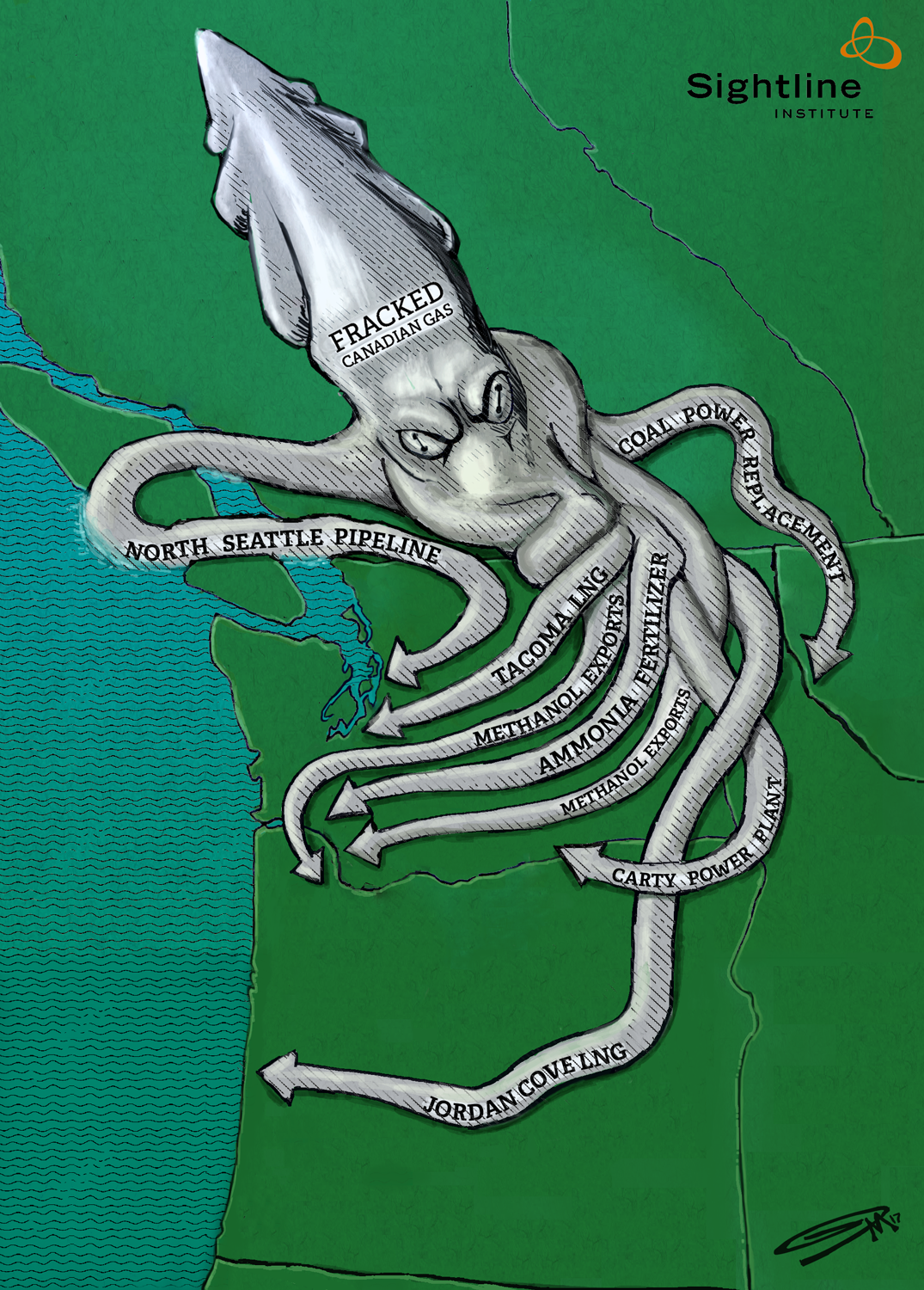

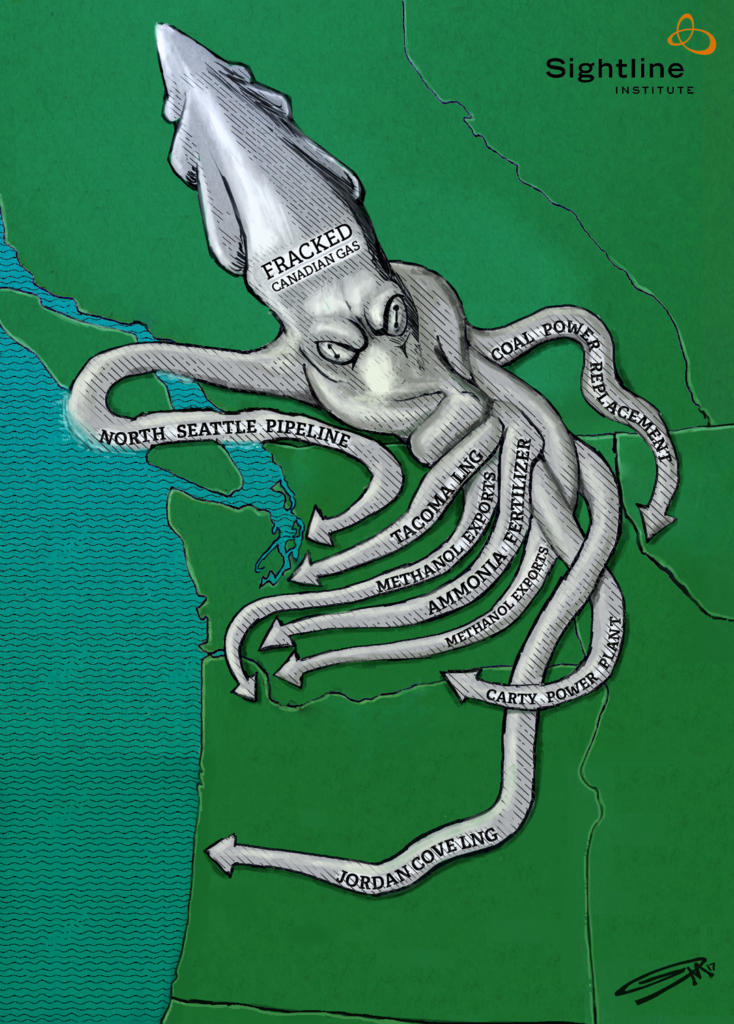

Editor’s note: We updated this article on May 29, 2018 to reflect projects that have been withdrawn, and include updated information about current projects. This article also features a third version of the graphic.

The Northwest is home to a range of project proposals to expand gas consumption. At first glance, they appear quite different from one another, but on closer inspection they can be seen as parts of a common beast: an ambitious Canadian fracking industry that sits atop huge gas reserves. These gas fields are far from North American markets, however, and so the industry’s expansion plans depend on inventing new uses for all that fuel.

In Oregon and Washington, utilities and exporters are scrambling to fill the void. From methanol refining to electricity generating to vessel fueling, industry backers hope to create a demand for more gas that would be shipped south by pipeline. It’s not possible to know if all the gas required by these projects would be sourced from Canada’s abundant gas reserves, nor is it possible to say that all of it would be fracked. But it is a near-certainty that Canada would supply much of the fuel for these projects and it is clear that plenty of that fuel would be fracked. About half of Canadian gas was already derived from fracking in 2014, and the figure is expected to increase to 80 percent by 2035.

Here are some of the proposed gas projects that would help drive the Canadian fracking industry.

Carty power plant expansion (Boardman, Oregon): The utility Portland General Electric was pushing an expansion of its gas-fired power plant in eastern Oregon until May 2017 when it suspended permitting. Still, the company did not withdraw its permits and it was partially approved for a new gas-fired generator at the site until the construction deadline passed. PGE wants a new air quality permit for the existing gas generator that would allow it emit triple the amount of carbon monoxide it is currently allowed to.

Coal-fired power replacement (Montana): When western Washington utility Puget Sound Energy (PSE) promised to wean itself off coal-fired power supplied by its Colstrip plant in eastern Montana, officials signaled that a portion of the replacement power would come from gas-generated electricity. It’s not clear where, precisely, this gas power would come from or how soon it might begin operating.

PSE customers (Seattle area): Despite pressure from environmental groups and bad press from a recent explosion in Seattle, the utility continues to expand the reach of local gas pipelines and gas-fired electricity in its service territory, which includes more than 1.1 million power customers and 790,000 gas customers, mostly in the central and south Puget Sound region. For one example, the utility is backing a pipeline expansion in Snohomish County and north Seattle.

Tacoma LNG (Tacoma, Washington): In another controversial project, PSE would build a new liquefied natural gas plant in the industrial port area of Tacoma where it would supply fuel for ships and heavy haul trucking, with a small portion set aside for winter heating. For both safety and environmental reasons, neighboring residents and the Puyallup Tribe strenuously object to the proposal.

Future gas power plants (Washington): There is currently only one publicly-known plan to build a new gas-fired power plant in Washington, but rumors abound that one or more of the region’s utilities are aiming to generate more electricity from gas-fired generators sited in the Evergreen State. The one known specific plan is for a 125-megawatt power plant (see 2.6.1.3) that would run a huge methanol production site at Kalama, Washington.

Methanol exports (Kalama, Washington): A huge Chinese government-backed project on the banks of the Columbia River would convert natural gas into methanol, a liquid petrochemical, for export to China where it would be used to manufacture plastics or perhaps be burned as a fuel for vehicles. The project would consume staggering amounts of gas, as much as 320 million cubic feet per day, more than every gas-fired power plant in the state combined. The proposal recently suffered a serious setback when state regulators invalidated key permits that will, at minimum, delay the project by a year or more.

Methanol exports (Port Westward, Oregon): On the Oregon side of the Columbia, the same company aspires to build a twin sister gas-to-methanol project. It’s no longer clear how viable that proposal really is, and the company recently removed mention of the Oregon project from its website, though it has not formally announced an end to the project.

Jordan Cove LNG (Coos Bay, Oregon): Designed to export 6 million tons of LNG from the Oregon Coast, the proposed facility would also require construction of a large new gas pipeline across 229 miles of southern Oregon to connect to the existing distribution system. Opposed by environmental advocates, property rights interests, and tribal nations, the first iteration of this LNG export project was rejected by the federal government, but it has sprung to life again with backing from the Trump Administration.

Thanks to Gavin MacPherson for the illustration, and to Paelina DeStephano, who provided research for the May 2018 version of this article.

Don Merrick

Thanks for the update about all the industry plans to send natural gas, fracked or not, through northwest ports. In Oregon where I live we have an added concern: the Jordan Cove Project and the Pipeline Connector from Malin, Oregon, near Klamath Falls. I feel it compliments this article to refer to the September article from 350PDX about Jordan Cove.

Find it here text to display

Eric de Place

Yes, Don. We are tracking Jordan Cove and we think it’s a big, big deal. The only reason we didn’t include it on this graphic is that the gas for that project is not likely to be sourced from Canada as for many of the others.

Francis

What? Gas for Jordan Cove “not likely to be sourced from Canada”? Wrong!!

Of course Jordan Cove gas is from Canada! Veresen said in their original application that 80% would be from Canada. In their latest application, they imply it could be 100% from Canada. Veresen is a Canadian company, and so is Permain, the company they just merged with. Why would Jordan Cove NOT export canadian gas if it is 100% Canadian owned?

Eric de Place

Francis, can you point me to the place in their permit application where they identify a source for the gas? I’d be happy to correct the graphic (and my thinking) based on that evidence. The evidence I’m familiar with indicates that the gas would travel via the Ruby Pipeline from the big Rocky Mountain gas basins like Green River and Uinta with maybe some minority supply from Canada. For examples, see here: https://seekingalpha.com/article/3618866-buy-veresen-growth-high-yield

And here: https://rbnenergy.com/new-kid-in-town-does-jordan-cove-lng-have-what-it-takes

The fact that Veresen is Canadian doesn’t really have much to do with it. They would presumably source the gas from wherever its cheapest, which usually means nearest. But, as I said, I’m happy to revise my beliefs if there’s evidence to the contrary!

Eric de Place

Well, it looks like I was mistaken. I’ll have a revised version of the graphic out soon, one that will include Jordan Cove LNG.

Jake

Natural gas burns clean and reduces emissions. Environmentalists should be supporting these projects!

Steven Storms

Jake, you are about 10 years outdated in your information. Natural gas from fracking wells is now considered one of the worst possible fuels to burn. The impact on global warming is several times worse than even coal. This is due to the methane leaks from the fracking wells. While the gas industry might try to claim it is a cleaner burning fuel, when the total life-cycle emissions are included, it is possibly the worst fuel possible.

Lynn

Jake you obviously work for an oil or company.