Sound Transit Bus 554 makes its first non-freeway Seattle stop at 5th and Jackson in the International District. A first-time Seattle visitor departing there is greeted not by a vibrant streetscape, but by five vast surface parking lots: a bold but disappointing proclamation that even in the transit-friendly urban core, the car is still king.

Could a land-value tax help dethrone the automobile?

Sightline has argued time and again that municipal parking rules have distorted housing markets and jacked up the price of rental housing. But the surface parking lots that dot the Northwest’s major cities are a symptom not so much of misguided parking rules, but largely of something else: land speculation.

Consider the lot to the left, at 500 S Main St. It’s right in the heart of Seattle’s International District and just a few blocks from Safeco and CenturyLink Fields. Owned by Fujimatsu LLC, the lot measures 27,000 square feet, about half the size of a football field. When I visited shortly after noon on a recent week day, 77 of its 100 spots were in use. By 5:30 pm, the picture speaks volumes: the lot was nearly deserted.

Although the lot’s owners have done very little to the property for years, it’s still been a sound investment. For 1998-99, King County appraised the two adjacent lots at $720,000 and $693,000, respectively. By 2014-15, those numbers had shot up to $2,016,000 and $1,764,000. Despite years of neglect, the value of the land nearly tripled. And that’s just the assessed value. Real-world property values (and gains) often far exceed the county’s assessments.

The reason the value of these lots grew so quickly is simple: nearby landowners and businesses, as well as the city government, invested in buildings and infrastructure that made the entire neighborhood more desirable. The lot owner does almost nothing to contribute to rising property values in the neighborhood. In fact, for most parking lots, the county finds that the “improvements” on surface lots are literally worthless, contributing no economic value.

Another surface lot example is found between 4th and 6th Ave S, where Sweazey Investments LLC owns 31,050 square feet of lot space, totaling 143 parking stalls. At 12:50pm, 25 stalls were available, but by 5:40 pm, the picture shows plenty of spots available. Similar to the above lot, valuable Seattle land sits vacant, a quiet testimony to ever present land speculation. But the business numbers again add up perfectly for the land holders, with the assessed land value going from $1,314,000 in 1998-99 to $4,347,000 by 2014-15.

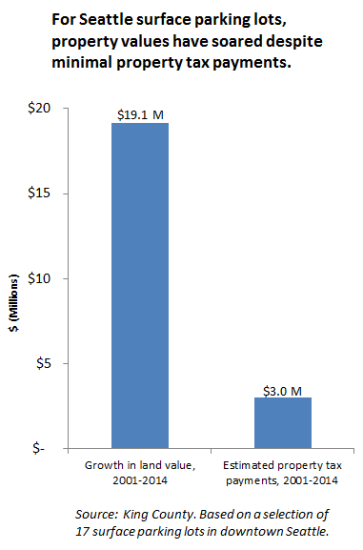

Looking at 17 different surface parking lots that I found by walking around downtown Seattle, I saw the same pattern repeated over and over. County records suggest that the aggregate value of those lots more than doubled between 2001 and 2014—figures that may be conservative. And just as importantly, the gains in land value outweighed estimated property tax payments over the period by a factor of 6. In short, for every dollar these property owners paid in property tax, the value of their property grew by $6. Quite a hefty return for doing nothing.

These examples suggest a simple formula for land speculation:

- First, claim a well-situated plot of land, and use it to create your very own asphalt jungle.

- Second, hold onto the land as your neighbors build housing and office space nearby. Those investments increase the number of people attracted to the neighborhood, boosting your property value. The new buildings also massively increase the amount of property tax those neighbors have to pay.

- Third, continue to sit idle while city and county governments use increased property tax revenue to invest in transit, streets, utilities and other public amenities, further pumping up the value of land.

Feel free to keep at steps 2 and 3 for as long as you like! As long as the revenue from your little plot of surface parking pays for your property taxes, you’ll be happily free-riding on the efforts of your neighbors. Their actions boost the value of the land…and you reap the benefits.

A land-value tax—described on this blog last week—would encourage owners like Fujimatsu LLC and Sweazey Investments LLC to use their land for something other than a surface parking lot. It would ramp up property taxes on idle land, making it much harder for landowners to make money keeping their land inactive. LVT is not some sort of panacea for the Emerald City. But as a tool for incentivizing smart urban development and spurring infill in depressed areas, it might quickly prove its worth.

Comments are closed.