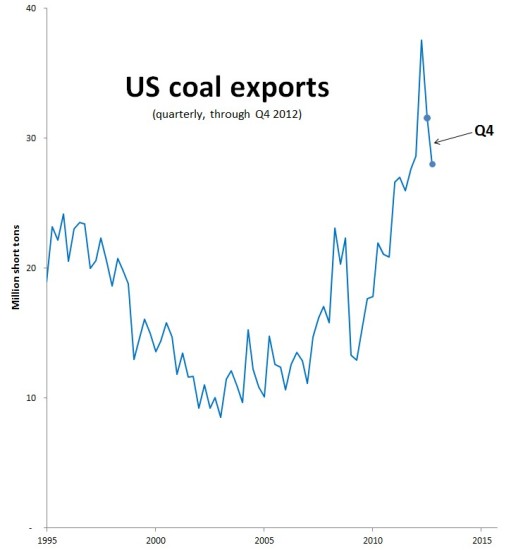

I’m a bit late getting to this, but here’s quarterly data from the latest coal report from the US Energy Information Administration, taking us up through the end of 2012:

Nationally, the big story was that coal exports fell for the second consecutive quarter. By the end of 2012, quarterly shipments were down by 25 percent from the historic highs registered during the second quarter. Still, at 28 million tons, coal exports remained very high by historical standards.

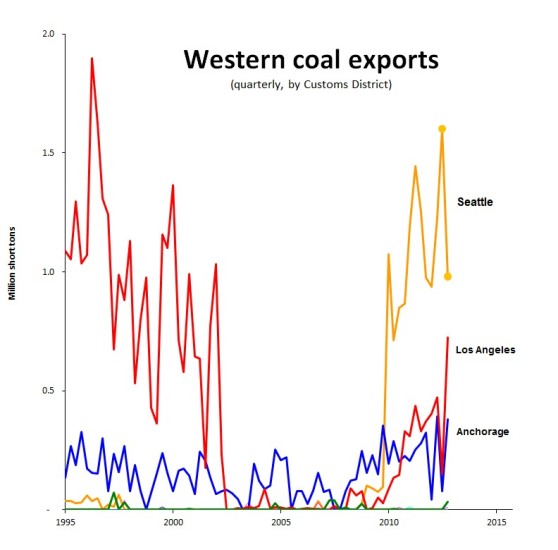

A bit player in the national coal export story, the Western Customs District exported a little more than 2.1 million tons in the fourth quarter, a 16 percent increase from the third quarter.

The West was the only part of the country to see an increase in coal exports, a somewhat surprising trend given that the region’s major coal shipping venue, the Seattle Customs District, registered a steep decline. Seattle District shipments—entirely accounted for by coal traveling north from Washington into British Columbia for onward shipment to Asia—fell to 980,000 tons, a 39 percent decline from the high water mark in the third quarter. The decrease was almost certainly the result of damage to the coal-loading trestle at BC’s Westshore Terminal.

Coal exports rose sharply in both the Los Angeles District (presumably from LAXT at Long Beach) and the Anchorage District (from the Seward Coal Loading Facility).

As in previous quarters, Cloud Peak Energy claimed responsibility for nearly all the coal transiting the Seattle Customs District. According to their fourth quarter investor report, “Asian exports were approximately 0.9 million tons in the fourth quarter 2012 compared to 1.0 million tons in the fourth quarter 2011.”

For all of 2012, US Customs officially reported a bit more than 4.7 million tons of coal exported from the Seattle District. Over the same period, Cloud Peak took credit for 4.4 million tons of shipments to Asia. Assuming that all of Cloud Peak’s coal exits via the Seattle District, which is very probable, their numbers indicate that few other coal firms are currently in the Northwest coal exports business. Signal Peak may be playing a small role, and Westshore has also claimed to be exporting coal from Peabody, though the terminal’s managers have not made these shipment figures public.

The official US Customs figures reported by the US Department of Energy—those I’m relying on in this blog post—should be treated with caution. In some cases they are at odds with the numbers given by coal terminals, by anecdotal accounts of coal train movements, and with shipment claims by the coal industry. For example, financial information for the Westshore Terminal implies that the Seattle District exported something like 8.6 million tons in 2012, compared to the 4.7 million reported by US officials. (See p. 6, “Shipments from [US thermal coal] shippers accounted for approximately 29% of Westshore’s volume in 2012.”)

For example, one continuing mystery is the Great Falls Customs District, which includes the Sweetgrass, Montana border crossing, the logical route from the Powder River Basin to the Ridley Coal Terminal at Prince Rupert. Official reports continue to show near-zero figures at Sweetgrass. Yet rail watchers report that several coal trains are crossing the border each week, and the Ridley Terminal also claims to be handling at least a modest volume of US coal.

The EIA is promising final 2012 data in June, and I’ll report on it here when it’s available.

Thanks to Pam MacRae for research assistance.

All figures in this post are given in short tons. All of my reporting on quarterly coal export volumes can be found in the series “Coal Export Trend Reports.” All data come from the US EIA’s latest quarterly coal report, covering the entire Western Customs Region. In addition to the districts shown on the chart here, the Western Region includes the Portland, Nogales, San Diego, and San Francisco Districts. These districts have been reporting virtually no coal exports.

Please note: The second chart shows Customs Districts, not individual ports. The Port of Seattle does not move coal, for example.

Comments are closed.