efficiency, and 2) decrease imports of dirty out-of-state power. That should make Cascadia’s ears perk up: we have some great energy efficiency experience, and most of our dirty power comes from out of state.

Some of the dramatic decrease in RGGI’s emissions was due to lower electricity consumption, driven partly by energy efficiency programs funded by RGGI auction revenue. Some was due to shifting away from coal and petroleum.

Below, you can see that total electricity use in the RGGI states was lower in 2012 than in 2005. You can also see the changing fuel mix: coal and petroleum (red and brown) generated one-third of RGGI states’ power in 2005, but only 10 percent in 2012! Natural gas (orange) rose from one-quarter to nearly half. This change was driven by several factors, including: 1) the price of natural gas dropped relative to the prices of coal and oil, 2) coal capacity decreased as coal plants were retired or converted to natural gas, and 3) RGGI’s price for carbon piled on to widen the price gap.

Original Sightline Institute graphic, available under our free use policy.

(2) Investing auction revenue in energy efficiency is a good idea.

As Sightline has long pointed out, giving allowances away for free, rather than making emitters buy the allowances in an auction, is regressive and counter-productive. Auctioning allowances enables states to use the value of the allowances for the public good. So, hooray! RGGI states auction almost all allowances in the central quarterly auction, collecting nearly $2 billion in revenue so far.

The RGGI memorandum of understanding requires member states to use at least 25 percent of allowance value for “consumer benefit,” but RGGI states have chosen to far exceed that minimum, using more than three-quarters of auction revenue for investments in energy efficiency, clean energy, and direct-bill assistance to help customers.

Original Sightline Institute graphic, available under our free use policy.

The programs RGGI invested in during just its first 2.5 years will add $1.6 million in net benefits to RGGI state economies and create 16,000 jobs. If RGGI continues auctioning and investing, it could add over $8 billion in net benefit and add 57,000 job-years of employment by 2020. These benefits come mainly from energy efficiency programs that lower bills for the participants and pare regional prices by reducing demand. Shifting from out-of-state power to in-state energy efficiency also keeps money in the local economy. Energy efficiency is six times more job-intensive than fossil fuels; as efficiency replaces fossil fuels in the resource mix, it creates jobs.

(3) Cascadia can set a lower cap.

In a cap-and-trade program, a low cap allows less pollution, meaning the price to pollute will be higher, equivalent to a higher carbon tax. A high cap allows more pollution, meaning the price will be lower.

As often happens, RGGI overestimated the cost of cutting pollution and set the cap too high. That’s an understatement. “Too high” might mean the cap was just a bit lower than actual emissions, only requiring a little emissions trimming. RGGI’s cap was much higher than actual emissions. In the chart below, the blue line shows actual emissions in the nine RGGI states, and the red line shows the RGGI cap. That’s not how it is supposed to work. The cap is supposed to be lower than historical emissions, forcing reductions. At least RGGI had a price floor. Allowances sold at the minimum price—less than $2 per ton—for many quarters.

Cleverly, RGGI built a 2012 program review into its design to catch and correct exactly this type of mistake. As a result of this review, RGGI updated its cap, and the new, tightened cap went into effect in 2014 (see steep drop in the red line below). As a result, the most recent auction price was $5 per ton. But even the new and improved cap may be too permissive: 2013 actual emissions were lower than 2014’s tightened cap, and RGGI’s 2020 soft price ceiling of $10.75 is lower than California’s most recent auction price of $11.48 per ton. To be effective, the cap needs to be low enough to shave emissions.

Original Sightline Institute graphic, available under our free use policy.

Lessons for Cascadia—keep the cap low by:

- using actual emissions data,

- considering the experience from older programs like RGGI when projecting emissions, and

- building in periodic reviews to allow adjustments as more data become available.

(4) Cascadia can commit to a longer-term price.

The current price is important, but the future price matters even more. Energy emissions are driven by decisions about long-term investments, such as what kind of power plant to build. Once built, each plant will be around for half a century or more. It’s hard to change course quickly. Power producers have few options for responding to the carbon price this year; they have many options for responding to the price 20 years from now. Motivating power producers to build clean power is the real clout of the carbon price.

Like California, RGGI only contains a binding cap through 2020, so investors cannot plan around a long-term carbon price. Cascadia could do better by committing to a longer-term price.

Even if RGGI’s cap extends through 2050 at its current rate of curtailment, it would only cut emissions 60 percent by 2050, which is less than California’s more aggressive (but nonbinding) goal to slash emissions 80 percent below 1990 levels by 2050. To get to a low-carbon economy, we need an aggressive goal.

RGGI Performance To-Date and the Path Ahead, May 2014 (2) by ENE (Used with permission.)

(5) Cascadia can price more carbon.

In-state electricity is important, but imported electricity and cars, trucks, factories, and farms also spew carbon. For climate leadership, we need to include all major sectors, as does California’s cap-and-trade program.

Especially important is for Cascadia to put a carbon price on imported electricity, since a lot of its electricity emissions come from imported power. Ignoring this could undermine the program by “leaking” emissions across state lines.

(6) You can trim pollution and energy prices.

Electricity prices in the RGGI region have dipped by 8 percent on average since RGGI took effect. In the rest of the United States, they rose 6 percent. RGGI-funded energy efficiency programs may have decreased total energy demand—and prices. At a minimum, we can conclude that RGGI did not increase prices.

(7) Bonus! Slashing carbon also cuts toxics.

Sulfur dioxide (SO2) and nitrogen oxides (NOx) can trigger asthma attacks, increase the risk of infectious disease, and form ozone that contributes to pneumonia, bronchitis, heart attacks, stroke, and risk of premature death in children and older adults. Mercury harms brains and developing babies. Bad stuff. The good news is that when you invite “CO2 pollution reductions” to the party, it brings along its buddy “toxic pollution reductions.” RGGI has pushed down these toxic pollutants by 35 percent and 82 percent already, and it is projected to trim them another 50 percent or so by 2020. Cascadia can get the same bonus.

RGGI Performance To-Date and the Path Ahead, May 2014 (3) by ENE (Used with permission.)

NOTES on Sources: “RGGI slashed coal and oil-fired electricity” from US Energy Information Administration, Detailed State Electricity Data; Environment Northeast, RGGI Emissions Trends, January 2011. “RGGI used most auction revenue for energy efficiency” from RGGI, Regional Investment of RGGI CO2 Allowance Proceeds, 2012, February 2014. “RGGI cap has been too high” from RGGI, 2009-2011 Allocation; RGGI, The RGGI CO2 Cap; RGGI CO2 Allowance Tracking System, Annual Emissions Report. These three infographics by GoodMeasures.Biz.

Matt Leber

Many may be alarmed by the large increase in electricity generated from Natural Gas. There are valid reasons to be concerned. However, it’s good to note that newer Natural Gas power plants cut our CO2 emissions in a short amount of time and can more rapidly adjust their power output to fill in when renewable energy sources go offline when the wind stops blowing, the sun goes down, or if the rain and snow don’t fall. And Carbon Capture technology for natural gas power plants is already available and faces far fewer technical hurdles the CCS for coal plants.

An excellent analysis by the US Energy Information Administration on competition among the different fuels can be found here.