Cloud Peak Energy—the third largest coal producer in the Powder River Basin, and one of the main proponents of coal export projects in Washington and Oregon—recently released its earnings statement for the fourth quarter of 2014. And as I read through the details of their earnings statement, I discovered that a prediction I made last fall was wrong.

I had anticipated that Cloud Peak would start reporting losses from its export division starting in 2015. But I was three months too late: Cloud Peak actually reported export losses in the fourth quarter of 2014.

But as bad as that revelation is for Cloud Peak’s export ambitions, the news gets much, much grimmer.

In a question-and-answer session during earnings conference call last week, the company’s CEO projected that Cloud Peak’s export arm will lose roughly $35 million on exports in 2015. Here’s the exact quote, courtesy of the always-useful Seeking Alpha:

David Gagliano – Bank of Montreal: I was wondering…what EBITDA contributions are you assuming for [your logistics] business?

Colin Marshall – President and Chief Executive Officer: For 2015…there will be a loss in the logistics, what, $35 million…that sort of order.

For those not fluent in financialese: “EBITDA” stands for earnings before interest, taxes, depreciation, and amortization, which is a measure of financial health commonly used on Wall Street. And “logistics” refers to the arm of Cloud Peak that handles coal deliveries, mostly to customers in overseas markets. So Marshall was saying that Cloud Peak’s export division will lose roughly $9 million dollars per quarter in 2015—enough to pull down the firm’s overall earnings by some 20 percent.

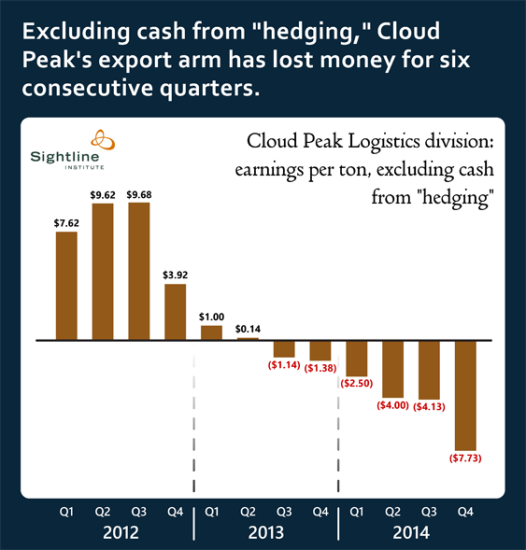

But it gets worse. Cloud Peak’s export arm expects to make about $21 million this year playing the futures market. Back when international prices were high, you see, the company made substantial long-term bets (called “hedges”) that coal prices would fall. Those hedges paid off handsomely. Without them the company would be expecting losses of $56 million in 2015, and would have been reporting accelerating losses for the last year and a half:

In short, the company’s canny bets on collapsing coal prices have been the only thing keeping their export strategy from looking like an absolute dud.

But there’s only so long that a coal company can make money betting on falling coal prices. As Cloud Peak’s price hedges unwind over through 2016, the losses could mount.

Cloud Peak’s export disappointment could spells bad news for the company’s long-term prospects. The company has already admitted that its sales to US customers are falling, forcing cutbacks at their domestic-oriented mines. So they’ve put exports squarely in the center of their growth ambitions. (See, e.g., pages 14 through 23 of this presentation to investors).

But the only thing growing right now for Cloud Peak’s export arm is the red ink—which may help explain why the company’s stock has fallen about 60 percent since last April.

Comments are closed.