Editor’s note: This extra-rich recipe was originally shared on Yoram’s own blog at The Stand-Up Economist. Check it out!

The National Association of Manufacturers just released a scathing report on carbon taxes (the full report was produced—unfortunately—with the assistance of my friends at NERA), but in reality all their analysis shows is that paying down the federal debt is the poison pill of economic policy: as long as the economy is struggling to recover, connecting debt payments to any policy will make that policy look terrible.

In other words, it’s a recipe for cooking the books on carbon taxes:

- Pre-heat the oven with debt-crisis rhetoric. The interest rate for federal borrowing is incredibly low, but don’t let that stop you from arguing that “[debt reduction] is appealing because this could reduce the interest rate for Federal borrowing.”

- Mix carbon taxes with debt reduction and tax cuts. Make sure to front-load the debt reduction: “Until 2023, all of the net carbon tax revenues would be used to lower the Federal debt.” Worried that this goes against what just about any economist would recommend at a time when “families [are] struggling to get by as the national unemployment rate hovers just under 8 percent” [emphasis in original]? Simply add a caveat: “We [at NERA] make no suggestion that this particular combination is desirable, politically likely, or that it will produce the best overall policy outcomes.”

- Cook until burned. “A carbon tax would have a net negative effect on consumption, investment and jobs.”

- Top with bittersweet glaze. “Factoring in lost revenue from reduced economic activity, the net revenue from a carbon tax available for deficit/debt reduction and lower tax rates is relatively small.” As an added bonus—call-back!—a weakened economy will presumably raise the interest rate for federal borrowing, so what comes out of the oven will be perfectly circular.

Yum, yum… Boy, that’s rich!

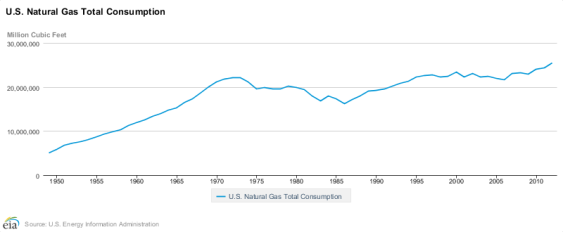

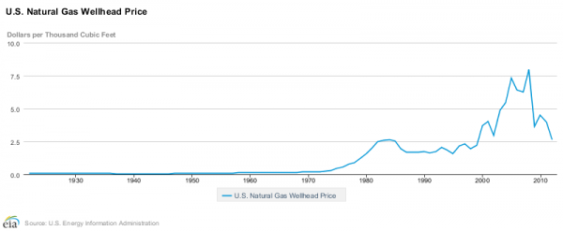

P.S. For the record, the NAM report makes a big deal about how “the price of natural gas would increase by more than 40%,” but almost half of this increase comes only in the very short run and relies on modeling assumptions about the short-term supply curves for natural gas being inelastic. (Translation: Fuel-switching from coal to natural gas drives up the price of the latter because producers have a hard time producing more.) Judge for yourself whether this makes sense by looking at how natural gas consumption has skyrocketed over the past few years at the same time that natural gas prices have been taking a nosedive. See the EIA graphs copied below.