Chinese customs statistics show that the nation’s coal imports fell 26 percent year-over-year in November. (Yes, the link above is to a page in Chinese, but Google Translate does a nice job with it.)

That’s the fifth straight month in which Chinese coal imports have fallen compared to 2013. Through June, the country was actually importing a wee bit more than it did the previous year. But for the second half of the year, imports have been plummeting. Overall, year-over-year imports for July through November are down 22 percent.

| Month | Year-over-year change |

| July 2014 | -20% |

| August 2014 | -27% |

| September 2014 | -18% |

| October 2014 | -17% |

| November 2014 | -26% |

| July-November | -22% |

Because of the second-half import slump, China’s coal imports are on track to fall by 10 percent for the year as a whole.

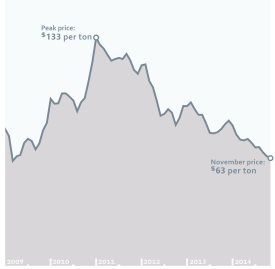

It’s hard to overstate how significant this decline has been, especially considering all of the hype we were hearing just a few years back about endless growth in Chinese coal markets. And what’s especially surprising is that China’s coal imports fell even as seaborne coal prices were regularly hitting multi-year lows. See the chart to the right, which shows the price of benchmark coal shipped out of Newcastle, Australia, one of the main coal export terminals supplying the Pacific Rim. China could have picked up lots of coal from seaborne markets for prices just a fraction of what they could have paid just a few years back.

But China’s simply not buying. The country has started to radically reshape its relationship with coal in ways that are radically undermining the bullish case for the seaborne coal market. And that’s the fundamental reason why Northwest coal export terminals are facing such severe struggles finding new investors: in today’s market, coal exports simply don’t pencil out.

Comments are closed.