I give a lot of talks about revenue-neutral carbon taxes—especially the Carbon Washington proposal to implement a BC-style carbon tax and use the revenue to cut sales taxes and business taxes. The question that is far and away the #1 question asked by conservatives is:

How do you know it’s going to stay revenue-neutral? It sounds all well and good to combine a carbon tax with dollar-for-dollar reductions in sales taxes and business taxes, but the legislature will just raise the sales tax back up, so pretty soon we’ll get stuck with both taxes.

I have two responses, one for realists and one for cynics.

Realists and cynics

If you’re a cynic, there’s nothing I can say to address your concerns. That’s because cynics are so terrified of things getting worse that they refuse to consider the possibility that things could get better. Rightly or wrongly, cynics believe they’ve seen too many promises broken and are skeptical of “facts” provided by anyone in politics. As a result, when it comes to politics their main concern is what my fellow comic Douglas Gale used to characterize as a one-sentence political platform:

“Vote for me and I’ll keep the g**-d*** kids off your g**-d*** lawn!”

If you’re a realist, however, then you pay attention to facts. And the most important political fact of the past few decades is that there’s been a complete and total stalemate about the size of government revenues.

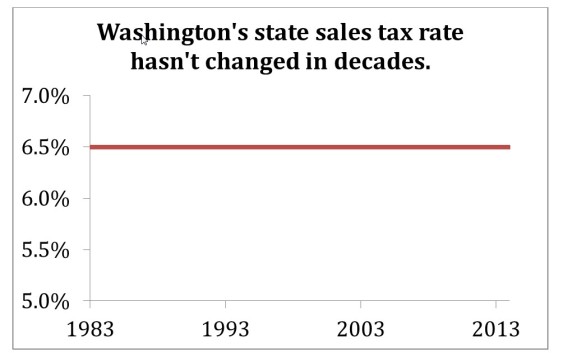

This is best captured by looking at the state sales tax rate in Washington going back over thirty years.

Source: Tax Statistics 2013. Original Sightline Institute graphic, available under our Free Use Policy.

Over the past 30 years, the state sales tax rate in Washington hasn’t gone up. It hasn’t gone down. It hasn’t gone anywhere. A reasonable conclusion, then, is that a revenue-neutral carbon tax that cuts the state sales tax from 6.5 percent to 5.5 percent will keep it there. Whatever political forces have been maintaining stability at 6.5 percent will maintain stability at 5.5 percent.

“Okay,” you say—because you’re a realist, not a cynic!—“but what about local sales taxes, or other state taxes? Surely those have been going up?”

This may be true in individual instances—for example, the local sales tax rate in Seattle has gone up from 1.3 percent in 1983 to 3.0 percent now—but there are also examples on the other side, such as the Department of Revenue noting that “the average statewide [property tax] levy rate has dropped from $3.59 per $1,000 assessed value in 1997 to $2.31 in 2007.” The best overall data I know of look at state and local government spending in Oregon and Washington as a percentage of personal income. They have been pretty much unchanged for over 20 years. I have not been able to find identical data for British Columbia, but this graph suggests that provincial revenue has been relatively stable as a percentage of GDP for over 40 years.

Source: Tax Policy Center 2013, “State and Local Direct General Expenditures as a Percentage of Personal Income.” Data not available for all years prior to 2004. Original Sightline Institute graphic, available under our Free Use Policy.

At the federal level, US government revenue as a percentage of GDP has mostly been declining or stable.

Source: Based on Tax Policy Center data. Original Sightline Institute graphic, available under our Free Use Policy.

A realistic view

The realistic view, then, is that there has been a stalemate over the past few decades about the size of government budgets relative to the size of the economy. A revenue-neutral carbon tax shift would not change that.

That’s not to say that there aren’t battles ahead related to transportation funding and education funding and who knows what else. Those battles will probably be fought along largely partisan lines, and there are some (possibly including some of my Sightline colleagues) who will want to, as Governor Inslee put it, “skin two cats or three cats with the same program” by using carbon pricing revenue to bolster government coffers. That’s a different question: the never-ending left-right war over how big government should be. And the whole point of a revenue-neutral carbon tax swap is to set that question aside and focus on reducing carbon emissions.

The fiscal stalemate of the last few decades means that realists can rest easy knowing that a revenue-neutral carbon tax swap really can be revenue neutral. Prince Humperdinck from The Princess Bride said: “I always think everything could be a trap, which is why I am still alive.” But Humperdinck was a cynic. Conservatives can support a tax swap without fearing a trap.

Research assistance by Pablo Arenas and Summer Hanson.

Update: Here’s a follow-up post about the #1 question from progressives about revenue-neutral carbon taxes.

Ben Schonberger (@SchonbergerBen)

Aside from carbon taxes, the graphs show the fallacy of the conservative position that a voracious government sector is steadily consuming an ever-larger share of the economic pie.

Kristen Walser

Another way to return revenue is through a monthly rebate or dividend to all adults in an equal share, as suggested by the Citizens’ Climate Lobby. Receiving a monthly dividend via direct deposit or a check ensures that those who will be affected most by the rising costs of fossil fuels, those without an income tax or a business, will also receive help during the transition to efficiency and energy alternatives.

As for the cynics, there’s nothing like a monthly rebate check to keep the voters’, and therefore the politicians’, loyalty to the tax. See citizensclimatelobby.org for more information and to locate your local chapter.

Christin

I love that idea! Besides being fairer to those who lack income, it allows citizens to use the rebate money to lower their personal carbon emissions even further!