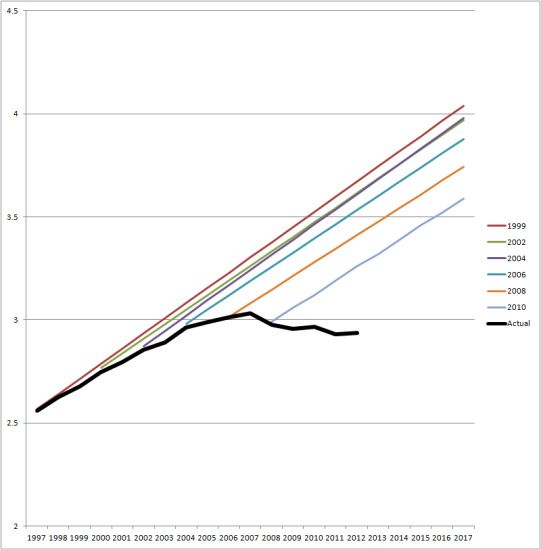

As the State Smart Transportation Initiative at the University of Wisconsin points out, the US Department of Transportation has been making the virtually identical vehicle travel forecasts for well over a decade. All of those forecasts project rapid and incessant growth in vehicle travel for as far as the eye can see. Meanwhile, actual traffic volumes have flattened out, and may actually be falling.

Each of the rising colored lines represents a forecast from a different year. The black line represents actual traffic trends on US roads—which never rose as quickly as the forecasters had predicted, and actually started a modest decline in 2007.

Where have we seen this sort of shape before? Well, we’ve noticed these sorts of “broken record” projections time and again here in the Northwest: on Washington’s SR-520, on greater Vancouver’s Port Mann Bridge, and even in unexpected places like forecasts of water consumption. I’m sure there are other examples. It seems to be a common shape exhibited by perpetually broken forecasts—let’s call it, with apologies to H.G. Wells, “The Shape of Things Not Actually to Come.”

This isn’t entirely USDOT’s fault, though. These forecasts are a “roll-up” of forecasts made by state DOTs. The US agency just collects the forecasts and reports them to the public: garbage in, garbage out.

But in a way, that’s even more sobering than if the fault were localized in USDOT, since it provides clear and compelling evidence that the nation’s entire transportation forecasting apparatus is completely broken. In the aggregate, all of those hard working forecasters in all of those state DOTs are just making up numbers. Worse, it appears that these traffic forecasters have had no incentive to correct their work, incorporate new information, or even ensure that their forecasts pass the laugh test.

It’d be humorous, if the fiscal consequences weren’t so dire. Washington’s transportation debate is a case in point: existing roads are in desperate need of maintenance and transit is hurting for money, but state legislators felt that they needed a transportation package full of highway megaprojects, financed through regressive taxes, to deal with all the “new” traffic we haven’t been getting for about a decade.

So here’s hoping that USDOT—and traffic forecasters nationwide—start producing forecasts that reflect the reality of traffic trends over the past decade. It’s high time that they stop living in the early 1990s, and start getting serious about making realistic traffic forecasts.

Weezy

Well Clark, hope you don’t mind if I point out two flaws with this piece:

1) Transit services providers here certainly are not “hurting for money”. Just look at the data. Metro and Sound Transit do far more taxing per capita than any peer bus and train services providers. Moreover, that direct taxing is far more regressive than financing sources the peers use.

2) Sound Transit’s abusively-financed and grossly overpriced projects were “justified” when the board began planning them on the exact same kind of staggeringly-bad traffic projections you decry in here. Those PSRC and WSDOT papers that projected massive traffic increases turned out to be entirely wrong, which shoots holes in the handful of outdated reports Sound Transit relied on as the basis for pushing its menu of rail projects.

Disagree with any of this?

Clark Williams-Derry

I’m not sure about 1, since I haven’t looked at the numbers; it’s also not clear to me if you’re arguing that Metro alone taxes more than any peer agency, or if you’re talking about Metro + Sound Transit. And it’s also not clear to me whether the right metric is per capita, per rider, per trip, per passenger-mile… Again, I’m not disputing, I’m just saying I don’t know.

I disagree with some of the language in 2, but I agree with the general thrust. Central Link was planned using the same failed traffic models that are used to justify other big transportation megaprojects in greater Puget Sound. That’s one reason that ridership is lower than originally projected. (I’m talking about the early projections, not the later projections after the goalposts got moved around.) I personally would have preferred a very different mix of transit & mobility investments with the money spent on light rail.

Regardless, I don’t think you’ve pointed out any flaws in this piece — which is about national traffic projections, not about transit spending priorities in central Puget Sound. You’re just mentioning other things that you’d like to talk about. Which is fine — you make reasonable points. But it doesn’t mean the article is “flawed” any more than your comment is “flawed” because it doesn’t discuss barbecue recipes or hair salons or whatever happens to be on my mind right now, and that I wish you’d pay attention to.

Weezy

I’m talking about Metro and Sound Transit’s combined taxing. That’s because they tax essentially the same hundreds of thousands of households here. No other region has two heavy regressive taxing entities imposing sales taxes and car tab taxes on the same hundreds of thousands of households. Moreover, their planning and operations overlap, they conduct joint operations, and their policy-setting boards share personnel.

The taxing for buses and trains targeting individuals and families here is far higher than in any peer region. Per capita tax impacts are the relevant metric — the others you mentioned don’t make any difference to people, no matter where in the country they live.

It’s not just “Central Link” that was planned using bad data. ALL of Sound Transit’s projects — including East Link, the tunneling north of Husky Stadium, etc. were based on just a couple of PSRC studies that grossly overstated traffic level growth.

Those are flaws with your piece. Transit taxing here is far higher than in any peer region, by a lot. That means the bus and train services providers are not “hurting for money”. Moreover, suggesting (without providing a single example) that flawed traffic growth projections meant too much highway spending is a deceptive half-truth. The truly bad policies derived from traffic studies around here are those that were used as justification for abusive taxing policies and grossly expensive municipal spending on largely-useless rail megaprojects.

Clark Williams-Derry

I will point out several flaws in your comment. It takes no stand on Justin Bieber’s merits as an artist. It contains no recipe for the perfect frittata. And you completely ignore the raging debate over whether string theory will ever produce a testable prediction!

Those are flaws with your piece.

On a more serious note, I actually do provide two specific examples of inflated, “broken record” highway projections that led to unnecessarily inflated highway spending. See if you can spot ‘em!

Michael

The central flaw from Weezy’s perspective is that you dared write “financed through regressive taxes” to describe the way we pay for large highway projects in this country, when everybody knows the system is entirely transparent and fair.

(/sarcasm)

Keith

Clark-

Your comment that “it provides clear and compelling evidence that the nation’s entire transportation forecasting apparatus is completely broken.” is right on. There is a bit of circular reasoning going on between the USDOT and the state DOTs. While the USDOT may be a roll-up, the state DOTs are still doing their work under the rules (formal and informal)setup by the feds. I listened to an interesting webinar last week by Steven Polzen at the Center for Urban Transportation Research, USF, http://www.cutr.usf.edu/2012/06/cutr-webcast-travel-behavior-trends-in-florida-an-analysis-of-the-national-household-travel-survey-data/. Polzen offered a whole range of explanations for why not only household travel but travel overall is down, in the process mostly coming down on the sad state of the economy, especially in the household formation demographic segment. He also makes some good arguments about satiation. Being a good academic, he raises more questions than he answers, but it was still an hour well spent. I sent him an email asking for his opinion on why the data says travel is down and doesn’t look to be changing, yet his brethren in transportation planning (and the fossil fuel energy business) keep forecasting higher levels. I’ve raised this same issue in comments to CLEW – without realistic forecasts of VMT and transparent analytic separation of VMT from other factors involved in transportation GHG emissions, it’s pretty hard to make sensible policy.

Dawn

Weezy, it doesn’t follow that because

“Transit taxing here is far higher than in any peer region, by a lot”

then

“That means the bus and train services providers are not “hurting for money”.”

Perhaps our taxes are higher than our peers’ taxes right now because we are in a phase of building infrastructure instead of just operating transit. If our expenses are higher than our peers’ expenses, then our transit service could still be “hurting for money.”

It sounds like your main point is that we don’t need as much mass transit as we are building, which is an interesting topic to pursue separately.

Weezy

“Perhaps our taxes are higher than our peers’ taxes right now because we are in a phase of building infrastructure instead of just operating transit.”

Some tax revenue is used around here to cover “costs of building infrastructure”, but not much. The peers use best practices to cover those capital costs: utilization of little or no new regressive taxing, mostly federal grants, some state grants, re-purposing portions of existing tax streams from cities and counties, modest taxes targeting businesses, LID revenues, bond revenues secured by fares and not general taxes, PPP’s, etc. The bus and train services providers around here don’t do any of that though.

Dawn: let’s see if you have more of a clue about transit funding in this neck of the woods than Clark. Can you estimate the regressive tax cost to secure the (approx.) $11 billion in long term g.o. bonds Sound Transit’s staff now indicates will need to be sold to cover “ST2” project construction costs?

Another thing Dawn. You suggest “It sounds like your main point is that we don’t need as much mass transit as we are building, which is an interesting topic to pursue separately.” Let’s turn that around. You tell me: why do we need the particular megaprojects Sound Transit’s board selected? Hint: the traffic studies cited in the EIS submissions that municipality produced are baseless garbage, just as is the case with the “VMT” studies cited in this piece by Clark. Don’t say those justify the megaprojects Sound Transit’s board selected.

Weezy

Another thing Dawn —

What you did is draw a false equivalency between “being in a phase of building infrastructure” and the fact that we have by far the highest regressive taxing burden in the country. You only have to look as far south as the greater Portland area to see that a metro area can build lots of fixed rail assets with NO regressive taxing of the people there. Over the past quarter century TriMet build out some 54 miles of light rail, dozens of stations, streetcars, and paid for buses and bus stations. It did so using NO new regressive taxes. The only taxing it did was a modest payroll tax that annually brought in about one-quarter of the revenue those abusive tax harvesting machines Sound Transit and King County Metro employ.

This site is weird. The posters here revel in their ignorance of transit finance best practices.

John Abbotts

As an occasionally interested observer, I am going to jump in here with a few observations.

First, Weezy, you have been cautioned before about keeping your comments civil and respecting others. I do not know if Sightline has ever shut down a commenter, but by continuing to insult both the Sightline staff an other commenters, you have gone beyond pushing the edge.

Second, I do not quite understand what your positions are. In summary, do you hate taxes, hate government, hate public money spent for public purposes, such as public transit, which by the way is more energy-efficient and likely to ease or reduce global climate change (or are you a climate change denier, to boot?) than either private transit or public subsidies to fossil fuel companies.

Or, do you stand by an earlier charge that Sightline is part of the Downtown Business Community, and therefore a band of apologists for the 1 percent? If so, you do not seem to be paying attention to Sightline’s commitment to sustainability, including a more sustainable and inclusive economy. If your gripe is that sales taxes are regressive, I would agree, but you need to be reminded that with Tim Eyman, the corporate right, and the Seattle Times, to cite a few, WA state voters have yet to approve an income tax, much less a reduction in tax subsidies for corporate giants. I recall that even J.K. Galbraith (maybe in the Affluent Society) wrote that while he regarded sales taxes as regressive compared to income taxes, when compared to the alternative of no public services in cities and states, he would accept sales taxes to fund such services.

In short, I am tempted to call you a jerk, but “That would be Wrong,” as Nixon said on the Watergate tapes, and contrary to polite discourse. So rather than do that, I close by recommending that you to express your positions in a way that is logically consistent, and stop the personal and professional insults.

Alex

Thank you Dawn for pointing out Weezy’s insane failure of logic.

Clark: “In this entirely USDOT’s fault, though.” Come again?

Actually, trains are inefficient

WI resident here. The reason the WI DOT juked their data was at the time pro-train interests inside the government and UWM wanted to build a line from Milwaukee to Madison. If built, the line actually would have ended up ending not far from the university. Clearly some interests were at play here. Absolutely unnecessary, but that’s what the public was told for years. They needed to make it seem like I-94 was a total mess so an alternative was needed, or else!

As a tax payer and a person who has seen the quality of UW Madison’s research arm decline for years, it makes one wonder why are we forced to finance their “research”, in this case traffic “research”? Clearly, it’s more politically oriented than science oriented.

Jason

The USDOT likely just makes a rough guess, which seems to be 2% growth per year (couldn’t tell from the original article for sure), which is likely based on average growth over the last 50 years or so. In the end, a rough guess is good enough because an over-designed pavement section simply lasts longer than the estimated design life (usually 10 to 25 years). Since pavement doesn’t get rehabbed or replaced until it starts to degrade to a certain degree, you end up not needing as much spending in the future to maintain the pavement.

Granted, if you can anticipate future interest rates, it is best to do a cost analysis to see if it is advantageous to defer spending later. However, given the fungibility of tax revenue and the fact government doesn’t “save” money, and the uncertainty in interest rates, it doesn’t make much sense to get too work up about the numbers. It will all come out in the wash one way or another.

Jeff

A recent post on Copenhagenize uses an earlier version of your graph. Great to see the Sightline messaging in the wild.

http://www.copenhagenize.com/2014/02/peak-travel-and-outdated-projections.html

Jeff

There is a tendency to used forecasted demands that are not constrained by capacity. Straight line regressions of historical data assume that past growth will continue unconstrained. Many of the counts that make up the Actual volumes in the graph are constrained by the capacity of the road facilities counted. Straight line forecasts can be used for individual facilities, is used judiciously, but not for ‘global’ forecasts.