This article is part of a series on Seattle’s proposed Mandatory Housing Affordability (MHA) program. In previous articles, I identified inconsistencies in the proposal and presented case studies (here, here, and here) on several housing prototypes, in all cases finding that MHA would suppress homebuilding and backfire on the city’s affordability goals to varying degrees. This time: MHA in downtown and South Lake Union, where the city got it right.

Seattle’s proposed Mandatory Housing Affordability (MHA) program has the potential to deliver two things Seattle residents need most: more new homes overall to address the city’s housing shortage and help keep prices in check for everyone, and more new subsidized homes for people without the means to afford what the market offers.

But if ever there was a policy where the devil is in the details, it’s MHA. Because if the affordability requirements are pushed too high, the added costs could make homebuilding projects financially infeasible. And when that happens, the city loses out on both subsidized and market housing, losses that hit the city’s most vulnerable the hardest. My previous analyses showed that, unfortunately, MHA as proposed for other areas of the city is likely to yield that lose-lose outcome.

This article analyzes the city’s proposal for MHA in the downtown and South Lake Union neighborhoods, finding that in these places, the city got the MHA balance right. If adopted as proposed, MHA will deliver on its promise to link growth and equity by creating the diversity of home options that Seattleites so desperately need.

Background: The two flavors of MHA upzone in downtown/SLU

Seattle policymakers have proposed two separate systems of MHA affordability requirements: one for downtown and South Lake Union (SLU), and one for everywhere else in the city. This article addresses the residential portion of MHA, for which the city projects a yield of 900 subsidized homes in downtown/SLU over the next ten years.

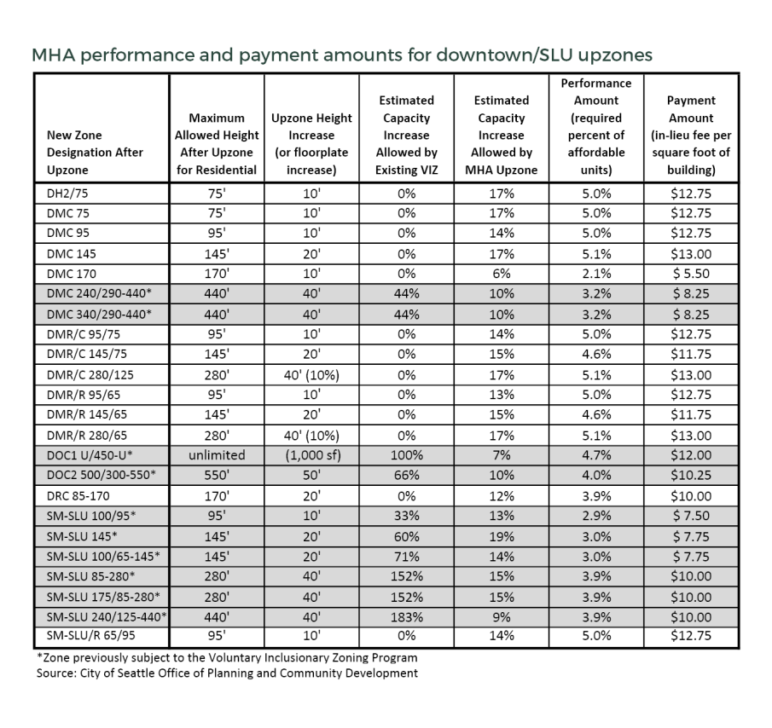

For each of the 23 zones in downtown/SLU, planners have set a specific inclusion rate and in-lieu fee based on the amount of extra capacity granted by the MHA upzone, though with some exceptions to that rule (see table in appendix). In contrast, they did not apply any standard formula to set the MHA requirements for the rest of the city.

For zones in downtown/SLU currently subject to the city’s existing Voluntary Incentive Zoning Program (VIZ), the MHA requirements were set according to the Grand Bargain agreement’s stipulation that the added capacity granted by the MHA upzones would be “charged at the existing incentive zoning rate.” In other words, the total in-lieu fee paid for MHA on a new building would be equivalent to the in-lieu fee that would have been paid for affordable housing with the same capacity increase under VIZ. The proposed MHA requirements cover the 60 percent of the VIZ fees that currently go towards affordable housing, but in addition, the developers would also have to pay the remaining 40 percent portion of VIZ that’s applied to transferred development rights (TDR) or amenities such as open space or daycare.

For zones not already subject to VIZ, planners calibrated the MHA requirements against a benchmark 5 percent inclusion rate for a 15 percent capacity increase. According to preliminary estimates provided by the city, existing capacity for residential development in downtown/SLU is split roughly half and half between zones with and without VIZ.

Pro forma results: The plan in action

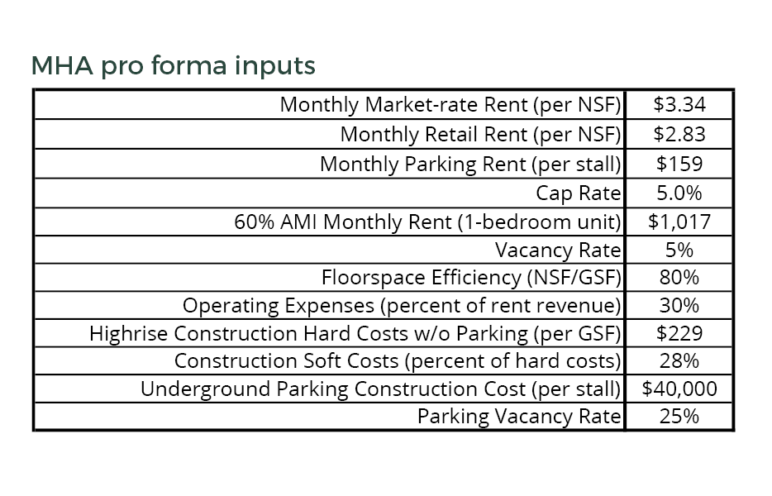

Following the before-and-after method I described previously, I applied static pro formas to estimate how the MHA upzone would change the homebuilder’s return on investment (ROI) compared to a baseline project under existing zoning that would deliver a 15 percent ROI. I assumed the rents, construction costs, cap rates, and other inputs used in the City of Seattle’s MHA feasibility study (see input table in appendix), although the city did not include analysis of downtown/SLU zones in its study.

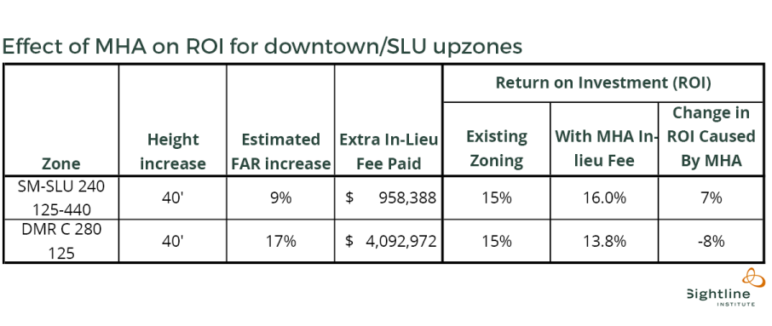

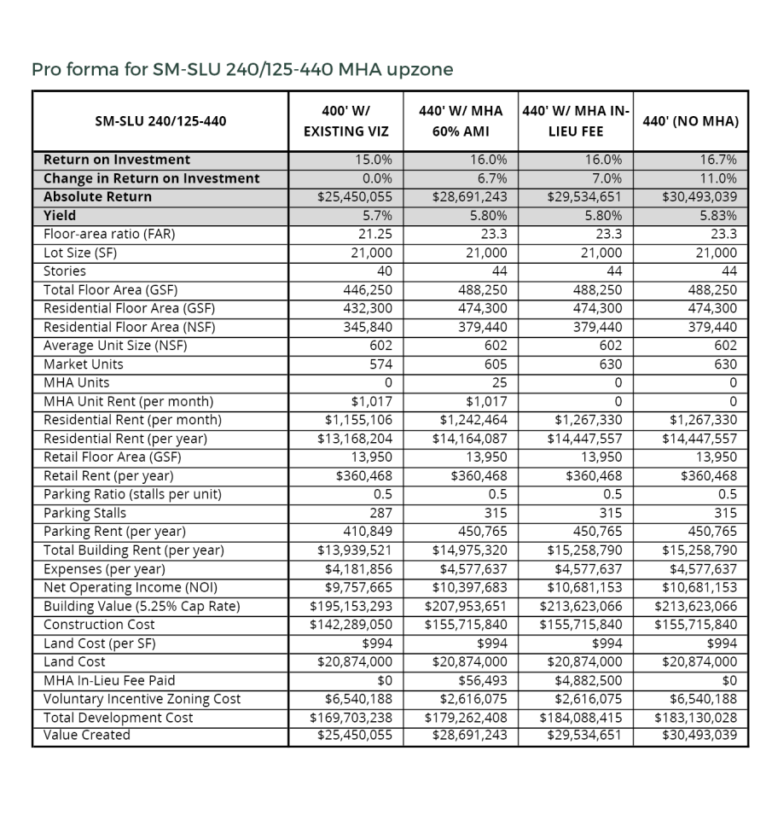

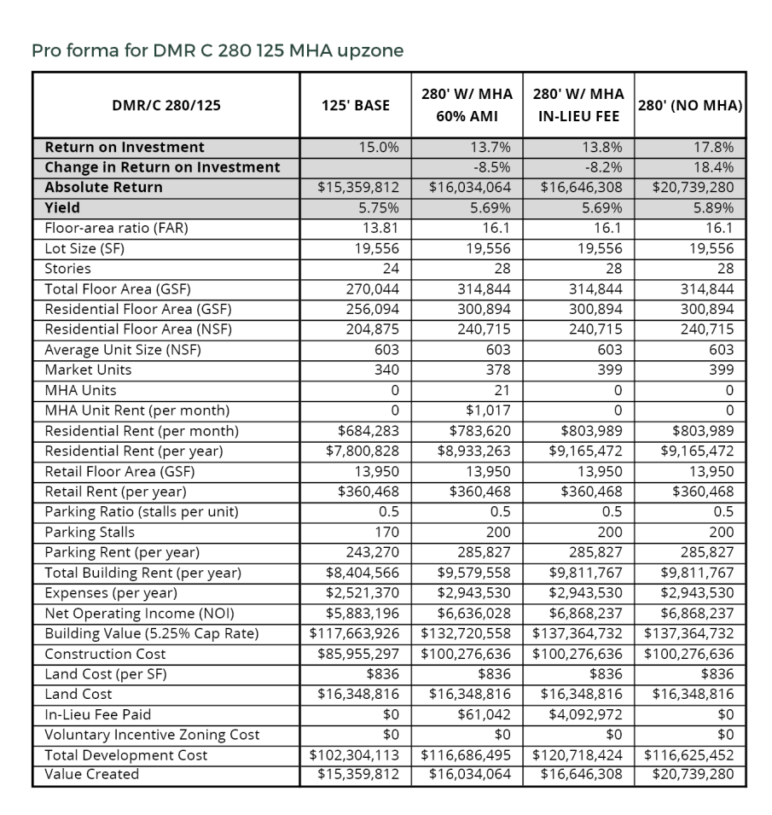

I ran pro formas on two prototypical buildings, one in the SM-SLU 240 125-440 zone, following the example recently presented by city planners, and the other in the DMR C 280 125 zone, which is not currently subject to VIZ. On request, city planners provided their capacity estimates for both prototypes. Results are summarized in the table below, which shows a 7 percent increase in ROI for the SLU building and an 8 percent decrease in ROI for the DMR building.

The SLU prototype demonstrates MHA done right: the value of the MHA upzone offsets the cost of the affordability requirement and therefore does not degrade ROI. For the DMR prototype, the value of the upzone is not quite enough to preserve ROI. The math is convoluted by the interplay of VIZ, but the simple reason for this difference is that the DMR project pays more for the added capacity granted by MHA.

Here’s the math: For the SLU prototype, I assumed the baseline building uses all of the capacity available under VIZ and so is 400 feet tall. At the current VIZ rate of $22.65, the required payment is $6.54 million. For the upzoned SLU building, the MHA in-lieu fee is $10 per square foot, which comes out to $4.88 million, and the 40 percent VIZ charge is $2.62 million, for a total payment of $7.5 million. Taking the difference, the developer pays an extra $958,000 for 42,000 square feet of MHA capacity. That converts to $22.82 per square foot—an almost exact match to the city’s existing VIZ fee, right in line with the Grand Bargain. In comparison, for the DMR prototype, the developer pays $4.09 million for 44,800 square feet, which converts to $91 per square foot.

Another way to think about this is in terms of the cost imposed by MHA per additional housing unit that the MHA upzone allows. Developers commonly assess these costs in comparison to how much they would have to pay per unit for raw land to build on. For the SLU prototype, the MHA charge is equivalent to $17,200 per unit, and for the DMR prototype, it’s $68,800 per unit. For comparison, in my pro formas, the cost of land per unit is $34,000 for the SLU prototype and $49,000 per unit for the DMR prototype. In other words, for the SLU prototype, MHA is cheaper than buying bare land, but for the DMR prototype, MHA costs more than land. These differences reflect the ROI results shown in the table above.

Why it works: A collaborative process, a balanced formula

The city applied a consistent formula to define the MHA requirements for all the zones in downtown/SLU that currently have VIZ. That means that for all of those zones MHA as proposed should be as well-balanced as my above analysis indicates for the SM-SLU 240 125-440 prototype. In short, the city nailed it: MHA will deliver more homes and more subsidized homes.

It’s no coincidence that these particular MHA numbers work so well. They were defined through negotiation and compromise between private development interests, non-profit housing providers, and city officials. Furthermore, the proposed MHA numbers for these zones err slightly on the pro-feasibility side of the value exchange equation, which, as I have argued previously, is a smart approach, given the swirling variability of real estate markets. In contrast, erring on the opposite side increases the risk of sacrificing both the affordable homes and the market-rate homes.

In short, the city nailed it: MHA will deliver more homes and more subsidized homes.

For downtown/SLU zones without VIZ, the city also applied a consistent formula, although it’s one that yields MHA requirements higher than those for zones with VIZ. Thus for all the zones without VIZ, MHA would tend to result in a loss of ROI similar to the 8% drop my analysis shows above. That these MHA numbers missed the mark for equal value exchange should not be surprising: planners did not conduct sufficient feasibility analysis before setting them. Fortunately, the ROI damage is not as severe as my analysis has shown for MHA as proposed for other parts of the city. For the DMR prototype pro forma, lowering the in-lieu fee from the proposed $13 per square foot to $9 per square foot would balance MHA.

A win-win for Seattle home-seekers

After so much MHA bad news in my previous MHA analyses (here, here, here, here), it’s encouraging to find that the city of Seattle’s proposal for MHA in downtown and South Lake Union gets it right. For roughly half of the new housing that could potentially be built in these areas, MHA as proposed would deliver the win-win outcome of more market-rate housing and more subsidized housing. For the remaining portion, MHA may cause a mild suppression of housing production, though the MHA balance is not far off and the damage done likely minimal.

In light of the technical complexities and political challenges, on my assessment the city’s MHA proposal for downtown/SLU does a superb job of creating a balanced program overall, and it should serve as a good model and precedent as policymakers refine the MHA proposal for the rest of the city.

[list_signup_button button_text=”Like what you|apos;re reading? Get our latest housing research right to your inbox.” form_title=”Housing Shortage Solutions” selected_lists='{“Housing Shortage Solutions”:”Housing Shortage Solutions”}’ align=”center”]

Appendix

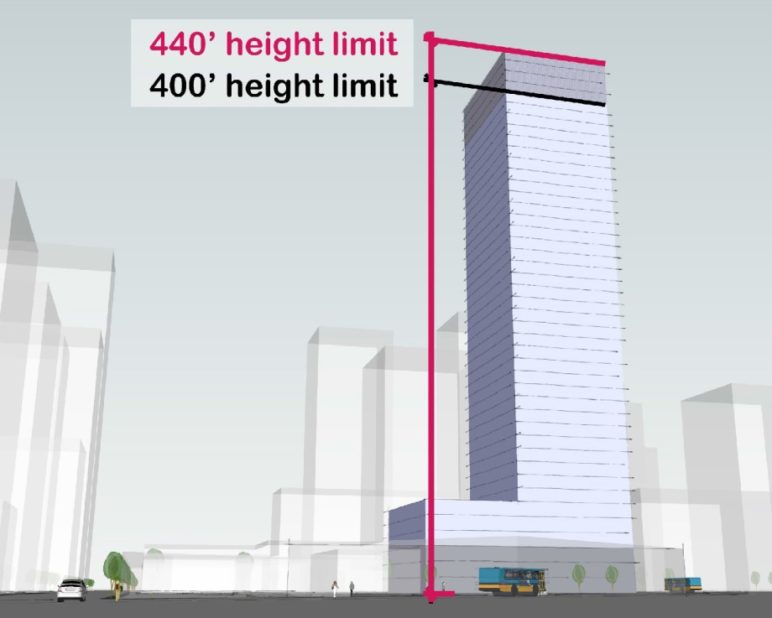

The proposed MHA requirements for 23 different upzones in downtown/SLU are listed in the table below (don’t get hung up on the cryptic zone designations—they’re just shown for reference). Most upzones come in the form of height increases, but a few allow for a boost in the allowed area per floor, or “floor plate” (illustrative examples are here).

Pro forma input assumptions were taken from the city’s MHA feasibility study and are summarized in the table below. Based on feedback on my previous MHA feasibility article that the construction costs were too low compared to current norms, I raised construction costs by 10 percent, corresponding to the upper limit the city’s study applies in its sensitivity testing. I also increased the per-stall cost of underground parking from $35,000 to $40,000.

Pro forma data are given in the two tables below. To maintain consistency between the before-and-after MHA prototypes, the present analysis assumes a consistent parking ratio. The number of required affordable units was based on an assumption that all of the increased development capacity granted by the upzone would go to residential use (the retail floor space remains constant on both buildings). Because the math never yields an exact integer number of required affordable units, the leftover fractional part of a unit was converted to an in-lieu fee, according the city’s method, documented here. The DMR pro forma does not include the potential added cost caused by the upzone crossing the 240’ height threshold that triggers requirements for structural peer review.

Comments are closed.