The last few days has seen a flurry of boosterish news accounts about the coal industry, suggesting that demand overseas can make up for the steep decline at home. It all has something of an “I’m not dead yet” ring to it.

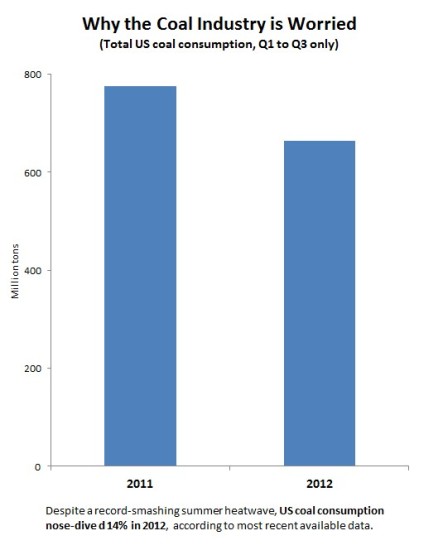

To understand why the US coal industry is so worried—and why the industry is so desperate to find new export markets—take a look at year-over-year trends in coal consumption through the third quarter of 2012.

According to the latest official numbers, total consumption in 2012 may have fallen by a staggering 14 percent in a single year. Even that makes things sound overly rosy for the coal industry because 2011 consumption was already down something like 11 percent from typical years in the mid-2000s. We’ll have to wait for final Q4 numbers to confirm, but it looks as though US consumers in 2012 used roughly 100 million tons less coal than the year before.

Keep in mind that 2012’s travails for coal came in spite of a tremendous heatwave that spread across much of the coal-burning regions of North America. Somewhat perversely, high temperatures are good for the coal industry because it induces Americans to crank up their air conditioners. Yet record temperatures were not enough to stave off a record decline in coal use.

If you need a single explanation for why coal interests are so aggressively pursuing export plans, this is about as close as you can get: the American coal market—home to the world’s biggest coal reserves—is evaporating right before our eyes.

Barry Saxifrage

Thanks for continuing to cover the story of King Coal’s downfall. It has been very useful to me and I’ve pointed to Sightline in several of my own climate articles such as “Rapid collapse of USA coal holds warning for tar sands”

As I cover in that article, I think the biggest nightmare scenario for USA coal is the EIA’s economic energy modelling that shows a modest carbon pricing wiping out domestic coal burning.

In every economic scenario the EIA looked at, coal continues to lose share of USA electricity. But the real worry for coal investors are the EIA scenarios where the bottom falls out completely: a slowly rising price on climate pollution.

The EIA scenario where a modest carbon price rises slowly to $35 in 2020 and continues to increase five percent each year virtually eliminates all coal burning in USA by 2035. It will disappear even faster if a more urgent climate policy is required.

Even if the USA just adopted BC’s current carbon price of $30, nearly half of America’s coal electricity would be replaced by cleaner alternatives.

I also think the oil and methane industries are starting to see carbon pricing as their way to stay in biz longer by shutting down coal first. This gives big oil and big frack awhile longer to keep the gravy train running. For example a number of large oil companies in the tar sands are now saying they want a carbon tax.

USA coal is toast unless it can get all that coal to China. By the way, China is about to pass up the rest of the world combined in coal burning.

So the survival strategy for USA coal is export, export, export.

Jon

I’m confused as the EIA is only projecting an increase in coal usage in electricity generation for as far as they can forecast.

Eric de Place

There’s some evidence that the EIA’s forecasts aren’t calling it straight. See: http://www.sightline.org/2012/07/19/why-is-the-us-government-so-bullish-on-coal/

Jon

Eric,

My point is that Barry states: “In every economic scenario the EIA looked at, coal continues to lose share of USA electricity. ”

That is just not correct. At all…

karol dietrich

Really appreciate your solid research and keeping the public aware of what is happening with coal fired electricity generation, etc.

I live in the Columbia River Gorge (Oregon side), and right now 200 Union Pacific crew are working at fever pitch to upgrade the rail line from Troutdale to The Dalles. Right across the river on the Washington side, BNSF also has a crew which looks to be improving their gorge river line too. I heard BNSF got a huge amt of federal stimulus funds for rail upgrades and they look to be using it in Washington in anticipation of moving coal down the line. Same goes for UP as they are making other line improvements here in Oregon… all the way west to the Port of Longview.

Not a really good future picture out my window. But, I will join forces with the public and do everything possible to stop these horrid black trains from moving coal out of our country through this beautiful National Scenic Act area and out to foreign land.