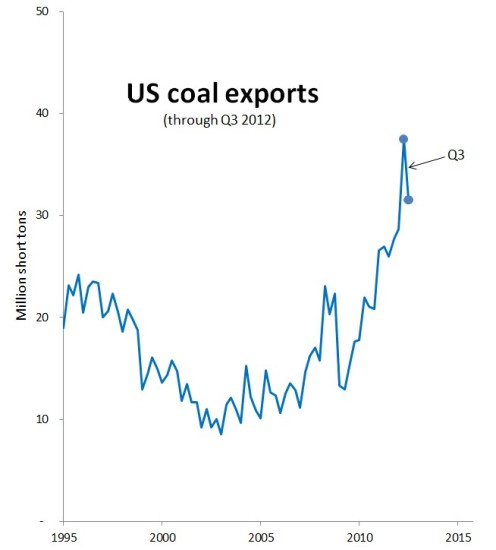

Here’s data from the latest coal report from the US Energy Information Administration, taking us up through the end of September 2012:

Nationally, the big story is that coal exports fell in the third quarter by 15 percent from the historic highs registered during the second quarter. Still, at 31.5 million tons, coal exports remained higher than at any other time in recent history.

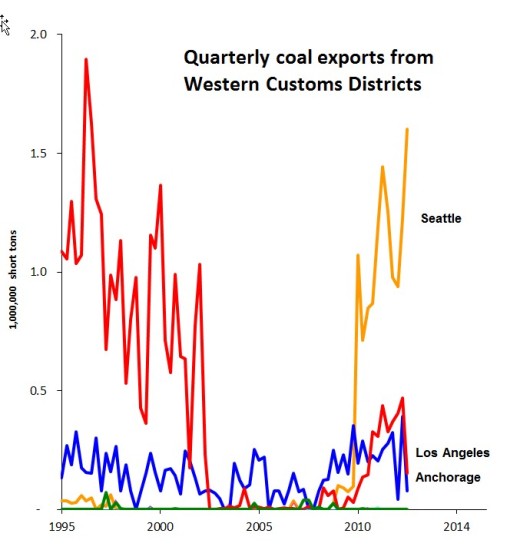

A bit player in the national coal export story, the Western Customs District exported a little more than 1.8 million tons in the third quarter, a 12 percent decline from the second quarter.

Only three Customs Districts in the West move any noticeable quantities of coal:

- Seattle District refers to coal shipped north from Washington into British Columbia for onward shipment to Asia. (This figure accounts for the coal trains seen in Seattle and other northwest Washington locations.) The district shipped a little more than 1.6 million short tons of coal in the third quarter of 2012, a new high water mark for the district.

- Los Angeles District coal shipments registered just 151,000 tons, a sharp decline from recent trends.

- Anchorage District also reported a sharp decline as quarterly coal exports from Seward, the only coal export terminal in Alaska, fell to less than 77,000 tons.

As in previous quarters, Cloud Peak Energy claimed responsibility for nearly all the coal transiting the Seattle Customs District. According to their third quarter investor report, “Asian exports were up approximately 7.5% in the third quarter of 2012 to 1.5 million tons from 1.4 million tons in 2011.” Cloud Peak expects to ship 4 million tons of coal from BC’s Westshore Terminal and another 300,000 tons from other locations, presumably the Ridley Terminal at Prince Rupert in northern BC.

Speaking of Ridley, there’s continued evidence that Prince Rupert is not a viable export hub for Powder River Basin coal. Consider that the Great Falls District continues to report near-zero figures for coal exports, which is telling because the logical route from PRB coal mines to Ridley crosses the border at Sweetgrass, Montana in the Great Falls District. (It is conceivable that some of coal bound for Ridley crosses the border at Blaine, Washington, but this entails a more tortuous and congested rail route.)

The big near-term question for Northwest coal exports is what happens at ports in the Vancouver area. Port Metro Vancouver is planning to add coal export capacity on the Fraser River, but the port has recently met with stiff opposition from local leaders. BC’s huge coal terminal at Westshore is also undergoing expansion, but a vessel collision in November will drastically impair shipments for at least several months. The uncertainty at Westshore calls into question Cloud Peaks 2013 export expansion plans and delivers yet another blow to Signal Peak Energy’s designs on Westshore’s export capacity.

The EIA is promising final 2012 data in March 2013, and I’ll report on it here when it’s available.

Thanks to Pam MacRae for research assistance.

All of my reporting on quarterly coal export volumes can be found in the series “Coal Export Trend Reports.” All data come from the US EIA’s latest quarterly coal report, covering the entire Western Customs Region. In addition to the districts shown on the chart here, the Western Region includes the Portland, Nogales, San Diego, and San Francisco Districts. These districts have been reporting virtually no coal exports.

Please note: The first chart shows Customs Districts, not individual ports. The Port of Seattle does not move coal, for example.