Last Friday’s excellent Vancouver Sun story put a much needed spotlight on the Golden Ears Bridge—where traffic is running so far behind projections that TransLink now forecasts that the agency will lose between $35 and $45 million per year on the bridge, for at least the next several years.

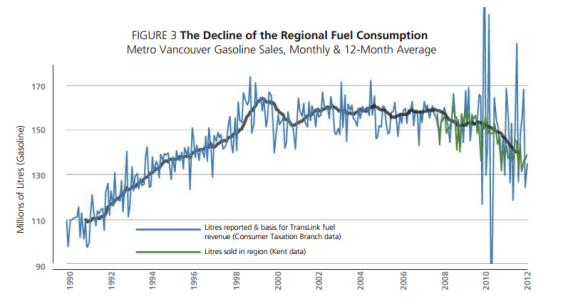

But the story is really just the tip of the iceberg in a much larger story about Greater Vancouver’s transportation finance woes. Not only are bridge tolling revenues falling behind projections, but gas tax revenues are too. Take a look at the black line in the chart below, representing the 1-year average gasoline sales volumes in Metro Vancouver:

You may notice the wild swings in fuel sales that started in about 2010. That’s when the province switched from a “tax at the rack” system, which taxed motor fuel as it was shipped to gas stations, to a “tax on entry” system, which taxes fuel at the first point it enters the province. Since entire tanker-loads of motor fuel are now taxed all at once, there are wild month-to-month swings in gasoline volumes. For a while, this created huge uncertainty about fuel sales trends; nobody knew whether fuel sales were soaring, sinking, or roughly flat.

But over a few years, it became clear that gasoline sales had started to decline. And that realization apparently sent shockwaves through TransLink’s entire budget. In the agency’s 2012 budget forecast TransLink was forecasting substantial growth in annual fuel tax revenue through 2021. But their 2013 plan recognized that gas taxes were at best flatlining—a realization that forced the agency to strip more than half a billion dollars from their budget through 2021. And the forecasts are getting progressively worse: the 2013 forecast was bad enough, but the 2014 draft forecast, which was just released for public comment this morning trims even more money from TransLink’s long-term budget.

The chart below illustrates the problem. If you’re not a transportation finance nerd, the gap between the red line (the fuel tax forecast from the 2012 “Moving Forward” Plan) and the blue line (the forecast from today’s 2014 draft plan) may not look dramatic. But to transportation planners who had been counting on the revenues represented by the red line, the lower revenue forecasts in the blue line must have come as quite a shock:

Several different forces are contributing to falling gas consumption in the lower mainland. Declining driving per capita certainly plays a role. Gains in fuel efficiency probably do as well. But there’s also evidence that a strong Canadian dollar is encouraging some drivers to cross over into Washington to buy gas. The US Bureau of Transportation Statistics has reported elevated border crossings between Washington and Canada since Canada’s dollar started to strengthen. At the same time, Washington has seen steep increases in revenue from the state’s little-known “Border Area Motor Vehicle Fuel and Special Fuel Tax,” which puts a one cent per gallon surcharge on motor fuel bought within 10 miles of a border crossing. The increase has been particularly high in Point Roberts, which isn’t even contiguous with the US mainland.

Regardless of the reasons for the decline in Greater Vancouver’s gasoline sales, there’s no question about the fiscal impacts: TransLink just isn’t getting as much gasoline tax revenue as it thought it would a few years back. Meanwhile, toll revenue from the Golden Ears Bridge is falling badly behind forecasts.

But the agency’s megaproject debt isn’t going away. And when gasoline and toll revenues don’t show up, but debt service obligations keep coming, everything else gets squeezed. Transit in particular has been on the chopping block over the last two years. So far the agency has managed to avoid major service cuts, in part by tapping into its reserve funds.

Still, TransLink has had to postpone transit service expansions and cancel some discount transit pass programs—a sign that the agency is hunkering down, even as driving is flat-lining and demand for transit is rising. In fact, TransLink now predicts that its budget woes will make it impossible for transit service to keep pace with population growth—leading to declines in per capita transit service.

The irony is palpable. Much of the agency’s budget problem stems from its relationship with cars. The lower mainland has built new, expensive facilities to move vehicles, but the drivers (and the revenue they generate) haven’t shown up. Yet the budget squeeze falls particularly hard on transit riders—people who aren’t using cars at all! If I were conspiracy-minded, I’d say that TransLink’s shrinking transit ambitions are part of a plot to keep people in private vehicles—where they’ll pay more tolls and gas tax.

But since I’m not conspiracy-minded, I’ll say it looks like just another in a long and depressing series of examples of how bad traffic forecasts can lead transportation spending astray.

Brie Gyncild

Interesting stuff, but I was distracted for the last half of the post, mainly because I was laughing. There’s a word missing. You meant to say that a strong Canadian dollar is pushing people south for gas — but instead, it says “there’s also evidence that a strong Canadian is encouraging some drivers to cross over into Washington to buy gas,” and I just kept picturing this Paul Bunyan type looming over people and suggesting they go south. Thanks for the grins – and the serious article too.

Clark Williams-Derry

Doh! Thanks for the catch.

Or perhaps I did mean a strong Canadian. Wolverine? Puck? This guy?

Barry Saxifrage

Another great article, thanks.

One solution is raise the taxes on gasoline. That would keep revenues constant even as less gasoline is purchased.

For example, in early 1990s the Conservative government of Prime Minister John Major grew concerned that low gas prices would hurt their nation in the long run. So they implemented the “Fuel Duty Escalator” policy. This raised gas taxes three per cent faster than inflation. A couple years later, they increased the rate to five per cent above inflation, and still later to six per cent. Within a decade, gas taxes in the UK had more than doubled and UK gas prices had risen to near the high end for Europe.

Today the UK has three times higher tax on gasoline than BC does ($1.27 per litre vs $0.44 here).

Even so, the average person in the UK, surprisingly, has a much lower annual fuel bill from gasoline. And yet the government collects the same amount of total gas tax per person as in BC.

So it is possible to maintain the funding for a transportation system even as gasoline sales decline. The UK provides an example how.

Such a program would have the added benefit of lowering carbon emissions too. As I explain in an article about this, gas taxes can be viewed as de-facto carbon taxes. BC total gas tax of $0.44 is equal to a carbon tax of $182/tCO2. The UK total gas tax of $1.27 is equal to a carbon tax of $527/tCO2. Numbers like that put the question of whether BC can afford to raise our carbon tax rate in perspective, eh?

Ron Hole

Any person living in Pitt Meadows or Maple Ridge could have told you the Golden Ears bridge was a mistake as they built a bridge that comes form nowhere and goes to nowhere. This is not hindsight. This is common sense.

Now the question is, is there accountability for the hundreds of millions of dollars that are not being recovered? Oh yes. The public are accountable for it.

As far as gas tax.

Increase gas taxes to force me to ride buses that you cannot provide because of the increased number of riders who cannot afford the gas taxes? Makes sense to me.

You want to fix this? Get people back IN their cars by lowering gas taxes. You have parking revenue. You have tolls. Drivers will drive but only when it becomes cost efficient to do so and your taxes are what is keeping them off the road. Better to collect 25c a litre from 100 than 37c a litre from 50.

You have an “Aircare” process that ensures clean “old” (stop laughing). cars and you new cars meet emission standards so don’t go all green on me.

And the other thing is. Provide incentives for commercial traffic to use the roads at nights. Get the trucks moving, delivering goods instead of clogging up the roads spewing their non-air cared diesel exhaust into the air.

Translink and it’s endless bureaucracy will go down as the largest boondoggle in BC history; if it is not already.