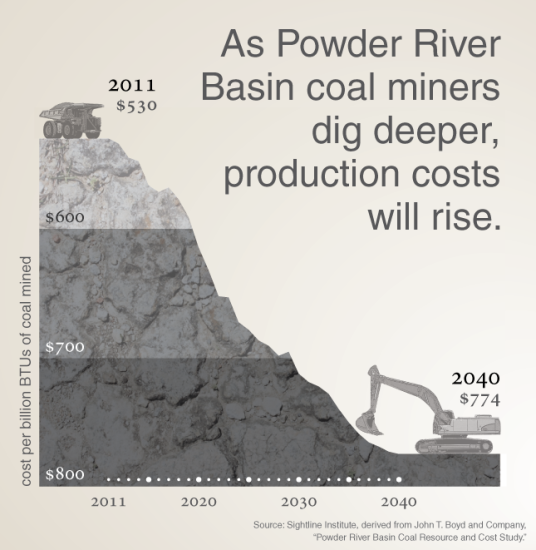

Here’s another reason that coal companies have to worry about their long-term financial prospects: they’ll have to keep digging deeper and deeper to get at their coal. And digging deeper means spending more to get coal out of the ground, which can simultaneously raise coal prices and crimp coal company profits.

Even in the Powder River Basin (PRB) of Wyoming and Montana—an area renowned for its inexpensive coal—industry analysts expect production costs to rise steadily over the next few decades. See, for example, this detailed report prepared by the John T. Boyd Company, which projects steady cost increases in every single PRB coal mine currently in production or under consideration.

We’ve summarized that report’s mining cost projections in two different charts: a fancy version and a simple version. First the fancy:

And for those who like their charts a little less metaphorical, and/or with a y axis that’s not reversed, here’s a simpler version:

For the coal industry, there’s an obvious problem here. Basic geology is pushing up their costs, but most analysts believe that coal’s competitors—particularly renewables like solar and wind—will only get cheaper over time. Look, for example, at the following chart taken from a National Renewable Energy Laboratory report, which shows how quickly the cost of solar installations has fallen over the last 15 years:

As you can see, the costs of commercial solar PV installations have fallen quickly, and are expected to fall even further.

And here’s another NREL chart, showing projections for the future cost of wind projects:

These diverging paths—coal costs increasing, wind and solar costs decreasing—offer just one more reason why coal companies face such dismal stock prices and are so desperate to open up new markets for their products.

David MacLeod

Interesting that the first graph looks like the backside of Hubbert’s curve, indicating ‘peak coal,’ which is not about running out, but is more to do with the fact that we tend to extract the lower cost, easy to get resource first, and what remains becomes increasingly expensive. And at some point provides less energy return as well as becoming economically unfeasible.

Clark Williams-Derry

Yes — though that curve could be a bit deceiving, since it doesn’t show the likely continued cost increases after 2040.

But thanks for pointing out the real meaning of “peak oil.” I’ve seen quite a bit of writing recently that tries to debunk the idea of peak oil, on the grounds that global oil production hasn’t actually declined. But it’s clear, both from prices and from what’s happening in Alberta’s oil sands and elsewhere, that we’re run short of “cheap” oil — which was the thrust of Hubbert’s argument.

Morgan

This info suggest that the financial viability of exporting coal through the NWest is briefer than many expect. By when or at what extraction costs might coal export loose adequate profitability?

Clark Williams-Derry

Very interesting question — but I think it’s impossible to say! There are too many other variables:

* coal production costs in China, Australia, and Indonesia;

* demand, which pushes global prices up the cost schedule;

* US rail costs

* panamax shipping prices

* handling costs at terminals

* overseas rail costs

* exchange rates

Any one of those factors could make US imports competitive or uncompetitive, regardless of what happens with US production costs.