Last time, I broadly assessed the math behind Seattle’s proposed Mandatory Housing Affordability (MHA) program and found it flawed but repairable. This time, I take a closer look at the thing I said Seattle policymakers most need to do if MHA is going to deliver on its promise—a promise to build more homes for everyone and more affordable homes for low-income residents, a promise to become a new North American model of blending housing choice with equity. Here, I analyze whether the current draft MHA proposal will impede housing development or not.

Specifically, I do a simple “feasibility analysis.” That is, I estimate whether construction of homes will turn enough of a profit to justify the risk investors and builders take—I see if projects “pencil.”

The essential notion of MHA is that it compensates builders for constructing reduced-price homes for low-income families by giving them something in exchange: allowing them to build larger buildings. Done right, MHA will never stop housing construction projects from proceeding that would have penciled without MHA. Instead, it will turn every currently feasible planned building into a bigger building with affordable apartments in it.

The flawed MHA math the city is currently proposing may be worse than doing nothing at all.

So the test of MHA’s effects on feasibility is “do housing projects that are currently profitable remain roughly as profitable, neither markedly more nor less, after MHA?” It’s a before-and-after test. Unfortunately, the City of Seattle has yet to do any analysis of this question, though the feasibility study it commissioned does provide much of the data needed to conduct such a check.

For this article, I studied two zoning categories, and what I found is troubling. In one of the city’s most common types of apartment construction in one of its critical zones for moderately priced apartments, the current MHA draft would impose a loss of return on investment big enough to render a substantial share of projects infeasible. It would suppress construction of a key source of new housing in urban villages across the city.

As I’ve laid out in detail elsewhere, problems with the current MHA draft are not unique to these two zones. Unfortunately, this new analysis compounds the implication of the previous one: unless MHA is corrected, the hindrance it imposes on homebuilding will not only worsen Seattle’s housing shortage and accelerate rising rents throughout the city but may also fail to achieve the city’s goals for subsidized affordable homes. That is, the flawed MHA math the city is currently proposing may be worse than doing nothing at all. Conversely, by correcting the current MHA draft in ways I discuss below, Seattle can have more housing choice, lower rents, and more apartments affordable to low-income families.

How feasibility is assessed

The routine method that developers and investors use for feasibility analysis is a spreadsheet called a “pro forma.” To do the math, the main things you need to know are:

- the expected rent (or sale price),

- the expenses of operating the building,

- the costs of land and construction, and

- the interest rates on the loans that fund the project.

Pro formas provide two fundamental feasibility measures: yield and return. I’ll focus on return here, which rarely leads to different conclusions than yield, and document the parallel results for yield in the appendix.

Return is the difference between the price for which a completed building could be sold and the total cost of developing it. The more value created, the more attractive the investment. As a rough guideline, the bare minimum return for feasibility is 10 percent (here and here, for example). Given all the risk and uncertainty, however, most developers and the banks funding them need to see the potential for returns greater than 10 percent to get interested—closer to 15 or 20 percent is a more realistic target.

Evaluating MHA’s impact on feasibility

The vital question for assessing MHA is this: would the policy make housing development more or less feasible than the status quo? More pointedly, compared to doing nothing, would the implementation of MHA slow or speed construction of the new homes desperately needed in Seattle’s current housing shortage?

Answering these questions necessitates a feasibility analysis that does a before-and-after comparison—“before” meaning under current zoning and “after” meaning subject to the new rules of MHA, including the upzone and the affordability mandate. Seattle city planners recently released a feasibility study of MHA, but it does not assess existing zoning and therefore provides no insight on how MHA would alter the feasibility of various types of homebuilding projects.

The city’s report calls out the wide variability of market factors and the uncertainty that injects into feasibility projections. Fortuitously, a before-and-after comparison reduces potential inaccuracies arising from imprecise pro forma assumptions, because the same variables apply to both scenarios. The crucial result is the difference in return on investment.

Pro formas for two MHA upzones

I developed a simple, static pro forma model to compare feasibility before and after the implementation of MHA. In practice, developers usually apply a more complex pro forma, but again, because for MHA the important result is the before-and-after difference in return, a simple pro forma is sufficient here. For input assumptions and development prototypes, I used the city’s MHA feasibility study and Urban Design study. Zoning regulations, building prototype metrics and assumptions, pro forma model inputs, and raw data are provided in the appendix below.

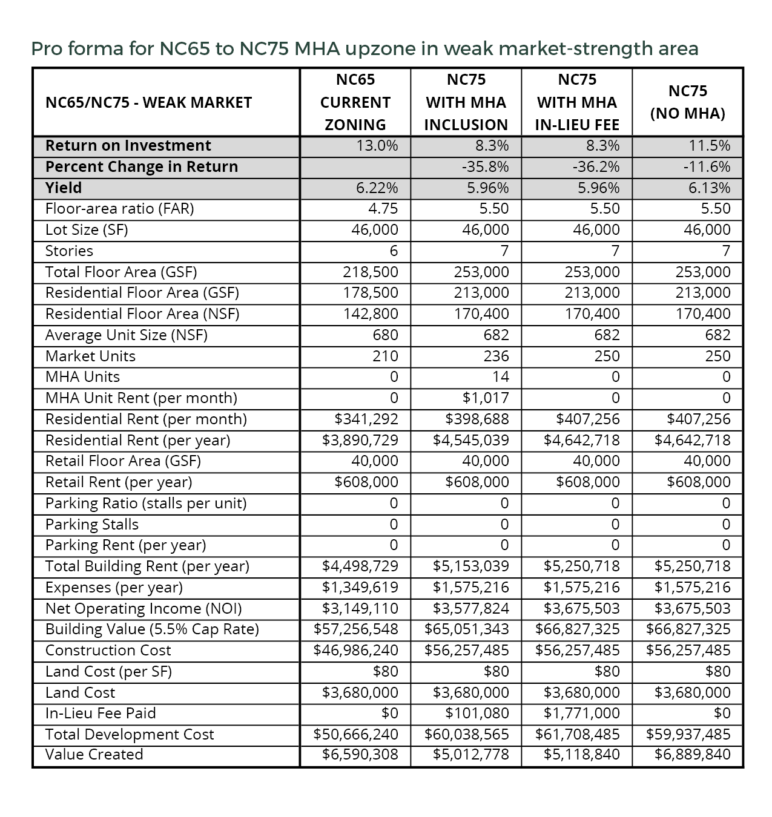

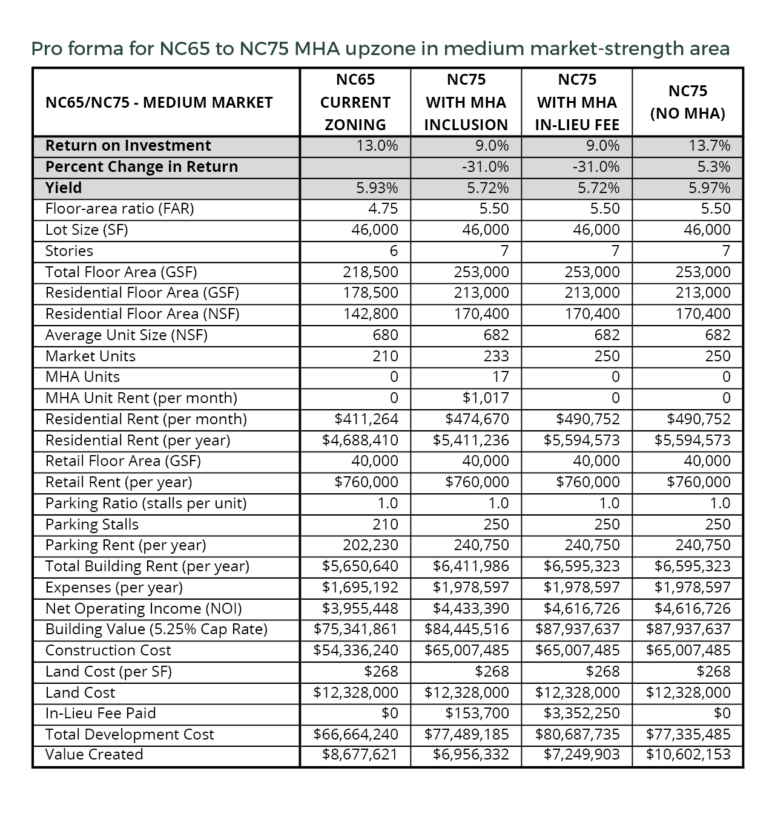

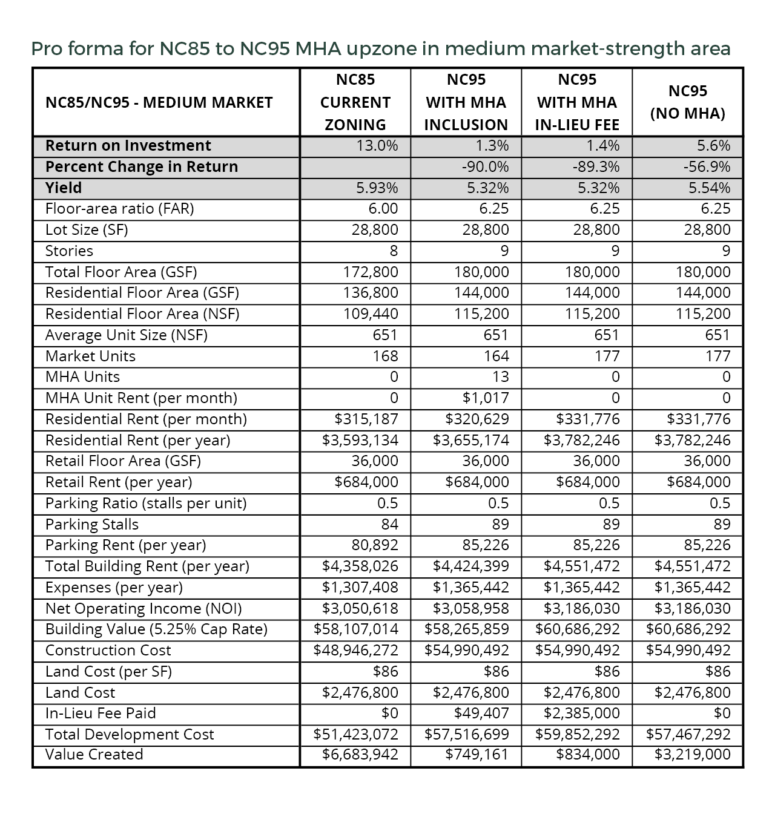

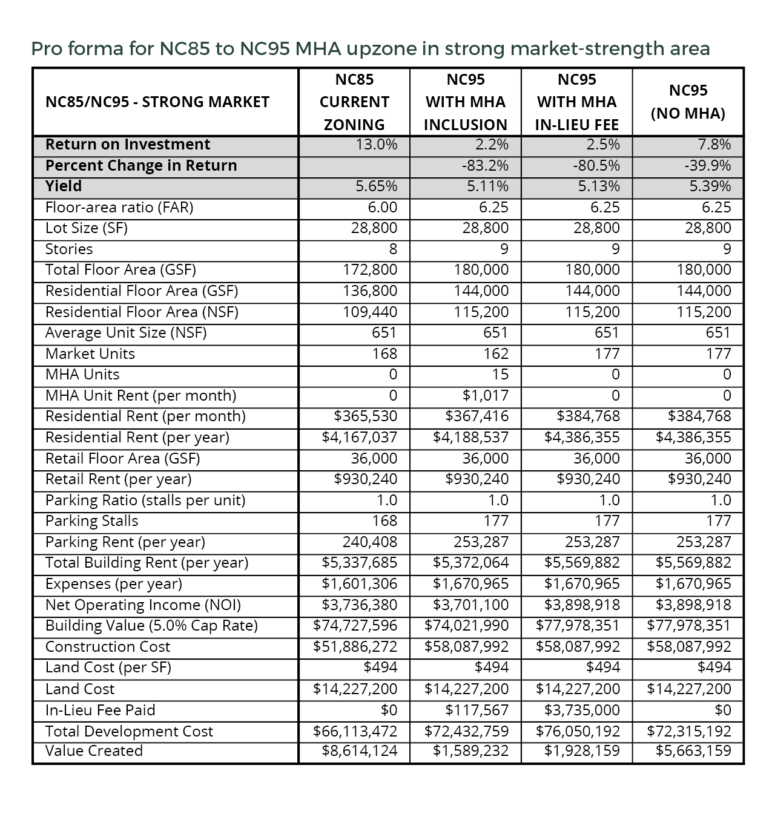

I selected two of the city’s proposed MHA upzones to illustrate the effect of value exchange on feasibility: NC65 to NC75, and NC85 to NC95. (“NC” stands for “neighborhood commercial” and the number indicates the maximum allowed building height in feet.) As I described previously, Seattle’s MHA proposal establishes a tiered set of affordability requirements based on three market-strength areas corresponding to the typical rents found in different neighborhoods. Based on what is typically built in Seattle, I analyzed the NC75 upzone in low and medium market-strength areas and the NC95 upzone in medium and high market-strength areas. For each upzone, I assumed land prices that provide a return of 13 percent on a mixed-use apartment building conforming to existing zoning. These land prices fall in the range of existing land prices in Seattle, according to the survey in the city’s feasibility study. I then applied the same land price, parking ratio, and other inputs to a building conforming to the MHA upzone.

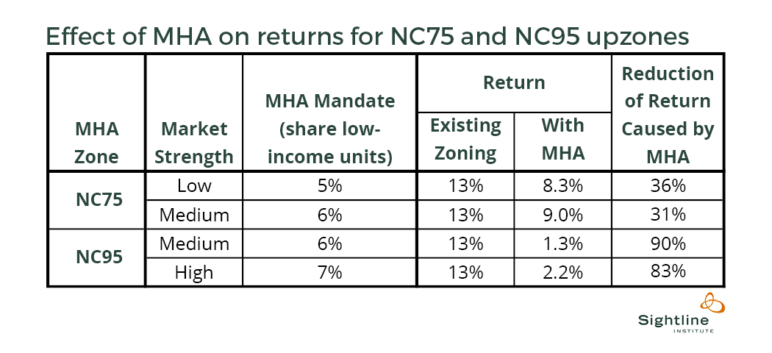

The pro forma results are summarized in the table below, which shows the estimated return on investment without and with MHA. The upshot: MHA undermines feasibility for NC75 and obliterates it for NC95. (Full pro forma tables are in the appendix, including returns under the in-lieu fee option, which are similar to the results shown here.)

The NC75 upzone

Compared with the existing NC65 zone, under the MHA NC75 upzone, returns are 36 and 31 percent lower in the low and medium market-strength areas respectively. Clearly, MHA does not provide an equal value exchange: the cost of including the below-market-rate units exceeds the value of the upzone, causing a hefty drop in the return on investment.

In addition to the added expense of providing the affordable units, higher construction costs also cut deeply into the value of the NC75 upzone. Going from six to seven stories entails adding a second story constructed of concrete to the base of the building, and concrete is 25 percent more expensive than wood.

The proposed NC75 upzone also adds a new requirement for 10-foot setbacks on the top two floors. Setbacks drive up construction costs for reasons including offsets in vertical circulation, breaks in plumbing and mechanical stacking, and expensive load-bearing transfer beams. Builders estimate that such setbacks introduce a 1 to 2 percent cost premium to the entire building. I applied the more conservative 1 percent. With the extra concrete floor and setbacks, on a per-square-foot basis (not including parking), under MHA, the seven-story building costs an estimated 3.4 percent more than the six-story building.

Seattle policymakers have two options for bringing the NC75 upzone into balance: raise the value of the upzone or reduce the affordability requirements. To maintain the baseline 13 percent return on investment for the NC75 building in a medium market-strength area, the city could make the following three changes:

- increase useable floor-area-ratio (FAR) from 5.5 to 6.0,

- remove the upper-level setback requirement to reduce construction cost, and

- lower the required affordable unit percentage from 6 percent to 4 percent.

The first two fixes are straightforward with minimal drawbacks, but the third—reducing the mandate from 6 to 4 percent—might at first appear to result in fewer affordable homes built. Paradoxically, though, if one-third of projects were rendered altogether infeasible by the 6 percent mandate and so weren’t built, the city would end up with the same number of new affordable homes under a 4 percent mandate that didn’t harm feasibility. Plus, crucially, it would also get 50 percent more market-rate homes, which would relieve rent inflation pressure overall. In this scenario, a lower mandate actually delivers a better outcome for affordability.

Even more pressing than correcting the flawed math in the citywide MHA draft for NC75 is fixing it in the currently proposed counterpart upzone in the University District, which is there called SM-U 75, and which the Seattle City Council plans to vote on in February. Adopting this upzone without first correcting this flaw would not only suppress housing choices and therefore raise rents in that neighborhood but also set a precedent for counterproductive policy in NC75 zones throughout the city.

Lastly, the NC75 pro forma results also indicate that MHA imposes a greater encumbrance—a bigger hit on returns—on housing construction feasibility in low market-strength areas than in medium market-strength areas, corroborating the findings of the city’s feasibility study. This inequity could be corrected by reducing the affordability mandates in low market-strength areas. Otherwise, MHA will disproportionately discourage homebuilding in lower-rent areas of Seattle such as the Rainier Valley.

The NC95 upzone

For the NC95 upzone, returns under MHA drop to nearly zero in both market-strength areas. The combination of the affordability mandates and an 8 percent bump in costs for high-rise construction eats up almost all of the return on investment. Under MHA as currently proposed, 95-foot-tall apartment buildings will never happen.

If any new homes are built in the NC95 zone, they will likely come in two forms. Some will be 85-foot apartment buildings constructed of five stories of wood-frame on top of three-story concrete bases, and others will be a cheaper alternative: 70-foot buildings constructed of five stories of wood over two stories of concrete. In either scenario, compared with existing zoning, MHA would knock down return on investment by 40 percent or more. In practice, MHA’s proposed NC95 upzone provides so little value that it is likely illegal under the State of Washington statute that authorizes affordable housing mandates only if “incentives” are also granted by the jurisdiction.

As with the NC75 upzone, removing the setback requirement would help add value to the NC95 upzone. But since it is so far in the red, it would also need a lot more of both FAR and height to pencil. For reference, the original HALA plan recommended increasing the allowed height to 12 stories. If such heights are unacceptable politically, the NC95 upzone would be better removed from the MHA program entirely.

The impact on homebuilding

What happens when a city enacts a land use policy that inflicts 30 percent or greater losses of return on investment in homebuilding? That city gets fewer new homes.

These cuts in return on investment are not trivial. If you were deciding where to invest your retirement nest egg and the city imposed a new policy that slashed the return on investment for one of the options you were considering by say, a third, you would likely put your money somewhere else. Same goes for investors in housing development.

How many new homes would be lost? The governing rule is simple: the lower the potential return on investment, the less likely a homebuilding project is to happen. For most typical feasible planned projects, an unforeseen change that imposes a 30 to 40 percent hit on return is usually a dealbreaker. And as I spelled out in a previous article, it does little good if developers try to compensate by bidding less for land: in most cases, that, too, holds back homebuilding. (The city’s MHA feasibility study is based on the same principle: MHA upzones are categorized as infeasible if they push residual land value below market prices.)

NC65 is one of the most prevalent zones in Seattle’s Urban Villages, and the six-story apartments that are typically built there are the city’s bread-and-butter form of new high-density housing. According to Dupre + Scott Apartment Advisors, Seattle currently has some 4,300 apartments in 44 buildings in NC65 zones that are either proposed or under construction. Over the past 20 years, these six-story buildings have yielded almost one-quarter of all the new multi-family homes built outside of downtown and South Lake Union.

Diminished return on investment under the proposed NC75 upzone jeopardizes the production of thousands of new homes over the next ten years. Historically, Seattle’s NC85 zones have yielded only about one-seventh the housing units of NC65 zones, but here still, the current MHA draft could eliminate many hundreds of new homes.

What it means for affordability

The city’s failure to conduct before-and-after feasibility analysis on MHA implies that city policymakers do not appreciate the negative impacts on affordability caused by the suppression of market-rate homebuilding. Would MHA extinguish all housing development? No. But even a single project killed—to say nothing of the many of projects MHA appears likely to doom—makes a big difference.

A hot housing market is like a giant game of musical chairs, with players joining faster than new chairs can be added. In the housing version of the game, instead of the slowest players landing on the floor, it’s the people with the emptiest bank accounts that always lose. Those with fatter wallets can secure a spot on a chair by offering more money for it. As soon as someone sets out a newly built chair, though, no matter how luxurious it may be, once it’s taken, there will be one more open chair to keep a family or individual with lower income off the floor.

Killing off just one 250-unit housing project negates about half of the MHA annual production goal of 400 subsidized homes.

The prototype I analyzed for NC75 has 250 apartment homes. Factoring in the existing housing that could be lost to demolition to make way for the new building, if MHA renders just one project like that infeasible, that’s a net loss of at least 225 new homes. And through the musical chairs competition that cascades all the way down to the bottom of the housing market, the inevitable end result is some 225 families at the low-end of the income spectrum who are left without housing options in Seattle. Because the housing market is a fluid, interconnected system, as long as demand is outstripping supply, homes sacrificed anywhere in the market transmute to a loss—through accelerated rent increases—of the city’s cheapest, non-subsidized homes.

To put it in perspective with the proposed MHA program, killing off just one 250-unit housing project negates about half of the MHA annual production goal of 400 subsidized homes. Now multiply that loss by the potential elimination of many, perhaps even most NC75 and NC95 homebuilding projects across the whole city and you can see why the draft MHA may be worse than doing nothing. It could not only fail to produce many new subsidized apartments, it might make the city’s musical chairs even crueler, eliminating so many new homes that hundreds of existing cheap ones at the bottom get snapped up by middle-class tenants.

Too important for guesswork

Seattle’s proposed Mandatory Housing Affordability (MHA) program is a quintessential instance of “the devil’s in the details.” MHA has great potential to unite growth and equity. But if the city gets the details wrong, it could do more harm than good. The problem is, city policymakers have not yet done the necessary homework of a comprehensive before-and-after analysis, and so they can’t know if they’re getting the MHA details wrong or right.

My previous analysis raised multiple red flags that the MHA draft could indeed backfire by imposing a burden on homebuilding that works against the city’s goals for both subsidized affordable homes and market-rate homes. In the current article, pro forma analysis of two case studies verifies that my red flags about MHA were warranted.

Compared to the city’s existing NC65 zoning, the proposed MHA upzone to NC75 yields a roughly one-third lower return on investment in a typical apartment building. That loss of profitability would render infeasible a substantial share of homebuilding projects in a zone that has historically been one of the biggest sources of new multi-family housing in the city.

For the proposed upzone from NC85 to NC95, MHA would actually obliterate almost all of the return on investment, such that the upzone would never be utilized in practice. The production of new homes would take a big hit because anything built in the NC95 zone would bear the full cost of the affordability mandate while gaining little to nothing from the upzone.

The city cannot hope to get MHA right without conducting thorough, before-and-after feasibility analyses and following them with fixes where necessary. The stakes are too high to play a guessing game.

Next time: The current draft MHA proposal for the city’s low-rise and high-rise multi-family zones appears as worrisome for affordable and market-rate homebuilding as do the NC75 and NC95 upzones. I’ll examine these zones in my next two articles.

[list_signup_button button_text=”Want more? Get our latest housing research right to your inbox.” form_title=”Housing Shortage Solutions Newsletter” selected_lists='{“Housing Shortage Solutions”:”Housing Shortage Solutions”}’ align=”center”]

Appendix

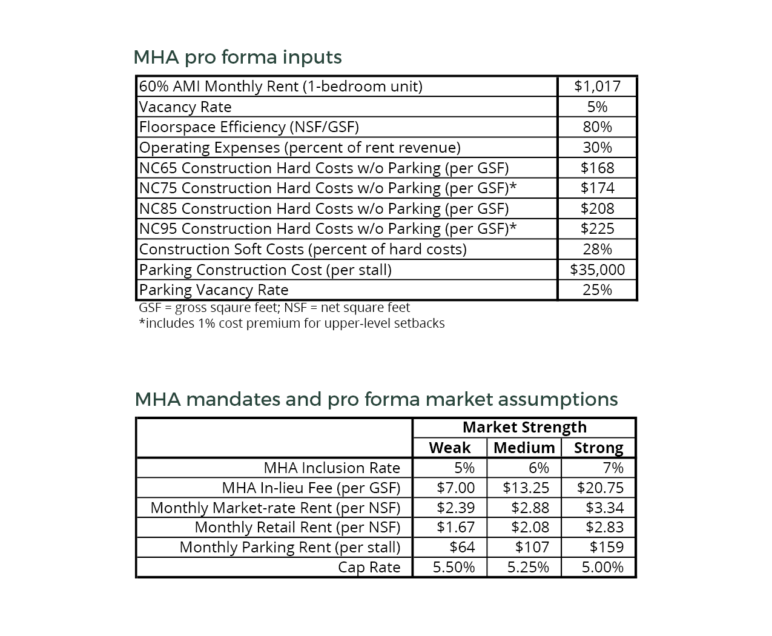

Pro forma input assumptions were taken from the city’s MHA feasibility study and are summarized in the two tables below. The capitalization rate, or cap rate for short, is the ratio of the building’s net operating income (NOI) to its sale price. NOI is the building’s total rent revenue minus the total operating expenses. Return on investment is extremely sensitive to the cap rate. Cap rates vary depending on local conditions as well as national financial trends such as the Federal Reserve discount rate, and typically fall between five and six percent—perhaps less than five percent in unusually hot real estate markets.

Pro forma data for each of the four case studies are given in the tables below. Parameters defining the individual building prototypes were taken from the city’s MHA feasibility study and from the city’s MHA Urban Design study. To maintain consistency between the before and after MHA prototypes, the present analysis assumes a consistent parking ratio, as opposed to the single full floor of underground parking assumed in the city’s analysis.

The number of required affordable units was based on an assumption that all of the increased development capacity granted by the upzone goes to residential use (the retail floor space remains constant). Because the math never yields an exact integer number of required affordable units, the leftover fractional part of a unit was converted to in-lieu fee according the city’s method, documented here.

In addition to the option to include affordable units discussed in the main text, the pro forma tables below also show results for the in-lieu fee payment option, and for comparison, the MHA upzone without the affordability mandate. In all cases, the in-lieu fee option had an impact on returns almost identical to that imposed by the inclusion option. This indicates that the inclusion and payment mandates are well matched, at least in raw monetary value. In practice, however, there are less tangible factors that would likely favor the in-lieu fee option.

Even without the affordability mandate, the MHA upzone doesn’t necessarily add value—see for example NC75 in a weak market, where returns are 12 percent lower than in the NC65 existing zoning case. This drop is caused by the higher per-square-foot cost of a seven-story building, and illustrates the importance of considering construction cost changes when assessing the value of an upzone.

In addition to return on investment, the pro forma tables below also show yield, which is the building’s NOI divided by the total cost of developing it. A rule of thumb target for yield is 6 percent. A drop in yield of just one or two tenths of a percentage point can flip a project from “go” to “no-go.” The yield results are qualitatively similar to the return results. For example, for the NC75 upzone in a medium market-strength area, compared to existing NC65 zoning, the yield is two tenths of a percentage point lower.

Comments are closed.