Washington House Democrats recently threw a ball by failing to include badly needed carbon revenue in their proposed budget. There may still be time to get carbon revenue back on the table, but a relief pitcher is warming up, just in case. In March, CarbonWA, a grassroots group, filed ballot language with the Secretary of State, and now supporters are out gathering signatures and raising money to put it on the 2016 ballot.

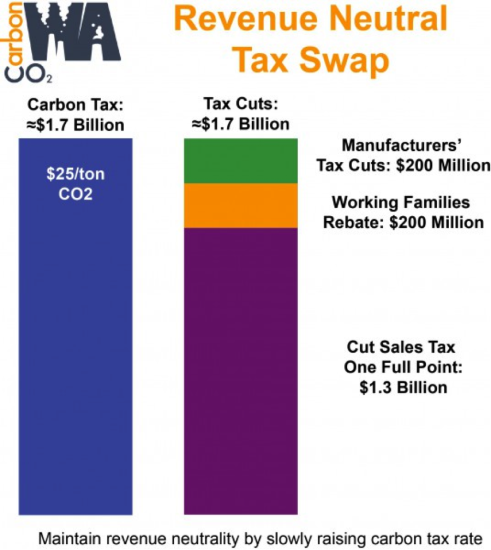

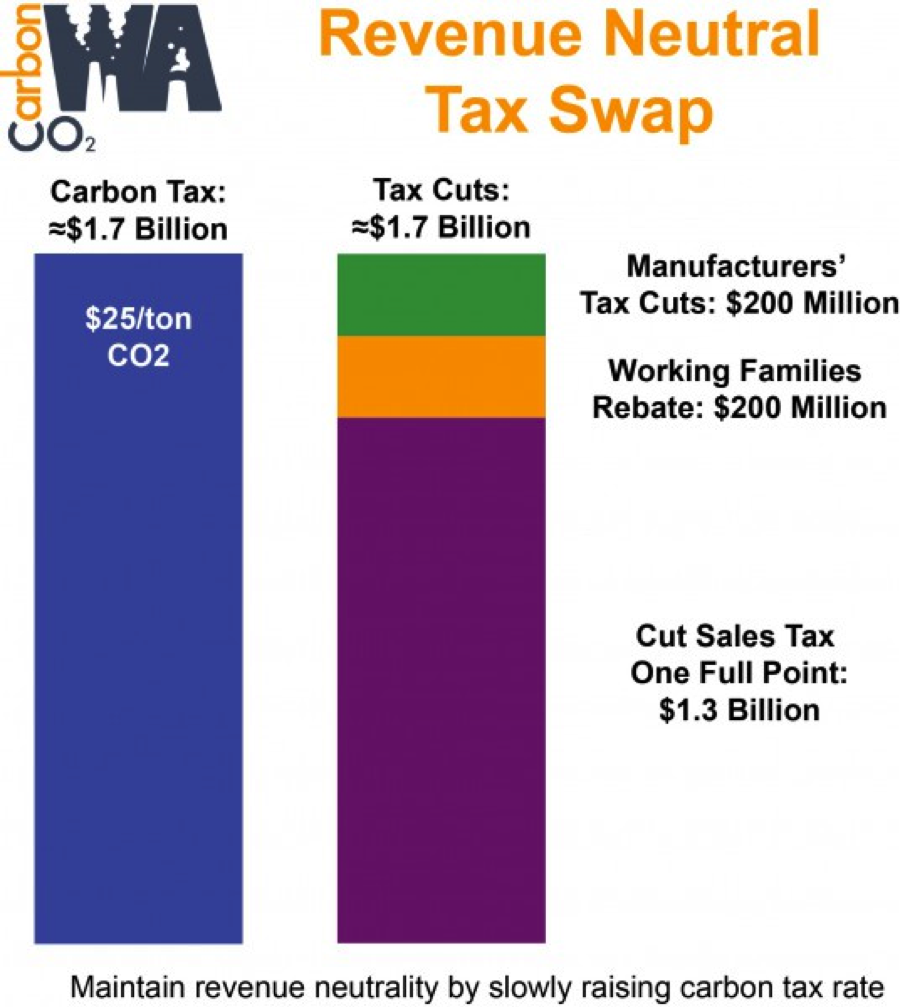

CarbonWA’s Initiative 732 is modeled after British Columbia’s successful carbon tax: it would tax pollution and use all the revenue to cut other state taxes. The CarbonWA tax would start at $15 per ton, rise to $25 per ton in year two, and then slowly and steadily increase by inflation plus 3.5 percent each year. The roughly $1.7 billion in annual revenue would:

- Reduce the state sales tax from 6.5 percent to 5.5 percent.

- Eliminate the business and occupation (B&O) tax for manufacturers.

- Fund the Working Families Rebate to provide up to $1,500 a year for 400,000 low-income working households.

Here’s what you need to know about what CarbonWA’s proposal would mean for Washington:

1. Most households’ total tax bill would not change.

A $25 per ton carbon tax plus a lower sales tax would mean most Washington families would spend a few hundred dollars more in energy prices and would save a few hundred dollars on sales tax. By taxing pollution instead of commerce, Washington could spur the transition to clean energy at no cost to most Washingtonian taxpayers.

If you live in Washington and want to know what the tax swap would mean for you, you can find out from the University of Washington’s tax swap calculator.

2. The Working Families Rebate would make Washington’s tax code more progressive.

Washington has the most regressive state tax system in the United States: the lowest-income families pay nearly 17 percent of their income for state and local taxes, while the richest families pay only 2.4 percent. CarbonWA’s proposal would start to fix that by paying for the never-funded Working Families Rebate. This tax break would reduce the tax burden on a working family with two children from 17 percent to 6.8 percent of income and would constitute the biggest improvement in Washington tax progressivity in almost 40 years.

3. By making polluters pay the true costs of pollution, the carbon tax would spur Washington’s transition to clean energy.

By ending the free lunch for polluters, CarbonWA’s tax would move Washington’s economy in the right direction. British Columbia’s eight-year experience with taxing pollution indicates that a tax of $10-30 per ton can cut fuel use much more than predicted without negative economic impacts. Current prices for electricity from coal, natural gas, and renewables indicate that CarbonWA’s $25 per ton could significantly shift the electricity sector toward less-polluting sources.

A steady and predictably rising price on pollution could usher in an orderly transition to clean energy for free for most households, with the added bonus of improving Washington’s woefully regressive tax code. Win.

Comments are closed.