Editor’s Note: Washington’s Carbon Emissions Reduction Taskforce is on the job, weighing alternative carbon-pricing proposals. Some members of the panel have asked what our ideal policy would be for Washington State. Yoram Bauman shares his thoughts today. Alan Durning will share his argument for a California-style cap-and-trade system, with key modifications, another day.

If I had my druthers, Washington State would push for a BC-style revenue-neutral carbon tax. Full disclosure: I’m part of the CarbonWA.org campaign to put just such a policy on the ballot in Washington State in 2016. In this article you’ll find information on the latest iteration of the CarbonWA policy proposal.

The BC approach

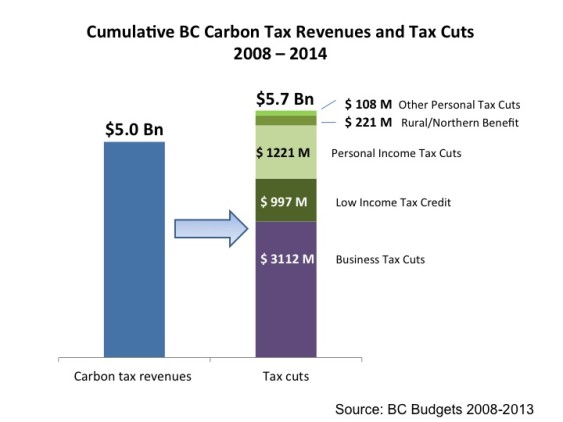

The basic idea behind the BC approach is to phase in a carbon tax on fossil fuels and pair it with broad-based tax reductions that benefit most households and businesses—which BC does by reducing personal and corporate income taxes—plus targeted tax reductions that focus on communities that may be disproportionately affected by the carbon tax, such as low-income households. (To match the language I’ve used in previous posts, the broad-based tax reduction is the entrée and the targeted benefits are the side dishes.)

Adapting the BC approach for Washington State

Something very much like the BC approach might work in Oregon, which, like BC, has an income tax. But Washington State has no income tax, so the CarbonWA proposal is for the entrée to be a reduction in the state sales tax, which generates revenue from just about all of the state’s households, businesses, and organizations, and for the side dishes to be targeted benefits for low-income households, manufacturers, and small businesses.

More specifically, the latest proposal from CarbonWA.org is to reduce the state sales tax rate (currently 6.5 percent) to 6.0 percent in year 1 and to 5.5 percent in year 2 and beyond. (City and county sales taxes would be unchanged, so in most parts of the state the result would be a reduction in the total sales tax rate from about 9 percent to about 8 percent.) A one-percentage-point reduction in the sales tax may not sound like much, but sales taxes generate revenues of $2,000 a year or more (see Table 9-1) from most households in Washington State; a one-percentage-point reduction would save many households almost $300 a year. Not coincidentally, that’s also what an average household would pay for a BC-style carbon tax, so in broad strokes this policy would mean that an average household would pay about $300 more for fossil fuels and about $300 less for everything else. (Results may vary for individual households, so CarbonWA.org is developing a carbon tax swap calculator that will allow you to see how it pencils out for your household.)

The sales tax reduction is the entrée, but there are side dishes for three groups of special concern in terms of carbon tax impacts: low-income households, small businesses, and energy-intensive trade-exposed manufacturers. For low-income households, the CarbonWA.org proposal will fund the Working Families Rebate, a policy based on the federal Earned Income Tax Credit that will provide up to $1500 a year for 400,000 working families in Washington State. (See the great work of the Washington Budget & Policy Center, but note that they’re assuming a 10 percent credit, while we’re assuming a credit of 15 percent in year 1 and 25 percent thereafter.) For small businesses, we will triple the small-business tax credit for the business and occupation (B&O) tax. For manufacturers we will reduce or eliminate the B&O tax for manufacturing. And note that the state Department of Revenue estimates (see Table 9-3) that business purchases generate 36 percent of state sales tax revenue, so all businesses—like all households—would save from the sales tax reduction.

Tax Swap by CarbonWA.org (Used with permission.)

All those incentives would cost almost $2 billion a year, and we will recoup that money with a carbon tax. The carbon tax would start in year 1 at $15 per metric ton of CO2 (equal to about $0.15 per gallon of gasoline or 1.5 cents per kWh of coal-fired power) and increase in year 2 to $25 per ton. Thereafter it would go up 5 percent per year in order to maintain revenue neutrality by keeping pace with inflation, economic growth, and carbon reductions. Like the BC carbon tax, the Washington State carbon tax would apply to the carbon content of fossil fuels burned in the state; unlike the BC carbon tax, it would also apply to the carbon content of imported electricity (carbon by wire) and to the carbon content of fuel loaded onto planes and boats heading out of the state. We are considering a peak rate of $100 per ton, which would occur in about 2050, and we are also considering exemptions for fuel used by farmers and public transportation systems (see Table 17) that total about 2 percent of fossil fuel consumption.

The big idea, again, is not to increase or decrease state tax receipts but to shift them in a revenue-neutral way so that more-polluting commodities and activities becomes more expensive and less-polluting commodities and activities becomes less expensive. Carbon emissions will gradually decline (BC has seen reductions of 10-15 percent), and money in and money out will be in rough balance for the next two or three decades. Beyond that, revenue neutrality is a bit less certain, but what is certain in that longer time frame is that tax reform will be necessary anyway. (For example, if there’s no carbon tax revenue in 50 years, then there will also be no gas tax revenue, and hence no money for road maintenance.) And keep in mind that our tax swap amounts to about 10 percent of state government tax revenue, so from a budgetary perspective the “worst-case scenario” (of zero fossil fuel emissions!) features only a 10 percent reduction in state tax revenue.

Thinking strategically about the political context

Now for the politics: The benefits of a revenue-neutral carbon tax are twofold: If we win, it will be terrific; if we lose it will still be OK. We need to think strategically about both outcomes because carbon pricing is what is known in political circles as a heavy lift. Success is not impossible, but it’s certainly not a slam dunk.

First, let’s think about what happens if a carbon tax loses. Losing would, of course, be unfortunate, but it wouldn’t be the end of the world. In large part that’s because nobody expects a carbon tax to win (“It’s got the word ‘tax’ in it,” “You can’t be honest with voters,” “Nobody will vote for a gas tax,” etc.). Those expectations are misguided—the polling basically suggests that carbon tax proposals are neither doomed nor less popular than cap-and-trade proposals once all the arguments are on the table—but it’s nonetheless true that those expectations do exist.

The bottom line, misguided though it may be, is this: If a revenue-neutral carbon tax loses, the chattering classes will say, “Duh!” If a cap-and-trade system loses, the chattering classes will say, “Climate action has no public support.”

A loss for cap-and-trade would be especially damaging because of the national implications. Right now there’s a cap-and-trade system in California and some East Coast states, and folks who are keen on these policies want to take them national. A win in Washington State would build momentum toward national action, but a loss would be a significant setback. That’s not true for carbon taxes because there’s no momentum to lose; all we have is the world’s best climate policy in a West Coast province of Canada that most folks ignore.

That’s an additional benefit of a carbon tax: Even if it doesn’t pass, we will raise the profile of the BC carbon tax. The old joke is that the most boring headline in the world is “Worthwhile Canadian Initiative,” but a revenue-neutral carbon tax campaign in Washington State would help bring more attention to the BC success story.

Finally, there’s some chance that a carbon tax proposal would reduce emissions even if it loses and doesn’t become law. Evidence from BC suggests that the carbon tax has reduced motor gasoline emissions much more than expected because of “salience.” My own interpretation here is that the carbon tax was in the news every day for a long time, so consumers responded not just to the price increase but also to the news stories. It therefore seems plausible that news stories by themselves—about legislative or ballot measure proposals to implement a carbon tax—could reduce carbon emissions even if the carbon tax never happens. (This would make a great PhD dissertation topic. Of course, the really great dissertation would be to follow the successful implementation of a carbon tax.)

Building on the best climate policy in the world

Let’s be honest: Everybody in the climate world can tell happy stories about how great it will be if their particular policy gets implemented. But I think the carbon tax story is especially compelling. This policy means we will be putting a price on carbon that is on par with BC’s carbon price, which is the highest broad-based carbon price in the world. A price of $25 per ton of CO2 is double California’s price and many multiples of the carbon prices on the East Coast and in Europe.

Passing a revenue-neutral carbon tax—and following through by keeping it revenue-neutral—wouldn’t just be a win for left-wing tree huggers. It would also be a win for all the brave conservatives, including local champions like Todd Myers as well as national figures like Hank Paulson and Bob Inglis, who have stuck their necks out for revenue-neutral carbon taxes. This is important because ultimately the goal is not to solve climate change in Washington State but to lay the groundwork for national and international action, and national action will almost certainly require votes from conservatives. Getting those votes will be hard, but a BC-style carbon tax is our best hope. (Remember that the BC carbon tax itself was passed by a right-of-center government.)

The upside, then, is that Washington State follows the path of British Columbia: carbon emissions fall, revenue neutrality works out as promised, and (grumbling aside) voters and both major political parties accept the carbon tax swap as part of the fiscal and environmental landscape. Like British Columbia, Washington State could then focus on building a strong economy and serving as a model for North America and the rest of the world.

A BC-style revenue-neutral carbon tax is a policy that makes sense for the economy and for the environment in Washington State. The politics play out in such a way that the policy has a limited downside if it loses and a great upside if it wins. That combination—low risk, high reward—makes for a great investment.

Steve Harrell

Yoram,

Nice piece of advocacy. Maybe the way to phrase this for a public vote would not be “revenue neutral carbon tax,” which sounds wonky and therefore suspect, but some catchy kind of “swap.” I can’t think if the right phrase right now (I’m just a doggerelist, not an actual standup-guy like you), but something like “Sales for Carbon Swap” or something catchier.

Yoram Bauman

Good idea… we’re working on it!

Dennis

And what happens to the fuel loaded in state portion of ths tax when the airlines and shipping companies figure out its cheaper to fuel up somewhere else? This is just another recipie for chasing business out of state

Bruce Burdick

For a name, how about “Phase out the sales tax, phase in a CO2 emissions fee”

Or

“Carbon Fee that goes to thee”

Thanks for the article. A California Senator is thinking of changing the California sales tax

Let us hope he will consider your idea of a British Columbia type carbon fee

John Worthington

Your tax credit position came up in an article about Alberta’s new carbon tax credit. Reducing the state sales tax would not bring about the proper conditions for reducing a carbon footprint in a reasonable time frame. Your position appears to be a continuation of making it too expensive to keep doing business the old way, and a financial coercion to do things a new way which is to the benefit of the responsible elite who have invested in run down urban properties taking advantage of publically funded utopian socialized mass transit projects to acquire square footage bumps in the name of saving a whale salmon and frog.

Rather than line the pockets of the responsible elite I would rather design systems that moved people from where they live now rather than wait until your economics frustrated everyone into a carbon friendly scheme. By the time we accomplished that frustration and mode shift we would suffer huge economic loss and further environmental damage.

Because my approach does not make the responsible elite any profits and does not see the carbon footprint debate through density colored glasses even though it makes perfect sense from a mobility standpoint, it will never get the proper traction it deserves. Moving people from where they live now in an overly efficient manner using express systems so as to reduce reliance of freeways, is not an agenda supported by the politicos and pundits on the payroll of the responsible elite whom have teamed up to acquire density and square footage increases that come along with that quest. They would rather sabotage our current system and make money off of Lovie and Thurston’s relocation to the utopian socialized mass transit corridor, and search for Santa Claus developers willing to build affordable little Odessa developments for the poor.

Your carbon tax plan only serves to support the cash grab by the responsible elite and further delays the development of futuristic travel modes that take anyone anywhere they need to go in an environmentally friendly manner within 5 or 10 minutes, rather than imprison them in isolated developments that target all economic activity within a confined utopian socialized mass transit corridor. Furthermore, your tax will make goods and services skyrocket.

Unfortunately, there is such a thing as economic fatigue, caused by the lack of economic activity because people are tired of spending capital downstairs at the local shop for the 5th time this week or forgo spending altogether because it is astronomical . That economic suppression will present a economic model that will not offer enough lure to spend capital in new places and experience different markets elsewhere.

My views not only provide a quicker environmental protection they offer a better economic result of people maintaining economic freedom they have traditionally enjoyed without the environmental damage.

All it takes is the investment in those express systems. These investments will never be made even if a carbon tax is put in force, because the responsible elite are bent on paying politicos for density policies that favor sabotaging our current system so the public has no choice but to fill in the developments and pay out to the responsible elite.

Therefore, I see your position on the carbon tax a mere sophist position that supports more of the same and part of a grand fraud that cuts off our economic nose to spite our environmental faces, because it makes money for the responsible elite under the guise of saving a whale salmon and frog in Colorado.

JW