Unless you live under a rock, you’ve probably heard something about the global stock market meltdown, caused in part by fears that the US economy is heading toward a recession.

Unfortunately for the middle class, incomes never did recover from the last recession. Sure, GDP grew; and even the Dow Jones has added value recently. But ordinary folks still haven’t recovered to 1999 levels.

After peaking in 2000, things got worse for a few years until they hit a low point in 2004. In the following two years, average households added income, though they never regained what they had in the late 1990s.

It’s not clear whether or not we’ll see a recession soon—or how severe it will be—but whatever happens, the next few years are not likely to be wine and roses for the middle class. That red line could easily taper off downward again.

There’s a pretty interesting comparison with high income households.

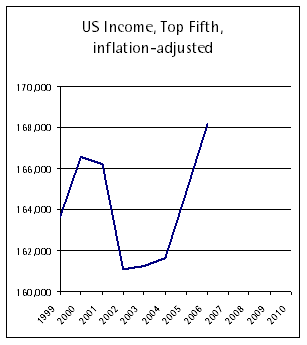

Here’s a chart showing the same years for the top one-fifth of US households.

Even the well-to-do were hit by the recession of the early 2000’s. But starting in about 2002, they levelled off and even made sizeable gains over the past few years. After adjusting for inflation, they ended up with about $4,500 more annually than they were pulling down in 1999.

By comparison, in 2006 the median US household was about $1,000 poorer than it was in 1999, after adjusting for inflation. In fact, every quintile (fifth) of US housholds lost money from 1999 to 2006. All except the highest-earning fifth.

* The middle class chart shows the mean income for the middle fifth of US households—which experience has shown is almost identical with median income. The high income chart shows the mean income for the top fifth of US households. For both charts, figures are inflation-adjusted into 2006 dollars, and the time series ends at 2006, which is the last year of reliable data. All data come from the US Census Bureau, here. And yes, you could say that I cherry-picked the starting date to make my point; median incomes were lower in 1997 and earlier years.