There’s been a lot of talk in the news lately about the struggles of the US coal industry. Since last spring, US coal companies have declared bankruptcy right and left, with others, such as Arch Coal, now teetering on the brink of insolvency.

But even though 2015 has been a particularly bad year for Big Coal, the industry’s troubles actually started about 7 years ago, when US coal consumption first started to slide.

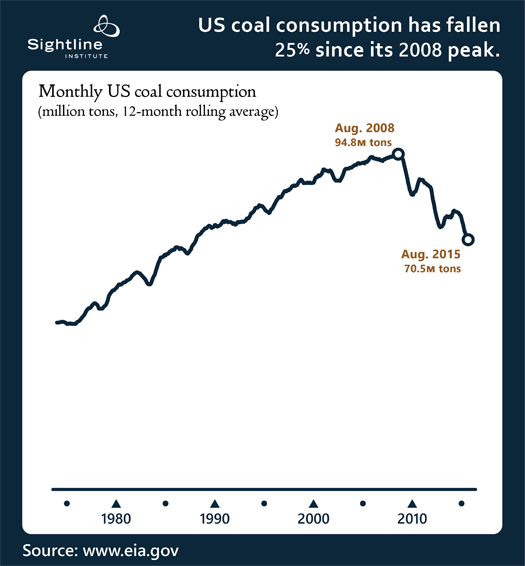

The declines were hard to spot at first. Both the weather and short-term market variations can jostle month to month consumption, obscuring the long-term trends. But the chart to the right smooths out some of the bumps, by taking a rolling 12-month average for US coal demand. What it shows is nothing short of breathtaking: by August 2015, US coal consumption had fallen by more than 25 percent from its 2008 peak. And if coal-by-rail shipments are a reliable indicator, those declines will continue through November and probably beyond.

At first, coal industry analysts assumed that these declines were a short-term consequence of the Great Recession. Indeed, after the US economy started to stabilize in early 2010, US coal consumption briefly ticked upward, even as China’s seemingly insatiable energy appetite inflated international coal prices. With domestic coal consumption rising and international markets appearing rosy, coal industry executives grew overconfident, taking on massive debts to buy new coal assets and expand their empires.

Soon enough, though, everything started breaking against the coal executives. US coal consumption started to plummet once again in mid-2011, as cheap natural gas and renewables cut deeply into coal’s market share. At the same time, international prices came back to earth, as massive new coal supplies from Indonesia, Australia, and China came online just as China’s demand softened.

Unsurprisingly, coal industry executives blame politicians for their current troubles. Yet what really undid the industry was the executives’ own hubris—an unjustified belief that the coal industry was simply too big and too powerful to fail, and that they could take on massive debts without risking insolvency. That hubris served the top brass of the coal industry quite well. The executives of bankrupt coal giant Alpha Natural Resources, for example, paid themselves $3.5 million in bonuses last year, even as they steered their company into a ditch. They’ve assured themselves merry Christmases for years. But for investors and for many of the industry’s former workers, that hubris has left little but unpaid debts, sour memories, and stockings full of unwanted coal.

Comments are closed.