Courtney Freeman met me this month at her front door, on which she’s hung a little wreath tied with a red ribbon. Then she led me past photos of her niece and nephew and into her little living room, where she offered me a bottle of water and started talking about sharing.

“I really worked my butt off and worked my way to being a homeowner,” said Freeman, a hospital health educator and mom who lives in Portland just east of Northeast 82nd Avenue. “I understand how it can be to go through the struggle. You don’t have it and you don’t have resources to get it. … I have walked that walk and know what it’s like to struggle and here I am, a homeowner.”

Meanwhile, she said, “we see the homelessness right before our eyes every day.”

The mismatch between her circumstance and those she sees around her is one thing that caught Freeman’s attention about a promising new plan in Portland: A program, now in development by the nonprofit Hacienda Community Development Corporation, that would build 537-square-foot cottages in the backyards of low- to middle-income homeowners, like Freeman. These modest cottages would provide regulated affordable housing for low-income tenants for 10 to 15 years. After that, the accessory cottage would revert to control of the property owner.

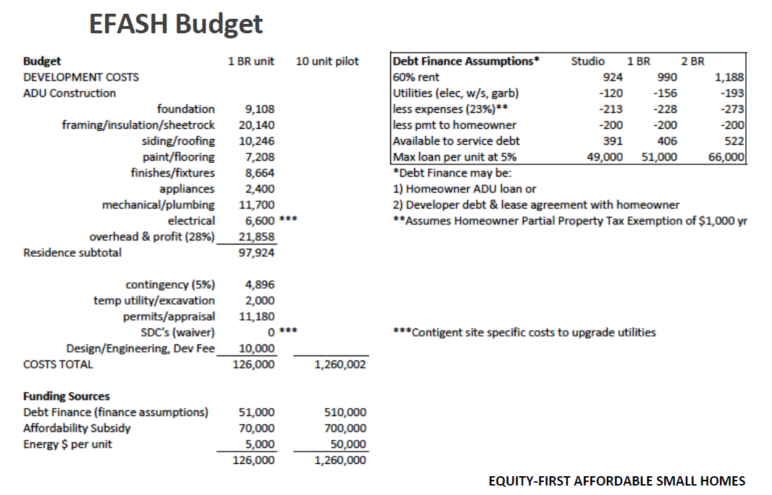

Hacienda calculates the program should be able to deliver homes at half the public cost of a more traditional below-market housing project.

That’s an audacious goal. But here’s the biggest mark in its favor: It’s making use of land that’s just sort of sitting around.

“I’ve got this huge backyard,” Freeman said. “And here could be someone else that’s coming from either a similar situation or a not so similar situation. But we both can relate to the struggle.”

“I looked at this as: here’s two people who can meet each other halfway and help each other,” Freeman said.

New twists on a fast-spreading idea

Hacienda’s concept isn’t entirely new. It’s just the latest local iteration of an increasingly common but frustratingly hard-to-execute idea: subsidizing construction of backyard cottages for scattered-site affordable housing.

For a few years, as privately funded ADUs have surged in popularity, nonprofit entrepreneurs around the United States have been chasing this concept with the tenacity of Thomas Edison, twisting filaments and reshaping glass in search of the light bulb they’re convinced is waiting to be invented.

My colleague Margaret Morales wrote last year about five of these programs, including an earlier pilot spearheaded by Portland’s Multnomah County that had focused on housing recently homeless people. That one, like Hacienda’s, was backed by the Oregon charitable foundation Meyer Memorial Trust. It ended up creating four such homes but stalled amid permitting delays, an unexpected tax liability and a decision by county leaders to pay above-market wages to workers on the project.

So far, Hacienda’s run at this concept exists only on paper. But it’s different from the county’s in various ways. The community-based nonprofit is specifically targeting lower-income homeowners to receive the ADUs, and building in a modest monthly income for the homeowner—maybe $200 out of a $990 per month rent payment. The program would recruit homeowners through partnerships with culturally or geographically specific nonprofits: Portland Community Reinvestment Initiatives, Verde, ROSE Community Development. (Freeman, for example, got wind of the program in part because Verde happened to help her build her rain garden.) Construction of each mostly-uniform 24-by-24 ADU would be done at market wages through a partnership with the National Association of Minority Contractors, by companies that lack the scale to tackle big commercial projects.

And, crucially, the homes are being privately financed by customized loans from a lender such as Craft3, Umpqua Bank or Consolidated Community Credit Union, with Hacienda serving as the homeowner’s advocate and financial counselor. After that, a seasoned property manager—PCRI or ROSE—will join the team to collect rent and start cutting monthly checks to landlord and lender.

That property management deal is a key factor in recruiting homeowners and persuading a lender that they can count on a steady flow of rent payments.

“A barrier to a lot of homeowners is ‘I don’t want to be a landlord,'” explained Kate Allen, a Hacienda consultant who’s co-creating the program with Rose Ojeda, Hacienda’s in-house real estate developer.

The pair are so bullish about their business plan that they’ve given it an ambitiously generic name: “Small Homes Northwest.”

For the moment, the program’s only subsidy is coming from Meyer Memorial Trust, but the goal is to eventually persuade the state or local governments to open a revenue stream that doesn’t add much paperwork: a tax abatement option or a simple, targeted grant.

If the cost estimates actually work, they think they’ll have a strong argument to make.

The Portland Housing Bureau’s usual subsidy for a newly created below-market home, Ojeda said, is $150,000 per unit.

“We’re asking for $66,000,” she said.

Simple backyard cottages are hard to finance. But they’re really not very expensive to build.

“The land is already owned,” explained Allen. “The utilities are already in.”

“The real question is: Can you make it replicable?”

Michael Parkhurst, a housing program officer at Meyer Memorial Trust who’s been part of funding the program’s development, said he doesn’t assume everything will go as planned.

“For me it’s important to realize that it’s a pilot effort,” he said. “We’ll see how some of these things work out.”

But Parkhurst said Meyer is excited about this pilot because of the strength of the project team and the fact that “they’re trying to think creatively around multiple challenges at the same time”—housing stability, wealth building, economic development and plain old housing supply.

“I guess the real question is: Can you make it replicable, so you can start doing significant numbers on an ongoing basis and keep going?” Parkhurst said.

If the first handful of homes can be built as planned, he imagines finding state or local funding that could potentially allow hundreds of such projects in the target neighborhoods: investment without displacement.

“That’s a place where you’re having some real tangible benefit,” he said. “That starts to feel like you’re supporting a community.”

Freeman, who bought her house four years ago—and who often looks after her young niece and nephew, in addition to her own two-year-old, because their mother is also a single mom—looks forward to building community around the home she’s worked so hard to have.

“That’s what I think homeownership is about,” she said. Freeman said her mother owns a home in Northeast Portland’s Sabin neighborhood, four miles to the west on the edge of Portland’s formerly redlined and majority-Black area. Today, the median home there costs $575,000, according to Zillow.

“It was not the neighborhood it is now, but it changed, and it changed so much for the better,” Freeman said. “This neighborhood, as well as any other neighborhood, could potentially be that in the future.”

Comments are closed.