In Seattle and other fast-growing cities across Cascadia and beyond, bitter stories of people priced out of their homes and of affordable buildings torn down for new construction are all too familiar. The sense of injustice we feel about these stories is well justified. Sightline recently assembled focus groups—random samples of long-time Seattle residents—to talk about the housing crunch, and strong feelings about housing costs ran to a fever pitch on the issue of displacement. To see friends and neighbors forced to relocate from their homes and communities stirs everyone’s hearts to indignation.

But the causes and solutions? Our focus groups, like many Northwesterners, were less clear on those.

This article lays out the best evidence on displacement in Seattle—the different types, rates, and causes—and assesses strategies for protecting our communities from it. Unfortunately and perhaps surprisingly, what common sense counsels on this issue—to stop demolition of old buildings and preserve them as low-rent apartments, for example—turns out to backfire in a sequence of unintended consequences.

The root cause of displacement is a shortage of homes, and the only real solution is to build lots more housing of all types, to bolster those efforts with public support for those most vulnerable, and to precisely target preservation efforts in places justified by the protection of cultural communities or the opening of economic opportunities. Seattle and other prospering cities can ensure that working families and people of color can stay in their homes and keep fragile communities together. Displacement does have solutions, in other words. They just may not be what you think.

Overview of displacement and remedies

Displacement comes in two main forms. Physical displacement happens when old buildings give way to new ones. Economic displacement happens when rising rents force tenants to move elsewhere. These two primary causes may also precipitate cultural displacement, when people move because neighbors and culturally related businesses have left the area.

Physical displacement is so conspicuous, it dominates popular thinking. But economic displacement is by far the bigger problem in expensive cities such as Seattle. This misplaced focus on physical displacement leads many to believe that the best remedy is to stop development. But as discussed below, any reduction in physical displacement gained by preventing the construction of new housing is vastly outweighed by increased economic displacement.

To stem economic displacement, advocates often propose another plausible-sounding remedy: preserve existing low-cost homes, so-called “naturally occurring affordable housing.” But this prescription, too, is destined to fail overall because it doesn’t treat the underlying disease: a shortage of housing.

The closer we get to having enough housing—plenty of housing types and choices—the fewer families will face displacement.

In booming cities such as Seattle, legal restrictions on housing construction create a situation in which the need for homes increasingly outstrips the supply of homes available to rent or purchase. And this enforced housing shortage creates a preservation paradox: conservation of existing inexpensive private-market housing—whether by halting demolitions or by instituting rent restrictions—does not reduce displacement. It only rearranges where the displacement happens—and can even increase its occurrence.

The simple explanation: because preservation adds no new housing to the city’s stock, it doesn’t relieve the demand for housing. When people hunting for housing outnumber homes, the inevitable results are rising prices and economic displacement of those at the bottom of the economic ladder—people with more money move in, and those with less have to move out. The simple solution: build more housing. The closer we get to having enough homes, the fewer families will face displacement.

To be clear, new housing is not the only means to mitigate displacement. Targeted low cost housing preservation can serve social justice goals for low-income neighborhoods that face acute risks of displacement. Or in wealthier neighborhoods, saving what low cost housing is left may be necessary to retain lower-income residents and preserve economic and racial diversity. Localized public investments can provide support for fragile cultural or economic communities to help weather displacement pressures. Requirements that landlords give ample notice of rent increases can help at-risk tenants plan for alternatives. And when displacement does happen, cities can—and should—be ready to provide robust tenant relocation assistance.

In a bidding war for scarce homes, however, the only way everyone can come out with a place to live is if there are enough new dwellings added for everyone who is bidding. Preservation, when policymakers pursue it, must be matched with citywide housing growth, or else displacement will only shift to other blocks and neighborhoods, protecting certain people from displacement by exposing others to it. Ultimately, no action is more effective at curtailing displacement across an entire city than creating more housing choices for the diverse families and individuals who need them. The following sections provide detailed support for these conclusions.

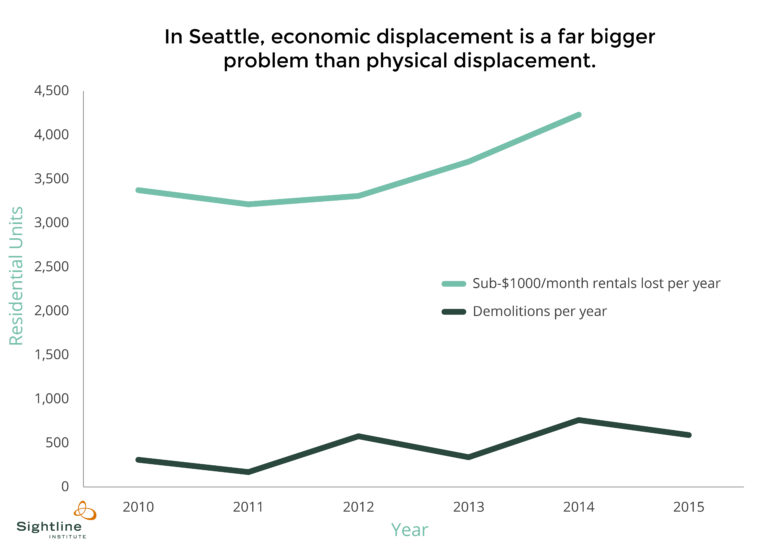

Data: Physical vs. economic displacement

The figure below shows the number of housing units demolished citywide over the past six years, based on City of Seattle building permit data. While the current situation in Seattle may feel extreme, these six years are typical of the historic trend: over the last 20 years, Seattle averaged about 475 housing unit demolitions per year; 2008 had the most, with 985.

City authorities track neither the value nor the rent of demolished housing, nor the reasons for its demolition, which is unfortunate. Not all units demolished are low-cost housing, and demolitions stem from varied causes, not just construction of new homes. Construction of commercial buildings precipitates demolitions; fires and other destructive events necessitate others; and nearly all buildings need to be replaced eventually simply due to aging.

Even when a home is demolished, it doesn’t always mean displacement: almost one-third of all demolitions in Seattle over the past five years were of single-family houses, and some of those teardowns were done by affluent owners who simply wanted to build new, bigger houses. Thus the data shown in the figure above demarcate an upper limit of the amount of physical displacement of low-income households caused by housing development, again, because many demolitions happened for reasons other than construction of new housing and not all of the demolished housing was low-cost.

The rate of economic displacement is difficult to assess. The US Census tracks how household incomes change within an area, but it does not isolate specific households—so it’s not possible to know why a household may have left a particular home. No one has conducted a survey of relocating tenants to ascertain where they are going and why.

But anyone with friends who rent in Seattle knows anecdotes of economic displacement. One of my Sightline colleagues recently moved out of her one-bedroom apartment in Seattle’s Capitol Hill neighborhood after the rent rose from $1,300 to $1,800 per month. She, her husband, and their one-year-old child ended up in the Seattle suburb of Lake Forest Park, where they could swing rent for a two-bedroom. Like many others facing a move farther out, their commute got more hectic, and they left behind a community of friends and favorite neighborhood activities—from restaurants to playgroups.

More than ten times as many people lose their homes through economic displacement (priced out) as physical displacement (demolition) in Seattle.

Still, a good proxy for the scale of economic displacement is the change over time in the stock of low-rent apartments. Also shown in the figure above is the number of all housing units renting for $1,000 per month or less that have been lost from Seattle’s citywide rental pool, based on US Census five-year average survey data. By city standards, $1,000 per month is affordable to a household earning 60 percent of area median income (AMI), or about $38,000 per year for a one-person household. Seattle’s proposed Mandatory Housing Affordability program targets 60% AMI households.

Most of the sub-$1,000-per-month homes disappeared because their rents increased, but demolitions consumed some as well. Accordingly, for the most conservative estimate, subtracting the demolished units yields a net average disappearance of about 3,100 sub-$1,000-per-month homes lost per year to rising rents—over seven times more than all homes lost to demolition that occurred for any reason, not just by new housing.

That ratio of seven to one is conservative, for several reasons. First, as noted, the demolitions include those with causes other than making way for new housing development. Second, rent increases both below and above the $1,000-per-month threshold can drive economic displacement. Consider my colleague, whose $1,300-per-month apartment became an $1,800-per-month apartment, sending her out of her beloved neighborhood. The $1,000 threshold is merely a proxy for a complicated cascade of relocation. If anything, the dwindling pool of sub-$1,000 apartments probably understates the rate of economic displacement because the loss is likely even more pronounced at lower rents levels. Third, the annual data points are five-year averages looking backward in time, resulting in an underestimate because the loss has been rising faster in the last few years. In all likelihood, more than ten times as many people lose their homes through economic displacement (priced out) as physical displacement (demolition) in Seattle.

[list_signup_button button_text=”Like what you|apos;re reading? Get the latest Sightline housing research right to your inbox.” form_title=”Housing Shortage Solutions Newsletter” selected_lists='{“Housing Shortage Solutions”:”Housing Shortage Solutions”}’ align=”center”]

Data: Density and displacement

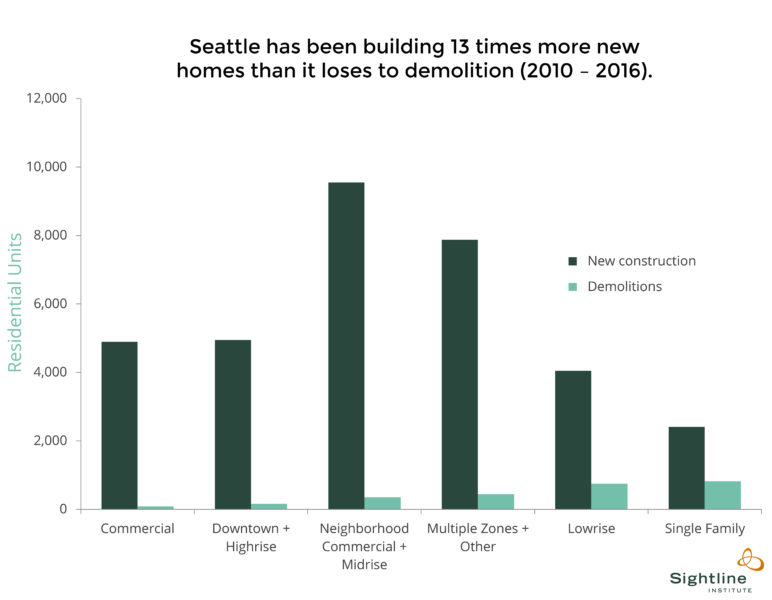

The dynamics of displacement are further revealed by comparing how many homes builders have constructed and demolished in different zones of Seattle, as shown in the bar chart below (see notes at the end of article for details on these data). In total, from 2010 to April 2016, Seattle added almost 13 times as many units as it demolished in all zones citywide. In terms of net housing gained versus housing lost, redevelopment is a big win for reversing Seattle’s housing shortage and relieving upward pressure on prices caused by unmet demand. More homes to accommodate more families at lower prices is a simple formula for less displacement overall.

The highest ratio—58 to 1—occurs in Seattle’s commercial zones, because these zones typically have no existing housing at all. Otherwise, the bar chart illustrates that the higher the density of new development, the higher the ratio of new housing to demolished housing. The second highest ratio—31 to 1—occurs in Seattle’s downtown and highrise zones, which makes perfect sense because taller buildings can fit more homes on a piece of land.

In neighborhood commercial and midrise zones, where building heights are typically limited to six or seven stories, the ratio is almost as high, at 27 to 1. Notably, large multifamily housing projects often replace parking lots or spent commercial buildings and typically displace little to no housing at all. (Several real-world examples of new housing construction projects and their associated demolitions are provided in this companion article.)

Large multifamily housing projects often replace parking lots or spent commercial buildings and typically displace little to no housing at all.

In Seattle’s lowrise zones, typically located between single-family areas and higher-density zones found in neighborhood commercial centers, single-family houses are often replaced by several townhouses, making the average replacement ratio about five to one. Not surprisingly, single-family zones have the lowest replacement ratio—only three to one—because only one new housing unit can be built on a lot, and in many cases, a new single-family house replaces an old single-family house, adding nothing to the housing supply and therefore doing nothing to relieve displacement.

What to do and what not to do

In short, these data indicate that to minimize overall displacement, Seattle should allow as many kinds of new housing at as high a density as possible. In many cases, this means big apartment buildings, but in others, it means older single-family homes replaced not with new single-family homes but instead with modest triple-family homes or houses with mother-in-law apartments. To support these assertions, I’ll first examine two policy scenarios that are unlikely to stem displacement, after which I’ll dig deeper into the effects of building more housing.

What won’t work: Prohibiting housing redevelopment that would demolish existing housing

In this scenario, the intent is to preserve naturally occurring affordable housing—that is, existing privately owned homes that for whatever reasons remain relatively inexpensive—by prohibiting any new housing development that would require their demolition. Based on the data shown above, the city would lose an average of 13 new housing units for every one existing unit saved.

The demand for housing—the people with fat wallets lining up to fill those 13 new units—would not disappear, however. Those people would still compete for what is available. This unmet need would push up rents in the very housing saved from demolition, as well as rents nearby. Any gains from preserving the existing housing would vanish, as rent inflation accelerated in the neighborhood. In the end, the increase in economic displacement would eclipse the reduction of physical displacement. Recent analysis by the City of San Francisco on a proposed development moratorium in the Mission District reached a similar conclusion:

…New market rate housing tends to lower, rather than raise, the value of nearby properties, and therefore a moratorium on market-rate housing would not protect nearby existing housing from rising prices….

In other words, halting development to save existing housing may provide a short-lived benefit for a lucky few, but only at the expense of many times more families who will see their rents rise faster.

What also won’t work: Restricting rents in naturally occurring affordable housing

In this scenario, the intent is to prevent economic displacement from naturally occurring affordable housing by capping rents. This can be accomplished through building purchase and subsidy by a public or nonprofit agency or through public subsidy provided to a private owner (or through rent control, were it not illegal in Washington State). The rationale is that without such an intervention, rents would rise according to what the market will bear, leading to economic displacement of the building’s lower-income residents.

This is the paradox of preservation: setting aside existing housing for low-income tenants helps those specific people—at the expense of other low-income people displaced elsewhere.

But again, the catch is that the act of restricting rents in an existing building does nothing to relieve the need for housing. If people cannot rent at a building that only allows low-income tenants, because, say, they make just a little more than permitted, they will find a different building that isn’t rent restricted. The resulting increase in competition for apartments in that building will then drive up the rent there, ultimately causing the displacement of that building’s poorest tenants. This is the paradox of preservation: setting aside existing housing for low-income tenants helps those specific people—at the expense of other low-income people displaced elsewhere.

In some cases, there is a legitimate public interest in preserving naturally occurring affordable housing in specific locations. For example, in fragile, low-income immigrant communities that have established an informal cultural home in a neighborhood, preservation serves a worthy purpose. Similarly, preservation of inexpensive, old buildings in otherwise expensive neighborhoods could create economic diversity and inclusion in areas of high opportunity, including proximity to good schools, transit, and parks.

In weighing these options, policymakers would do well to remember that when there is unmet demand for housing, there is no cheating displacement. Quell it in one place and it will just rear its head somewhere else—potentially even pushing out a family right next door.

What will work: An Rx for the homes we need

Next, let’s play out the scenario in which the primary policy goal is to create more housing choices—much more housing, of all types, throughout the city. New homes directly and immediately reduce displacement by making room for more people. It doesn’t matter whether they are expensive or cheap. Under current conditions in Seattle, any new home with a household living in it means one less household displaced from the city.

New homes directly and immediately reduce displacement by making room for more people.

Recent research confirms that this dynamic plays out in the real world, and it does so not only across urban regions but also within neighborhoods. Economists with the California Legislative Analyst’s Office found that displacement was more than twice as likely in low-income census tracts with little market-rate housing construction than in tracts with high construction levels. Lots of new housing construction, in other words, slows displacement: more construction may cause more physical displacement, but it compensates many times over through reductions of economic displacement.

In a previous article, I explained the dynamic:

Consider the simplified case of a city with a total of five rentals ranging from cheap to expensive, and five people living in them with corresponding incomes. Along comes a wealthy newcomer who offers more for the most expensive unit, so the landlord raises the rent and the newcomer gets the unit because the current tenant can’t afford to pay that much.

The person who was displaced then offers more for the next cheapest rental, and so that landlord raises the rent, displacing the current tenant, who then bids up the next cheapest rental, and so on. In the end the person left without a place to live is the one with the lowest income of the five original renters.

Now consider how that scenario changes dramatically when there is one simple difference: a newly built expensive rental is available. The wealthy newcomer rents that unit, and that’s it—nothing changes for any of the existing five renters. No rents are raised, and no one is displaced. As counterintuitive as it may seem, the creation of a new expensive rental prevented displacement of the poorest renter.

If, in this scenario, building the one new rental caused the demolition of an existing lower-cost rental, then there would be a net loss of affordability. However, as shown in the Seattle data plotted above, on average, new housing development in Seattle results in at least 13 times as many units added as lost. In other words, on average, the expected result of building new homes is that for every one lower-income household that loses a home to demolition, 13 lower-income households are not displaced from the city elsewhere. The net increase in supply of housing not only reduces displacement by making room for more households, but also exerts downward pressure on housing prices throughout the market, thereby putting the brakes on economic displacement.

Building more new homes creates more affordable homes through filtering

The process by which new market-rate housing reduces economic displacement is called filtering. Filtering has two mechanisms, one fast-acting, one slow. The fast process moves at the pace of a moving van, as new housing allows rich people to trade up, which allows slightly less rich people to trade up, which allows upper-middle-class people to trade up, and for those in the cheapest apartments to trade up—or stay where they are—because there is less competition for housing, up and down the housing market.

When the production of new homes lags behind the need, filtering shuts down as intensified competition from tenants pushes up rents in older apartments.

In the slower process, as time passes, older housing tends to become less desirable compared to new housing, and that older housing evolves into the next generation’s naturally occurring affordable housing. The more new housing gets built, the faster both filtering mechanisms occur.

Conversely, filtering can run in reverse. When the production of new homes lags behind the need, filtering shuts down as intensified competition from tenants pushes up rents in older apartments. Increasingly, people with more than enough means vie with people of lesser means for the same homes, a battle that the poorest always lose.

The longer the lag in construction of new homes, the worse the shortage of moderately priced housing. San Francisco, for example, has been starving its housing stock of new units for decades (with rent control, mandatory inclusionary zoning, and severe building restrictions), which is why even older, low-quality housing commands astronomical rents.

Of course, new homes are typically more expensive to rent or buy than old ones, just as new cars cost more than used ones. Because homes, unlike cars, typically last a hundred years, new construction tends to favor the high end of the market rather than “economy” models. Inexpensive older housing fills the need for inexpensive homes, just as used cars fill the need for cheap cars.

Throughout history, most new homes have been built for the higher end of the income spectrum. But thanks to filtering, in prosperous cities, even if new housing is more expensive, building more of it still curtails displacement and slows average price inflation in the housing market as a whole.

Building more new subsidized affordable homes doubly reduces displacement

The biggest problem precipitated by the high cost of new housing is loss of community diversity. When a neighborhood gains a lot of new market-rate housing over a short period of time, on average it will become wealthier—and likely less racially and economically diverse—even when no lower-income households are displaced.

But the solution is not to stop market-rate housing development. Rather, it is to also build subsidized below-market-rate housing. Indeed, researchers at University of California Berkeley recently found “the effect of subsidized units in reducing the probability of displacement to be more than double the effect of market-rate units.” Unlike preserving existing homes, building new subsidized homes reduces net displacement because the latter adds to the supply of housing.

When average rents are held lower by ample supply, more people can afford market-rate apartments without public subsidy.

Compared with most US cities, Seattle has been relatively successful at fostering subsidized affordable housing development throughout the city, including in expensive locations such as downtown and South Lake Union. There are currently about 27,000 subsidized homes in the city, making up about eight percent the city’s total housing stock. The prospects for economic diversity throughout Seattle depend heavily on the continuation and expansion of existing public programs.

At the same time, robust private housing development supports Seattle’s subsidized housing efforts by tackling the root cause of rising rents—the housing shortage—and thereby reducing the number of people who need subsidized housing in the first place. When average rents are held lower by ample supply, more people can afford market-rate apartments without public subsidy.

Private development also contributes directly to Seattle’s stock of subsidized homes through the Multifamily Tax Exemption, which has produced more than 6,000 below-market rate apartments in otherwise market-rate buildings. Seattle’s proposed Mandatory Housing Affordability (MHA) would explicitly link private development to the creation of below-market-rate homes. If the city can correctly balance the program’s zoning changes and affordability mandates, MHA has the potential to ramp up production of both market-rate and subsidized housing.

Furthermore, because the additional homes allowed under MHA would not expand the building footprint , MHA would cause no increase in physical displacement. MHA is designed to make already feasible homebuilding projects slightly bigger and to include some affordable apartments, but not to increase the overall number of profitable homebuilding projects. Repeat: MHA would cause no added increment of physical displacement, even as it doubly reduced economic displacement, because it would increase the number of new homes available, speed filtering, and leverage construction projects to include additional subsidized homes that they wouldn’t otherwise build.

Loosening restrictive zoning is the key to building more housing of all types

The chief roadblock to building the homes Seattle needs is zoning restrictions that limit the number of new units allowed on a given piece of land. It follows that relaxing such limitations—that is, upzoning—is a fundamental anti-displacement strategy in high-demand cities such as Seattle.

If policymakers hope to help those most in need of inexpensive housing, they must carefully weigh the rationale for zoning rules that limit the creation of much-needed new homes against the stark reality: one more low-income household is forced out of the city every time those rules prevent the construction of a new home.

Some advocates, however, argue just the opposite, that upzones accelerate displacement because they increase the financial incentive for redevelopment that replaces existing affordable housing with expensive new housing. A recent Seattle example is the Housing Affordability and Livability Agenda (HALA) recommendation to allow duplexes and triplexes in single-family zones, about which Councilmember Mike O’Brien stated:

I do not support zoning changes that would lead to rapid redevelopment of our single-family zones and the replacement of existing single-family housing with newly constructed multi-family housing. I don’t believe this will help with affordability.

Any time zoning restrictions result in fewer new homes than the private market would otherwise have built, it’s a lost opportunity to reduce displacement at zero cost to the public purse.

But here’s the flaw in that viewpoint: it ignores the fact that the reason prices are rising and causing economic displacement is that Seattle doesn’t have enough housing! Putting two more homes on a single-family lot with, say, a triplex, most definitely will help affordability simply because it makes room for two more households than could live on that lot before. And that means two low-income households who can stay in Seattle instead of being pushed out because they don’t have to complete with the wealthier triplex newbies for their lower-cost homes.

The single-family zoning that covers over half of Seattle’s land is particularly egregious. It overregulates or outright prohibits a variety of more affordable housing options that could fit well in single-family neighborhoods, such as backyard cottages, duplexes, triplexes, and small-scale apartments. As can be observed in neighborhoods throughout Seattle, these legal limits lead to the lose-lose outcome of higher prices and zero gain in housing supply when existing houses are torn down and replaced with single McMansions that sell for well over $1 million.

But whether we’re talking about a single-family lot or a downtown highrise, the point is this: any time zoning restrictions result in fewer new homes than the private market would otherwise have built, it’s a lost opportunity to reduce displacement at zero cost to the public purse. Moreover, in some cases, upzones may actually reduce not only economic displacement, but also physical displacement of naturally occurring affordable housing.

For example, City of Seattle analysis on a proposed upzone in the University District projected that 40 lower-cost housing units would be demolished if proposed upzones were enacted, compared to 60 housing units demolished if no zoning changes were made, stating that, “the implication of this framework is the need for less land (and the potential demolition of low-cost housing) to meet the target population.”

The root cause of displacement is unmet need for homes, and the act of relaxing zoning to allow larger buildings does not create more need. The ultimate futility of wielding restrictive zoning to thwart displacement is another stubborn facet of the preservation paradox. It’s true that density limits mandated by zoning can kill the financial incentive for redevelopment, potentially staving off the demolition of low-cost housing. But unmet demand will drive up the rents anyway, more than negating any benefit.

Conclusion

The housing market in rapidly growing cities such as Seattle is like a giant game of musical chairs. It has different sizes and styles of chairs, and new ones are replacing or adding to old ones. But as in any game of musical chairs, players outnumber chairs, so round after round, people get knocked out of the game.

In the housing market version of the game, the players excluded are not random, though. Because there aren’t enough chairs (homes), and because players can pay to stay in their chairs or to buy the chairs of others, those with the most money never lose, while the poorest always end up chairless. They move out of their favorite neighborhood to less desirable ones or out of the city entirely.

Displacement is the paramount challenge to creating cities both that prosper and that advance that prosperity for all of their residents—not a rich or lucky few.

In fact, if you’re poor, your only hope is that chair production will someday catch up with the number of people who want to play. Even if the game-makers preserve certain chairs for certain people (“reserved for veterans” or “special-needs players only”) or stem the addition of expensive new chairs to the game (“no McMansion chairs!”) or give money to some players to help them buy chairs (“Section 8”), as long as people outnumber homes, the game will still keep knocking players out. And it will always, always, always knock out the players with the least financial resources.

The only way to stop displacing poor players is to provide enough chairs, in enough sizes and styles, to meet the needs of everyone. Then—and only then—when the music stops, everyone will have a place to sit down.

Displacement is the paramount challenge to creating cities both that prosper and that advance that prosperity for all of their residents—not a rich or lucky few. Overcoming that challenge hinges on tackling the root cause of displacement in booming cities: a housing shortage.

In Seattle, available evidence suggests that at least ten times more displacement is caused by rising rents than by demolition of low-cost housing. Under such conditions, neither halting development nor preserving low-cost housing can reduce net displacement—these measures can only push the displacement problem someplace else, to someone else, likely someone poor. The absolutely necessary condition for minimizing the very real damage to communities caused by displacement is the construction of lots and lots of new homes, of many sizes and shapes and price points.

Within the complex cultural and economic dynamics of a growing city, however, particular communities will need more than new housing alone to equitably address displacement pressures. Such cases warrant locally targeted preservation of low-cost housing, a concentration of new subsidized housing, or other public investments to stabilize vulnerable communities. If such interventions are to work, though, they must be supplemented with increases in housing construction in other areas of the city. Otherwise, they may save a chair in one neighborhood, only to knock out several across town or even across the street. Tackling displacement requires a “both/and” approach: build lots and lots of new housing, and provide support for communities most vulnerable to change.

Notes

City of Seattle data do not associate specific construction permits with their demolition permits. In this companion Sightline article, we matched permits for several new housing construction projects, lot by lot, to reveal the actual number of physical displacements occasioned by new construction of multifamily buildings.

The five-year average census data for sub-$1000-per-month rentals are not adjusted for inflation. Changes in income also factor into housing affordability, and the five-year average census data for Seattle show that households earning less than $35,000 per year declined slightly between 2010 and 2014. Some of this decline may have been caused by economic displacement. Overall, we believe that these data limitations do not compromise our conclusions.

In 2012, the 272-unit McGuire apartment building, located in one of Seattle’s downtown zones, was demolished due to faulty construction. Because the reason for the demolition had nothing to do with new housing development, and because the high number of units lost would significantly skew the data for downtown zones, these 272 units are not included in the bar chart comparing zones.

Based on similarities of typical building scale, the bar chart aggregates downtown with highrise zones, and neighborhood commercial with midrise zones. The “multiple zones + other” category in the bar chart includes projects built on land in multiple zones, in major institutional overlays, or in zones that were for some reason unidentified.

Thank you to Ethan Phelps-Goodman who generously shared his data on demolitions and rent increases. Check out Ethan’s excellent work at Seattle in Progress.

Comments are closed.