As we pointed out yesterday, inclusionary zoning (IZ) ordinances—rules that encourage private developers to provide some housing to lower-income tenants at below-market rates—were largely a reaction against “exclusionary zoning” practices that made it hard to build low-cost housing in many municipalities. Starting in the early 1970s, hundreds of cities and towns across the United States began to adopt IZ policies. This raises a key question: how effective have these programs been in boosting the supply of affordable housing, and reversing the legacy of exclusionary zoning?

The truth is that it’s hard to tell, in part because inclusionary zoning programs come in all shapes and sizes. Some IZ programs are mandatory, while others are purely voluntary. Some offer developers incentives to provide low-cost housing, others do not. They differ in the share of new units that developers must produce; the price targets for affordable housing; the length of time that units must remain at below-market rates; and many other details.

This dizzying variety makes it difficult to analyze how IZ programs affect local housing markets. Consequently, much of the formal academic literature on IZ has relied more on theory than on empirical evidence.

But in 2008, researchers from New York University’s Furman Center for Real Estate & Urban Policy tried to bring order to the chaos by systematically analyzing IZ programs from 1973 through 2004 in three metropolitan areas: greater San Francisco, suburban Boston, and the Washington, DC region. (The small number of participating jurisdictions in the D.C. area prevented a robust statistical analysis of that city.) But even with its data constraints, the Furman Center report is one of the few empirical reviews of IZ’s impact on regional housing markets.

| San Francisco Area | Suburban Boston | Washington, DC Area | |

| Prevalence | 7/10 counties | 99/187 cities & towns | 5/23 counties |

| Year Adopted Median | 1973-2004 | 1974-2004 | 1973-1996 |

| % of Mandatory Programs | 93% | 58% | 80% |

| % of Units That Must Be Affordable | |||

| Median | 15% | 10% | 8.13% |

| Range | 5-25% | 5-60% | 6.25-15% |

In many ways, the Furman study pointed to the limits of inclusionary zoning. In suburban Boston for example, the research found that 43 percent of IZ programs failed to produce any affordable units. IZ programs in the Washington, DC metro area had more success, but still created only about 15,252 below-market units over 30 years—with roughly 3/4th of those units in Montgomery County, Maryland, home of the nation’s oldest IZ program. In greater San Francisco, IZ programs produced 9,154 affordable units over the three decades studied; a typical program in the region produced about 9 units of housing.

The Furman researchers found that municipalities that adopted IZ tended to differ from those that chose not to: jurisdictions with IZ tended to be larger and more affluent than those that did not, and to have neighboring jurisdictions that also adopted the zoning ordinances; they also had adopted land use policies such as cluster zoning or growth management.

Interestingly, the researchers noted that IZ programs affected housing markets differently in San Francisco than in Boston.

- In greater San Francisco, researchers discovered that IZ ordinances were associated with a small decrease in housing prices when overall housing markets were falling; but when regional housing prices were appreciating, inclusionary zoning programs were associated with a small increase in local housing prices. Overall, they found that inclusionary zoning had no statistically significant impact on either the amount of housing produced or on median housing prices in the Bay Area.

- In suburban Boston, during periods of rising housing prices inclusionary zoning modestly constrained housing production while contributing to a small increase in housing prices, but had no impact during declining housing markets.

For their final conclusions, Furman researchers ended on a careful note. Owing to the potential negative impacts on the price and supply of market-rate housing, the authors urged municipalities considering IZ programs to act with caution before full implementation.

Similarly, a second empirical review concluded on a cautious note regarding IZ ordinances. The authors of this journal article studied housing market effects of IZ in California from 1988 to 2005, and they found that the ordinances do have a measurable impact on local markets:

- IZ programs were associated with an increase in the price of single-family houses, while the size of these units decreased.

- There was no decrease in the amount of single-family homes constructed, but there was an increase in production of multifamily homes.

- Lastly, IZ policies led to a reduction in the size of market-rate homes.

Perhaps the most surprising conclusion from a review of the history of inclusionary zoning programs is the low number of affordable units that such programs have actually created. Since 2001, Seattle’s modest incentive zoning program has generated $31.6 million in payment fees from developers, and $27.2 million of that has created 616 affordable rental units, or about 50 per year. Additionally, 56 affordable units have been built onsite in new developments in this same time span. Notably, this is out of a total of 40,000 new households added between 2000 and 2014 (an average of 2,850 per year). But even in the Bay Area, which has a much more robust set of IZ policies, the programs there produced fewer than 10,000 units between 1973 and 2004, out of a population of 7 million. That’s not to say that more aggressive inclusionary zoning programs might not create more affordable units—but it certainly shows that, even in places where IZ has been used for decades, the effects on new affordable housing construction have been modest.

Exclusionary Zoning?

Inclusionary zoning represents, in part, an attempt to fix the housing problems created by exclusionary zoning. But while debates over the usefulness of inclusionary zoning sometimes spark white-hot passions, they typically miss a more fundamental problem: Cities of the Pacific Northwest still struggle mightily with the legacy of exclusionary housing policies.

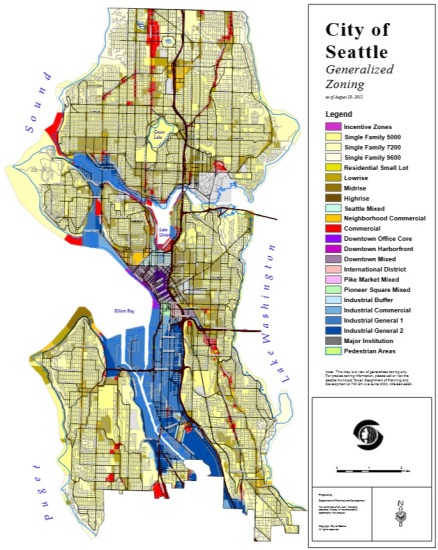

Distressingly, exclusionary zoning remains the norm in the Northwest, and creates huge problems for housing costs. Zoning policies in many cities continue to reserve the majority of residential land for single-family housing, which limits the supply (and increases the price) of land for multifamily development. As depicted by the light yellow in the map below, 65 percent of Seattle’s zoned land is reserved for single-family housing (with a lot size between 5,000 and 9,600 square feet).

Cities continue to outlaw many of the most inexpensive forms of housing, as well as once-common forms of compact, family-friendly housing such as courtyard apartments. New forms of lower-cost housing—small (or micro) apartments, housing without parking—face fierce opposition from neighborhood groups and political roadblocks.

Curbing exclusionary zoning offers one place where all sides of the inclusionary zoning debate can agree. Pacific Northwest cities should steer towards those policies that help boost overall housing supply and make new lower-cost housing both legal and profitable. Undoubtedly, stakeholders must expand their conception of what constitutes the housing affordability debate, and make a long-lasting commitment to gradually erase the region’s legacy of exclusionary zoning.

Thanks for research assistance must be extended to A-P Hurd of Touchstone, and Esther Handy, legislative aide to Seattle City Councilmember Mike O’Brien.

Comments are closed.