A few years back, when most oil industry analysts thought that oil prices would remain in the $100-per-barrel range for the foreseeable future, domestic oil companies found that they could earn a healthy profit by fracking “tight oil” out of shale rock formations. Drilling activity in North Dakota, home of the oil-rich Bakken Shale, shot through the roof, catapulting the Flickertail State (yes, that’s an actual nickname for North Dakota) into the #2 oil-producing state in the country, second only to Texas.

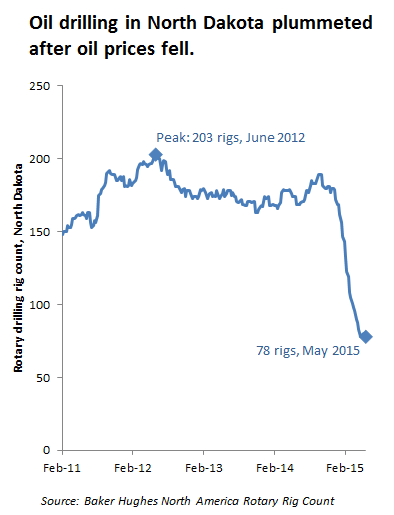

But starting in the summer of 2014, global oil prices began to collapse. Within a few months, US prices had fallen below $50 per barrel, and oil drilling activity in North Dakota collapsed. Take a look at the oil drilling trend for North Dakota, derived from the Baker Hughes North American rotary rig count.

It’s perhaps a little early to see the drilling collapse in the state’s oil production statistics. But some Wall Street analysts have certainly noticed the drilling trend and are starting to speculate that the collapse in shale oil drilling could lead to a new round of oil price volatility.

For the Pacific Northwest—where the oil industry has proposed a host of oil-by-rail projects up and down the coast—the implications of this trend are clear: the oil business is fraught with uncertainty. For years, the oil industry thought that prices would stay high, and that fracking the Bakken would be a stable business. So they planned massive terminal projects to handle all of the new oil they expected to produce.

But if today’s rig count is to be believed, it’s not at all clear that Bakken fracking is economically sustainable. And that raises huge questions about the economic viability of Northwest oil-by-rail projects. Are we seeing the early stages of the same sort of economic uncertainty that have placed Northwest coal terminals in financial limbo? Could the collapse in Bakken fracking turn massive oil-by-rail proposals into “stranded assets“? Stay tuned!!

Comments are closed.