This article is part of a series on Seattle’s proposed Mandatory Housing Affordability (MHA) program. Previously, I identified inconsistencies in the proposal and presented case studies (here and here) on two key housing types. In both cases, MHA would suppress homebuilding and backfire on the city’s affordability goals. Next up: apartments in MHA’s low-rise upzones.

In Seattle urban planner-speak, “low-rise” means modest-scale multi-family housing such as townhouses, rowhouses, and small—3 or 4 story—apartment buildings. These homes fill the gap between single-family houses and large-scale apartments, providing much needed affordable home options in city neighborhoods near schools, transit, and jobs. They are often referred to as “missing middle” because in many US cities the predominance of single-family zoning has made them uncommon.

Seattle’s proposed Mandatory Housing Affordability (MHA) program would allow the developers of low-rise buildings to construct larger structures with more homes in them. And it would require that in exchange, they either provide a quota of subsidized affordable homes within the building or pay a fee to the city, with which Seattle would subsidize homes elsewhere. The theory of MHA is sound, but implementation is risky: if the mandate costs homebuilders more than the added apartments let them earn, they may choose not to build at all, yielding neither additional market-rate nor affordable housing choices. A policy intended to be a win-win becomes a lose-lose.

Indeed, my previous case studies of mid-rise and high-rise upzones found that MHA as proposed —and now implemented in the University District—is so poorly balanced that it would slash builders’ return on investment and suppress homebuilding. Disappointingly, it’s a similar story for the low-rise apartments I analyze here: the draft low-rise MHA policy is imbalanced and will slow construction and produce less housing—subsidized and market-rate—as a consequence. And less housing means more competition for what’s available, rising rents, and more displacement of low-income families and individuals.

MHA’s financial hit on low-rise homebuilding would be less severe than what my previous analysis indicated for mid-rise and high-rise examples. But most low-rise housing is built by small businesses that have less tolerance for added costs than the larger companies that build mid- and high-rise apartments. MHA as currently proposed would not only undermine Seattle’s goals to build more affordable homes for low-income residents, but also the city’s goals to create a full spectrum of housing choices for all.

The good news is that Seattle officials can fix it. The city could grant more capacity in the MHA upzone along with complementary changes to development rules to ensure builders can make use of that extra capacity. Or they could make the affordability requirements less demanding. Or they could combine those options. Either way, bringing MHA into balance will unlock its potential to deliver Seattle neighborhoods more subsidized homes and more market-rate missing middle housing.

Four-story apartment on 16th and Denny in Seattle, by Dan Bertolet, used with permission.

Assessing MHA’s net effect on affordability

In a previous article I described the rationale behind my method of assessing MHA. Here’s a synopsis for newcomers; skip ahead if you don’t need it:

- The root cause of Seattle’s soaring housing prices, leading to displacement, monster commutes, and community disruptions, is a shortage of housing; to keep prices down for everybody, we need more homes of all kinds. Building market-rate homes is good for affordability.

- Regulations that hold back the production of market-rate housing ultimately hurt the city’s lowest income individuals and families most through the housing market’s cruel version of musical chairs that results in fierce competition for what’s available in the city and leaves no homes for those with the least to pay for them.

- MHA’s net impact on affordability depends not only how many subsidized homes it creates but also on how it affects market-rate production. If, for every one subsidized home created, the policy also prevents the production of two market-rate homes, the outcome will be a net loss of affordability.

- The rate of private housing development is determined by risk versus return. When regulations make homebuilding more expensive or risky, less housing gets built.

- The hinderance on homebuilding caused by MHA’s cost is not nullified by reduced land prices because when owners get offered less for property that is producing income, they will be less likely to sell it, and if they don’t, no new housing gets built.

- Designing and assessing MHA requires a comparison of homebuilding feasibility under existing regulations versus under the proposed MHA requirements. Inexplicably, the City of Seattle has not conducted this type of before-and-after analysis of MHA and does not account for feasibility—that is, the market test—in its MHA production projections.

- Feasibility analysis is highly sensitive to assumptions about rent, construction cost, capitalization rates, and other factors. But before-and-after analysis is largely immune to the noise caused by imprecise assumptions: they largely cancel out to reveal the most critical result which is the change in feasibility caused by MHA.

- Feasibility does not operate like a light switch, contrary to what is presumed in the City’s MHA feasibility study and other similar analyses (here and here, for example). Just because the costs imposed by MHA don’t drop the return on investment (ROI) below some arbitrarily chosen cutoff doesn’t mean it’s not harming feasibility. Across the city, on average, feasibility is a game of probabilities: like any other building regulation, the more MHA drives ROI down, the less new housing becomes available to city residents

Case study: LR2 and LR3

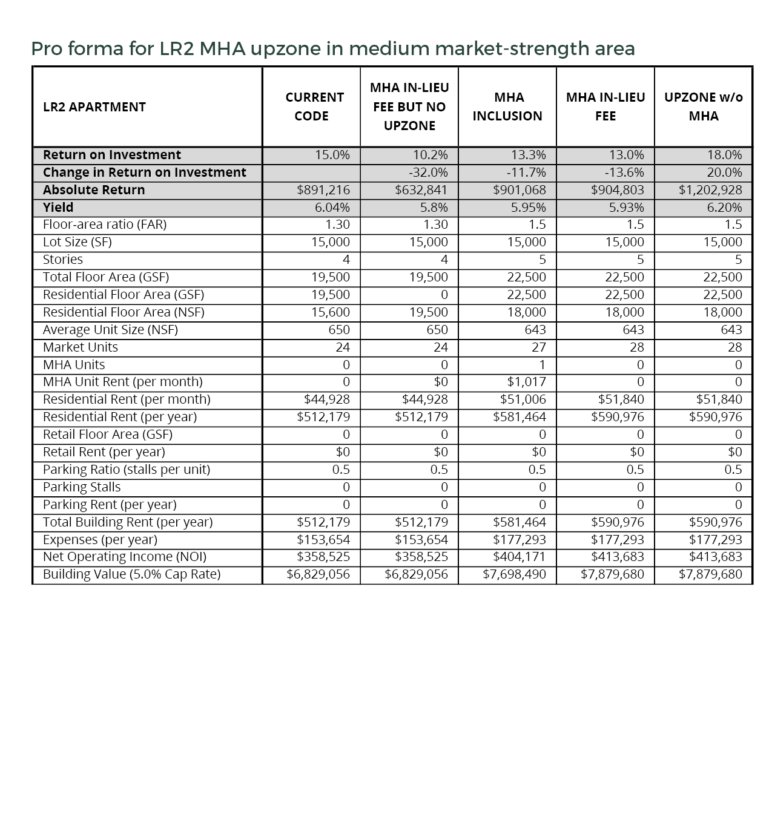

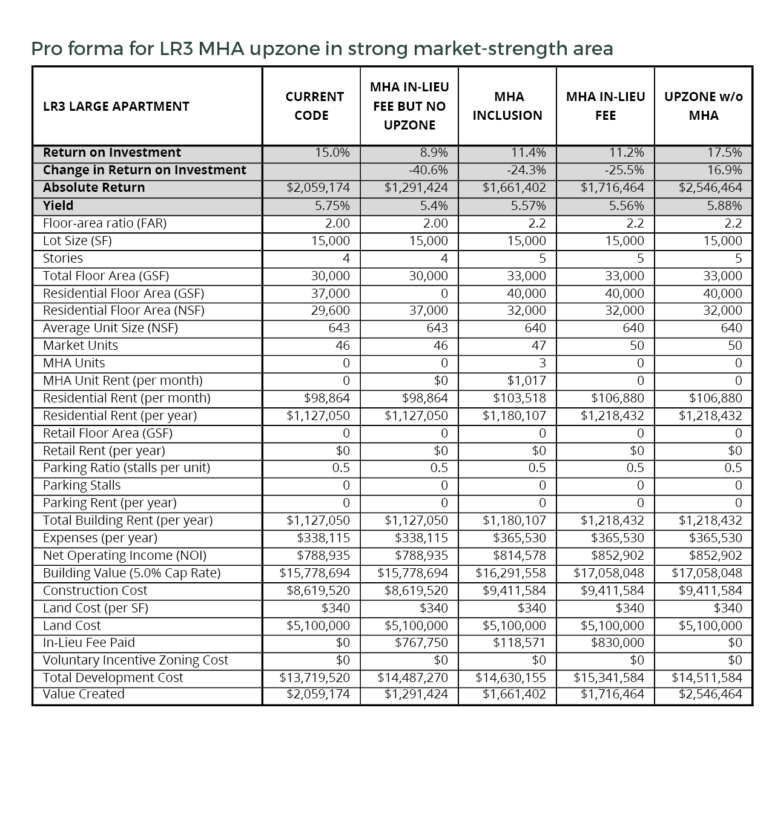

I assessed three small apartment building prototypes from the city’s own analyses to illustrate likely development under the proposed MHA low-rise upzones (details here, here, and here). Following the before-and-after method I described previously, I applied static pro formas to estimate how the MHA upzone would change the homebuilder’s return on investment (ROI) compared to a baseline project under existing zoning that would deliver a 15 percent ROI.

I focus on results under the assumptions for a medium market-strength area in Seattle because that is where these projects would most likely be built. (Results for low and high market-strength areas are qualitatively similar and are in the appendix). The proposed MHA performance (inclusion) and payment (in-lieu fee) amounts are 6 percent subsidized units or $13.25 per square foot of building, respectively. Because these prototypes have relatively small numbers of units, setting aside 6 percent of them will sometimes be mathematically impossible. Many developers will have no option but pay the fee, so this article highlights results for the in-lieu fee option. (Results for inclusion are similar and are in the appendix)

I chose three examples that cover a range of sizes and included examples in both the low-rise 2 (LR2) and low-rise 3 (LR3) zones to illustrate the effect of the increase in allowed floor-area-ratio (FAR) granted by the upzones. (For reference, a table of all the proposed MHA low-rise upzones is in the appendix.) For both the LR2 and LR3 upzones, planners have proposed a requirement for 12-foot upper-level setbacks on the top floor. Because this requirement introduces construction inefficiencies, I assume a 1 percent construction cost premium.

The table above shows the pro forma results. For the two LR3 prototypes, the MHA upzone knocks down ROI by one quarter. For the LR2 prototype, the ROI loss is 14 percent. The simple reason LR2 looks better: the LR2 upzone grants more capacity (more FAR), and that allows the developer to add a larger share of market-rate units, which offsets more of what the developer is required to pay in fees.

These ROI reductions for low-rise apartments are smaller than my previous analysis found for MHA’s proposed mid-rise and high-rise upzones. That’s mainly because for low-rise, enlarging a building to conform to the MHA upzone does not require a switch to more expensive construction. Builders simply add another floor of the same wood-frame construction.

I did not analyze the proposed MHA upzone for LR1, because it would typically involve a major change in building type. Instead of homes for sale, the upzone would likely result in apartments for rent—a change that greatly complicates the value comparison. To encourage small apartments, the proposed LR1 upzone removes the existing limit on numbers of apartments and exempts from FAR any apartments that are partially below grade, although it also adds a requirement for family-sized units. My preliminary estimates suggest that the proposed upzone’s generous FAR boost of 30 percent would likely balance the MHA mandates and fees. ROI would likely stay about the same, an MHA upzone done right. It might even improve ROI compared to existing zoning. But historically, production of new homes in LR1 zones has lagged behind production in LR2 and LR3 zones. So the LR2 and LR3 zones matter more to Seattle’s housing future.

Three-story condo building at 16th and Pike in Seattle, by Dan Bertolet, used with permission.

What’s at stake

The estimated reductions in ROI shown above for the LR2 and LR3 zones will result in less low-rise homebuilding under MHA as proposed, compared to homebuilding that would occur under existing zoning. Unfortunately, there is no easy way to quantify the new homes sacrificed. To give a better sense of what’s at stake citywide, from 2006 to 2016 low-rise comprised 19 percent of all homes built in Seattle. For comparison, Seattle’s neighborhood commercial (NC) zones—the zones where all the new four- and six-story mixed-use apartments are built—accounted for 21 percent.

As noted above, the estimated drops in ROI caused by MHA are not catastrophic, especially in the case of LR2. However, compared to larger-scale mid-rise and high-rise developments, low-rise homebuilding is more likely to be more susceptible to death by reduced returns. Because low-rise buildings are relatively modest in size and cost, they are most often developed by local, small-scale homebuilders who are more vulnerable to added expenses. Larger projects usually have the benefit of financial backing from deep-pocketed institutional investors who have access to lower cost capital and can accept lower returns if necessary. In contrast, small-scale local developers are typically faced with less favorable lending terms, and they may be literally risking everything they own on a project.

Implementing MHA without tuning it for feasibility is a recipe for failure—not just for HALA’s promises but for the very people that HALA promises to protect.

Consider the prospect of building the small LR3 apartment prototype. Today, by my pro forma estimates, investors would weigh the risk of a $3.2 million total investment against a potential return of $474,000. After MHA, they would weigh the risk of a larger $3.6 million investment against a smaller return of $422,000. In addition, the developer would have to write a check up front to the city for $146,000 before even receiving a permit to start construction.

Would the loss of incentive caused by MHA stop all low-rise apartment projects? No. But neither would it be harmless. The shrinking returns and rising costs would stifle projects. And every new home sacrificed matters, because one less home means one more low-income household pushed out of Seattle. Every time a homebuilding project that would have occurred under current zoning gets shelved because of MHA, the housing shortage gets worse and stiffened competition for the homes we have forces families without resources out. Implementing MHA without carefully tuning it for feasibility is a recipe for failure—not just for the goals of Seattle’s Housing Affordability and Livability Agenda (HALA), but for the very people that HALA promises to protect.

How to fix it

To balance the scales, Seattle can either increase the value of the upzones or reduce the affordability requirements.

Allowing a higher FAR—a larger building—is the most straightforward means. In particular, the proposed LR3 FAR boost of only 10 percent is low compared to almost all of the other proposed MHA upzones. For the larger LR3 prototype, raising the FAR boost to 25 percent would increase the estimated ROI to 13.7 percent, getting closer to the 15 percent ROI baseline. For the LR2 prototype, raising the FAR boost to 25 percent would increase ROI to 14.8 percent.

As shown in the FAR table in the appendix, the proposed MHA upzone for apartment buildings in LR3 zones not located inside a designated Urban Village or Station Area Overlay grants a 20 percent FAR boost. The feasibility of homebuilding projects in these specific areas would suffer less under MHA than the LR3 prototypes I analyzed, but this FAR discrepancy again illustrates the troubling inconsistencies in the MHA proposal.

For typical low-rise buildings, however, the floor space that can be built is often more constrained by other rules than by FAR. Seattle’s code, for example, currently requires larger side and rear setbacks for apartments than for townhouses and rowhouses. The code also erodes design efficiency by mandating a maximum “façade length,” that is, the uninterrupted length of a building’s exterior walls. Seattle’s HALA called out the need to revise these standards (recommendation MF.6):

In some of the low-rise multifamily zones, townhouse or rowhouse forms of development are favored by the code over stacked flats (apartments or condominiums located on different levels in a building). This can limit production of potentially greater numbers of housing units, or limit the housing product to ownership units instead of rental units. The City should change the code to allow more stacked flats in all low-rise zones.

Relaxing these requirements would help meet the intent of HALA and also reduce the MHA burden. It would let homebuilders actually use the upzone MHA grants them.

City of Seattle diagram of the LR3 small apartment prototype illustrating 12-foot setbacks on the 5th floor (shown in turquoise) as would be required under the proposed MHA upzone.

The MHA upzones for both LR2 and LR3 add a new requirement for 12-foot setbacks on the top floor (see diagram above). I assumed that these setbacks add a 1 percent premium to the building’s total construction cost, which may be an underestimate of the added cost. For the larger LR3 prototype, that’s an extra $93,000—about 6 percent of the ROI—out of the homebuilder’s pocket. For the larger LR3 prototype, increasing the FAR to 2.5 and eliminating the setback requirement would bring the ROI under MHA up to 14.6 percent. In practice, MHA’s setback requirement prioritizes some people’s opinions about how a building might look over other people’s need for a place to live.

On the other hand, Seattle’s low-rise zones were designed for relatively small-scale housing. If officials opt not to upsize the buildings further, they could instead balance MHA by reducing the affordability requirements. How much reduction would be needed? For the larger LR3 prototype, lowering the in-lieu fee from the proposed $13.25 to $3 achieves an ROI that matches the existing zoning baseline ROI of 15 percent. For the LR2 prototype, a reduction of the in-lieu fee to $8 would do the same.

Keeping the affordability promise

Done right, MHA can deliver affordability two ways: by helping Seattle neighborhoods add enough homes of all kinds to keep prices down overall and by leveraging new building to invest in subsidized homes across the city . Done wrong, it will hamper both. Discouragingly, the current draft low-rise MHA proposal is more likely to hamper than deliver. City leaders can avoid this damaging misstep by enlarging the proposed upzones, or dialing back the proposed mandates and fees, or a bit of both.

Unfortunately, a pattern is emerging among the MHA upzones I have so far analyzed: they all lean by varying degrees toward diminished homebuilding and the lose-lose outcome of fewer new affordable homes and fewer new market-rate homes. If the city hopes to implement an MHA program that doesn’t risk doing more harm than good for affordability overall, policymakers must do the math and bring MHA into balance.

Appendix

The table below shows the FAR limits for the four building types allowed in Seattle’s low-rise zones, under existing zoning and under the currently proposed MHA upzones. The change in FAR—the most fundamental determinant of the value of the upzone—varies substantially depending on both the zone and building type. Note that to encourage small apartments the proposed LR1 upzone removes the existing unit density limit and exempts partially below-grade units from FAR, although it also adds a requirement for family-sized units. The proposed LR1 upzone was not analyzed in this article because it would involve a major change in building type from a for-sale to a rental product, complicating the value comparison. Given the generous FAR boost of 30 percent, the proposed LR1 upzone would likely result in a preserved or even improved return on investment compared to existing zoning.

Pro forma input assumptions were taken from the city’s MHA feasibility study and are summarized in the tables below. For simplicity parking was not included in the prototypes. Including parking would not significantly alter the change in ROI before and after MHA, and in higher density areas of the city, projects such as these with zero parking are not uncommon. The assumption of a 1 percent cost premium for the loss of efficiency and added expense of the upper level setback is likely conservative. For a cost premium of 2 percent on the large LR3 prototype, the loss of ROI caused by MHA would increase from 25 percent to 30 percent.

Pro forma data are given in the tables below, including the three prototypes discussed in the article, along with results for the larger LR3 prototype in both low and high market-strength areas to illustrate qualitatively similar results. Note that the city’s larger LR3 prototype includes 7000 square feet of partially underground units that don’t count toward FAR but do count for calculating the MHA requirements.

Pro forma data are given in the tables below, including the three prototypes discussed in the article, along with results for the larger LR3 prototype in both low and high market-strength areas to illustrate qualitatively similar results. Note that the city’s larger LR3 prototype includes 7000 square feet of partially underground units that don’t count toward FAR but do count for calculating the MHA requirements.

Michael Ruby

The error in this analysis begins with the assumption that the root cause is with too little supply. It is important to remember that in any economic analysis you must focus on both the supply and the demand side of the equation. Equally important is the increase in demand driven by the City’s rezoning of commercial space to allow far greater office space to be built, which allows more employees to be packed into Seattle. Those who benefit from this increased opportunity are not paying for the adverse impacts the increased demand places on existing city residents. In economics this is called an “externality”. It is well accepted now that the solution to externality problems is for the person who benefits (such as the industrial firm that dumps water pollution without the expense of controls) to pay full cost for the privilege. That is not being done in Seattle. The firms that are hiring all the new workers and expecting the City to somehow provide their housing are not making commensurate payments for their impact on traffic, housing, education, etc. The impact fees allowed by state laws are inadequate to fully cover the costs but Seattle does not impose even those fees. Seattle does require traffic fixes on the immediately adjoining blocks but that is only a tiny part of the externality imposed by the new hires. MHA is an important idea, but it should not be seen as the entire way that we respond to these new demands on the city. As pointed out in this article the details are important. The causes of the increased demand should participate in righting the ship. We should not destroy the city in order to save it.

Bryan K

Rising home values are a positive externality, not a negative externality like pollution.

Imagine a smokestack that belches $50 bills rather than soot. Incumbent homeowners who live nearby benefit from being able to walk out their front door each morning and harvest free money.

Of course this would cause property values near the magic smokestack to go up.

Redistribution of this un-earned windfall from incumbent homeowners to others is how we should address equitable access to homes nearby.

Michael Ruby

Yes Bryan, you are correct that we need to consider positive as well as negative externalities. There are negative externalities that impact everyone, homeowners, renters and those just working in Seattle. As I noted, traffic congestion and increased difficulty with accessing a good education are of that type. You posit that this is more than matched by the increase in value for homeowners’ property. This Georgist analysis does have some merit but in this case it overstates the value to the community. First, it only applies to homeowners and not to the rest of society, in the case of Seattle more than half of those on the streets or with their children in the more crowded schools or parks are not homeowners. Second, it ascribes all the increase in property value to the recent manic growth that is causing the problems we increasingly face and need to be mitigated.

General price inflation has caused a substantial fraction of the increase in value. Much of the additional value increase can be ascribed to improvements to parks, schools, roads, libraries, etc. that have been paid for by years of property taxes, such as Forward Thrust, BEX levies for the schools, parks, library and transportation bonds and levies, etc. Yes, there is a portion of increased property value that is due to the recent hyperinflation but this is just as likely to disappear when the bubble bursts before the property owner can collect it. When growth is more measured, local government can keep up and adapt. When growth is manic everyone suffers from the externalities of growth.

Specifically with respect to the capital gains of growth, remember that most folks who sell their house in Seattle use the proceeds to purchase another overpriced house in a quieter part of the city. So they never really see the benefit of the gain. However they still need to pay the feds a capital gains tax, so they don’t even get to keep all the proceeds. And if their property is rezoned their property taxes go up. A recent study in Wallingford found that two almost identical houses in the same local area with only a difference between zoning as Single Family and Low Rise meant a nearly $1000 increase in annual property taxes (“highest and best use”). And consider the loss in social capital to the residents as new construction disrupts the neighborhood and long time neighbors move out. That alone may exceed any increase in asset value of their home.

As I said above, let’s not destroy the city in order to save it. I would argue that the negative externalities far outweigh the positive externality you are focused on.

Bryan K

I don’t think you have actually identified any negative externalities.

“Thing have changed in a way I don’t like” isn’t one.

If Amazon employees are sitting in the same traffic as everyone else, that is not a negative externality caused by tech workers, because tech workers are internalizing the costs right along with everyone else.

I am not sure what you mean by difficulty accessing a good education. If you mean “there are more kids,” that is not a “negative externality,” it just means there are more kids. Assuming every parent is participating in the same tax scheme to fund education, moving here with a kid or having a kid are the same thing (and not an extenrality).

Lisa

Wow, communistic anti-family rhetoric from more of the city’s finest.

Sarajane Siegfriedt

Seattle Public Schools has grown by about 1,000 students a year every year since 2010, creating a need for at least two new grade schools per year. The most recent 3-year school capital levy is devoted to the $ billion-plus maintenance backlog, so there are no plans for building an elementary school downtown or in the U District.

Based on the maxim that “growth pays for growth” the Growth Management Act of 1990 allows municipalities to charge developer impact fees (typically 5% charged at permitting) to pay for consurrent infrastructure limited to schools, parks, roads (not sidewalks or transit) and fire safety. Of the 80 municipalities that charge impact fees, schools are the most common use. Note: Bellevue has not experienced any lack of new housing, even with impact fees.

Counting replacing moldy, substandard portables, SPS is currently short 600 classrooms. The Mayor is pressuring SPS to make room for preschools in their buildings, yet he has done nothing to contribute to relieving the school capacity crisis. He could start by supporting impact fees to lower Seattle class sizes and put new schools where we are experiencing growth.

Sarajane Siegfriedt

Seattle Public Schools has grown by about 1,000 students a year every year since 2010, creating a need for at least two new grade schools per year. The most recent 3-year school capital levy is devoted to the $ billion-plus maintenance backlog, so there are no plans for building an elementary school downtown or in the U District.

Based on the maxim that “growth pays for growth” the Growth Management Act of 1990 allows municipalities to charge developer impact fees (typically 5% charged at permitting) to pay for concurrent infrastructure limited to schools, parks, roads (not sidewalks or transit) and fire safety. Of the 80 municipalities that charge impact fees, schools are the most common use. Note: Bellevue has not experienced any lack of new housing, even with impact fees.

Counting replacing moldy, substandard portables, SPS is currently short 600 classrooms. The Mayor is pressuring SPS to make room for preschools in their buildings, yet he has done nothing to contribute to relieving the school capacity crisis. He could start by supporting impact fees to lower Seattle class sizes and put new schools where we are experiencing growth.

Lisa

Seattle had forgotten all of its families in favor of a populace made up of 25 year old, car-less workers for the corporate elite. Those of us who pay your exorbitant taxes while the city rots in a cesspool of homeless excrement are counting the days until we can hightail it out of here, leaving our high property purchases for more foreign investors who care nothing for the way this ends. Good luck to all of you absolute dolts forsaking what really once was a pretty cool place. You’ll whine all about it becoming an inevitable ugly concrete jungle, blaming others while never once looking at your own ideologies. When you become old enough to change your minds (it’ll come), it’ll all be too late.

Deb

Developers have plenty of other areas of Seattle to build in too. Let’s see what happens in terms of development in these urban villages before we opt to give the massive incentives for builders. I fail to see how the current fee levels will be crippling to development.

Matt Bedsole

I have a hard time taking this analysis seriously when it holds land costs constant throughout the different affordability/IZ scenarios. IZ regulations which depress the revenue generating potential of a property will see land costs for a project fall as well. Economic theory and observed conditions bear this out. In this way, IZ units are subsidized by land owners at the time of property transaction, which is when windfalls from conversion to a higher use occurs. It essentially works as an implicit tax on windfalls. Upzoning allows for a conversion to a higher use but it isn’t the only case where windfalls occur. For instance, if the existing zoning already allows for a conversion to a higher use, increased rent potential of an improved market could also have the same effect. This is why IZ works best in cities with high land costs.

Dan Bertolet

Matt-

I am aware that IZ depresses land values. You can do the analysis as I did, or you can do it by holding ROI constant and looking at how residual land value changes, as the city of Seattle (and San Francisco and others) did in their analysis. When land values drop, it reduces the likelihood that an owner will sell, thereby impeding the production of housing. With either method, the answer you get is effectively the same. We discussed this in detail in a previous article:

http://www.sightline.org/2016/11/29/inclusionary-zoning-the-most-promising-or-counter-productive-of-all-housing-policies/