King County voters are receiving ballots in the mail for the April 22 special election. Many of them have only one issue to decide: Proposition 1. Unless voters approve it, King County Metro will be forced to cut between 16 percent and 17 percent of its current bus service.

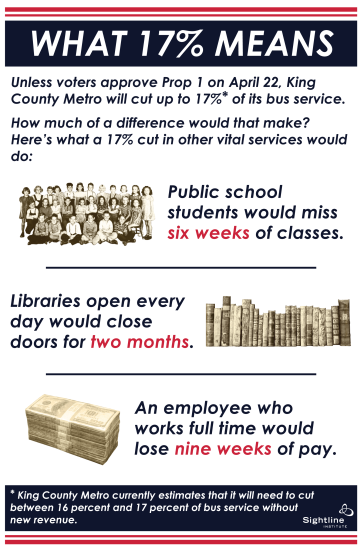

That number is a little hard to visualize. Seattle Transit Blog has done it with this map revealing how much of the region’s frequent service network would disappear. King County has crunched numbers to show how route cuts will impact highways and job centers. But for those of us who aren’t transit nerds or intimately familiar with traffic patterns, here’s another way of thinking about what a 17 percent cut really feels like:

What 17% KC Metro Cuts Mean, by GoodMeasures.biz, for Sightline Institute. (Original Sightline Institute graphic, available under our Free Use Policy.)

The reductions would go beyond trimming fat or belt tightening. They would cut deeply into a core service that 400,000 people rely on to get where they’re going. And one that benefits everyone else by getting those people out of cars and freeing up road space. So if a nine-week pay cut—or figuring out what to do with your kids for an extra six weeks of summer—feels like a big deal to you, chances are good that Metro bus cuts would be too.

Weezy

The taxing for transit here already is much heavier than anywhere else in the country AND it is more regressive.

Our state legislature and its local enablers get off on soaking the lower middle class and the poor.

They are the worst in the country in terms of regressive taxing, and the excessive transit taxing is the main reason.

Don’t believe me? Just compare the amounts of regressive tax confiscations here to the metro area just south of here where a different state legislature structured the financing plan: Oregon’s.

The best way to gauge how well a transit system’s leadership is able to maximize local tax revenue – that is, the best way to see whether or not some region’s government heads are taxing excessively – is to compare the average weekday boardings to the amount of tax revenue confiscated in that region. The former figure is a sound way of comparing the sizes of different regions transit systems.

Sound Transit now confiscates about $660 million of regressive tax revenue (with that amount climbing year after year), and Metro taxing (plus the distributions to Metro from the Seattle City Council of its separate Bridging the Gap tax revenues which nobody knew were going to be made before that vote) is another $520 million, for a total of $1.2 billion.

The combined average weekday boardings of Metro and Sound Transit buses and trains is 490,000. The average weekday boardings of TriMet buses and trains is 318,000 (http://trimet.org/pdfs/publications/factsheet.pdf).

Sound Transit and Metro combined thus have about 56% more boardings than TriMet, but they confiscate nearly 500% more tax revenue each year.

Sound Transit and Metro thus already haul in THREE TIMES the tax revenue per weekday boarding for buses and trains compared to how it’s done in the three-county Portland metro area. In the greater Portland area there is NO targeting of individuals and families via regressive taxing. The $259 million of tax revenue TriMet collects comes from a progressive payroll tax, and it is the only taxing TriMet does.

The government heads up here are doing a lousy job of managing the heavy, regressive tax revenue streams they already impose. The last thing the public should do is encourage more bad management in that critical area. That’s the truth despite the threats they make about cutting service if they don’t get to tax the poor even more.

rocketscience

Are you comparing apples and apples? Much of Sound Transit revenues are going into the expansion of facilities. If it were just operating budgets that you are comparing, the figures would be more meaningful.

Regarding the tax structure in this State, when an income tax is attempted to be implemented, the voters keep saying no. The strange result of the last election was that Bill Gates Sr. was pushing it and the low income voters (who wouldn’t pay any of the taxes, since it was structured to hit the higher income individuals) apparently didn’t want a more progressive tax structure.

Weezy

Neither of your two points is valid.

1) The FAR heavier transit taxing here is not needed because of Sound Transit’s capital project spending plans. Not much of the upcoming Sound Transit tax revenue is slated to be used for capital expenses. The remaining ST2 projects will cost about $11 billion, and bond sale revenue ($7.5 billion) and MAP-21 federal grants will be used to cover most if not all of those expenses. Plus, Portland’s modest taxing rates have remained essentially the same since the late 1980’s, and it has managed to build out 53 miles of light rail, dozens of stations, and streetcar networks over that period. In the Twin Cities the initial 15-mile light rail line from downtown to the airport was built in the 2001-2004 period using no new local tax revenue.

2) That flawed initiative for a proposed statewide income tax Bill Gates the elder pushed several years back was intentionally defective. That faux effort was meant to be a loser. None of his business associates or social acquaintances want an income tax, so he and his colleagues structured one they knew the public would reject.

That particular income tax initiative was rejected by voters for very good reasons. For example, plenty of people understood the state legislature would have lowered the kick-in level after two years so it no longer would be just a high-earners tax. Also, that initiative did not target profitable businesses more than individuals.

The right kind of income tax measure would involve amending the state constitution (the supreme court already has ruled income taxes here are unconstitutional) and it would have a constitutional kick-in limit for individuals and households so the legislature could not lower that level to impact the middle class. That kick-in level also would be indexed for inflation. That kind of tax also should be structured to target profitable corporations.

You understand there are a handful of other progressive taxes used around the country to fund transit that are not income taxes, right? If Metro needed more tax revenue – and it does not – those could be imposed almost immediately by the state legislature for Metro. Instead, the state legislature here just does what it likes doing: using the local yokel government heads to push higher and higher sales taxes and car tab taxes.

Jay

Still, nothing is more regressive than not allowing poor people to get to work in the first place, when their bus service is gone.

Ralph

“King County Metro will be forced to cut between 16 percent and 17 percent of its current bus service.”

This is not true. It has been reported that the worst-case scenario would be cuts of only 13 to 14 percent, because of higher-than projected sales tax revenues for Metro.

There has never been a lower limit to the cuts, let alone “at least 16 percent” as you write. Please cite where you read that the cuts would not be any lower than 16 percent.

Jennifer Langston

Ralph, the 16 to 17 percent range is the latest estimate from King County, which they provided to me last Thursday. Because I had read several different numbers in various news reports on the possible range of the cuts, I asked for the most accurate and up-to-date estimate based on the latest financial projections.

I’m curious where your assertion that the cuts would be in the 13 to 14 percent range comes from. I’ve only been able to find one news story that reported those numbers several weeks ago, and they don’t appear to be accurate anymore, if they ever were.

John Niles

Thanks for describing the impact of Metro service cuts, but there is a deeper level of analysis possible than simply reinforcing Metro management’s claims of service damage if voters don’t approve the agency’s proposed tax bump of a $60 car tab hike and more sales tax.

Has Metro issued a document that describes exactly how the alleged resource shortage is translated into 17% reduced service? In other words, has Metro explained which “cut” routes are related to which of the four priorities described at http://metro.kingcounty.gov/am/future/priorities.html ?

Has Metro left room in its agenda of future service reductions for rider pressure to cause some route cuts to be deferred even if Prop 1 fails to pass? I mean, are the oft-repeated 17% cutbacks likely to end up at a smaller number as a result of customer pressure?

Here’s another question: If Prop 1 fails to pass, what is the potential roll-back of the 17% cut number that would be caused by the revenue bump that Metro enjoyed recently, that is briefly alluded to at http://metro.kingcounty.gov/am/future/index.html as follows, “A recent sales tax projection predicts that revenues from this source will be higher than the amount expected in our 2013-2014 budget.”

Also, is there an alternatives-analysis document available from Metro that describes option for cutting categories of overhead as opposed to hours of service? For example, has the option of laying off a fraction of the Metro planning staff been compared to cutting bus service hours? What are the categories of overhead that are subject to cutting? Look in http://ow.ly/i/4HFo3 at how much of Metro bus operating costs are “support functions.”

Do the bus operators feel that all the existing levels of supervision are necessary? Could supervision be rolled back at a cost saving?

There are dozens of questions that could be asked about Metro’s plans for operations under fiscal restraint in the absence of the Prop 1 tax hike. I don’t see anybody asking them. The give-Metro-what-it-wants segment of the market seems only interested in joining Metro in amplifying the impact of the single plan of cutting 17%. Where is skepticism about management’s claims?

In the absence of documentation like I describe, why is everybody so willing to believe the claim made by King County Council Chair Phillips, “There is no more fat to trim”?

Furthermore, the issue may not be trimming fat, but rather designing and implementing new administrative and service delivery processes.

I’m raising the question, how solid is the justification behind long-described 17% service cut? When years ago I worked in the budget office of a large local government jurisdiction back east, we invariably had operating departments telling stories about service delivery damage from reduced revenue that didn’t stand up to close analysis.

There is an ongoing need in all service delivery organizations to work smarter by finding and making improvements.

Kylek

John Niles: It’s “up to 17%” which could mean a bit less. This is coming at a time when most people in Seattle and close in suburbs want more and better transit. Can Metro be better? Maybe, but I’m 100% positive failing to pass prop 1 will hurt transit in our region and hurt Metro. That said — you have publicly talked up buses over rail in the past, are you planning to vote no?

John Niles

Metro needs some tough love. Costs are up, up and away. Appeasing the beast by feeding it is not smart.

Billions committed for light rail doesn’t justify a blank check for buses written on taxpayer bank accounts.

Look at these graphics of revenue and cost curves over time:

https://twitter.com/JN_Seattle/status/449456758440738816

https://twitter.com/JN_Seattle/status/449466007531171841

http://ow.ly/i/4HFo3

A breathtaking Metro resource grab — $60 car tab hike for every one of 1.2 million private vehicles, plus a sales tax hike — is “justified” with unconscionable overstatement of threats to bus service –advertised with taxpayer-funded posters plastered all over the bus system. Voting “yes” on Prop 1 should not be easy for anyone who cares about sustainable transit economics.

Read http://metro.kingcounty.gov/am/future/PDFs/20140325-sales-tax-forecast.pdf buried on the Metro web to see the contrast in how Metro pulls back on it main threats to customers.