We are already paying a high price for fossil fuels: strange and severe weather, asthma and cancer cases, a Northwest economy weakened by huge bills for importing coal, oil, and gas, and the political vice grip that Big Oil has on our democracy. Last year, Portland State University (PSU) gave the Oregon legislature a teaser about how to face those problems with a carbon tax. Intrigued by the possibility of holding big polluters accountable and generating revenue for Oregonians, the legislature asked for more information, and this week PSU’s Northwest Economic Research Center (NERC) delivered. The new and expanded analysis concludes that charging carbon polluters would cut pollution and it could create jobs and raise wages. If Oregon spends the money right.

What scenarios did NERC model?

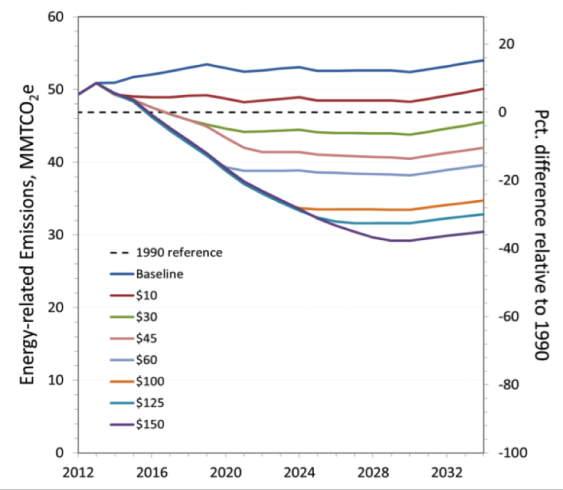

NERC modeled carbon taxes ranging from $10 to $150 per ton of greenhouse gas pollution. The tax would apply to pollution from burning fossil fuels, such as coal, petroleum, and natural gas. It would tax pollution from coal burned outside the state to generate electricity used by Oregonians. In each scenario, the tax starts at $10 per ton in 2014, and then goes up slowly and smoothly, rising just $5 or $10 each year. Knowing that the price to pollute is slowly rising over time gives dirty energy producers the time and the motivation to start investing in clean energy. NERC ran scenarios with prices that maxed out at $10, $30, $45, $60, $100, $125, and $150.

How much carbon pollution can a carbon tax cut?

In every scenario other than $10 and $30 per ton, a carbon tax would enable Oregon to meet its 2020 goal of trimming pollution 10 percent below 1990 levels by 2020. In the graph below, the blue line is the “baseline” or business-as-usual expectation for pollution, and the dotted line is Oregon’s 1990 level of pollution. The red line is $10 per ton tax—it cuts pollution, but not below 1990 levels. All the other lines cut pollution well below 1990 levels.

However, NERC found that even $150 per ton (the purple line), by itself, would not let Oregon reach its 2050 goal of slashing pollution 75 percent below 1990 levels.

This finding is consistent with other states’ experience trimming carbon: a price works best when paired with other policies. It’s the wind in the sails, not the sails. For example, the same economic model concludes that in California a price of $50 per ton will cut carbon 10% below 1990 levels by 2020. But California is on track to cut pollution to 1990 levels with a carbon price currently hovering around $13 per ton, and expects to slash 80 percent below 1990 levels by 2050. California’s price is lower than the models predict because the Golden State is using other policies—like aggressive energy efficiency programs—that work with the price to cut pollution faster and cheaper than a price alone. Indeed, NERC reported that a carbon tax would complement many of the policies Oregon already has in place, such as the Renewable Portfolio Standard and Clean Cars program. Currently, those programs each valiantly struggle forward against the headwind of fossil fuel prices that don’t reflect their true costs. Holding big polluters accountable with a carbon tax would make prices tell the truth about carbon pollution, thus smoothing the path for Oregon’s other policies to do their jobs.

Image by NERC

How much money could a carbon tax raise?

A $30 tax—the same as British Columbia’s carbon tax—would raise about $1.4 billion per year in Oregon. The maximum tax modeled—$150—would raise about $4.5 billion. To put this in perspective, Oregon’s General Fund is about $7 billion per year, and total annual expenditures (including from federal and other funds) are about $27 billion per year. So a carbon tax could provide a meaningful chunk of revenue to the state.

Can carbon revenue create jobs?

NERC found that by holding polluters accountable for their pollution and then reinvesting that money in the state, Oregon could create jobs. A $30 per ton carbon tax that supplements the state’s General Fund—meaning it gets spent mostly on education and health—would create thousands of jobs across the state (dotted line). The Willamette Valley region (lavender line in the graph below, and red region in the map further down) would get the biggest jobs boost.

Not only could a carbon tax reinvested in the state create jobs, it would give everyone a raise. In the $30 per ton tax going to the General Fund scenario, compensation (wages and benefits) would increase by about 1 percent across the state (dotted line in the chart below), and by about 2 percent in the rural Central (red line), Southwest (orange line), and Northwest (teal line) regions. Rural regions get a bigger benefit because more General Fund money is spent per person in rural areas. Most of the new jobs would be construction jobs to build or maintain schools, roads, and prisons.

Image by NERC

Wait, won’t a new tax destroy jobs?

Under every scenario NERC modeled, jobs growth in Oregon was strong. The worst scenario NERC was able to come up with is the tax revenue could get stuck in financial reserve funds and not spent in the economy at all. Taking money and locking it away is obviously a bad move for the economy. This worst-case scenario would result in 1 percent slower job growth compared to business as usual—see the red line in the graph below, slightly lower than the dotted business-as-usual line. On the flip side, the green line shows how investing the money would grow jobs slightly faster than business-as-usual.

Image by NERC

Using the money to reduce personal income taxes would also create a slight drag on job growth, though not as much of a drag as stashing the money in reserves. Higher-income people pay higher taxes, so a tax break would help them more than lower-income people. Higher-income people are more likely to save the extra money, which doesn’t help the local economy, while lower-income people will likely spend money from a tax break immediately, giving the economy an immediate boost. But even if individuals do spend their tax break, they may use it to buy food or products that were produced outside of Oregon, thus losing some of the local economic benefits.

The best way to help Oregon’s economy is to invest the money in the state. The best in-state investments are local projects like energy efficiency, schools, and road maintenance. In the scenarios where the government spent the money on these types of projects, jobs and wages increased, especially in rural areas.

Won’t a tax hurt rural people because they have to drive more than urbanites?

The Portland Metro region—green in the map below—emits 60 percent of the state’s pollution and so would pay 60 percent of the tax. The Valley region—red in the map—emits 20 percent of the pollution. The remaining 20 percent of emissions is split relatively equally between the other four regions.

Image by NERC

In all scenarios, the tax hits the Metro region harder than it hits the rural regions. More of the energy-intensive commercial and industrial activities—such as outdoor gear companies and breweries—are concentrated in the Metro region, so Metro emits more pollution per person than rural areas: 43 percent of people in the state live in Metro, but they emit 60 percent of the state’s pollution. Metro would pay more of the tax and would also be responsible for more of the pollution reductions. Most of the reductions would come from industries tightening their efficiencies and burning less fossil fuel.

NERC did not specifically analyze the driving cost impacts, but its results showing more jobs and higher compensation in rural areas compared to urban is consistent with a 2013 analysis showing that rural drivers do not actually drive more miles than urban drivers: rural drivers take longer trips, but take them less frequently than urban drivers, so urban drivers actually slightly more miles per year than rural drivers. With miles driven about the same and more industries in the metro area, it turns out the tax hits urbanites harder than rural dweller.

How would a carbon price affect people of different incomes?

The lowest quintile of income-earners in Oregon spends 25 percent of their income on energy (gas, electricity, natural gas, and home heating fuel) while the highest earning quintile spends only 4 percent. This means that a carbon tax hits the lowest income-earners the hardest. However, NERC found that a rebate of just $14 to $100 per tax filer (depending on his or her income, region, and the level of the tax) would make him or her whole. In other words, with a small amount of assistance, poorer Oregonians would not be hurt by the carbon tax, and their communities could benefit from increased investment. The state would not need to create a new bureaucracy to administer this assistance—it could use existing channels such as the low-income bill assistance and low-income weatherization programs.

What should the legislature take away from all this?

Charging polluters for the carbon they dump in the air can cut carbon pollution and raise revenue. If Oregon spends carbon money upgrading homes, businesses and schools to be more efficient and improving the maintenance and safety of roads across the state, it will create jobs and raise wages, especially in rural areas.

R Briggs

“However, NERC found that even $150 per ton (the purple line), by itself, would not let Oregon reach its 2050 goal of slashing pollution 75 percent below 1990 levels.”

Eyeballing the energy-related emissions lines, one can infer that ramping at $10/ton CO2 would lead to a decrease in emissions of about 1.8 MMTCO2e (3.5%) per year. Stick with that for 30 years adjusting the $10/ton for inflation and you just might have the whole problem solved; i.e., zero emissions.

James Hansen says it costs $600/ton to remove carbon from the atmosphere using current methods. So even after 30 years when the tax hits $300/ton you still may be charging less than it takes to remediate the damage. And zero carbon emissions is really where we need to be as soon as possible, not at 75 percent below 1990 levels by 2050.

The graphs don’t reflect any short-coming in the taxing carbon approach or its ability to solve our problem, but rather that the policy will not enable us to reach an ambitious long-term goal if we phase it out when we’re halfway there.

Prentice Smith

The article keeps pointing out that the ‘big oil’ and ‘big polluters’ need to step up and show the ‘true’ cost of fossil fuels. But I am confused – how does a farmer plow his field any more efficiently? How does a school bus or long haul trucker get the job done without creating pollution? Same with airplanes, locomotives, etc.. There are many fossil fuel users that simply cannot alter the way they conduct how they do business, and no amount of tax will alter the amount of pollutants created.

How does this tax remove carbon? Very few of us just take pleasure drives anymore, and the era of multi-state car bound vacations has diminished. All of us are turning down our thermostats and buildings have never been more efficient with heating costs and resulting pollution.

But, there will be higher food costs for the consumer because the farmer has to pay more for his fuel, and the trucker has to pay more to get the wheat/produce/cattle etc. to market. School districts will have to pay more for fuel, and the same with county transit.

But the government gets a new revenue stream with seemingly no strings attached. Who thinks that is a good idea? More complexity to our daily lives and higher costs for the individual leaves less $ at the end of the month. Plus, the tax does not remove carbon in any meaningful way.

I don’t get the appeal to this ‘solution’.