Washington’s foresters, fishers, farmers, and farmworkers have become painfully familiar with the impacts of climate chaos while American politicians have spent the decade kicking the climate change can down the road. Last summer, both sides of the state lived and breathed under a blanket of smoke as wildfires forced those effects right into the state’s homes. Washington schools closed, the government entered a state of emergency, and no one was left on the sideline. From the wettest winter on record to ash falling like snow in Seattle, scientists tell us extreme weather is connected to climate change.

In 2017, Washington and California led 14 other states and territories to create the US Climate Alliance, which represents, together, more than 40 percent of the US economy. California created enforceable limits on pollution, but Washington and Oregon have yet to give their commitments teeth. The Oregon legislature might remedy that this session, and in his 2018 State of the State address, Governor Jay Inslee proposed a way for Washington to really bite in: SB 6203.

Last chance for Washington legislators?

In 2014, Governor Jay Inslee put forth a robust cap and trade plan. Republicans shut it down. In 2015, he tried using executive power. A judge shut it down. Then came Initiative 732 (I-732), a carbon tax proposal that split the environmental community and didn’t make it past the voters. In 2017, a total of four carbon tax proposals were floated in the legislature. Not one made it out of committee.

Washington’s government is running out of time to price carbon on its own terms. With climate impacts more immediate than ever and the advocacy more united than ever, voters may take the matter into their own hands come November. In his speech, Governor Inslee subtly reminded legislative foot-draggers that momentum for climate action is building. The governor gave a nod to members of the Alliance for Jobs and Clean Energy, a powerful and unprecedented coalition of civil society and business groups waiting impatiently in the wings to drive its own plan to the ballot the minute the legislative session ends in March. Legislators and business groups might prefer to shape a plan through the legislature than to face the Alliance at the ballot.

So what do these teeth look like?

The bill, SB 6203, would make polluters pay each time they spew pollution into the atmosphere, and would invest the revenue in cleaner energy, natural resource resiliency, and supporting workers.

The polluters that would have to pay are the big oil, gas, and electricity companies selling dirty energy into Washington. These are among the largest sources of carbon pollution in Washington, and have escaped all prior rounds of attempted regulation. This tax would apply upstream, at the first sale or use of a fossil fuel or fossil fuel-derived electricity in the state, meaning electricity utilities, natural gas utilities, and petroleum fuel distributors would be the ones paying. (Downstream would mean you, I and mom-and-pop business would pay, which would be an inefficient administrative nightmare).

How much would polluters pay?

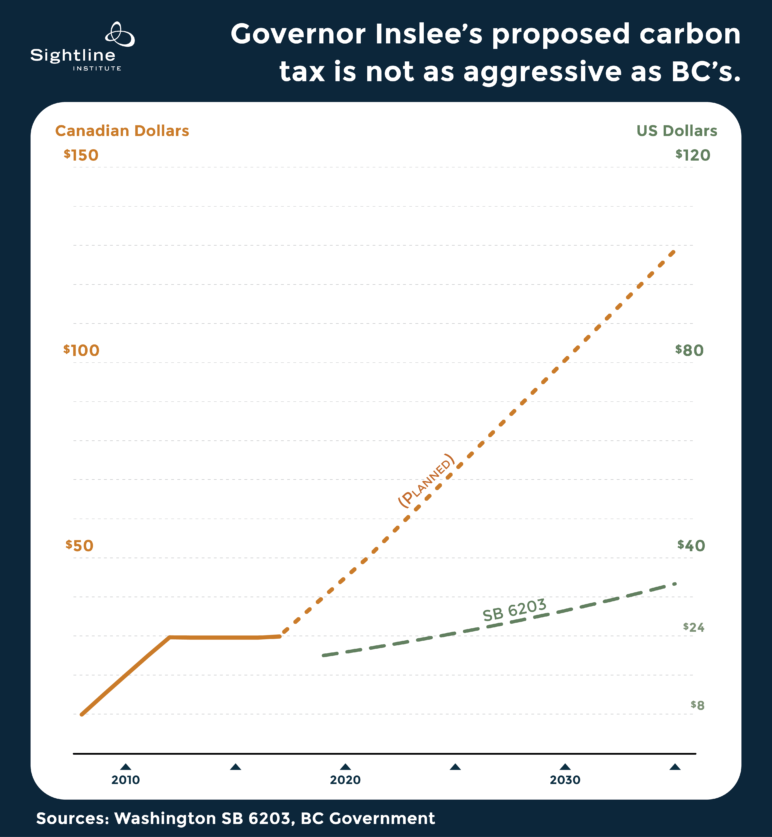

The tax would start small, with a price of only $20 per metric ton on July 1, 2019, increasing by 3.5 percent per year above inflation, reaching $35 in 2035 and $58 per ton in 2050, not counting inflation. This is lower than earlier proposals, and much lower than BC’s carbon tax, which is marching upward toward a goal of $50 Canadian per metric ton by April 2021 and, if it keeps going, will reach $120 in 2035 and $195 in 2050. SB 6203 starts out higher than California, Quebec, and Montreal’s joint auction, which reached $15 per ton in November 2017, but which may rise more quickly than Washington’s proposed tax as their joint cap ramps down more aggressively.

How much total money are we talking?

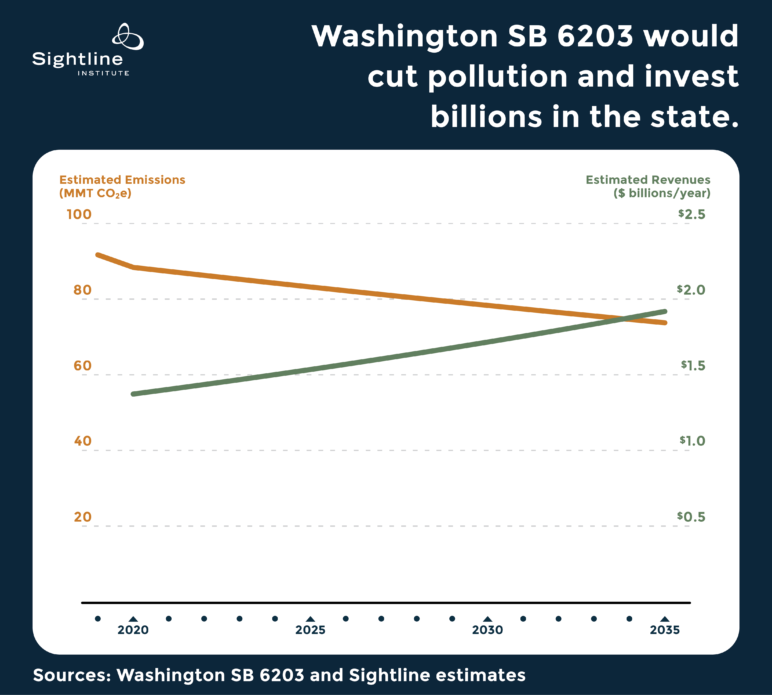

This tax would generate in the ballpark of $726 million of new revenue in its first year, $1.5 billion over the first two years, and $3.3 billion over four years. It also incentivizes utilities to invest, by its third year, more than $500 million per year in clean energy. In total, the tax would likely bring in around $2 billion in revenue and utility investments by 2035. The tax would nudge pollution downward, though not as quickly as state law requires. The rising tax on declining pollution levels adds up to slightly more revenue each year.

Where does the money go?

By itself, taxing pollution won’t be enough for Washington to become a model of a thriving, equitable, green economy. Alone, the proposed modest tax won’t even get Washington to its climate pollution reduction goals. A tax would likely need to hit $125/ton by 2050 to help the Evergreen State reach its existing statutory goal of reducing greenhouse gas pollution 50 percent below 1990 levels by 2050. This proposed tax, reaching just $58 by 2050, isn’t up to the task. (As the Department of Ecology argues, even that 2050 goal, set by the Legislature in 2008, is probably insufficient).

In addition, a carbon tax alone could be inequitable. Although a price on pollution will work to avoid some of the ills of climate change that are already falling disproportionately on the most vulnerable populations, any carbon pricing policy still needs to be carefully designed to avoid unfair impacts. Other programs have tried different approaches for helping low-income residents and other vulnerable populations: BC’s carbon tax helps low- and modest-income families with tax credits; California’s cap-and-trade program sets aside money for investment in highly-impacted communities, and some proposals would recognize that we all have a share in a clean atmosphere by giving everyone a dividend check. Sightline has proposed using “green stamps” to allow low-income residents to make their own investments in the green economy.

Washington’s bill would take an approach similar to California’s, prioritizing investments in projects that benefit low-income communities, communities of color and indigenous communities, and requiring utilities to invest in low-income energy assistance.

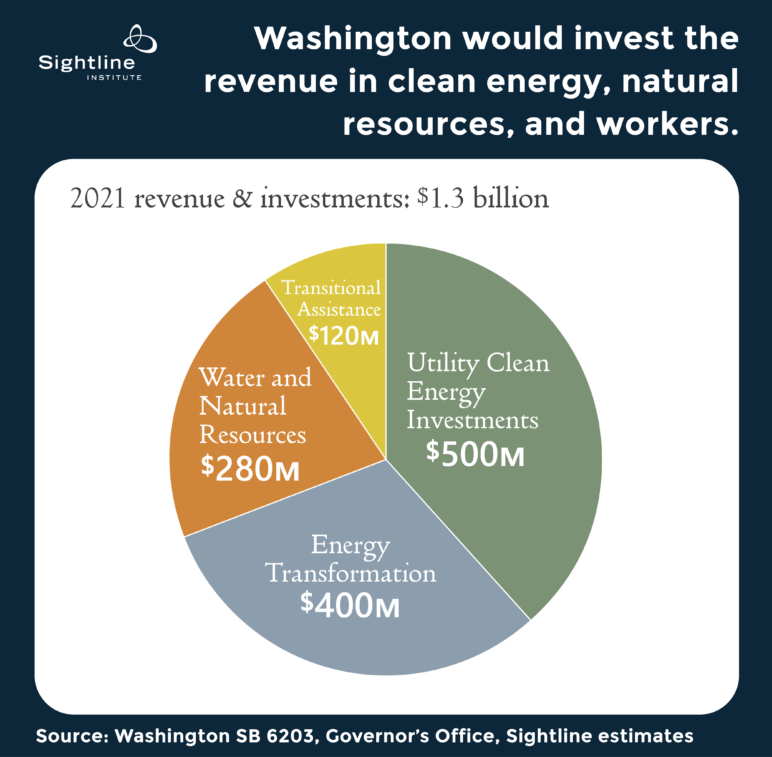

SB 6203 would send revenues to three investment accounts housed in the State Treasury (each of which would be subject to appropriation by the legislature). It would also encourage utilities to make certain investments.

Energy Transformation Account—more than $350 million per year

Half the tax revenue would go to the Energy Transformation Account to speed Washington’s transition to a clean-energy economy. Public and private entities would be allowed to pitch grant ideas to this fund. This bin is where the bill requires that priority be given to projects that benefit heavily-impacted communities.

This bin would help firms take advantage of cheap pollution-cutting opportunities that are otherwise blocked by market barriers, like efficiency retrofits at industrial manufacturing facilities. It would boost clean transportation statewide, fund transit-oriented development, and address agricultural emissions by supporting fertilizer and soil management.

Water and Natural Resource Resilience Account—more than $250 million per year

Thirty five percent of the tax revenue would go into the Water and Natural Resource Resilience Account to fund climate-conscious forest and water management projects. These would reduce flood and wildfire risk to communities, improve the availability and reliability of water supplies, and support wildland fire prevention and suppression.

A federal court reaffirmed in 2016 that Washington must replace hundreds of salmon-blocking culverts by 2030. In 2017, the Legislature also directed the Department of Natural Resources to step up its fire management game, setting a goal of treating one million acres by 2033 to improve resiliency to fire. These funds could help with both those obligations.

Transition Assistance Account—more than $100 million per year

Fifteen percent would go to the Transition Assistance Account to usher along a just transition to a cleaner economy. First, it would support low-income households and vulnerable communities through cash, in the form of help with their utility bills or food stamps, through services such as public health programs, through investments in affordable housing and transportation, and through economic development such as investments in rural communities and in new green businesses.

Second, it would assist workers in fossil fuel industries affected by the transition to a cleaner energy economy. For examples, workers who lose their jobs could get wage replacement benefits, training and education in clean energy jobs, job placement support, and relocation assistance.

Finally, it would fund three clean energy centers for excellence in the state community college system to facilitate research and development, help attract investment in clean energy, and promote clean energy jobs across a range of sectors. Each center would be devoted to one of the following:

- The development of renewable energy integration and generation.

- The development of smart grid technology and the next generation of hydropower resources.

- A center to promote renewable forest products and research to improve forest health and reduce fire risk.

Utility Clean Energy Investments–around $500 million per year

SB 6203 would allow electric or gas utilities to claim tax credits for up to 100 percent of what they pay under the carbon tax, under the condition that they spend the money on projects that reduce or offset carbon emissions that they would not have pursued without the funding. At least 20 percent of the funds spent on each project would be required to go toward low-income energy assistance.

Since the tax credits could effectively exempt utilities from paying the tax at all, the investment requirements are worrisomely vague at the moment. How will the utility show it would not have, for example, contracted to buy that renewable energy or fund this energy efficiency program anyway? The bill also does not define what offsetting emissions could look like, possibly leaving the door open for utilities to use their tax credits to purchase questionable offsets.

What will the dirty energy companies say?

The oil companies and their political allies are already dusting off their multi-million dollar pro-dirty-fuels PR machinery. Pricing carbon means making dirty energy more expensive. But the increase in price will be predictable and swamped by the natural volatility of oil and gas prices. And as the people of Washington stop subsidizing dirty energy, clean energy companies will be able to compete. As a result, people will have better ways to power their homes and business and to get where they need to go at a reasonable price that doesn’t hide the deadly price of free pollution.

The Governor’s office predicts that residential natural-gas prices would increase about 10 percent in 2020, gasoline prices between 6 and 9 percent, and electricity costs 4 to 5 percent. It’s worth noting that, because Seattle consumers already source less carbon-intensive electricity, in the form of hydropower, their bills would likely see even less change.

Are there any loopholes?

Though Washington is in the top 10 states for jet fuel consumption, or maybe because of it, aircraft fuels are exempted. Fuels used for agriculture, fuels used at energy-intensive, trade-exposed (EITE) facilities, and energy or fuel that gets carbon taxed or carbon-charged elsewhere are all exempted. Washington’s only remaining in-state coal-fired power plant is also exempted, though it’s slated to shut down its last boiler in 2025.

SB 6203 also includes a preemption clause prohibiting any local government in the state from imposing “comparable” carbon taxes or charges on the sale or use of fossil fuels or electricity generated from fossil fuels. Eager localities would not be able to go above and beyond the state’s modest dirty fuels tax.

What’s the bottom line?

Extreme and damaging weather is already hitting Washingtonians as the legislature dawdles. Time is running out for it to lead before the people get tired of waiting.

With multiple major proposals on the table, Washington seems to have finally moved from the question of whether to price carbon to the question of how. Though some details still need to be fleshed out, Governor Inslee’s SB 6203 is a well-crafted bill. It asks and answers the right questions. It does an admirable job of addressing a major threat with a generative solution. Washington’s legislators have 37 days to act on it. The clock’s ticking.

Thanks to Michael Peñuelas for his help researching and drafting this article.

Comments are closed.