The notion of the “greedy developer” is alive and well in North America. A recent UCLA study found that the most powerful catalyst of opposition to the construction of new homes is the conviction that developers pocket too much profit. And in booming Cascadian cities such as Seattle, that belief creates a political environment hostile to homebuilding, which worsens an affordability crisis caused by a shortage of homes.

When people see new apartments with high rents, many assume it’s because developers are making a killing. But an audit of the typical costs to create and run an apartment building tells a much more mundane story: new housing is expensive simply because it’s expensive to build and operate.

My Sightline colleague Michael Andersen recently devised an auditing method that boils it down to this question: What is the rent check actually paying for? For privately-owned housing, rent income has to cover every cost: no proposed apartment building will move past the idea stage unless investors believe that it will bring in enough rent to pay for all of its development and operating expenses.

Michael found that for a typical new apartment in Portland, Oregon, the biggest chunk of rent—one third—goes to covering the cost of physical construction. In comparison, the developer—that is, the team that manages the whole project—gets just 3 percent. Add the equity investors—the early-stage, financial backers who are also commonly thought of as developers—and the total portion of the rent check that goes to the “developers” comes to 8 percent. The rest of the rent covers a laundry list of expenses including the land purchase, permitting fees, design services, interest on loans, property taxes, and more.

Bottom line: the rent is what it is because the cost of the new building is what it is.

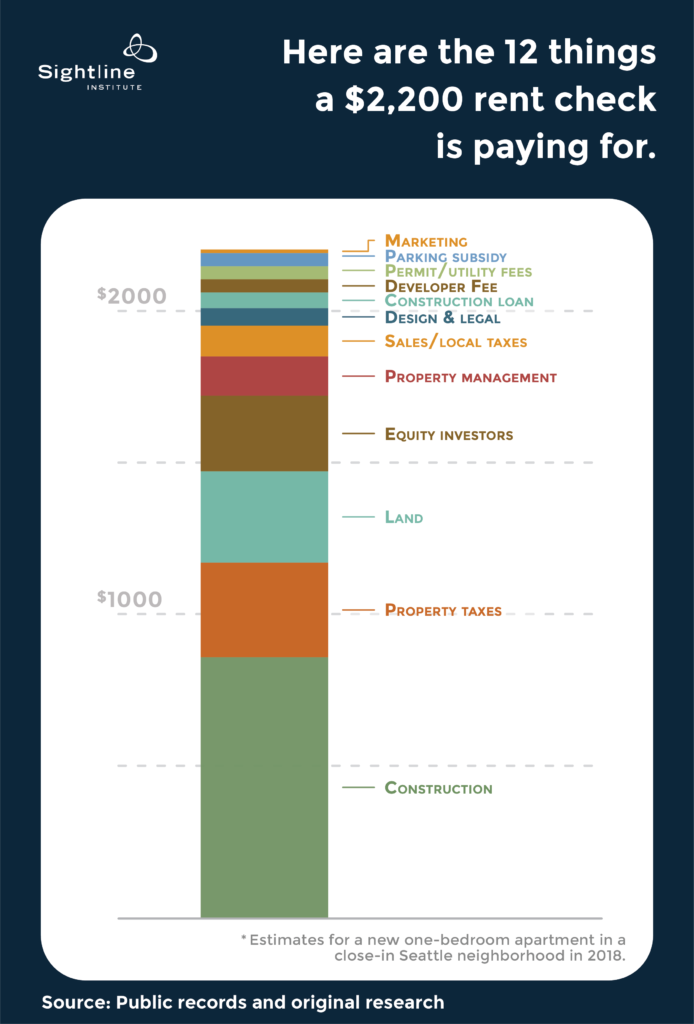

That’s such an important truth that I repeated the exercise for Seattle, running the numbers for a typical new six-story apartment building based on data provided by local Seattle developers. The results are similar to Michael’s. Construction is the biggest single cost, consuming 39 percent of the rent check.

The developer and equity investors together take 13 percent, which is more than our Portland example’s 8 percent, but in the same ballpark. So, contrary to the “greedy developer” narrative, developers aren’t getting half the rent; they’re getting around a tenth of it. Some developers may be less ethical than others—just like any other business. But on the whole, their paychecks reflect their entrepreneurial risk and effort—just like any other business.

Overall, the analysis shows that there’s no single solution for big cuts in the cost of homebuilding, which also means there’s no silver bullet for lowering rents in new housing. There are, however, ways to chip away at it, and those ways add up.

Where the rent check goes

My test case is a generic 75-unit, six-story apartment building with 50 stalls of underground parking and a small street-level retail space. As is common in Seattle, it’s constructed of five wood-framed floors built on top of a concrete bottom floor. I assume developers launched the project in mid-2014, finished construction three years later, and took another six months to fully lease it up.

Typical rent for a new one-bedroom apartment in this type of building located in a close-in Seattle neighborhood is $2,200 per month. As illustrated in the graphic above, here’s what a $2,200 rent check pays for, listed from the smallest to biggest portion:

Marketing consultants: $12/month (0.6 percent)

These folks spread the word about the building and get tenants in the door.

Parking subsidy: $43/month (2.0 percent)

What owners charge for parking usually isn’t enough to cover the cost of constructing it—a staggering $50,000 per stall for underground parking in the present example. That means apartment tenants end up subsidizing the parking through higher rent, whether they own a car or not. A typical $175 per month parking charge leaves an average $43 per month for each apartment renter to cough up.

Permitting and water/sewer/electrical connection fees: $43/month (2.0 percent)

Utility connection charges paid to city and county were $530,000, adding an average of $7,100 to the cost of each apartment. City building permit fees account for the rest, which comes to $2,100 per apartment.

Developer fee: $43/month (2.0 percent)

The main function of developers is master project manager during the entire three- to four-year development process. For this they typically charge 2 or 3 percent of the total development cost, or $690,000 in this example.

Construction loan interest and fees: $52/month (2.4 percent)

The 4.5 percent interest on the loan used to pay all the construction contractors came to $470,000. Miscellaneous fees and insurance associated with the loan added another $360,000. (Today, interest rates are one half to one percent higher.)

Design, engineering, and legal consultants: $57/month (2.6 percent)

This includes the architects and various engineers that design the building and its inner workings, and the lawyers that ensure it complies with regulations.

Sales, B&O, and real estate taxes: $102/month (4.6 percent)

Seattle’s sales tax rate, counting state and local levies, is a steep 10.1 percent, and it applies to all materials and labor that go into a building. In 2017, sales taxes on construction alone provided 5 percent of the Seattle’s total general fund tax revenue of $1.2 billion. For this example, sales tax was $1.5 million, which raises the average cost of each apartment by $20,000. Real estate taxes on the building were $64,000, and Seattle Business and Occupation taxes paid by contractors, another $35,000.

Property managers: $129/month (5.9 percent)

These folks clean, maintain, and repair the building. This figure also includes the building’s gas, garbage, water, and sewer bills, paid by the landlord. (Tenants pay for electricity.)

Private equity investors: $249/month (11.3 percent)

Equity investors put up the cash to pay for the development expenses not covered by the construction loan. They receive interest payments on their investment after the building is completed and leased up, and recover their principle when it’s sold. Equity investment is high risk—lots of things can go wrong with a large homebuilding project that takes several years to build! For this example, equity investments that accrued to about $11 million over the three and half year development would deliver a return of $4 million, which is 15 percent of the anticipated sale value of the completed building.

Land purchase: $301/month (13.7 percent)

The one-third acre of land cost $4.8 million. That comes out to $339 per square foot of dirt, and $64,000 per apartment. Customarily, developers put down a nonrefundable deposit of around 10 percent to secure an option to purchase the land later—ideally right after the city grants the permit to start construction, which minimizes holding costs. (Over recent years the cost of land has risen sharply in Seattle and sellers now often require full upfront payment, not just an option deposit.)

Property taxes: $312/month (14.2 percent)

Most Seattleites probably wouldn’t guess that property tax eats up so much of a typical rent check. State law caps Seattle’s property tax revenue increases to 1 percent annually, but recent voter-approved levies and state school funding legislation superseded that cap and boosted Seattle’s current rate to $9.56 per $1000 of assessed value. For an assumed building value of $30.4 million, the annual tax bill is $291,000 per year. Landlords usually pass those tax costs on to tenants, especially in a hot rental market like Seattle’s. In any case, property taxes are a cost that any proposed homebuilding project’s expected rent income must cover for it to get the green light from investors.

Construction: $858/month (39.0 percent)

The cost of physical construction is the single biggest share of the rent check. Seattle’s boom has inflated that portion as the shortage of skilled labor and materials has pushed prices ever higher. The construction firm Mortenson estimates that costs in Seattle rose around 4 percent annually over the past few years. Construction “hard” costs—that is, just the costs that go into the physical structure—run to $228 per square foot for the living space portion of this example. If the building had gone up three years earlier, cheaper construction could have knocked about $170 off the rent.

How much fat could be trimmed to lower the rent?

The total building development cost of $26.4 million averages to $352,000 per apartment. Scrolling through the above list reveals that when it comes to cutting costs deeply, there’s no obvious fix. Many of the cost factors are relatively small and wouldn’t help much, even in the unlikely event that they could be entirely eliminated. And there’s no easy way to abate the biggest factors—land, property tax, and construction.

For this example, the costs typically associated with developers—their project management fee plus the equity investor returns—accounts for 13 percent of the rent check. Even if that entire cost could be magically wiped out it would only reduce the monthly rent from $2,200 to about $1,900. But without the chance to earn a reasonable profit, no one would risk multiple millions of dollars and subject themselves to four years of cat-herding inspectors, investors, and contractors. Perhaps one could find socially motivated “impact investors” willing to accept a one third lower return, as Michael suggested in his Portland study? That would drop rent by a mere $80 a month.

Developers, like any entrepreneurs who take financial risks, get paid more when things go better than expected, but they also take the hit when things go off the rails. On average, their payoff is commensurate with normal standards that apply to any other business pursuit. And as illustrated in our Seattle and Portland examples, that typical payoff is nothing spectacular—it’s a modest portion of the rent check.

I’ll take a look at specific cost reduction approaches in future articles. For now, some observations:

- Construction is the big kahuna. It’s expensive to build big things! Developers have little control over the cost of labor and materials. Modular construction holds promise: if it delivers on bullish expectations to cut costs in half, it could knock down the rent check by one fourth. In contrast, cutting back on “luxury” finishes and appliances might bring a rent reduction of just a few percent.

- Seattle captures one fourth of the property tax collected, and if the city exempted multifamily housing from its portion (legally, it cannot), rent could drop by about 4 percent. Cutting the non-city portion of the property tax bill would be, well, a political fight for the ages.

- The price of land is dictated by the expected net income it can generate, which is a function of what can be constructed on it and what people will pay for that built space. Rent, in other words, flows from the local market and how many homes zoning allows on the lot. Rezones that allow more homes tend to increase the price of land, but the price of land per home usually drops, which reduces the rent check for each apartment. Over the long term, cities can minimize land prices by allowing as much new housing as possible, which keeps market rents as low as possible. (Better yet, the state or its cities could convert to a land value tax, but that too would be a political fight of Biblical proportions.)

- Eliminating off-street parking requirements at least ensures that city laws won’t force renters to subsidize parking. Seattle doesn’t require off-street parking in most locations where midrise apartments tend to be built, but investors and lenders often do. They operate in a risk-averse world where changes to parking norms established in suburban locales set off alarm bells and bring funding to a halt. My Seattle example has two parking stalls for every three apartments, a relatively low ratio by historic standards. If the building had two stalls for every apartment, the subsidy would rise from $43 to $127 per month.

- Waiving all fees for permits and utility connections could trim rent by 2 percent. Seattle is at risk of moving in the opposite direction, however; it is considering new impact fees to fund water, sewer, and transportation investments.

- Cities that force homebuilding projects to go idle waiting for permit approval boost the rent check by increasing the carrying cost of the project’s high-risk, high-return, early investments. In Seattle developers report that the typical time it takes to entitle a midrise apartment project has risen to nearly two years, almost doubling over the past decade or so. For a ballpark estimate of what that added delay would cost this example project, 15 percent interest on $3 million for a year is $450,000. That translates to $29 per month higher rent. Roughly triple that if the project had to pay the full land price up front. On top of that, though it’s hard to quantify, the uncertainty caused by just the possibility of delay can also add cost, as I discussed in a previous article.

The core rent driver: long-term yield

The fundamental link between the cost of an apartment and its rent is the yield required by investors. By yield I mean the net income generated by the building divided by its purchase price—known in the biz as yield-on-cost (see the “how the math works” endnote for details). No one’s going to sink a pile of money into an apartment building unless it can reliably deliver a cash flow that makes the investment worthwhile compared with other options such as the stock market. Institutional investors are often responsible for getting reliable returns on pension funds, for example.

The present example was financed assuming a yield-on-cost of 5.8 percent, which was typical a few years ago. But what if long-term owners had been willing to invest even if the anticipated yield-on-cost was lower? Reducing the yield-on-cost to 5 percent would drop the required rent by $262 per month, or 11 percent. Seattle affordable housing developer Bellwether tapped impact investors to partially fund two projects, offering a return of just 2 percent. At 2 percent yield-on-cost, the $2,200 rent could be cut in half!

It’s an exciting prospect, but whether it scales to more than a few niche projects depends on finding enough impact investors willing to trade financial returns for social benefit. In rapidly growing Seattle, billions of dollars flow into apartment construction annually, mostly supplied by giant institutional investors that seek to maximize returns, not social benefit. Are there people or institutions with billions of dollars to invest who are willing to accept dramatically lower returns? It seems unlikely.

Cutting costs helps housing affordability across the board

Setting public policy and regulations that will help ease, rather than inflate, the rent of new apartments depends on a clear understanding of all the costs associated with developing and operating a building. Assessing the various costs in terms of rent paid by the tenant exposes how they translate to affordability.

The main take-home point from the above analysis is: there’s no single cost factor that offers big cuts—that is, absent some as yet unproven scalable way to finance housing while paying radically discounted returns to long-term owners. Minimizing rents will require working to reduce many different factors. Conversely, every cost added by regulations, no matter how small, pushes the equation in the wrong direction, eventually leading to death of homebuilding by 1,000 cuts. Most regulatory costs also apply to nonprofit affordable housing development, raising the burden on limited public funding sources.

The second key point is that developers are not to blame for the high rent of new housing. Based on the present Seattle example and Sightline’s prior Portland analysis, what developers get paid typically accounts for around a tenth of the rent check, plus or minus a few percentage points. Advocates for inclusionary zoning or impact fees are wrong to presume that developers are awash in windfall profits ripe for extraction. The unavoidable, unintended consequence of any such added cost is either higher rents or fewer new homes.

Lastly, some readers may be thinking that even if costs are reduced, the landlord will still charge whatever the market will bear, in which case those reductions won’t help affordability. That may be true for one building at a single point in time. But what matters most is the effect on the citywide housing market over the longer term. When costs drop, developers build more, because projects with lower expected rents can still attract investors. The growing abundance of homes pushes down the whole city’s baseline average rent. That benefits all renters in the private market, while at the same time lowering the number of people who can’t afford what the market provides—and that means limited public dollars for housing subsidy can help more of those who need it.

Endnote: How the math works

The rule is simple: the rent pays for everything. That includes the paychecks for everyone who played a role in making the new building happen, along with the purchase price of the land to build on, returns to equity investors, interest on the loans, taxes and fees, and, once the building is done, the ongoing costs to keep it running.

Investors and lenders won’t put money at risk in apartment projects unless they are confident that the rent income will achieve a minimum “yield-on-cost.” Yield is the annual income from rent minus the operating expenses. Cost is the total expense to create the building and get it leased up. In 2014 in Seattle, the standard green light target for yield-on-cost was 5.8 percent. In other words, investors had to be convinced that every year the building would generate a net cash flow equal to 5.8 percent of its total development cost. (Today in Seattle investors have begun to accept lower yields in the 5.2 to 5.6 percent range.)

It follows that the rent necessary to cover a specific development cost for my example is that cost multiplied by 5.8 percent. For example, the $4.84 million expense for land must be compensated by $281,000 rent annually. Rent also must offset all of the building’s ongoing operating expenses such as maintenance, repairs, utility bills and property taxes. I excluded the small retail portion of the building to isolate the residential portion, but included the parking because it mainly serves the residents. The total required residential rent income for the building is the rent that delivers 5.8 percent yield-on-cost for total residential costs, plus operating expenses. The spreadsheet I used is here.

Comments are closed.