Seattle’s zoning has roots in racial and class exclusion and remains among the largest obstacles to realizing the city’s goals for equity and affordability. In a city experiencing rapid growth and intense pressures on access to affordable housing, the historic level of single-family zoning is no longer either realistic or sustainable.

Strong words from the 2015 Seattle Housing Affordability and Livability Agenda (HALA) report in support of its headline-grabbing recommendation to “increase access, diversity and inclusion within single-family areas.” Media reaction was incendiary, with commentators rushing to take sides over the historical claim made in the first eight words: “Seattle’s zoning has roots in racial and class exclusion.” (Here, here, here, here, here.)

What drew far less attention—and what is ultimately far more important—is the rest of HALA’s assertion. Those other 43 words point directly at local restrictions on housing construction in Seattle, prominently including its vast allocation of land to single-family lots as “among the largest obstacles to equity and affordability.”

Across North America, such statements are vanishingly rare in the official pronouncements of policymakers. Zoning, especially single-family zoning, is presumed sacrosanct. What may be surprising to those not steeped in land-use and urban economics, however, is that HALA’s words are not strong at all in light of the growing body of evidence that restrictive zoning undermines equity and social justice.

“HALA’s words are not strong at all in light of the growing body of evidence that restrictive zoning undermines equity and social justice.”

Indeed, as the magnetic attraction of successful cities continues to intensify over coming years, dismantling the apparatus of exclusionary zoning may be our most acute urban public policy challenge.

Urban exclusionary zoning in today’s cities

Exclusionary zoning was a defining feature of the 20th Century North American exodus to suburbia, where municipalities commonly imposed zoning that only permitted single-family homes on large lots as a thinly veiled means to keep out poor people and people of color. But over the past two decades, as the demographic tide has shifted back toward cities, an analogous story of exclusion is unfolding. And while policymakers’ intentions may not be as blatantly exclusionary as they often were in the suburbs, the result is the same: regulations that restrict the production of new housing cap the number of people who can live in a desirable urban area, the wealthy outbid the poor for homes, and high prices and economic exclusion ensue.

New analysis by economist Jed Kolko comparing 2000 to 2014 confirms that on average across the United States, newcomers to urban areas fall predominantly on the upper end of the income spectrum: “While well-educated, higher-income young adults have become much more likely to live in dense urban neighborhoods, most demographic groups have been left out of the urban revival.”

In “The New Exclusionary Zoning,” an exhaustive academic review of urban exclusionary zoning published in 2014 in the Stanford Law and Policy Review, Georgetown University Law Center Fellow John Mangin summarizes: “The anti-development orientation of certain cities is turning them into preserves for the wealthy as housing costs increase beyond what lower-income families can afford to pay.”

The single-family shut-out

The most egregious offenders in this new exclusion are single-family zones that impose extreme density limitations relative to their more intensely developed surroundings, yet are often the most desirable areas in the city—not least because they are likely to have the best public schools. The equation is simple: because valuable urban land is in short supply and city codes require large lots, single-family houses are inherently expensive. They also tend to be occupied by wealthier residents who have the resources to engage in political fights against the relaxation of zoning.

Exclusionary zoning afflicts West Coast cities in particular because they typically reserve an exceedingly large portion of their land for low-density single-family houses—a common trait of cities built out during the automobile age. In Seattle, for example, 54 percent of the city’s land (excluding public rights-of-way and parks) is zoned single-family.

Moreover, from the 1920s through the 1980s, most cities followed a general trend of ratcheting down housing flexibility in single-family zones, including prohibitions on mother-in-law apartments, duplexes, and corner stores, along with requirements for parking. In recent decades, city planners have won modest reversals to this trend in many North American cities, though most proposals to loosen restrictions in single-family areas still incite storms of resistance from residents.

Height and density hold-ups

But it’s not just single-family zoning. The height and density limits we impose on apartment buildings can also cause exclusion if they reduce the number of units that otherwise would have been built. In cities where lots of people want to live, less new housing means more upward pressure on prices. And one fewer housing unit built means one fewer household that can live in a place with good access to opportunity.

A 2007 study led by Gerrit Knaap, director of the National Center for Smart Growth Research and Education at the University of Maryland, verified that exclusionary zoning blocks the production of multifamily housing:

[We] focused on this issue—limiting multifamily housing through exclusionary zoning—because it is one of the most common and most pervasive barriers to affordable housing in America. This study provides the documentary evidence that exclusionary zoning is in fact a significant barrier to higher-density, multifamily housing in major metropolitan areas throughout the United States.

While zone-based regulations that limit housing density are the primary culprits of exclusion, “exclusionary zoning” is a blanket term that also covers other types of rules that stymie housing production, including parking requirements, building setbacks, environmental review, historic preservation, design review, and impact fees.

The case against exclusionary zoning

A wave of academic research has in recent years convicted exclusionary zoning of a litany of offenses, forming a case against the practice far more damning than HALA’s restrained accusation. Had HALA written its 8 + 43 words as a summary of the research literature, it might have said something like:

Seattle’s zoning system, which like all zoning partly arises from impulses for exclusion by class and race, continues to severely limit housing construction, widening the gap between supply and demand. A large and growing body of empirical research has now demonstrated that Seattle-style housing limits cause unexpected, unintended harms. They radically inflate housing costs, segregate neighborhoods by class, displace longstanding residents by pricing them out of their rented homes, amplify economic disparities between rich and poor, eliminate opportunities for working people to improve their lots in life, trap poor children in poverty, bar the doors to good schools for those who most need public education, reduce society’s overall prosperity, and push more people into homelessness. The evidence is irrefutable. Seattle can become an equitable and affordable city, or it can continue its current pattern of exclusionary zoning. It cannot do both.

Here is a rundown of these academic findings:

1. Tight regulations radically inflate housing costs

A 2016 literature review titled “How Land-Use Regulation Undermines Affordable Housing” provides a good starting point on the core issue, namely, that regulatory restraints on housing production boost prices:

Because land-use regulations tend to limit housing supply and drive up the price of housing, current homeowners tend to benefit while renters and new homeowners are harmed. This burden falls disproportionately on poor households.

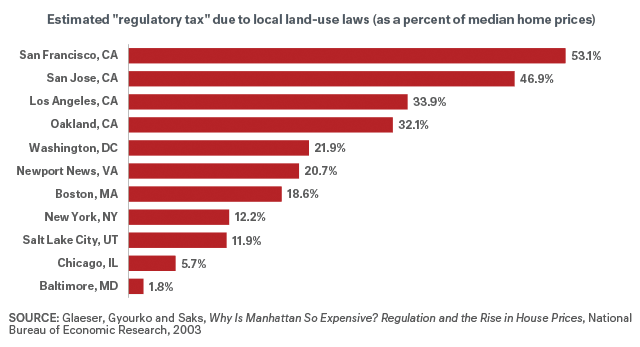

This assertion builds on earlier work by Edward Glaeser and Joseph Gyourko, who in 2003 described how restrictive land use regulation acts like a tax on housing that significantly hikes prices. Glaeser and Gyourko estimated effective “zoning tax” rates as high as 53 percent in San Francisco. In other words, if a San Francisco house was worth $1 million in 2003, Glaeser and Gyourko’s research showed that the price in the absence of zoning limitations would have been around $654,000. The “zoning tax” was the other $346,000.

Since then, prices in San Francisco have roughly doubled, so the house would now be worth about $2 million, and the zoning tax would account for much of that escalation. That is, as unmet demand grows and prices are bid up, the share of a house’s cost that is simply the result of scarcity increases. Few policymakers likely anticipate that such high cost premiums may result from the regulations they impose on housing.

Brand new analysis by Zillow confirms that not only home sale prices but also rents appreciate faster in cities with restrictive land use regulations (although other factors also contribute to rent escalation): “On average, rents in the nation’s least restrictive cities rose 6.1 percent over the past five years, while rents in the most restrictive cities rose 16.7 percent.” In other words, rent on a $1,000/month apartment in a highly restrictive city such as Seattle or Austin would have risen by an additional 10.6 percent—$106 a month—over rent increases in a less restrictive city such as Cincinnati.

These findings on regulation and housing prices are relatively new, but the idea is not. For example, in 1982, the Report of the President’s Commission on Housing stated:

Growth controls can artificially enhance the financial well-being of the resident community at the expense of newcomers by increasing the cost of producing housing. Studies show that minimum house and lot sizes … and regulation of the density and location of multifamily development can contribute substantially to housing-cost inflation.

Lastly, while the consensus is strong, in 2005 University of California researchers John Quigley and Larry Rosenthal identified several shortcomings in the empirical evidence, including the potential for “endogeneity,” that is, the possibility that wealthier communities simply have stronger tastes for regulation.

2. Housing restrictions segregate neighborhoods by class

If exclusionary zoning drives up housing prices, then it should come as no surprise that it induces segregation by wealth. Over recent decades, researchers have identified numerous social harms caused by economic segregation, summed up by UCLA economists Michael Lens and Paavo Monkkonen:

The segregation of the rich—which is growing rapidly in U.S. metropolitan areas—results in the hoarding of resources, amenities, and disproportionate political power. The segregation of the poor often creates neighborhoods besieged by crime and severely limits life chances in schooling, employment, health, intergenerational mobility, and other vital outcomes. More pragmatically, it is not sustainable or efficient for low-wage workers to travel long distances to work where higher-income households spend money.

Using data from the 95 biggest US cities, their 2015 study showed that restrictive zoning breeds segregation by income:

Density restrictions are associated with the segregation of wealthy and middle-income households. Such restrictions do not appear to lead directly to the concentration of poverty but rather to the concentration of affluence, a finding which adds important nuance to the way in which exclusionary zoning techniques isolate the poor.

The above results reinforce the 2010 findings of the Brookings Institution’s Jonathan T. Rothwell and Princeton University’s Douglas S. Massey, who studied the suburbs of 50 US metropolitan areas and found higher levels of income segregation in places with more restrictive zoning:

The evidence is consistent with the idea that restrictive density regulations prevent the construction of high-density, multifamily housing, and thereby limit the supply of affordable housing by increasing the average price of units in affluent neighborhoods to the exclusion of lower income people. This arrangement perpetuates and exacerbates racial and class inequality in the United States.

3. Tight housing regulations kill opportunity

In 2016, Harvard researchers Raj Chetty, Nathaniel Hendren, and Lawrence Katz published some of the most compelling evidence yet that the neighborhoods in which children grow up dictate their chances of future success. They compared the outcomes of children who moved to better neighborhoods with those who didn’t: “Every year of exposure to a better environment improves a child’s chances of success.”

In this context, “better environment” means a neighborhood that provides robust opportunities for upward mobility. Previous work by Chetty and colleagues published in 2014 identified economic integration as one of five key characteristics of places with upward mobility. Their analysis of the records of 40 million US children verified that segregation is toxic to disadvantaged children’s futures: “Areas that are more residentially segregated by race and income have lower levels of [upward] mobility.”

The link between economic segregation and exclusionary zoning discussed in the previous section completes the connection back to upward mobility. In a 2015 paper on rising inequality in the United States, Jason FurmanChairman of President Obama’s Council of Economic Advisers, and Brookings Institution Fellow Peter Orszag spelled out this potential for housing regulations to put the brakes on economic mobility: “Zoning and land use restrictions can potentially discourage low-income families from moving to high-[upward] mobility areas—effectively relegating them to lower-mobility areas, reinforcing inequality.”

In a related speech to the Urban Institute in November, Furman asserted, “While land use regulations sometimes serve reasonable and legitimate purposes, they can also give extranormal returns to entrenched interests at the expense of everyone else.”

Meanwhile, University of Utah professor Reid Ewing, who has published extensively on sprawl and climate change, observed a strong correlation between upward mobility and higher density development—that is, the type of development that exclusionary zoning prevents. In this 2016 analysis, Ewing and colleagues utilize their previously developed “sprawl index” to determine that:

Upward mobility is significantly higher in compact areas than sprawling areas. The direct effect of compactness is attributed to better job accessibility in more compact areas. As compactness doubles, the likelihood of upward mobility increases by about 41%.

Conversely, exclusionary zoning that freezes affluent, low-density neighborhoods in amber also traps a larger share of low-income families in deprivation and hopelessness.

4. Restrictive zoning keeps good schools out of reach of those who most need them

In a 2012 Brookings Institution study titled “Housing Costs, Zoning, and Access to High-Scoring Schools,” Jonathan Rothwell looked at data from over 84,000 US schools and found strong evidence that regulatory limits on housing can deprive underprivileged families of access to high-quality public schools:

Eliminating exclusionary zoning in a metro area would, by reducing its housing cost gap, lower its school test-score gap by an estimated 4 to 7 percentiles—a significant share of the observed gap between schools serving the average low-income versus middle/higher-income student. Public policies should address housing market regulations that prohibit all but the very affluent from enrolling their children in high-scoring public schools in order to promote individual social mobility and broader economic security.

Recent data suggest that housing costs exacerbated by exclusionary zoning in Seattle are inhibiting equitable access to, and boosting segregation in, the metro area’s public schools. Between 2007 and 2015, the percent of students of color and the percent of students living in poverty declined in Seattle’s schools, while both metrics rose in less wealthy surrounding suburbs. As Seattle educator Sean Riley observed in The Stranger, “Instead, people of color are being priced out and ending up in South King County, in schools that are approaching apartheid status.”

Furthermore, the 2014 study by Chetty cited above found that access to “better primary schools” was one of the five main factors that correlate with upward mobility.

5. Housing supply restrictions price people out of their neighborhoods

Another potential result of the higher housing prices induced by exclusionary zoning is displacement of renters priced out by rent hikes. Economists with the California Legislative Analyst’s Office observed this effect in low-income Bay Area neighborhoods between 2000 and 2013, finding that displacement was more than twice as likely in census tracts with little market-rate housing construction than in census tracts with high construction levels. They conclude:

Construction of market-rate housing reduces housing costs for low-income households and, consequently, helps to mitigate displacement in many cases. We suggest policy makers primarily focus on expanding efforts to encourage private housing development. Doing so will require policy makers to revisit long-standing state policies on local governance and environmental protection, as well as local planning and land use regimes.

This finding belies the common assumption that market-rate housing development is the primary cause of displacement. More specifically, it shows that upzoning to allow higher density housing is not a threat to low-income renters but rather a strategy to keep more of them in their homes. The report also noted that regulatory barriers to private development also hinder the development of subsidized housing.

6. Exclusionary zoning increases homelessness

That high housing prices cause homelessness is intuitive—and also documented. In a 2012 study, Thomas Byrne and colleagues with the National Center on Homelessness Among Veterans estimated that a $100 increase in median rent causes a 15 percent increase in homelessness.

To put that in perspective, between 2014 and 2015—a period of abnormally high rent inflation—the average rent in Seattle rose $97, reaching some $1,266 per month. If Byrne’s estimate is accurate and had nothing else changed in Seattle that year, homelessness in the city would have increased by 15 percent. (In fact, the best available data indicate it did, or worse: the one-night homeless count in Seattle grew by 22 percent from 2014 to 2015.) More generally, the huge “regulatory tax” cited above—the spike in housing costs caused by the scarcity resulting from zoning barriers to residential construction—is so large that it may be a major cause of homelessness in many cities.

In 2009 Steven Goldman at the University of California, Berkeley, detailed the direct connection between restrictive regulations on housing and homelessness:

Regulated markets experience slower growth in housing, produce less higher-quality housing, experience higher housing price appreciation, and experience much larger increases in the budget shares that renters (and in particular, low income renters) devote to housing expenditures. The data reveal a striking positive relationship between the degree of homelessness across states and the stringency of local housing market regulation.

These findings corroborate a 1991 paper by William Tucker published in The Public Interest. Using data from 40 US cities, Tucker studied numerous variables and determined that median home price was the strongest predictor of homelessness:

High median home prices are usually found in cities with strict zoning ordinances and a strong no-growth effort. The most plausible explanation of the relation of homelessness to high median home prices … seems to be what might be called ‘intense housing regulation.’

7. Housing restrictions make everyone poorer

Exclusionary zoning also drags down national economies. In 2015, Chang-Tai Hsieh of the University of Chicago and Enrico Moretti at the University of California, Berkeley, estimated the loss of US economic output caused by regulations that limit housing development:

Lowering regulatory constraints in New York, San Francisco, and San Jose to the level of the median city would expand their work force and increase U.S. GDP by 9.5 percent. Incumbent homeowners in high wage cities have a private incentive to restrict housing supply. By doing so, these voters de facto limit the number of US workers who have access to the most productive of American cities.

While this study is only a thought experiment that assumes tens of millions of people could move to new housing in the nation’s most productive cities, it does illustrate the immense potential for zoning restrictions to hold back prosperity for everyone.

In 2015 Harvard researchers Peter Ganong and Daniel Shoag documented the root cause of this loss of economic productivity, namely, that housing price escalation caused by exclusionary zoning quashes opportunities for people to move from poor places to wealthier places: “Housing supply constraints reduce permits for new construction, raise prices, lower net migration, slow human capital convergence and slow income convergence.”

These striking macroeconomic findings are continent-scale analogs for the way exclusionary zoning deprives disadvantaged people of access to opportunity at the neighborhood-scale. By restricting housing supply in cities as a whole, we price out people who would contribute more to national prosperity if they could work in the continent’s most productive and innovative metro areas, which include not only the California Bay Area and New York, but also Cascadia’s trifecta: Portland, Seattle, and Vancouver.

8. Exclusionary regulations on housing widen income inequality

Last year MIT grad student Matthew Rognlie made waves with a research paper arguing that housing costs are among the main causes of rising income inequality in the United States. Specifically, Rognlie demonstrated that a rise of income flowing to housing largely accounted for the loss of US income flowing to labor since the onset of the Great Recession. Obama’s Council of Economic Advisers Chairman Jason Furman called out the direct connection to exclusionary zoning: “Increased rents in housing markets due to land use restrictions that create artificial scarcity may be part of the cause of the rise in the share of income going to housing and land.”

Or, as Vox commentator Matthew Yglesias made the point:

Across the vast majority of America’s valuable land we’ve made it illegal to build rowhouses or apartment buildings. And so the land’s value only increases, the rents going to its owners accumulate, and workers lose out.

Or, stated even more succinctly by New York Times columnist Paul Krugman:

Building policies in our major cities, especially on the coasts, are almost surely too restrictive.

[list_signup_button button_text=”Like what you|apos;re reading? Get the latest Sightline housing research right to your inbox.” form_title=”Housing Shortage Solutions Newsletter” selected_lists='{“Housing Shortage Solutions”:”Housing Shortage Solutions”}’ align=”center”]

A cost we all pay, an opportunity we should all embrace

In growing cities where we choke housing supply with zoning restrictions, finding housing becomes like a game of musical chairs—but a twisted version in which when the music stops, the person with the emptiest wallet automatically ends up on the floor. In prosperous cities, any regulation that thwarts the creation of more housing causes exclusion of the less privileged. This is not to say that all zoning should be deleted. It does mean that city policymakers have an obligation to carefully reassess restrictions on housing according to who wins and who loses, with special attention given to the people with the fewest resources—including those who hope to be future residents.

With the HALA roadmap, Seattle has the opportunity to be a leader in a movement to eradicate urban exclusionary zoning and empower equitable access to the city. It won’t be an easy political battle. But it’s the only path that doesn’t lead to the transformation of Seattle into an enclave for the wealthy. The same goes for Cascadia’s other major cities, Portland and Vancouver, as well as high-demand cities throughout North America and across the globe.

Fortunately, if cities succeed in opening their doors to all, they will also reap the many other social, economic, cultural, and environmental rewards of compact urban development. Zoning that enthusiastically welcomes housing can undo the ills of exclusion. It can help make homes affordable, neighborhoods integrated, good schools accessible to many more children, opportunity-rich neighborhoods available to the less privileged, homelessness less common, income disparities smaller, prosperity more shared, and everyone richer in the qualities of community and vibrancy that really define a city.

Comments are closed.