As I wrote about a few weeks ago, corporations have a long and storied history of “crying wolf” when people try to protect themselves from industrial pollution or safety hazards. Business interests also have a history of paying consultants to produce studies that “prove” the wolf is really there. For example, in 2017, Oregon Business & Industries (OBI) paid consultants to run a few models to conclude that climate action would cost Oregonians dearly on their electricity, gasoline, and natural gas bills.

I’ll let you in on two little secrets about modeling. First, the only thing you can really know about energy prices three decades out is that nobody really knows what they will be. More specifically, staid institutions like the Energy Information Administration (EIA) usually predict business as usual—and when it comes to clean energy, they are usually wrong. Way wrong.

Second, it’s all about the assumptions. If you hire a consultant to do a study showing that a person can knock down a skyscraper by punching it, the consultant will say something like, “Sure, assuming the person can punch the load-bearing beams with a force of X.” The X is the key.

OBI’s sponsored study used some pretty wild Xs to make climate action look dangerous. But you know what’s actually dangerous? Climate chaos. And luckily, we have real-world evidence about climate action that show OBI’s Xs are just more phantom wolves for the trade group to cry about.

Modelers are wrong when it comes to a clean energy future

Modelers like to assume that the fossil fuel economy will keep on keeping on, business as usual, forever. Even as evidence mounts that the economy is shifting to favor clean energy infrastructure, modelers continue to assume that people will drive more, that they will burn more dirty fuels, and that those dirty fuels will be cheap and plentiful as far as the eye can see, while clean energy remains an insignificant blip on the horizon.

EIA overestimates oil consumption fully 70% of the time and has underestimated solar energy build-out by a whopping 4,813% over 10 years.

This article, plotting the EIA’s solar energy predictions by year, shows most clearly how preposterously wrong the agency is, over and over again. Each year, the EIA predicts solar will increase at a low, flat rate. And each year, solar blows the EIA predictions out of the water, following a steep “S-curve.” The next year, the EIA grudgingly lifts its prediction a smidge, but keeps it low and flat, never admitting to the reality right in front of its eyes.

Meanwhile, despite this stingy treatment of solar, their outlook is (ironically) exceptionally sunny for fossil fuels. Here’s another analysis showing EIA overestimates oil consumption fully 70 percent of the time and another showing EIA underestimated solar energy build-out by (wait for it…) a whopping 4,813 percent over 10 years.

As for the driving habits of the average consumer, Sightline’s Clark Williams-Derry has shown the Washington State Department of Transportation continues making preposterous predictions about increased driving.

OBI’s paid consultants used an inflated carbon price and other costs, while assuming zero efficiency gains

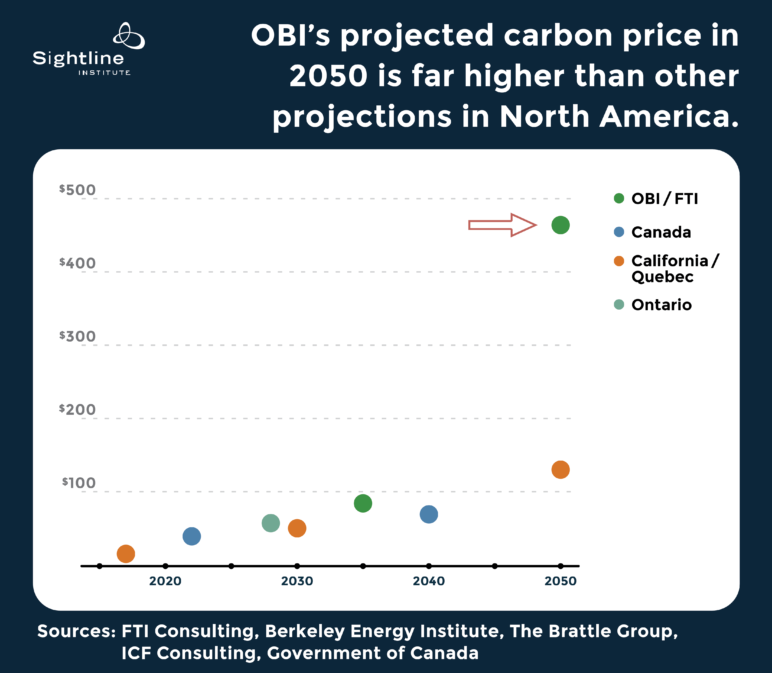

Oregon Business & Industry’s paid modelers assume a 2050 carbon price of $464 per ton, far outside the range of what credible sources estimate for other polluters-pay programs in the US and Canada.

The erroneously high carbon price the OBI consultants use in their calculations is the primary driver behind their report’s predictions for alarmingly increased household electricity costs.

Their model doesn’t stop there, though; it makes a few additional exaggerated assumptions to further drive up that electricity cost figure. First, the study assumes that 15 percent of carbon auction revenue will go to administrative costs. By comparison, California’s administrative costs add up to less than 5 percent of their revenue. The model also ignores the point that by linking to the joint program between California, Quebec, and Ontario, Oregon could piggyback on existing administrative structures, reducing those costs further. So the OBI consultants’ 15 percent assumption appears off by at least a factor of three, which artificially increases their estimated cost impacts.

Second, the study assumes that Oregon will not accelerate energy efficiency savings as a result of the program. But a well-designed polluters-pay program would drive the Oregon economy towards clean innovation, investing in communities while making corporate polluters pay the true costs of their dirty fuels. This approach encourages households and businesses to invest in energy efficiency, the growing demand for which will will spur the growth of Oregon’s most forward-thinking companies and the establishment of new ones. Indeed, this pattern has repeated itself everywhere that carbon pricing has been implemented. RGGI, the 10-state polluter-pays system in the Northeast, had created more than 30,000 new jobs by 2015. California, because of aggressive reinvestment of its cap-and-invest revenues, is on track to double savings from energy efficiency by 2030. The OBI consultants ignore all this, though, cherry-picking numbers that help their client perpetuate the tired myth that a price on carbon would be a hit to Oregonians’ bank accounts.

[list_signup_button button_text=”Like what you|apos;re reading? Get quarterly carbon pricing updates from Kristin Eberhard directly to your inbox.” selected_lists='{“Carbon Pricing & Making Polluters Pay”:”Carbon Pricing |amp; Making Polluters Pay”}’ align=”center”]

Moving to clean energy means lower costs

Luckily, we don’t have to depend on modeling stuck in a dirty fuels world. We can look across North America at the numerous places that have started pricing carbon and see that people there in fact spend less on electricity.

It may seem counterintuitive that charging more for dirty fuels would result in lower monthly bills, but here’s how it works: in Oregon, as in many states, we import dirty fuels from outside, meaning our dollars flow outward. By switching off those out-of-state fossil fuels, we invest more of that money here in our own region and create more jobs here.

Investing some of the money from the carbon price into our communities’ energy efficiency priorities will also create clean energy jobs here in Oregon. Upgrading buildings creates jobs, saves energy, and saves the building occupants money on their electricity bills—a virtuous cycle, and one already at work in the RGGI states. There, the strategy of investing in clean energy closer to home has saved families, businesses, and other ratepayers a whopping $460 million on their electricity, natural gas, and heating oil bills. On the other side of the country, California has been pricing carbon for nearly a decade, and its residents now have the third lowest per capita energy consumption in the country, keeping their bills low. Both of those examples represent serious money—not to mention a figure the OBI consultants would prefer to omit from their considerations.

Don’t let disingenuous modeling block Oregon’s clean energy future

If you tweak your assumptions enough, models can say whatever you want them to say. And those who profit from the status quo obviously want models to show that the status quo is our best option. But Oregonians don’t want business as usual. We want a cleaner future, and experience shows cleaner is not just easier on the lungs, but on the pocketbook, too.