On Thursday the British Columbia Legislature will take a vote that portends nothing but bad news and headaches for the province’s floundering liquefied natural gas (LNG) industry.

With that vote, the BC Liberals—a party that wholeheartedly supported LNG development, going so far as to put LNG exports at the center of the party’s economic platform—will likely lose their grip on power for the first time since 2001. The new government will be led by the New Democratic Party (NDP) and supported by the Green Party, both of which take a far dimmer view of LNG projects. NDP leader John Horgan came out against the massive Pacific Northwest LNG project in early 2016, though his party tempered its opposition to LNG projects as the election approached. The Greens, however, oppose LNG development outright, and have called it “economic suicide” to build pipelines to serve LNG plants.

So while the new government’s precise position on LNG remains unknown, the Liberals’ full-throated support for the LNG industry almost certainly will be replaced with something ranging from caution to outright opposition—a change that led some financial analysts to predict “infinite deferral” or cancellation of the province’s LNG export proposals.

Yet the truth is that British Columbia’s LNG industry would have faced dire prospects even if the Liberals had managed to hold onto power. The real enemy of the province’s LNG industry hasn’t been politics but economics. And in today’s world of cheap oil and abundant gas, the economics of BC’s LNG proposals look increasingly grim.

The finances didn’t always look this bad. Just a few years ago, in fact, it appeared that the province stood on the brink of an LNG boom. No fewer than 22 different LNG proposals peppered the province’s coast, all designed to move fuel from the methane-rich Montney Basin in northeastern BC to energy-hungry Asian markets. The provincial government fueled the LNG hype by handing out permits—along with inexpensive power, tax breaks, and other subsidies—like cheap party favors, promising that it would deposit tax revenues from LNG projects in a “prosperity fund” that could reduce other taxes or eliminate the province’s debt.

That exuberance has all but evaporated. Only the smallest of the new liquefaction facilities slated for the province’s shores—the Woodfibre LNG project in Squamish, BC—appears to be moving forward. Progress on the remaining projects has ground to a virtual halt, with global energy investors staying on the sidelines. Project backers have completely pulled the plug on several proposals. Most recently, Malaysian energy giant Petronas announced that it had delayed its final decision on its controversial Pacific Northwest LNG project in Prince Rupert, despite speculation last fall that the project’s backers would make a decision this spring.

So what turned the LNG boom into LNG gloom? The simple answer is that a collapse in global prices has turned BC LNG exports from a financial cornucopia into money-losing duds.

As recently as 2013, Pacific Rim LNG prices stood at more than $15 per million BTUs. (LNG prices typically are measured in US dollars per million BTUs—shortened to “mmBTU”.) Those prices virtually guaranteed healthy profits for new LNG plants in the province.

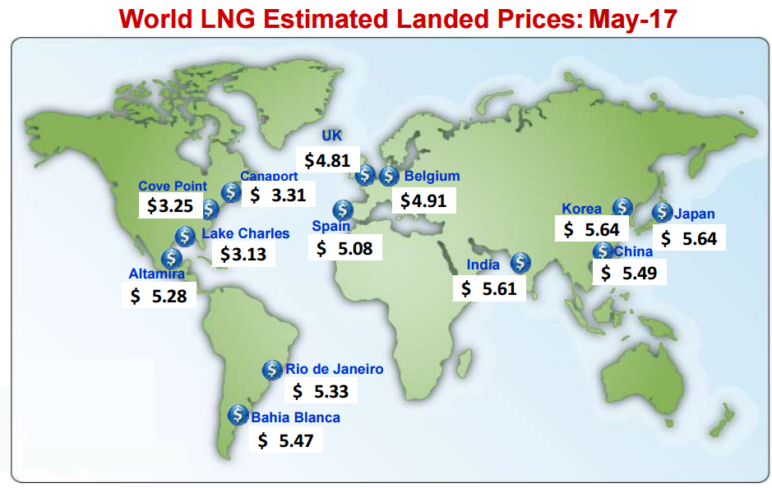

But prices collapsed throughout 2014 and 2015, and they remain depressed today: the US Federal Energy Regulatory Commission reported that LNG prices in Japan and Korea stood at just $5.64 per mmBTU in May.

At today’s prices, there’s simply no way for BC’s LNG projects to earn a profit. It takes too much money to extract the gas, move it by pipeline to the coast, liquefy it, and then ship it overseas—and still more money to pay the immense capital costs for pipelines and liquefaction plants.

At today’s prices, there’s simply no way for BC’s LNG projects to earn a profit. It takes too much money to extract the gas, move it by pipeline to the coast, liquefy it, and then ship it overseas—and still more money to pay the immense capital costs for pipelines and liquefaction plants.

Don’t just take my word for it. A slew of independent analysts have found that BC LNG projects need much higher prices than are found in today’s market:

- This 2015 report from the Oxford Institute for Energy Studies found that Canadian LNG projects would need Pacific Rim prices of $10.30 to $11.60 per mmBTU in order to break even.

- This Cedigaz report, also from 2015, estimated that BC’s LNG projects would break even when Asian prices hit $11.80 per mmBTUs, though it had a “low case” estimate of $8.60 and a high case of $16.10.

- This 2012 report from global infrastructure giant Macquarie estimated break-even prices of $8.60 to $10 (though LNG infrastructure costs have risen quickly since the report was published).

- This 2014 analysis by TD Economics found break-even prices between $10 and 12 for most BC LNG projects.

- This 2017 JWN Energy analysis suggests that Canadian LNG break-even costs could range from $12 to $16.

Two key factors drive up the cost of BC’s LNG projects. The first is pipeline costs. Although it’s relatively cheap to extract methane from the Montney Basin, transporting the fuel to BC’s coastline would require brand new pipelines requiring billions of dollars in upfront capital expenditures. Those costs drive up the prices that LNG plants would have to pay for their feedstock. Second is construction costs. LNG projects built on “greenfield” sites—i.e., previously undeveloped locales—cost far more to build than projects at industrialized “brownfield” sites. Worse, LNG plant construction costs have soared in recent years, particularly for large, complex projects located in remote areas, conditions that apply to virtually all of the province’s LNG proposals.

These high costs might not matter much if LNG prices were on the upswing. But many global analysts forecast that global LNG markets will remain oversupplied for years, keeping prices in check. The International Gas Union’s 2017 World LNG Report identified 340 million tons per year of LNG liquefaction capacity, with an additional 115 million tons scheduled for completion by 2020 and an astonishing 879 million tons of new capacity proposed worldwide—numbers that virtually guarantee a sustained glut in global LNG supplies.

Not even the massive tax and energy subsidies promised by BC’s outgoing Liberal government could brighten the gloom for LNG backers. As the International Gas Union pointed out in 2016, “The British Columbia government provided clarity on taxation in 2014 and 2015 via an LNG export-specific tax and royalty regime. Although important, these steps are unlikely to have a major impact on the overall pace of project development.” Apparently, even with subsidies, BC’s nascent LNG industry was submerged in red ink.

The combination of high costs and sustained low prices has led most analysts to conclude that BC’s LNG projects aren’t viable in today’s market—and may not be viable for nearly a decade, if not longer. The Oxford Institute for Energy Studies declared that “the window of opportunity to capture premium Asian markets has eluded” BC’s LNG projects. And some energy analysts believe that even if global LNG markets do rebound, the industry will boost supply by expanding existing plants rather than building brand new ones—suggesting that “the window of opportunity” may not just be closed temporarily, but boarded up.

Remember: the economic prospects for LNG projects in British Columbia tanked while a wildly supportive government held the reins of power in the province. Once a less supportive government takes office, global LNG investors may be even more inclined to steer clear of the province.

That said, nothing’s set in stone. Some NDP politicians vocally supported LNG development during the last election. It’s unlikely that the NDP will be as hard on LNG plans as the Greens would like them to be. And besides, most political observers think that the NDP government will prove unstable, with a new election likely within the next 18 months—soon enough that some early-stage LNG projects might decide to hunker down and weather the storm, rather than close up shop entirely.

Yet it’s clear that after Thursday’s vote, an industry that’s already been beaten down by the market will face new obstacles in the realm of politics. And at this point, virtually any additional roadblock—the removal of a key subsidy, new requirements for protecting sensitive sites, new demands to respect First Nations’ rights or alter pipeline routes—could be the death knell for an embattled industry.

Thanks to Deric Gruen and Tarika Powell for their invaluable assistance with this article.

Comments are closed.