[vc_row][vc_column][vc_column_text]As the mid-summer mercury ticks skyward, we have a natural seasonal reminder that climate change is upon us. And while Sightline researchers may have swapped their rain boots for short-sleeved shirts, they have not slackened their pace in opposing fossil fuel expansions in the Northwest. Our team on Thin Green Line has been hard at work since our last update during the bluster of late March.

Researcher Tarika Powell’s nose is to the grindstone, developing a robust analysis of methane leakage from gas projects. Her work will query the oft-repeated claim that natural gas is a “cleaner” bridge between fossil fuels and renewables. Spoiler alert: she will demonstrate any such fuel bridge is likely a path to climate disaster.

Listen to the interview.

Tarika also spent time to advance environmental justice causes in Tacoma. She presented to the Affiliated Tribe of Northwest Indians on the risks of gas infrastructure, and she was a featured guest on an hour-long KBOO segment covering Northwest fracked fuel projects. She also published a hard look at “Trump LNG,” a zombie-like fracked gas project in Coos Bay, Oregon. That review process is now open for public comment.

Communications strategist Anna Fahey contributed her messaging expertise to highlight the natural gas industry’s “dirty secrets,” not to mention the kid-gloves treatment “natural” gas gets in the media.

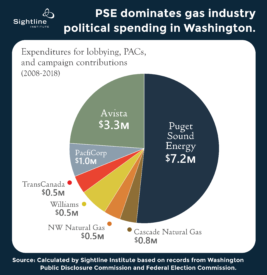

(The gallery below recaps some of those dirty little secrets. Read the full piece.)[/vc_column_text][vc_gallery type=”flexslider_slide” interval=”0″ images=”66765,66766,66767,66768,66769″ img_size=”large” onclick=””][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]I wrote about gas too. Researcher Paelina DeStephano and I tracked the industry’s political spending in Washington to reveal that Puget Sound Energy spends as much as all the other fracked gas companies combined.

We also showed that the project would consume more gas than Cascadia’s biggest cities put together. Plus, I demonstrated three ways the proposed Kalama methanol project would be a huge climate mistake, using key research from Stockholm Environment Institute.

Ahren Stroming and I examined a proposal for a small-town silicon smelter and outlined the big questions it tees up for Northwest climate action. Ahren and I also took a many-decade retrospective on the Washington oil industry and asked whether its steady expansion can ever be halted. If it can, it will likely involve more protective zoning—a subject that I analyzed in an article surveying anti-fossil fuel land use laws adopted by Northwest cities and counties.

I got to tout Thin Green Line’s successes during a 30-minute audio appearance on KEXP and I spent about an hour with KBOO talking primarily about tar sands other Northwest oil schemes.

When the company behind the Trans Mountain tar sands pipeline declared that it might abandon ship, I explained what the unexpected announcement might mean. But it was Clark Williams-Derry, Sightline’s director of energy finance, who did the real heavy-lifting on oil news. He explained why the former Trans Mountain Pipeline backer, Kinder Morgan, had a big oil spill problem on its hands—and why the company was exposed to potentially huge financial liabilities.

In a particularly trenchant piece, Clark explained Canada’s surprise purchase of the pipeline, including plans for expansion and how the buy amounts to the Canadian government will bail out a Houston billionaire. He also explained how the project’s new owners could put Washington in the crosshairs of a related oil pipeline expansion south of the 49th parallel.

Bird-dogging its failing fortunes, Clark also covered the collapse of “self-bonding”—another blow to the western coal industry.

On top of all that, Clark coauthored two reports with colleagues from the Institute for Energy Economics and Financial Analysis. One covered the ongoing financial stress in the oil and gas industry and a bizarre paradox: oil and gas production are booming despite shrinking financial clout in the fossil fuel sector. A second report covered the financial case for divesting from fossil fuels. Both individuals and professional money managers, it argues, have excellent reasons to pull their money out of underperforming and volatile investments in oil, gas, and coal.

Finally, in two guest pieces for Sightline, Seattle University School of Law professor Michael Mayer shared his expertise. In the first, he asked what is the “necessity defense” and what are its limits? In the second, he highlighted a range of important courtroom climate cases, including the latest news on “the trial of the century.”

Sightline’s work on the Thin Green Line is continuing to have an impact, at least if our media coverage is any indication. Since our previous update in March, Sightline’s research on fossil fuels was mentioned in the Casper Star-Tribune (three times), Everett Herald, Forbes, Indian Country Today, KNKX, Longview Daily News, Public News Service, Seattle Times, Tacoma Weekly, Think Progress, and The Tyee, among dozens of other outlets both regional and national.

With ice cubes in our drinks and hearts full of gratitude to our supporters, we’ll crank up our desk fans and get back to work on the Thin Green Line.[/vc_column_text][/vc_column][/vc_row]

Comments are closed.