A pair of new data releases help sketch a clearer picture of how oil trains move throughout the Northwest. By analyzing the data in the new reports alongside what we already know about the industry, we can better understand how the Northwest oil sector works.

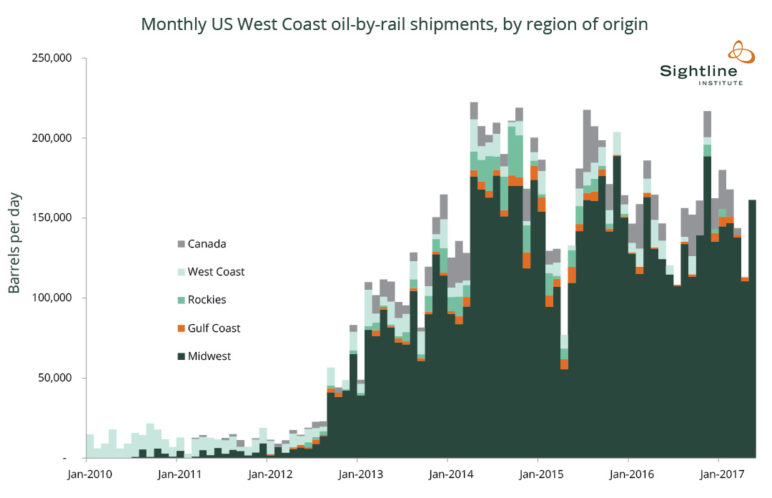

Federal data for the US West Coast show that nearly all oil shipped by rail to the region originates in the Midwest region, presumably North Dakota, with a small minority sent from Canada and an even smaller minority from other places (including from within the West Coast states). Although monthly receipts vary widely from month to month, the West Coast gets an average of about 161,000 barrels per day of crude oil-by-rail, at least up until May 2017, the most recent month for which data are available.

It appears that nearly all the oil transported by rail to the West Coast is bound for destinations in Washington. We can ascertain that fact by looking at state-level data, which is published quarterly by the Washington Department of Ecology. For the second quarter of 2017 (from April 1 to June 30), oil shippers reported moving an average of 156,854 barrels of oil per day by train—a total of 14.3 million barrels.

Data in the new state report indicate that BNSF Railway once again dominated oil train movements in Washington, handling roughly 94 percent of the cargo. Union Pacific (UP) contributed only about 6 percent and likely delivered that oil solely to Tacoma. Interestingly, it appears that no loaded oil trains transited the mountain passes over the Cascades. The vast majority, about 95 percent, of the oil originated in North Dakota, passed through Spokane, and ran along the Columbia River Gorge before turning north to destinations on Puget Sound. A minor fraction, a bit more than 5 percent, came from Alberta and entered Washington by way of Whatcom County before traveling south along the Sound to the Tesoro Refinery at Anacortes.

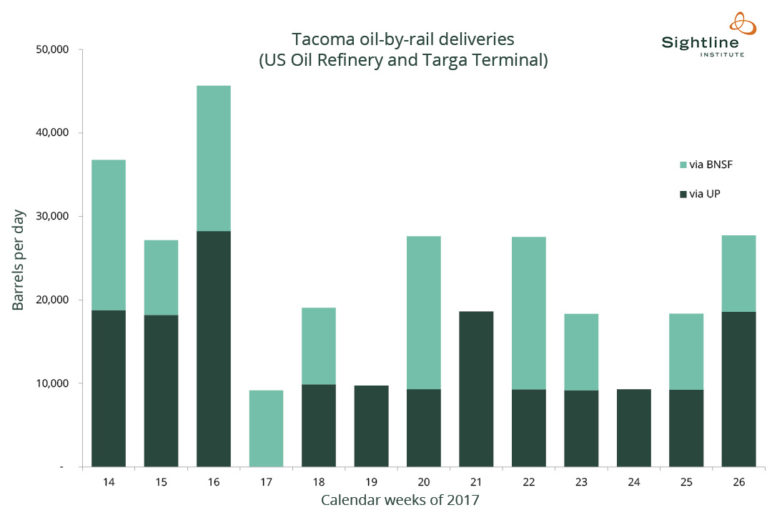

All oil trains in Washington are destined for one of three places on the shores of Puget Sound: Tacoma, Anacortes, or Ferndale. In Tacoma, oil trains may be unloaded at the US Oil refinery, the smallest refinery in Washington, or at Targa Sound Terminals. In the second quarter of 2017, these two facilities accepted an average of 22,684 barrels per day, about the same as in the first quarter of the year.

Tacoma was the only site that took delivery of oil trains moved along UP rail lines, the railroad responsible for the catastrophic explosion in Mosier, Oregon, in June 2016, which was in fact bound for Tacoma.

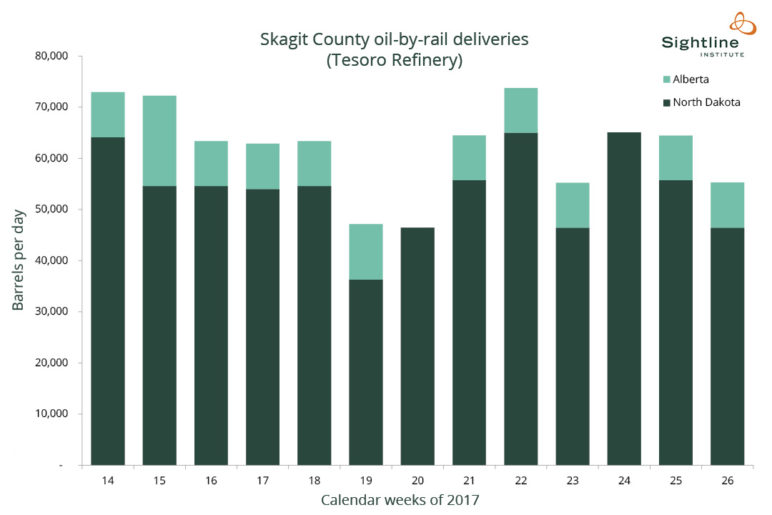

Most oil trains passed through Tacoma, Seattle, and many of Washington’s other big population centers en route to refineries on the north Sound. The Tesoro Refinery at Anacortes—the intended destination for the oil train that derailed under Seattle’s Magnolia Bridge—accepted more than 5.6 million barrels of crude oil by rail, over 62,000 barrels per day on average.

The Tesoro Refinery was the only facility that accepted oil trains from Alberta and therefore the only site to accept rail deliveries of heavy crude oil.

Tesoro may be selling a portion of its rail deliveries to the neighboring Shell Refinery, so we don’t know whether all this oil was ultimately refined by Tesoro. Shell had intended to construct an oil train unloading facility, but its plans were scuttled by a robust opposition movement, procedural delay, and worsening economic conditions. Moreover, the future of oil train deliveries to Tesoro remains uncertain, as the local Swinomish tribe is suing BNSF in federal court for breaching the terms of an easement that the railroad obtained across tribal land.

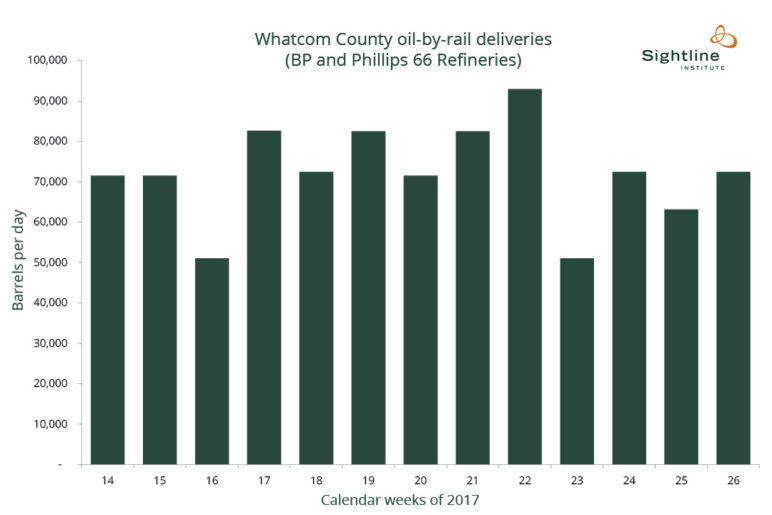

Other oil trains continued north to the BP and Phillips 66 Refineries in Whatcom County. Together these refineries accepted more than 6.5 million barrels of crude oil, an average of nearly 72,000 barrels per day. All of it was light oil from North Dakota that moved along BNSF’s rail lines in Washington.

The report also reveals that in the second quarter of 2017, Washington shipped out more than 1 million barrels of crude from refinery or port docks—whether for international export or to other domestic locations, we don’t know—roughly the amount that would be carried by seven standard tank barges or three tanker vessels. Yet ships delivered far more oil than they took away: 24.5 million barrels, which is equivalent to roughly 61 tankers during the same period. It works out to roughly 272,000 barrels per day brought in on tankers and barges.

The second biggest delivery mechanism for oil is pipelines. Nearly all of that oil arrives by way of the Puget Sound Pipeline, which extends south from the Trans Mountain Pipeline in Canada to serve the four refineries at Anacortes and Cherry Point. During the last six months of 2016, the most recent period for which data are available, pipelines delivered 33.2 million barrels, an average of about 182,000 per day.

Prone to derailments, spills, and explosions, the Northwest oil-by-rail industry is not yet five years old. Yet the industry’s schemes for the future are ambitious. One gargantuan proposal remains: on the banks of the Columbia River in Vancouver, Tesoro aims to build a rail delivery facility capable of handling 360,000 barrels per day—twice as much as now moves on the rail to every destination in the state combined.

Notes and methods: Federal data refers to the US Energy Information Administration’s July 31, 2017 release. Sightline’s analysis counts data from weeks 14 to 26 of 2017; we exclude the partial-week (one day) data for week 13 that is included in the Ecology report. We converted Ecology’s weekly figures into barrels per day, consistent with industry standards. More of Sightline’s leading analysis of Northwest oil-by-rail can be found in our series The Northwest’s Pipeline on Rails and in our July 2015 report on the industry’s plans.

[list_signup_button button_text=”Like what you|apos;re reading? Get our latest fossil fuel research right to your inbox,” form_title=”Fighting Fossil Fuels” selected_lists='{“Fighting Fossil Fuels”:”Fighting Fossil Fuels”}’ align=”center”]

Comments are closed.