As the Carbon Pollution Accountability Act, now HB 1314, wends its way through committee hearings, new economic analysis and revised revenue estimates are popping up. It’s still the same pollution-cutting, clean-energy-spurring bill you know and love, but the new numbers show it will send even more money to Washington public schools, and it will also grow jobs. Less pollution, more clean energy, better schools, and more jobs. I think that qualifies as awesome.

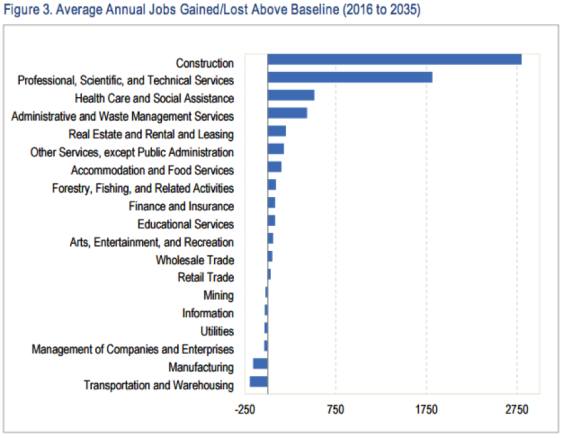

Less pollution means more GDP and more jobs, especially construction jobs.

Last week, the Office of Financial Management (OFM) and the Governor’s office presented findings from OFM’s new economic analysis of the Carbon Pollution Accountability Act, Washington HB 1314. The OFM economic modeling, unsurprisingly, showed results similar to Oregon’s recent modeling of a potential state carbon tax: GDP and jobs grow slightly faster in a future where Washington transitions from fossil fuels to clean energy than in a future where we continue with pollution-as-usual. The differences are small, because the pollution-limiting program would be a minuscule 0.3 percent of Washington’s gross state product of $381 billion. But GDP and jobs are a little higher with the polluters-pay than without, due to investments in schools and roads. The biggest job gains between 2016 and 2035 would be in the construction sector (see OFM graph below), since a large chunk of the pollution revenue would go to building and maintaining Washington’s roads.

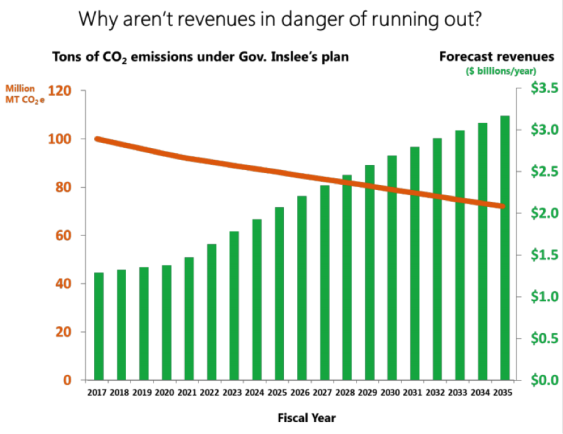

The revenue will not run out.

Assuming pollution prices start at $12.90 per ton in 2016 and slowly rise to $44 per ton in 2035, total revenue will start at $1.3 billion in fiscal year 2017 and increase to $3.2 billion in 2035. Prices have to keep rising in order to drive pollution downward (orange line in graph below), so revenue (green bars in graph below) increases for decades.

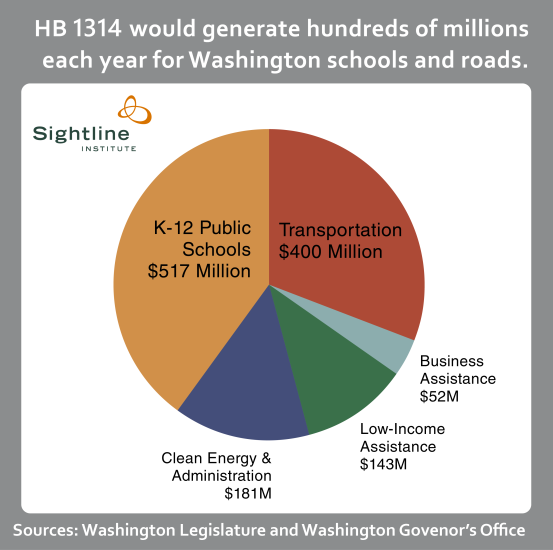

More money for schools

Increased projected revenue plus HB 1314’s slight adjustments to the amount of revenue going to each category means the revenue pie chart (below) looks a little different than when the Act was first proposed. Most of the money still goes to K-12 public schools and transportation, but now there is even more money for schools: an estimated $517 million in the first year. Half a billion would go part of the way to meeting the legislature’s court-mandated education funding requirements.

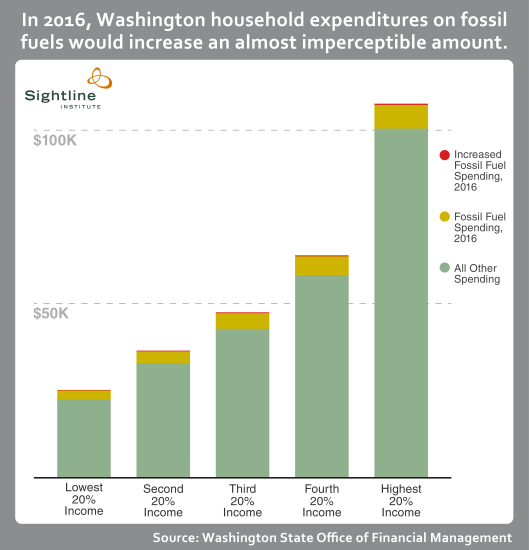

In the first year, households would see a tiny bump in fossil fuel expenditures.

OFM’s economic analysis modeled the fossil fuel cost impact on households at different income levels. As fossil fuel companies pass on the cost of their pollution permits to customers, fossil fuel prices would rise: gasoline would go up about 12 cents per gallon, and electricity up about half a cent per Kwh. In the first year of the pollution program, 2016, the lowest income households would pay about $144 per year more for fossil fuel energy. However, because some of the pollution-permit revenue would fund a Working Family Tax Credit of $223 per household, many of the lowest-income families would completely recoup their costs.

Of course, the point of transitioning off fossil fuels is that Washington households will ultimately spend less of their money on fossil fuels. In the first year, households will see a very tiny—0.36 to 0.65 percent (orange area in chart below)—increase in annual expenditures due to increased fossil fuel costs. But as time goes on and Washington weakens fossil fuels’ stranglehold on the economy, household spending on fossil fuels will decrease.

Refineries, not fuel distributors, will purchase permits.

HB 1314 makes refiners, rather than fuel distributors, purchase permits. Since there are fewer refineries, fewer than 100 facilities will likely need to purchase pollution permits. This new estimate is down from the previous list of up to 130 facilities. There are several facilities right on the cusp of the 25,000 million metric tons cut-off, so the exact number of facilities is hard to pin down. But the bill would update Washington’s existing reporting requirements for large facilities in order to get more clarity on who is in and who is out before the program moves forward.

OFM carefully ran the numbers and found that making polluters pay and reinvesting the money in Washington would trim pollution, grow jobs and the economy, fund schools, maintain roads, while holding working families and vulnerable businesses harmless. You don’t find deals like that very often!

Comments are closed.