Cascadia’s cities face a growing shortage of affordable housing, to which they are responding with a variety of policies. But Seattle stands out for the successful use of one tool in particular: property tax levies to subsidize housing. Since 1986 Seattle voters have consistently approved four such levies, creating the city’s biggest local funding source for affordable housing.

As the affordability squeeze has tightened over recent years, other Cascadian cities have been seeking to emulate Seattle’s success. In 2012, Bellingham became the second major city in Cascadia to adopt a property tax levy to support affordable housing, and Portland and several cities in Washington State are currently considering similar levies.

Advancing a key recommendation of Seattle’s Housing Affordability and Livability Agenda, Mayor Ed Murray has proposed doubling the current housing levy, set to expire this year. Although voters have been generous in the past, this expanded levy renewal comes on the heels of two even larger Seattle property tax levies for parks and transportation, raising concerns that “tax fatigue” could jeopardize success at the ballot box this August. The elected King County Assessor himself recently opined that property taxes have gone too far.

To help Seattle—as well as other cities hoping to follow the same path—overcome anti-tax sentiment and win voter approval of affordable housing property tax levies, here are nine reasons why renewing the Seattle housing levy is not just the right thing to do, but also the smart thing to do as Cascadian cities continue to grow and prosper.

1. Seattle’s housing levy works—really well.

To date, Seattle’s housing levy has enabled the construction of 12,500 apartments with below-market rents available only to low-income households. That’s close to half the city’s total of 26,000 “rent-restricted” housing units. By comparison, the Seattle Housing Authority, which relies primarily on federal funding, supplies 5,000 units of the city’s rent-restricted inventory. The levy has also cumulatively provided emergency rental assistance to 6,500 households and down-payment loans to 800 first-time homebuyers.

The housing levy plays a particularly important role in providing for the low end of the income spectrum. A recent example of a levy-supported project is the 108-unit Mercy Othello Plaza, offering rents as low as $450 per month, affordable to a household earning just $18,000 per year.

2. Seattle’s property tax rate is low.

In a 2013 study ranking the effective property tax rates of 51 major US cities, Seattle came in 37th (Portland was 26th). In 2015, the owner of a median-priced $480,000 home paid about $5,000 in property taxes, a rate of 1.04 percent. The national average for property tax is 1.19%, and it runs as high as 2.20 percent in New Jersey.

3. The proposed housing levy is small.

The proposed housing levy would cost the owner of a $480,000 home a total of $122 per year—about as much as a subscription to Netflix. That’s equivalent to only 2.4 percent of the property tax paid by Seattle property owners, and would raise the rate paid in 2015 to 1.05 percent, which is still significantly below the national average.

4. The proposed housing levy would capture only about five percent of Seattle’s property tax revenue, and would rank as the city’s third-largest special-purpose levy.

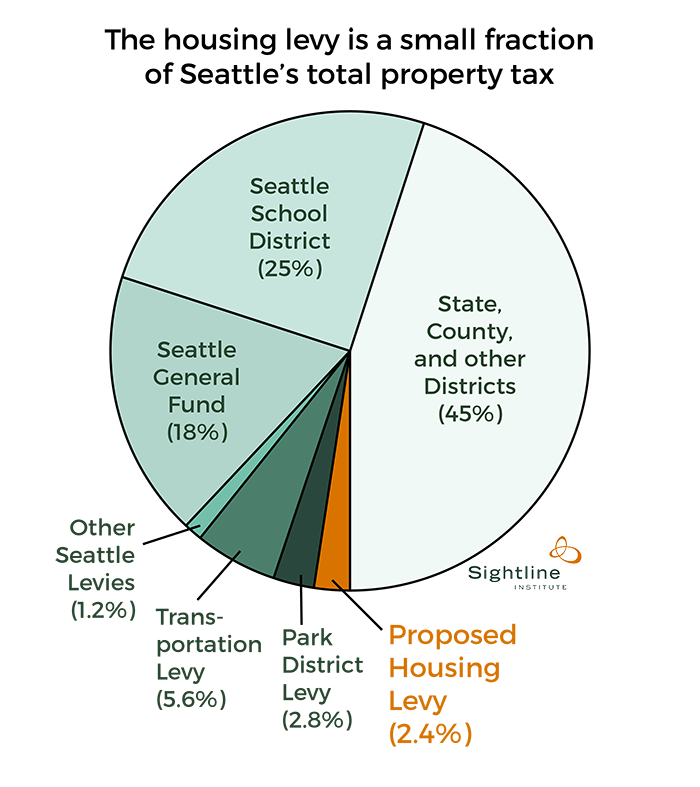

Of the total tax collected on property within Seattle city limits, the City of Seattle and Seattle School District typically receive about 30 percent and 25 percent, respectively. State, county, and other local tax districts collect the remainder. Of the city’s portion, about 60 percent is general fund revenue that requires no voter approval, and the rest comes from voter-approved levies (see the pie chart below for an estimated breakdown of Seattle’s property taxes).

The housing levy would collect $41 million per year, compared with $95 million a year for the city’s 2015 transportation levy and $48 million per year for the 2014 Seattle Park District levy. Considering the scale and gravity of Seattle’s affordable housing challenges, if anything, the expanded housing levy looks relatively small.

5. Property value appreciation dwarfs the proposed housing levy tax increase.

In 2015, Seattle home values rose by 13 percent, or $61,000 for a $480,000 home. That one year of appreciation alone would cover more than 400 years of the extra tax owed under the proposed housing levy.

Of course, not all years are so hot as 2015. Over the 16 years since 2000—including the declines of the Great Recession—Seattle’s median home sales price increased a total of 120 percent. That’s equivalent to an average annual appreciation of 5 percent… which is still about 200 times greater than the added annual tax amount the levy would impose.

6. State law limits property tax increases.

Washington state law prevents cities from enlarging their property tax revenue by more than one percent annually without voter approval. Thus, if property values appreciate by more than one percent, the base property tax rate must be correspondingly lowered so that the tax revenue does not increase by more than one percent (excepting new construction). When annual appreciation significantly exceeds one percent—as it certainly has in Seattle in recent years—this cap shields owners from being taxed on most of their property’s added value. That is, state law mandates a tax break for property owners in cities with fast-rising real-estate values. The bigger the windfall, the bigger the tax break—and that applies to everything from houses to high-rise office buildings.

Voter-authorized “levy lid lifts” allow cities to counteract the State-imposed tax block on rapidly appreciating property. For example, if property value in Seattle appreciated by five percent in one year, the base property tax rate would have to be lowered from 1.04 percent to 1.00 percent, such that effectively only one fifth of an owner’s property value gain would be taxed. The proposed housing levy would recapture some, though not all, of that tax rate reduction, pushing the rate back up to 1.02 percent.

[button link='{“url”:”http://www.sightline.org/2016/03/03/video-seattles-housing-shortage/”,”title”:”Want more? Here|apos;s how rising home values are pushing up rents and pricing people out.”}’ color=”orange”]

7. No, the proposed housing levy will not force people on fixed incomes out of their homes.

This is a favorite claim of anti-levy campaigners, but it doesn’t hold up to scrutiny. First, Seattle low-income households may qualify for an exemption from paying the roughly 90 percent of their property tax bill that is not associated with levy lifts. The exemption is currently available to homeowners with incomes of $40,000 per year or less or who are 61 years of age or older, disabled and unable to work, or veterans with service-related disabilities.

Second, the robust, long-term appreciation of homes in Seattle gives homeowners with limited means the option of borrowing against their equity to cover unanticipated expenses. Home equity can be converted to cash through refinancing, a home equity line of credit, or a reverse mortgage. The cost of the levy is so paltry compared to Seattle’s historic home value appreciation that a very modest loan would cover it, and ongoing equity gains would provide a long-term cushion to pay back loans.

In fact, this equity resource could be leveraged to easily cover a typical homeowner’s entire property tax bill. Remember: Seattle’s 16-year average annual home price gain was roughly five times the total property tax paid over those same years. So over that period, the typical Seattle homeowner could have extracted her entire annual property tax bill out of equity from appreciation and still been left with a net gain of over 80 percent on her home value. And while taking this sort of loan to pay taxes is surely not the most palatable idea to most people, it is a realistic solution that means no one ever need be taxed out of her home.

8. The housing levy fairly spreads the cost of affordable housing subsidies.

First and foremost, owners of the most valuable properties would pay the most tax. The state of Washington’s property tax is a residue of the state’s long-ago embrace of wealth taxes, the fairest of all taxation systems.

All in all, a property tax is the most practical, equitable option for most cities to self-fund affordable housing.

In addition, because every property owner throughout the city pays property tax, the impact is relatively small on each individual property owner. In contrast, developer fees for affordable housing are assessed only on the small fraction of the city’s properties that get redeveloped. With developer fees, owners of high-value properties that won’t be redeveloped for decades—the $700 million, 76-story Columbia Center, for example—contribute nothing toward affordable housing.

One potential unintended consequence of the housing levy is that it could compel apartment building owners to compensate by raising rents, which would disproportionately impact the lower-income households that tend to live in apartments. The portion of a tax that landlords can pass on to renters depends on local market conditions. In any case, for the housing levy the effect is likely to be minimal, because not only is it a tiny tax increment to begin with, but the majority of the tax is collected from property types other than apartments (mainly commercial buildings and single-family homes).

9. The housing levy helps correct for the inequities of an inflating housing market.

Seattle’s housing shortage is driving up both home prices and rents, a circumstance that benefits existing property owners but creates hardships for renters and those who want to buy their first homes. Seen through that lens, a property tax is an apt choice for funding affordable housing, because targeting the tax on property owners helps compensate for the unequal advantage enjoyed by incumbent owners in an inflating real estate market.

Just ask yourself whose shoes you would rather be in: my Seattle renter friend who recently opened her mail to find notice of a 41 percent rent hike, or my Seattle homeowner friend who was just hit with an $800 property tax increase—roughly half of which is for the new transportation levy—on a bungalow that is worth $115,000 more than it was last year.

Let’s Do This, Cascadia

All in all, a property tax is the most feasible, equitable option for most cities to self-fund affordable housing. (A land-value tax would be even better, but that’s another story.) The points enumerated above are most relevant to Cascadia’s other two largest cities—Vancouver and Portland—because they have similarly hot housing markets. But in general, the case for a property tax to subsidize affordability is also strong in smaller cities and towns.

In high-demand cities where housing prices are rising fast, a property tax is especially defensible, as it asks property owners to share a small portion of their good fortune—their unearned gain from real-estate appreciation—with their neighbors not lucky enough to own property.

For Seattle, then, the only question is: why not make the housing levy even bigger? As for the rest of Cascadia, what are you waiting for?

[list_signup_button button_text=”Like what you|apos;re reading? Get the latest Sightline housing research right to your inbox.” form_title=”Housing Shortage Solutions Newsletter” selected_lists='{“Housing Shortage Solutions”:”Housing Shortage Solutions”}’ align=”center”]

Comments are closed.