Oil-by-rail schemes are popping up across the Northwest and beyond, raising serious questions about public safety given that they have a nasty tendency to explode catastrophically. Even more worrisome, oil train numbers are increasing at a rate so astonishing that we cannot rely on historical trends or safety statistics. To illustrate the new era of freight rail, I put together four charts drawn from data published by the American Association of Railroads.

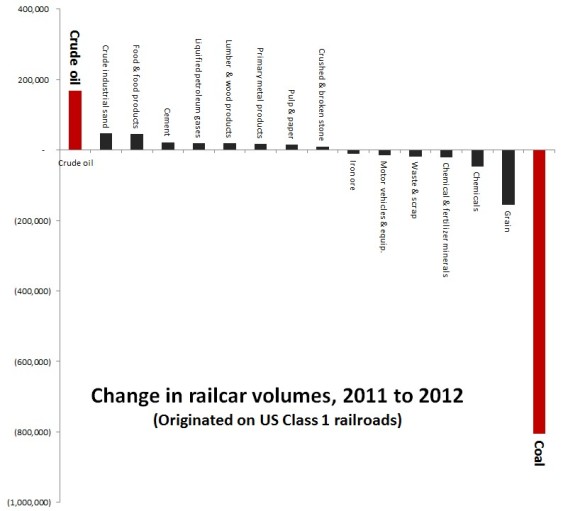

Oil is far and away the fastest growing type of freight hauled by rail in the US (although its increase does not come close to offsetting the recent precipitous decline in coal transport).

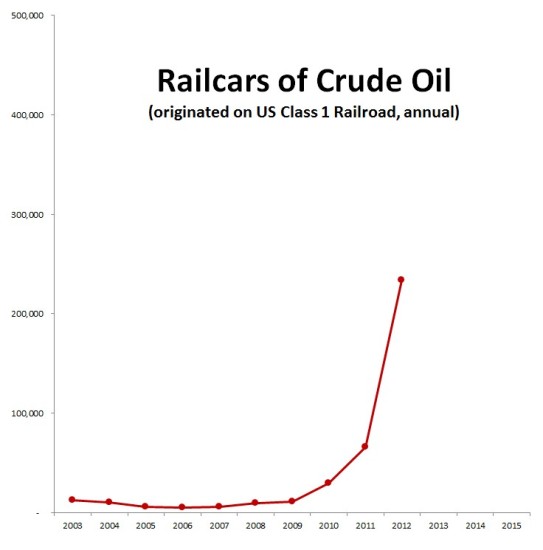

From 2009 to 2012, oil by rail volumes multiplied more than 21 times, from fewer than 11,000 railcars nationally to well over 230,000:

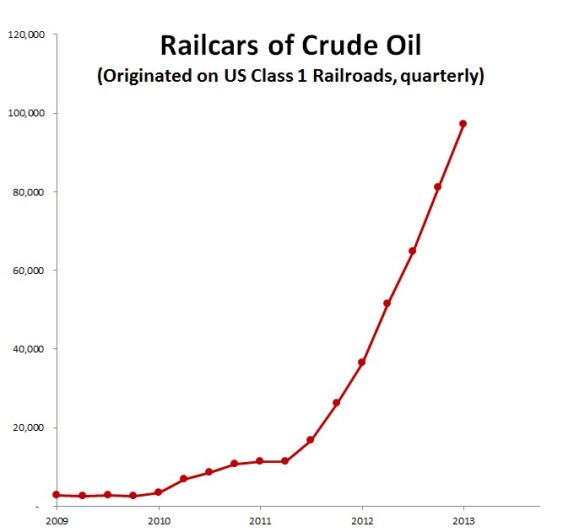

The skyrocketing growth rate of oil trains is continuing in 2013. The most recent quarterly data shows that the first quarter of this year saw more than 2.5 times as many oil railcars as the first quarter of 2012:

The skyrocketing growth rate of oil trains is continuing in 2013. The most recent quarterly data shows that the first quarter of this year saw more than 2.5 times as many oil railcars as the first quarter of 2012:

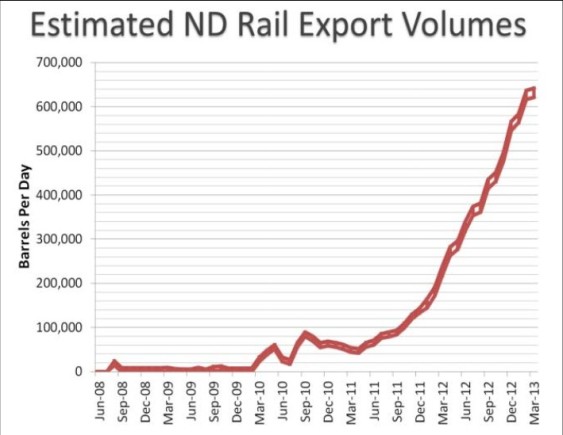

In North Dakota, home to the majority of Bakken oil extraction and originator of most oil trains, the growth in crude oil shipments has been staggering, growing more than sixfold in a little over a year:

Chart from “Moving Crude Oil By Rail,” a report from the American Association of Railroads,

https://www.aar.org/keyissues/Documents/Background-Papers/Crude-oil-by-rail.pdf.

Because the growth of oil trains has happened so suddenly, neither the public nor the industry should rely on historical trends or safety statistics. The simple fact is that the US has never experienced large-scale oil-by-rail movements to the degree that we are now.

Notes. All data in this report come from Moving Crude Oil by Rail, a report from the American Association of Railroads. The data shown in the charts here are conservative because they do not count crude oil shipments originated on railroads in Canada or on US short rail lines.

Cave Johnson

I would interpret this not as a sign of health in American oil, but a sign of weakness. Oil is being transported by rail because no one is ready to pony up the cash for a pipeline. The huge up-front cost and the long lead times create two huge problems.

This first is that the fields they serve could tap out before the pipelines are even completed, much less fully depreciated. The reluctance to make these investments suggest the long money is betting against fracking. Rail is a highly inefficient way to move bulk liquid, but has relatively low startup costs.

The second is that there is not much patient capital in the world anymore. Investors do not put much long money out there and big oil seems to be shying away from such a long-term investment.

Meighan

Thanks Eric!

If we’re missing all train loads that originate in Canade, then the Alberta tar sands are omitted, which leaves a gaping hole in the data. I wonder what the real figures would be if those trips were included.

I also wonder whether the spike in shipment of crude industrial sand (on the first chart) is related to fracking. (And why would grain shipments be down? Did we have a bad year? That might be a trend to track.)

Laurie Dougherty

Hi Megan, yes at least some of that sand is for fracking. Mining sand for fracking is becoming a big industry in Wisconsin. Aldo Leopold would weep. I’m traveling across country right now via Amtrak from Salem, OR to Boston, MA to spend Thanksgiving with my son. Have seen hundreds of oil tanker cars on the route. Yesterday in Wisconsin I saw several sand mining operations. I took photos of one big one in Sparta, WI. I googled for confirmation and found a map of “frac sand” operations in Wisconsin and Sparta was one of dozens of locations. Writing this on my phone and might lose this comment if I try to find the URL for the map, but it was easy to find. I put a photo of the sand mine on the Face Book page for Salem Climate Activists. Last year on the same route saw a whole train of cars filled with sand on a siding (in Minneapolis I think) and someone told me it was fracking sand.

I’ve made this trip several times and I haven’t seen as much coal this time as other times. I thought maybe because it was night when we came through the most likely places t o see coal and I just didn’t see it . Glad to know there really is less of it. We’ve got to keep fighting to stop coal export in the NW to keep those numbers going down.

Eric, you’re research on coal and oil is a great resource. Thank you.

Richard Tilley

Oil producers are not required to have an environmental review which often takes years, to ship crude by train. Expect Tar Sands bitumen to be delivered through NW ports within the next 2-3 years.

chris conover

I live with trains rolling by, all day and all night, I see it all, coal, oil, grain, lumber, chemicals and my daily favorite garbage (my favorite because unless you know it’s garbage it looks like it might be heading to Walmart). I lived here for some time and have watched the commodities roll by and can confirm your graphs with my observation. I also know who is behind much of this trend and I know his plans.

The 1,000-pound gorilla is Warren Buffet and his plan is to make a lot of money off his investments, or more business as usual. Living by the tracks gives you perspective, it puts reality to head lines such as Buffett Railroad Sees Crude Cargo Climbing 40% (Bloomberg, Jan 8, 2013) it also unveils the realities that don’t make the paper, like the $Billions of infrastructure improvements financed for practically free as he purchased his railroad in disrepair just after the recession with President Obama watching his back. I watched as they rebuilt and now I see an ever increasing amount of traffic and I know there’s much more to come as they don’t roll by non stop, yet.

As far as those “schemes” you mention, the same Bloomberg article quotes a BNSF spokeswoman stating “BNSF is working with customers to build new loading facilities connected to its 32,000-mile (51,500-kilometer) rail network and plans to deliver crude to refineries in California, Oregon and Washington.” So get ready for new oil depot applications as Warren is banking on em.

As for the coal trains, not to worry, the capacity is still there, even if the market isn’t at the moment. From my perspective demand seems strong as the trains keep a rolling by,

Laurie Dougherty

Chris Conover,

Absolutely, the BNSF Hi Line is Warren Buffet’s Fossil Fuel Express. There are already plans in the Pacific Northwest to expand port and refinery capacity to handle North Dakota oil (and potentially Alberta tar sands oil). Hundreds of people turned out for a hearing in Vancouver, WA to oppose the proposed 360,000 barrel/day rail-to-ship Tesoro/savage oil terminal on the Columbia River at Vancouver. Not one person spoke in favor and many more people have submitted written comments Even the ILWU Vancouver local is opposed to it. The local president testified at the hearing, spoke at the rally outside the hearing, and has participated in other events to oppose Tesoro Savage. He says this project is too dangerous – an accident could shut down the river.

Comments to the Washington Energy Facility Siting Evaluation Council can be submitted until Dec 18. Columbia Riverkeeper has information on how: http://columbiariverkeeper.org/events/efsec-comment-period-for-tesoro-savage-project/

The public comment period for the Longview, WA 44 million ton/year coal export terminal closes today Nov 18). Power Past Coal has information:

http://www.powerpastcoal.org/

T. Strege

I work in the energy sector. I hear rumors that coal shipping is down in part because the rail industry makes more money hauling oil. I hear that the trains are not honoring their contracts with coal burning plants in favor of more lucrative oil. They are preferring to pay contract damages to coal plants rather than deliver. In my opinion this spells trouble for energy diversity in this country. I suspect (know) politics is driving this. The same groups that hate coal also stand in the way of installing pipelines for oil.