Today, Sightline is releasing a new report: Peabody Energy, Gateway Pacific, and the Asian Coal Bubble. The report shows that at today’s prices, there’s no way for Peabody to make money shipping coal to Asia. Peabody’s strategy is now to hope that the Asian coal bubble re-inflates—which is an increasingly risky bet, given the collapse of Asian coal prices, recent steps by China to curb coal demand, and the oversupply of coal from other Pacific Rim exporters.

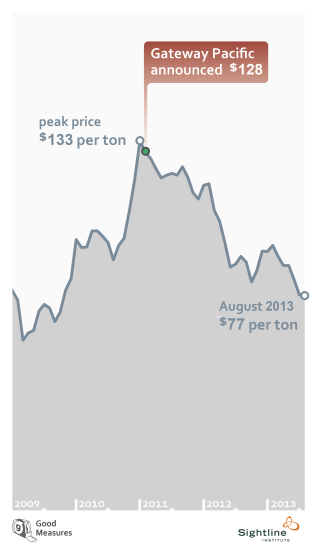

In case you don’t happen to check the price of Australian coal every day, you might not have noticed that the price of coal in the Pacific Rim export markets has collapsed over the past year or so. In fact, it’s looking very much as if the meteoric rise in coal prices that enticed so many companies to enter the Northwest coal export game was simply a bubble.

And perhaps no Powder River Basin coal company has more at risk from this collapse than Peabody Energy.

Peabody has plans to export up to 24 million metric tons of coal each year through the proposed Gateway Pacific terminal in northwest Washington. It announced those plans in February 2011—about two years after Pacific Rim coal prices started to spike but a month after they peaked.

Since Gateway Pacific was launched, Pacific Rim coal markets have fallen almost as quickly as they rose. At today’s prices, Peabody Energy would lose roughly $10 per ton selling coal through the Gateway Pacific terminal.

Sightline’s new report, Peabody Energy, Gateway Pacific, and the Asian Coal Bubble, tallies the costs for Peabody to ship its coal from the Powder River Basin to Asia—including the cash costs of mining coal, rail shipping fees, handling fees at coal terminals, shipping costs on ocean-going vessels, and adjustments for the low energy content of Peabody’s Powder River Basin coal.

The conclusion is clear: in today’s market, there is literally no chance for Peabody to make a profit on coal exports.

To illustrate, consider Peabody’s three Powder River Basin mines, compared with coal from major Pacific Rim coal export competitors: Northern China, Australia, and Indonesia. Peabody’s PRB coal will be most competitive in South Korea, which is closer to the Northwest than southern Chinese markets are and which is further away from export hubs in Indonesia and Australia than southern Chinese markets.

Tallying all costs—mining, rail, terminal, shipping, and price adjustments for low-quality PRB coal—South Korean buyers would have to be willing to pay well over $73 per metric tonne of coal for Peabody to break even on the cash costs of its most competitive export coal. Peabody’s other coals would need to receive even higher prices for Peabody to avoid cash losses.

But in today’s market, Korean buyers can find abundant supplies of coal for less than $64 per metric tonne, delivered to Korean markets. This means that if Peabody had to start exporting today, it would lose between $9 and $10 per tonne selling its best export coal into its most competitive market. (Note, of course, that coal markets fluctuate constantly; these prices represent our best estimates for market conditions last week, but they may change without notice.)

The implication is clear: if the Gateway Pacific terminal were open today, Peabody couldn’t afford to use it.

Much of the public conversation around coal exports has taken it as a given that coal companies are sober, blue-chip enterprises seeking easy profits. But the market dynamics show something completely different. Coal exports are a long shot. And coal executives are little more than gamblers, praying for Asian coal prices to re-inflate enough to justify the confident predictions (and major investments) they made at the height of the bubble.

But they’re not just gambling with their investors’ money. They’re also gambling with the health of Northwest communities, our cultural heritage…and with our climate.

Mark Hersh

The report compares the energy content of the PRB coal vs. the Asian/Australian competition. I have no idea about air quality requirements in South Korea or any other destination nation, but I wonder if the PRB coal is lower in sulfer than the competition. I believe that eastern US coal-fired electric generating plants are one of the major customers of that coal now, in response to Clean Air Act requirements (the coal is “blended” with higher-BTU eastern coal that is higher in sulfer).

So are there possible pollution requirements that give Peabody a partial competitive edge over the competition?

Clark Williams-Derry

PRB does have low sulfur content compared with some coals. But there’s actually a lot of Indonesian sub-bituminous coal with very little sulfur. A bunch of coal grades even have far less sulfur than PRB coal. (See, e.g., http://adaro.com/glossary/envirocoal/) Those coals don’t seem to trade at any particular premium in the Pacific Rim markets.

So I think it’s possible that PRB coal might earn a premium at some point, but I think at the moment it’s a modest premium at best.