A few months ago we reported on the shaky finances of Ambre Energy, Ltd, the Australian firm that’s at the center of two of the three remaining coal export terminal proposals in Washington and Oregon. Ambre’s finances paint the picture of a struggling, high-risk start-up: by the end of 2012 the company had burned through well over a hundred million dollars of its investors’ money, accumulating massive debts and obligations in the process, yet still hadn’t cobbled together even a hint of a profitable business.

A few months ago we reported on the shaky finances of Ambre Energy, Ltd, the Australian firm that’s at the center of two of the three remaining coal export terminal proposals in Washington and Oregon. Ambre’s finances paint the picture of a struggling, high-risk start-up: by the end of 2012 the company had burned through well over a hundred million dollars of its investors’ money, accumulating massive debts and obligations in the process, yet still hadn’t cobbled together even a hint of a profitable business.

But if the company’s recent financial disclosures are accurate, our earlier report just scratched at the surface of Ambre’s financial woes. Our brand-new look at the finances of Ambre’s Morrow Pacific coal export project suggests that one of the company’s export proposals is in deep financial trouble, because it faces:

- Higher transportation costs than any nearby competitor;

- Higher handling costs than existing coal terminal projects in the region; and

- Greater capital costs than comparable export terminal projects.

For more details, read on…

Last year, Ambre published an economic analysis of its proposed Morrow Pacific coal export project, prepared by Portland-based consulting firm ECONorthwest. With Morrow Pacific, Ambre hopes to ship coal by rail from the Powder River Basin in Montana and Wyoming to an upstream port on the Columbia, barge the coal downstream to a second port, and then move the coal onto ocean-going vessels bound for Asia.

Ambre apparently used the ECONorthwest study to tout the economic benefits of its project. But a close reading of the study reveals Morrow Pacific’s financial Achilles’ heel: the Morrow Pacific project would have substantially higher costs than any other Northwest export project, either existing or proposed.

Ambre apparently used the ECONorthwest study to tout the economic benefits of its project. But a close reading of the study reveals Morrow Pacific’s financial Achilles’ heel: the Morrow Pacific project would have substantially higher costs than any other Northwest export project, either existing or proposed.

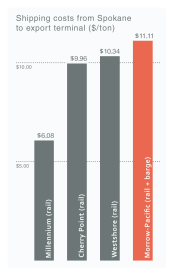

The chart to the right (click for a larger version) shows how Morrow Pacific’s transportation costs (in red) stack up against potential rivals in the region. Although Morrow Pacific offers the shortest rail trip, barging pushes up overall transportation expenses. After factoring in both barge and rail costs, coal companies using Morrow Pacific would pay more than $11 per ton to move coal from Spokane to a deep-water port. That’s more than the cost of shipping coal all the way to the Westshore terminal in British Columbia, and far more than Morrow Pacific’s nearest would-be competitor.

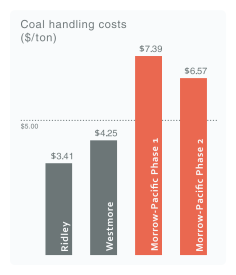

Morrow Pacific faces an even steeper cost disadvantage in coal handling. We looked at the cash costs of handling coal at two export terminals in British Columbia: Westshore, just south of Vancouver, and Ridley, in remote Prince Rupert.  At Ridley, average handling costs came in at $3.41 per short ton of coal over the past few years. For Westshore, the figure was $4.25. Yet for Morrow Pacific, Ambre estimates coal handling costs of well over $7 per ton during the project’s early phase, and north of $6.50 per ton after full build-out. (See the chart to the right.) The logistics at the two proposed coal terminals in Washington—Millennium and Gateway Pacific—would be similar to Westshore and Ridley, and likely give those projects a substantial cost advantage over Morrow Pacific.

At Ridley, average handling costs came in at $3.41 per short ton of coal over the past few years. For Westshore, the figure was $4.25. Yet for Morrow Pacific, Ambre estimates coal handling costs of well over $7 per ton during the project’s early phase, and north of $6.50 per ton after full build-out. (See the chart to the right.) The logistics at the two proposed coal terminals in Washington—Millennium and Gateway Pacific—would be similar to Westshore and Ridley, and likely give those projects a substantial cost advantage over Morrow Pacific.

Capital costs tell a similar story: adjusted for the amount of coal moved per year, it appears that Morrow Pacific has exceptionally high up-front capital expenditures compared with likely rivals.

The Morrow Pacific project’s high cost structure stems from its unusual logistics. All other coal terminal projects in the Western US ship coal by rail directly to an export terminal. But Morrow Pacific adds an intervening barging step, perhaps to avoid a controversial rail trip through the densely populated Portland area. As it turns out, though, barging could prove to be Morrow Pacific’s downfall. Transferring coal twice, first from rail to barge, and then from barge to ocean-going vessel, boosts coal handling costs; paying for custom-built barges and loading equipment at two sites boosts capital costs; and Ambre expects that operating its barges will cost more than an equivalent trip by rail.

As a result, in each of the three major cost components of an export project—handling, transportation, and capital—Morrow Pacific’s expenses handily outstrip its rivals’. For any prospective coal company, high logistical expenses mean lower profits—meaning that Morrow Pacific would likely be the last-choice terminal for prospective coal shippers. Worse, if today’s coal prices persist, it’s difficult to see how any coal shipped via Morrow Pacific could be sold profitably into Asian markets—meaning that Morrow Pacific could sit idle except in the event of exceptionally high overseas demand.

All in all, the situation looks pretty gloomy for Morrow Pacific. Any investor taking a close look at putting more money into Ambre ought to take a close look at Morrow Pacific’s finances. And if they do, they probably won’t like what they see.

Comments are closed.