A federal child credit, a concept backed by both President Joe Biden and Senator Mitt Romney—a monthly payment of $250 to $350 for each child with a Social Security number—would be an epochal victory in the fight to house vulnerable Americans.

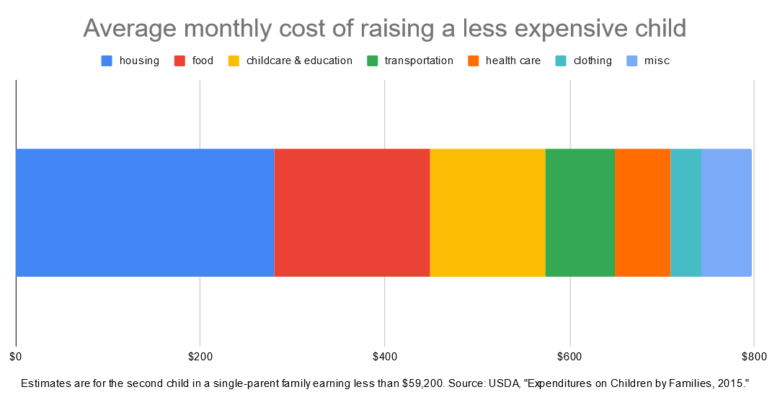

The payments, which would phase out for the wealthiest families under both proposals, would be far less than the cost of raising a child. In 2015, the United States Department of Agriculture used reported household expenditures to put the average cost of parenting at $797 per month for its least expensive category of child, one in a single-parent family with income below $59,200. (The USDA figures don’t include any higher education costs.)

But $250 to $350 per month happens to be very close to another number that represents the single largest expense of parenting: Housing a child. (The blue bar in the chart below).

And that is one way to think about these proposals. They’re basically the equivalent of a massive boost to the federal housing voucher program, specifically for households with kids.

Except these proposed benefits are much, much better.

Six ways a child credit would be better than housing vouchers

In Oregon and Washington, the average Housing Choice Voucher household gets $661 a month. But it’s of little help to most poor families in both states. More than 80 percent of households in poverty in those states don’t get Section 8, as the program is known, even if they meet its requirements. Seattle’s housing authority hasn’t been able to accept a single new name onto its voucher waitlist in four years. In Portland, it’s been five years.

The proposal backed by Biden would give a two-child family almost that same amount—$500 to $600—in monthly cash. But the proposed child credit would be better than a voucher expansion in the following ways:

- This benefit would automatically go to everyone eligible, the way Section 8 vouchers never have. There would be no waitlists and no process of signing up for a waitlist.

- You wouldn’t risk losing it if you move.

- You wouldn’t lose it—and risk going through the years-long waitlist process again—if you get a raise or a new job.

- You could use it on a mortgage just as easily as on rent.

- Your landlord or seller wouldn’t need to go through any special process to accept your payment. It’d be a check like any other.

- You could spend it on whatever your household needs most in a given month, not just housing: a hospital visit, a car repair, a preschool.

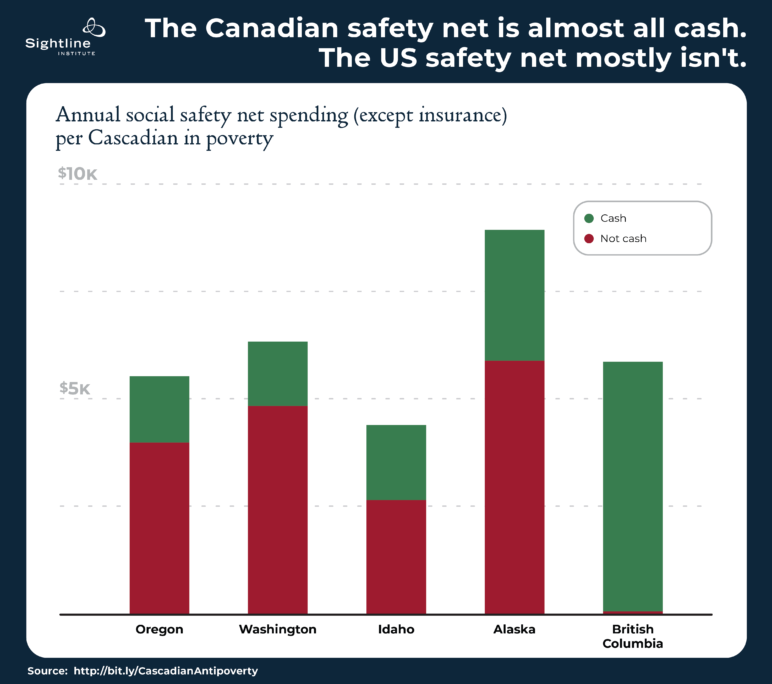

Helping families with kids cover their additional housing costs isn’t a new or radical idea. It’s almost exactly how rental subsidies work in Canada, where the Rental Assistance Program is a monthly cash payment to tenant households that include children.

“Anyone who’s a tenant advocate or a renter should be intrigued by this proposal and wanting to engage,” said Kim McCarty, executive director of Oregon’s Community Alliance of Tenants, in an interview Monday. “Families could have support from their government that is more dignified, less intrusive, more comprehensive.”

There’s a catch. Under the US Senate’s current filibuster rules, a proposal like this isn’t allowed to be permanent unless it either pays for itself in spending cuts and tax hikes, or gets 60 votes. Biden’s current child credit proposal does neither, so it wouldn’t be permanent.

But if it were to be prioritized by enough senators—including the new Senate Finance Committee Chair Ron Wyden of Oregon and his colleagues on the Senate Budget Committee, Jeff Merkley of Oregon and Patty Murray of Washington—the Senate could find the money to make it permanent.

So the future of one of the most important new US anti-poverty initiatives in decades will depend quite a bit on the Pacific Northwest.

The United States spends very little on its children

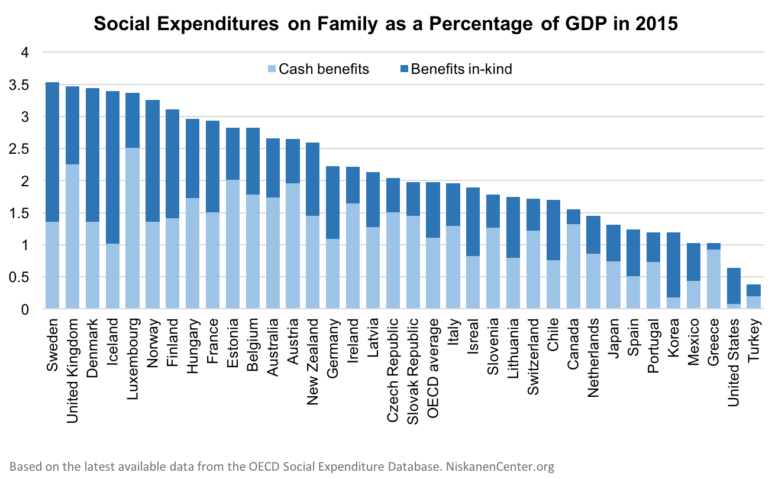

The United States currently has one of the highest child poverty rates in the rich world. That’s largely because most mid- to higher-income countries dedicate much more of their national wealth (more than 3 percent of all economic activity in the United Kingdom and Scandinavia) to helping their youngest citizens begin their lives.

The United States is even more unusual in its singular unwillingness to give children cash. You can see this in the light blue bars above: no other country in the chart gives out less cash to families with children as a share of its GDP.

As I wrote in December, Canada’s use of cash benefits for almost every anti-poverty program is the single biggest difference among the social safety nets of British Columbia and Cascadia’s other jurisdictions:

That’s not for a lack of evidence that it’s useful to give money and other aid to childrens’ households. Keeping a child housed in the United States seems to boost their adult income, reduce their chance of future incarceration, improve their schoolwork, and keep them healthier. US children who get housing vouchers are less hungry, less likely to be in households with domestic violence or addiction, less likely to switch schools, and less likely to be legally removed from their parents. Living in an overcrowded home as a child tends to constrain your academic achievement and worsen your health, with lifelong effects. Similarly, pregnant moms who get cash wage subsidies get more prenatal care and, seemingly as a result, smoke and drink less. Giving families cash also seems to improve student achievement, help people be better parents, and even reduce breakup rates among new parents.

To summarize the obvious: poverty is bad for you, especially if you’re a kid. One of the main ways it’s bad for you is that it often deprives you of safe, stable housing.

Cascadia’s left-leaning wonks agree: sending cash to kids is an ideal approach

I write mostly about housing, not social welfare programs more generally. So I asked a bunch of Pacific Northwestern experts what they thought about a broad federal child credit along the lines of Biden’s or Romney’s benefit.

They love it.

John Burbank, executive director of Washington’s left-leaning Economic Opportunity Institute, agreed.

“Social Security, you just get a check in the mail,” he said. “The government doesn’t ask you ‘What are you going to do with it?'”

Andrea Paluso, executive director of Family Forward Oregon, which advocates for state laws that help parents, made a similar point.

“Cash benefits could help with housing security,” she wrote in an email. “And affording other essentials. There is data showing that people spend more on child care than housing, especially in some parts of the state. … Obviously cash assistance would help there too.”

McCarty, the Community Alliance of Tenants director, said the same.

“Government might decide that you need it for housing, but maybe housing wasn’t the most critical need for that household,” she said. “They might need it for a car repair. They may need it for food or medicine that week.”

McCarty added that her organization is skeptical of any social benefit that’s reserved only for poorer people.

“We really question means-testing, and we question it because it comes from this idea of scarcity,” McCarty said. “When you look at the unemployment system, it seems to be designed to fail. … It’s so bogged down in presuming that individuals are trying to commit fraud. When that kind of attention is put to regulation, it seems like it’s really not designed to help. It’s designed to control people.”

In that, McCarty was echoing points made over the last year by Matt Breunig. Breunig’s Washington, DC, based think tank, the People’s Policy Project, has been churning out a sustained argument to simply send a monthly payment for every single child and pay for it with progressive income taxes. He argues that a directly means-tested program would accidentally miss some poor children and create needless administrative burdens for others.

These proposed benefit expansions dwarf recent state-level proposals

Two years ago, the Oregon Center for Public Policy published a persuasive case for a new state-level renter assistance program that might amount to four-figure annual assistance payments for many low-income households, supplementing federal Section 8. The concept was seen as so ambitious that passing it would require a years-long campaign in one of the nation’s most Democratic states. In 2021, it’s seemingly been sidelined amid the coronavirus pandemic.

For 13 years, the Washington State Budget and Policy Center has been valiantly working to persuade lawmakers to fund the state’s Working Families Tax Credit, a wage subsidy for low-earning households, especially those with kids. Under the latest proposal, a potential WFTC would be worth up to $79 a month for qualifying households.

Under the Biden-backed proposal, almost every US household with a child would get more than triple that amount each month. A household with two children would get more than six times that amount.

“Of all the policy issues being discussed this Congress, of all the things we are working on, the biggest impact we can make for economic justice in our country—and enact measurable transformational change—lies within this policy that would slash child poverty,” Senator Cory Booker of New Jersey told the Washington Post last week.

Cash payments would work in tandem with building enough homes

At Sightline, we think our housing markets should feel more like our grocery stores: abundant for everyone and subsidized for anyone who needs help.

This is why we’ve spent much of the last year arguing for federal pandemic assistance for renters, not just the band-aid of eviction moratoriums.

In the longer term, yes, we can build our way to more housing affordability. But the truth is that private-sector construction alone isn’t going to adequately house everyone, even in the long run. For many of us, a labor-based economy simply doesn’t deliver enough money to cover the operating and replacement cost of decent housing. That’s especially true for those, like young kids, who don’t work.

If we want to house everyone who wants a home, we should be figuring out how. If we read the science of who could benefit most from housing, we should probably be looking most urgently for ways to house children.

There are many ways to do this. Cash payments would be a very good one. They seem to be within political grasp. Housing advocates should seize this moment.